Introduction

In the vast and often complex landscape of the modern workforce, understanding the value of your labor is the first step toward building a fulfilling and financially stable career. For millions of Americans, a wage of $12 an hour is a significant starting point, a transitional phase, or a long-term reality. It represents a paycheck that is substantially above the federal minimum wage, yet it often sits on the cusp of what is considered a "living wage," depending heavily on where you live and your personal circumstances. This article is designed to be your definitive guide to navigating the world of a $12 an hour salary. We will dissect what this wage truly means for your budget, explore the types of jobs that offer it, and, most importantly, provide a strategic, actionable roadmap for using this position as a powerful launchpad for significant career and income growth.

My journey into career analysis began not in a corner office, but on the front lines of the service industry. My first real job paid just a little over minimum wage, and I vividly remember the feeling of stretching every dollar and the drive it instilled in me to find a path toward greater opportunity. That experience taught me that while a starting wage defines your current income, it does not have to define your future potential; it can be the very foundation upon which you build a more prosperous life. This guide is built on that core belief: that with the right knowledge, strategy, and determination, a $12 an hour job can be a stepping stone, not a stumbling block.

We will delve deep into authoritative data from sources like the U.S. Bureau of Labor Statistics, analyze salary trends, and break down the critical factors that can elevate your earning power. Whether you are currently earning this wage, considering a job that pays it, or are a student planning your future, this guide will equip you with the expert insights needed to take control of your professional journey.

### Table of Contents

- [What Does a $12 an Hour Job Entail?](#what-does-a-12-an-hour-job-entail)

- [The $12 an Hour Salary: A Deep Dive into the Numbers](#the-12-an-hour-salary-a-deep-dive-into-the-numbers)

- [Key Factors That Influence Your Salary and How to Leverage Them](#key-factors-that-influence-your-salary-and-how-to-leverage-them)

- [Job Outlook and Career Growth from a $12/Hour Position](#job-outlook-and-career-growth-from-a-12hour-position)

- [How to Get Started on Your Path to Higher Earnings](#how-to-get-started-on-your-path-to-higher-earnings)

- [Conclusion: Turning a Wage into a Wealth of Opportunity](#conclusion-turning-a-wage-into-a-wealth-of-opportunity)

What Does a $12 an Hour Job Entail?

A $12 an hour wage is most commonly associated with entry-level, foundational, and service-oriented roles that are essential to the daily functioning of our economy. These positions are often the first point of contact for customers, the backbone of logistical operations, and the entry point into numerous industries. While the specific duties vary widely, there are common threads that run through many of these jobs: they typically require a high school diploma or equivalent, involve structured tasks, and place a strong emphasis on reliability, consistency, and a core set of soft skills.

These roles are crucial because they provide the initial work experience where individuals develop fundamental professional habits. Skills like time management, teamwork, customer communication, and problem-solving are forged in these environments.

### Common Jobs and Core Responsibilities

The landscape of $12-per-hour jobs is diverse. While wages are constantly shifting due to inflation, minimum wage laws, and market demand, here are some of the most common roles that historically fall within this pay bracket, particularly in regions with a lower cost of living:

- Retail Sales Associate / Cashier: The face of a retail store. Responsibilities include assisting customers, operating a point-of-sale (POS) system, handling cash and credit transactions, stocking shelves, and maintaining store cleanliness.

- Fast Food Worker / Crew Member: Working in a fast-paced environment to take orders, prepare food according to safety standards, operate kitchen equipment, and provide quick and friendly service.

- Entry-Level Administrative Assistant: Supporting an office environment with tasks like answering phones, scheduling appointments, managing mail, data entry, and filing documents.

- Warehouse Worker / Stocker: Handling the logistics of goods. This involves receiving shipments, scanning and tracking inventory, picking and packing orders for shipment, and maintaining a safe and organized warehouse.

- Home Health Aide (Entry-Level): Providing basic care and companionship to elderly, ill, or disabled individuals in their homes. Tasks can include assisting with personal hygiene, light housekeeping, and meal preparation.

- Call Center Representative (Entry-Level): Answering inbound calls from customers to address questions, resolve issues, process orders, or provide information about products and services.

### A "Day in the Life" Example: The Retail Associate

To make this more tangible, let's walk through a typical day for "Maria," a full-time retail associate earning $12 an hour at a large clothing store.

- 8:45 AM: Maria arrives, clocks in, and heads to the back room for the daily team huddle. The store manager discusses sales goals for the day, new promotions, and assigns specific tasks.

- 9:00 AM - 1:00 PM: The store opens. Maria's primary role is on the sales floor. She greets customers, helps them find sizes, offers styling suggestions, and answers questions about the new "25% off" promotion. Between customer interactions, she neatens folded displays and returns items from the fitting rooms to their proper racks.

- 1:00 PM - 1:30 PM: Lunch break.

- 1:30 PM - 4:00 PM: The afternoon rush begins. Maria is assigned to the cash register. For over two hours, she processes a steady stream of transactions, expertly handling cash, running credit cards, and promoting the store's loyalty program. She has to resolve a minor issue when a coupon doesn't scan, calmly calling a manager for an override.

- 4:00 PM - 5:30 PM: As the store quiets down, Maria is tasked with helping to restock the sales floor with items from a new shipment that arrived earlier. She uses a scanner to log the new inventory before bringing it out.

- 5:30 PM: Maria completes her closing duties, which include a final sweep of her assigned section and ensuring the register till is balanced. She clocks out, having spent her day interacting with dozens of people, solving small problems, and keeping the store's operations running smoothly.

This example illustrates the blend of customer-facing soft skills and task-oriented hard skills that define many jobs at this wage level.

The $12 an Hour Salary: A Deep Dive into the Numbers

Understanding the raw numbers behind a $12 an hour wage is the first step in assessing its financial impact. This section provides a comprehensive breakdown of what this salary equates to on a weekly, monthly, and annual basis, and places it in the context of national economic data and the cost of living.

### Annual, Monthly, and Weekly Earnings

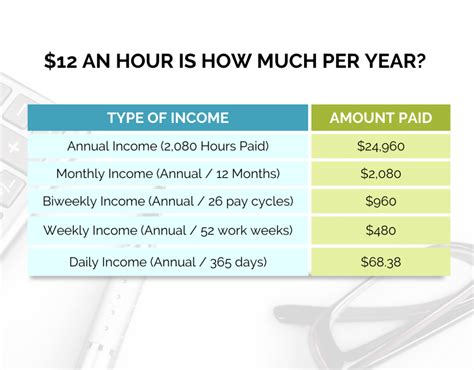

Let's start with the basic calculations, assuming a standard full-time work schedule of 40 hours per week and 52 weeks per year.

- Hourly: $12.00

- Weekly (40 hours): $12.00/hour * 40 hours = $480 per week

- Monthly (approx. 4.33 weeks): $480/week * 4.33 weeks = $2,078 per month

- Annual: $12.00/hour * 2,080 hours (40 hours/week * 52 weeks) = $24,960 per year (Gross)

This gross income of nearly $25,000 is the figure before any deductions are made for taxes, insurance, or retirement contributions.

### From Gross to Net: A Sample Monthly Budget

Your net income, or take-home pay, is what truly matters for budgeting. After federal, state, and FICA (Social Security and Medicare) taxes, a gross monthly income of $2,078 can be significantly reduced. The exact amount varies by state and filing status, but a single individual can typically expect to see their net pay be around 15-25% lower than their gross pay.

Let's estimate a monthly take-home pay of approximately $1,660 (assuming a 20% total tax and deduction rate) and see how it fits into a sample budget. This budget is based on national averages and will vary dramatically by location.

| Budget Category | Estimated Cost | Percentage of Net Income | Notes |

| ----------------------- | -------------- | ------------------------ | ------------------------------------------------------------------------------------------------- |

| Housing (Rent/Utilities) | $850 | 51% | Extremely challenging. Often requires roommates or living in a very low-cost-of-living area. |

| Transportation (Car/Gas/Public) | $200 | 12% | Assumes a used car with minimal issues or reliance on public transit. |

| Food (Groceries) | $300 | 18% | Requires careful meal planning and minimal dining out. |

| Personal & Health Care | $100 | 6% | Basic toiletries, co-pays, over-the-counter medicine. |

| Savings/Emergency Fund | $50 | 3% | A critical but difficult category to fund. |

| Discretionary/Other | $160 | 10% | Phone bill, internet, entertainment, clothing, etc. |

| Total | $1,660 | 100% | |

As this sample budget clearly illustrates, a $12 an hour salary leaves very little room for error. A single unexpected expense, such as a car repair or medical bill, could destabilize the entire budget. The 51% allocation to housing is well above the recommended 30% guideline, highlighting the primary financial pressure point for individuals at this income level.

### Comparison to National Averages and Minimum Wage

To provide further context, let's compare this wage to other key benchmarks.

- Federal Minimum Wage: As of late 2023, the federal minimum wage remains at $7.25 per hour. A $12/hour wage is 65% higher than this federal floor. However, many states and cities have enacted much higher minimums. For example, in states with a $15 minimum wage, a $12/hour job would be considered substandard.

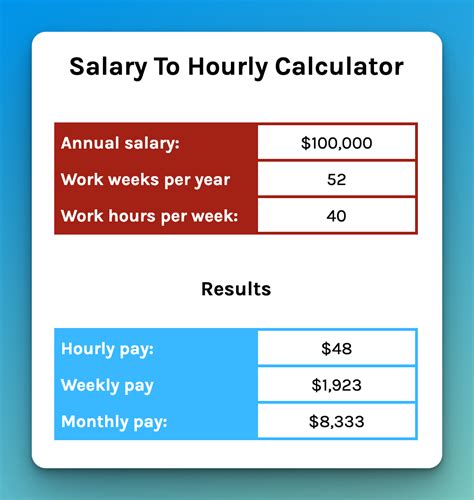

- U.S. Median Hourly Wage: According to the U.S. Bureau of Labor Statistics (BLS), the median hourly wage for all occupations was $23.11 in May 2022. This means that a $12/hour wage is just over half of what the typical American worker earns. The median annual wage was $46,310.

- Living Wage: The concept of a "living wage" is the hourly rate an individual must earn to cover basic necessities without public assistance. According to the MIT Living Wage Calculator, a living wage for a single adult with no children in the U.S. (as of 2023) is approximately $24.58 per hour on average, though this varies from around $17/hour in Mississippi to over $35/hour in Massachusetts. This data starkly reveals that a $12/hour salary is not a sustainable living wage in most parts of the country.

### Compensation Beyond the Hourly Rate

For roles paying $12 an hour, the compensation package is often straightforward, but it's important to consider all components:

- Bonuses & Overtime: These roles are typically non-exempt, meaning employees are legally entitled to overtime pay (1.5 times the hourly rate) for any hours worked beyond 40 in a week. Some retail or sales roles may offer small performance-based bonuses, but this is not standard.

- Benefits: This is a major differentiating factor. Full-time positions may offer access to a benefits package, but it can be limited.

- Health Insurance: Employer-sponsored health insurance may be available, but employees often have to contribute a significant portion of the premium, which can be a strain on a tight budget.

- Paid Time Off (PTO): PTO (including vacation and sick days) may be offered, but often accrues slowly.

- Retirement: A 401(k) plan might be available, but employer matching is less common or less generous than in higher-paying professions.

- Other Perks: Employee discounts are a common and valuable perk in retail and food service jobs. Some large corporations (like Starbucks or Walmart) may offer tuition assistance programs, which can be an incredibly valuable benefit for career advancement.

In summary, while $12 an hour provides a gross annual income of nearly $25,000, the take-home pay presents significant budgeting challenges, especially in moderate to high-cost-of-living areas. The path to financial stability often lies in leveraging this position to move toward a higher wage bracket.

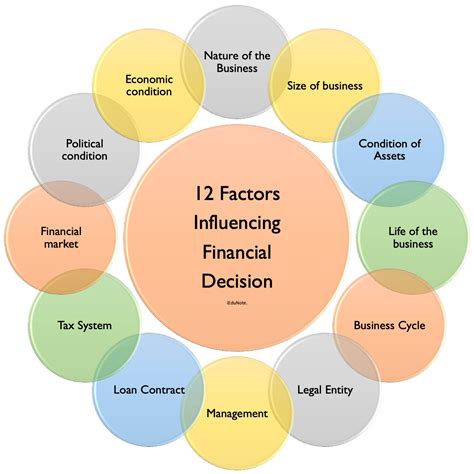

Key Factors That Influence Your Salary and How to Leverage Them

A $12 an hour salary should be viewed not as a fixed destination, but as a starting point on a career trajectory. Your ability to increase your earnings is directly tied to a set of key factors. By strategically focusing on improving in these areas, you can build a compelling case for a raise or qualify for higher-paying roles. This section breaks down the most critical factors and provides actionable advice on how to use them to your advantage.

### 1. Level of Education

Education is one of the most reliable long-term drivers of increased earning potential. While many $12/hour jobs require only a high school diploma, even small steps up the educational ladder can open doors to new salary brackets.

- The Data: The U.S. Bureau of Labor Statistics provides clear data on the correlation between education and income. In 2022, the median usual weekly earnings were:

- High School Diploma: $853 ($21.33/hour)

- Some College, No Degree: $949 ($23.73/hour)

- Associate's Degree: $1,005 ($25.13/hour)

- Bachelor's Degree: $1,432 ($35.80/hour)

- While these are medians across all jobs, the trend is undeniable: more education leads to higher pay.

- Certifications: Beyond traditional degrees, professional certifications are a powerful and often faster way to boost your value. A certification demonstrates specialized knowledge and proficiency in a specific area.

- Example 1 (Healthcare): A Home Health Aide ($12-14/hr) can complete a short training program to become a Certified Nursing Assistant (CNA). According to Payscale, the average hourly wage for a CNA is around $16.03. This is a direct pathway to a higher wage.

- Example 2 (IT): A warehouse worker ($12-15/hr) interested in tech could study for and pass the CompTIA A+ certification. This can qualify them for an entry-level IT Support or Help Desk role, which often starts in the $18-22/hour range.

- Example 3 (Skilled Trades): A general laborer could pursue a certification in welding, HVAC repair, or as a forklift operator. A certified forklift operator, for instance, earns an average of $18.66 per hour, according to Salary.com (as of late 2023).

- How to Leverage It:

- Explore Employer Tuition Assistance: Many large companies (e.g., Target, Amazon, Walmart) offer programs to help pay for college courses or certifications. This is arguably the most valuable benefit for long-term growth.

- Focus on High-ROI Certifications: Research certifications that are in high demand in your region and lead to tangible job opportunities. Community colleges are excellent resources for these programs.

- Start Small: Even completing a free online course series on a topic like "Project Management Fundamentals" or "Digital Marketing" can be a valuable addition to your resume.

### 2. Years of Experience

Experience is the currency of the workplace. As you accumulate time in a role and industry, your value increases. You become more efficient, require less supervision, and can often mentor newer employees.

- The Career Ladder: Virtually every role has a potential progression.

- Retail/Food Service: Cashier ($12/hr) -> Shift Supervisor ($15-17/hr) -> Assistant Manager ($18-22/hr) -> Store Manager ($25+/hr).

- Administrative: Entry-Level Admin ($12-14/hr) -> Administrative Assistant II ($16-19/hr) -> Executive Assistant ($22-30+/hr).

- Warehouse: Packer ($12-14/hr) -> Inventory Clerk ($15-18/hr) -> Warehouse Supervisor ($20-25+/hr).

- Salary Growth Trajectory: Data from salary aggregators like Payscale shows a clear correlation.

- Entry-Level (0-1 year): This is where the $12/hour wage is most common.

- Early Career (1-4 years): With a few years of solid performance, it's reasonable to expect or negotiate a wage in the $14-17/hour range within the same or a similar role.

- Mid-Career (5-9 years): By this stage, employees have often moved into supervisory or more specialized roles, pushing their earnings into the $18-25/hour bracket.

- How to Leverage It:

- Document Your Accomplishments: Don't just list your duties on a resume. Track your achievements. Did you exceed a sales goal? Did you suggest a process that saved time? Did you receive positive customer feedback? Quantify these successes whenever possible.

- Be Proactive: Don't wait to be given more responsibility. Ask your manager if you can learn new tasks, cross-train in another area, or help train new hires. This demonstrates initiative and makes you a more valuable asset.

- Know When to Move: If you've been in the same role for 2-3 years with no significant raise or promotion, it may be time to leverage your experience to secure a better-paying position at another company.

### 3. Geographic Location

Where you work is one of the single biggest determinants of your pay for the exact same job. A $12/hour wage has vastly different purchasing power and competitiveness depending on the city and state.

- High vs. Low Cost-of-Living:

- High-Cost Areas (e.g., San Francisco, CA; New York, NY; Boston, MA): In these cities, a $12/hour wage is far below the local minimum wage and is not a livable income. Entry-level service jobs in these locations often start at $18-22/hour or more out of sheer market necessity.

- Low-Cost Areas (e.g., Jackson, MS; Huntington, WV; Brownsville, TX): In these regions, the cost of living is significantly lower, and a $12/hour wage, while still tight, stretches much further. It is more competitive in these local job markets.

- State-Level Data: The BLS provides detailed Occupational Employment and Wage Statistics. Let's look at the mean hourly wage for "Cashiers" (a common entry-level job) in May 2022 to illustrate the difference:

- Washington: $17.65

- California: $17.18

- Texas: $13.06

- Mississippi: $12.18

- Alabama: $12.06

- This shows a more than $5/hour difference for the same job, purely based on location.

- How to Leverage It:

- Research Your Local Market: Use tools like the BLS website or Glassdoor to understand the pay range for your specific job in your city. This knowledge is crucial for negotiating a fair wage.

- Consider Relocation (If Possible): For those with flexibility, moving from a very low-wage area to a region with more robust economic activity can be a powerful strategy for a significant income boost, provided the higher wages outpace the increase in living costs.

- Explore Remote Work: The rise of remote work has opened up new possibilities. A person living in a low-cost area might be able to secure a remote customer service or data entry job for a company based in a higher-paying region, earning a wage of $15-18/hour that is excellent for their location.

### 4. Company Type & Size

The type of organization you work for can have a major impact on your compensation and career opportunities.

- Startups vs. Large Corporations:

- Large Corporations (e.g., Amazon, Target, Home Depot): These companies often have standardized pay scales. While they may seem rigid, they frequently offer slightly higher starting wages (e.g., Amazon's $15/hr minimum) and, more importantly, structured benefits like tuition assistance, 401(k) matching, and clear paths for internal promotion.

- Small Businesses / Startups: Pay can be more variable. A local "mom-and-pop" shop might pay closer to the minimum wage, while a well-funded tech startup might offer competitive pay but fewer traditional benefits. The advantage here can be broader responsibilities and more direct access to leadership.

- Non-Profits and Government:

- Non-Profits: Pay is often modest, but the work can be mission-driven and highly rewarding. Benefits can sometimes be surprisingly good to compensate for lower cash wages.

- Government (Local, State): Entry-level government jobs (e.g., a clerk at the DMV) may start in a similar range but are known for offering excellent job security, defined-benefit pension plans, and generous healthcare benefits, which are valuable parts of the total compensation package.

- How to Leverage It:

- Target Companies with Growth Programs: When job searching, specifically look for large companies known for their employee development and tuition reimbursement programs. Think of the job not just as a source of income, but as a gateway to a free or subsidized education.

- Network within Your Company: Regardless of size, build relationships. In a large company, this can lead to internal transfers to better-paying departments. In a small company, it can lead to taking on more responsibility as the business grows.

### 5. Area of Specialization (Industry)

Moving laterally from one industry to another can be a powerful salary-boosting strategy, even if the initial role seems similar.

- Retail vs. Healthcare Support vs. Manufacturing:

- A Retail Associate at $12/hour has a certain career ceiling.

- An entry-level Hospital Transporter might start at $13-14