Table of Contents

- [Introduction](#introduction)

- [The Financial Reality of a $15 an Hour Wage](#the-financial-reality-of-a-15-an-hour-wage)

- [Breaking Down Your $15 an Hour Earnings: A Deep Dive](#breaking-down-your-15-an-hour-earnings-a-deep-dive)

- [Key Factors That Influence Your Earnings (And How to Move Beyond $15/Hour)](#key-factors-that-influence-your-earnings-and-how-to-move-beyond-15hour)

- [Job Outlook and Building a Career from a $15/Hour Role](#job-outlook-and-building-a-career-from-a-15hour-role)

- [Your Action Plan: How to Advance Your Career Beyond $15 an Hour](#your-action-plan-how-to-advance-your-career-beyond-15-an-hour)

- [Conclusion](#conclusion)

---

Introduction

The discussion around a $15 per hour wage is one of the most significant economic and career conversations of our time. For many, it represents a benchmark for a "living wage," a step up from the federal minimum, and a gateway into the professional world. If you're currently earning $15 an hour, or considering a job that pays this rate, you're standing at a pivotal point in your career journey. This wage can be a stable starting block, but it's what you build upon it that truly defines your future success and financial well-being. This guide is designed to be your definitive resource, moving beyond a simple calculation to offer a comprehensive roadmap for understanding, maximizing, and ultimately, growing beyond a $15 per hour income.

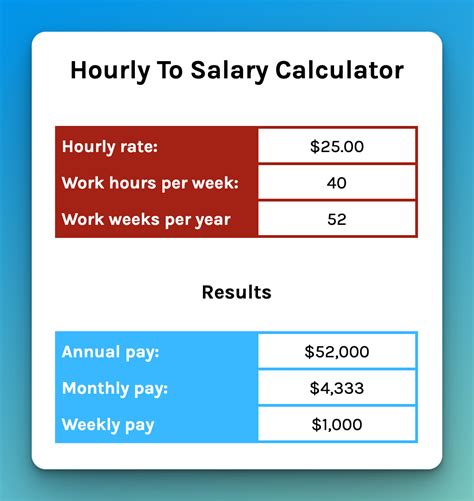

First, let's clarify a common point of confusion in the query "$15 hour annual salary." An hourly wage and an annual salary are two different methods of compensation. An hourly wage, like $15 per hour, means you are paid for each hour you work. An annual salary is a fixed amount you are paid over a year, regardless of the specific hours worked in a given week. For the purpose of financial planning, we can calculate the annual equivalent of a $15/hour wage. Assuming a standard 40-hour workweek and 52 weeks in a year, the calculation is:

$15/hour × 40 hours/week × 52 weeks/year = $31,200 per year (gross income)

This $31,200 figure is the foundation of our analysis. Throughout my career as a professional development analyst, I've seen countless individuals start in roles at or around this pay grade. I once mentored a young professional working as an administrative assistant for about this rate; she felt stuck. But by strategically identifying the most valuable skills in her role—project coordination and software proficiency—she was able to leverage that experience into a higher-paying project coordinator position within two years. Her story underscores a critical truth: your starting wage does not dictate your career ceiling.

This guide will provide you with the same strategic insights. We will dissect the financial realities of this income, explore the types of jobs available, analyze the key factors that can increase your pay, and lay out a step-by-step plan for career advancement. Whether you see a $15/hour job as a temporary stepping stone or the start of a long-term career, this article will equip you with the knowledge and tools to take control of your professional and financial future.

---

The Financial Reality of a $15 an Hour Wage

While the number "$15 an hour" is often discussed in policy debates, its real-world impact is best understood by examining the types of jobs that offer this wage and what a day in one of these roles truly looks like. A $15/hour wage is most common in entry-level positions across several major industries that form the backbone of our economy. These roles are crucial, providing essential services and serving as the first point of contact between businesses and consumers.

Common Industries and Job Titles at the $15/Hour Level:

- Retail: This is one of the largest sectors for jobs at this pay grade. Roles include Retail Sales Associate, Cashier, Stocker, and Customer Service Representative. The national median pay for retail salespersons was $14.44 per hour in May 2022, placing $15/hour squarely within the typical range (Source: U.S. Bureau of Labor Statistics - BLS).

- Food Service and Hospitality: This industry includes roles like Fast Food Worker, Barista, Host/Hostess, and some line cook positions. While the median hourly wage for food and beverage serving workers was $13.52 in May 2022 (BLS), many national chains and establishments in higher cost-of-living areas have raised their starting wages to $15/hour or more to attract and retain talent.

- Administrative and Office Support: Entry-level administrative assistants, receptionists, data entry clerks, and office clerks often start in the $15-$18 per hour range. The median hourly wage for general office clerks was $18.33 in May 2022 (BLS), making $15/hour a common starting point for those with limited experience.

- Customer Service: Call Center Representatives and Customer Support Agents are vital roles that frequently start around this wage. Companies rely on these professionals to handle inquiries, resolve problems, and maintain customer satisfaction.

- Healthcare Support: While some specialized roles require certification and pay more, entry-level positions like Medical Receptionist, Patient Transporter, or Dietary Aide in a hospital or nursing home can fall into this pay category.

- Warehousing and Logistics: With the e-commerce boom, jobs like Warehouse Associate, Picker/Packer, and Material Handler have become widespread. Major companies like Amazon and Target have set their minimum wages at or above $15/hour for these physically demanding yet critical roles.

### A Day in the Life: Composite of a $15/Hour Worker

To make this tangible, let's imagine a "day in the life" of "Alex," a composite character working a full-time customer service role at a large retail company for $15 an hour.

- 8:45 AM: Alex arrives at the call center, logs into the computer system, and reviews any overnight updates or new promotional information. Coffee in hand, Alex prepares for the first calls of the day.

- 9:00 AM - 12:00 PM: The phone queue is active. Alex handles a variety of calls: a customer wants to track a missing package, another needs help processing a return, and a third is having trouble applying a discount code on the website. Each call requires active listening, problem-solving, and accurate data entry into the CRM (Customer Relationship Management) software. Alex must maintain a polite and helpful demeanor, even with frustrated customers.

- 12:00 PM - 1:00 PM: Lunch break. This is an unpaid hour, a standard practice for most hourly roles.

- 1:00 PM - 3:00 PM: The afternoon brings more complex issues. Alex collaborates with a warehouse team via internal chat to locate a specific item for a customer and escalates a technical website bug to a supervisor. These tasks require skills beyond just answering the phone—they involve inter-departmental communication and clear, written documentation.

- 3:00 PM - 5:00 PM: The call volume slows slightly. Alex uses this time to respond to customer emails, follow up on earlier cases, and complete any required online training modules on new products. The shift ends with a final check of open cases and a log-out from the system.

This "day in the life" illustrates that a $15/hour job is not just about performing a single, simple task. It often involves a blend of soft skills (communication, empathy, patience) and hard skills (data entry, software navigation, product knowledge). These are the foundational experiences that, if recognized and developed, can pave the way for significant career growth.

---

Breaking Down Your $15 an Hour Earnings: A Deep Dive

Understanding the headline number—$15 per hour or $31,200 per year—is just the beginning. To truly grasp the financial reality, you must look at your net income (take-home pay) and understand the full compensation picture, including benefits and other potential earnings. This deep dive will help you budget effectively and evaluate job offers more comprehensively.

### From Gross to Net: What's Your Take-Home Pay?

Your gross income of $31,200 is not what you'll have available for rent, groceries, and other expenses. Several deductions are taken from your paycheck first.

Typical Deductions Include:

- Federal Income Tax: This is a progressive tax, meaning the rate increases with income. For a single individual earning $31,200 in 2023, a portion of their income falls into the 10% bracket and a portion into the 12% bracket.

- FICA Taxes (Social Security and Medicare): These are fixed-rate taxes. You'll pay 6.2% for Social Security (on income up to a certain limit) and 1.45% for Medicare.

- State Income Tax: This varies significantly. Some states like Texas and Florida have no state income tax, while others like California and New York have progressive tax brackets.

- Pre-Tax Contributions: Deductions for health insurance premiums, 401(k) contributions, or other benefits are taken out before taxes are calculated, which lowers your taxable income.

Let's create a hypothetical breakdown to illustrate the difference between gross and net pay.

Sample Monthly Paycheck Breakdown (Based on $31,200 Annual Gross)

| Item | Monthly Amount | Notes |

| :--- | :--- | :--- |

| Gross Monthly Income | $2,600 | ($31,200 / 12 months) |

| --- | --- | --- |

| *Pre-Tax Deductions* | | |

| Health Insurance Premium | -$150 | (Varies wildly by plan and employer subsidy) |

| 401(k) Contribution (3%) | -$78 | (A common starting contribution rate) |

| Adjusted Gross (Taxable) Income | $2,372 | |

| --- | --- | --- |

| *Taxes (Estimates)* | | |

| Federal Income Tax | -$185 | (Approximate, single filer, standard deduction) |

| FICA (Social Security & Medicare) | -$199 | (7.65% of Gross Income) |

| State Income Tax (e.g., 5%) | -$119 | (Highly variable by state) |

| Total Estimated Taxes | -$503 | |

| --- | --- | --- |

| Net Monthly Income (Take-Home Pay) | ~$1,869 | (Approximately $22,428 annually) |

*Disclaimer: This is a simplified estimate. Your actual take-home pay will depend on your specific state, W-4 elections, and the exact cost of your benefits.*

As you can see, the take-home pay can be roughly 25-30% less than the gross income. An annual salary of $31,200 effectively becomes closer to $22,000-$24,000 in spendable income. Budgeting with this net figure is essential for financial stability.

### The Full Compensation Package: It's More Than Just the Wage

While the hourly rate is the main attraction, the total value of a job offer lies in its full compensation package. When comparing opportunities, look closely at these components:

1. Health Insurance:

This is arguably the most valuable benefit. An employer-sponsored health plan can save you thousands of dollars per year compared to buying a plan on the open marketplace. Key questions to ask:

- What is the monthly premium deducted from my paycheck?

- What is the plan's deductible (the amount you pay before insurance starts covering costs)?

- What are the copays for doctor visits and prescriptions?

- Does the plan include dental and vision coverage?

According to a 2022 KFF report, the average annual premium for employer-sponsored health insurance was $7,911 for single coverage, with employees contributing an average of $1,327. Having an employer cover the bulk of this cost is a significant financial benefit.

2. Retirement Savings (401(k) or similar):

Many large employers offer a 401(k) plan. Even more valuable is an employer match. A common match is "50% of the first 6% you contribute." This means if you contribute 6% of your salary, your employer adds an extra 3%—that's free money and a 50% return on your investment instantly. On a $31,200 salary, contributing 6% ($1,872/year) could get you an additional $936/year from your employer.

3. Paid Time Off (PTO):

This includes vacation days, sick leave, and paid holidays. A typical entry-level package might offer 10 vacation days and 5 sick days per year, plus paid public holidays. This time is crucial for rest, preventing burnout, and managing personal responsibilities without losing income.

4. Overtime Pay:

As an hourly employee, you are generally eligible for overtime pay under the Fair Labor Standards Act (FLSA). For any hours worked over 40 in a workweek, your employer must pay you at least 1.5 times your regular rate. For a $15/hour wage, your overtime rate would be $22.50 per hour. The availability of overtime can significantly boost your earnings, though it shouldn't be relied upon as consistent income.

5. Other Perks and Benefits:

- Employee Discounts: Particularly in retail, this can lead to substantial savings.

- Tuition Assistance: Some companies, like Starbucks and Target, offer programs to help pay for college courses or certifications. This is an incredibly valuable benefit for career advancement.

- Commuter Benefits: Pre-tax programs for public transit or parking.

- Bonuses: Some roles, especially in sales or call centers, may offer performance-based bonuses for meeting targets.

When evaluating a $15/hour job, always look beyond the wage. A job offering $15/hour with excellent, low-cost health insurance and a 401(k) match is far more valuable than a $16/hour job with no benefits at all.

---

Key Factors That Influence Your Earnings (And How to Move Beyond $15/Hour)

While $15 per hour is a common starting point, it is by no means a fixed ceiling. Your earning potential is influenced by a dynamic interplay of factors. Understanding these levers is the first step toward strategically increasing your income. This section will break down the most critical elements that affect your pay and provide actionable insights on how to leverage them for career growth.

###

Geographic Location

Where you live is one of the single most significant factors determining both your wages and how far those wages will go. A $15/hour wage can feel vastly different depending on the local cost of living and prevailing wage laws.

State and Local Minimum Wage Laws: The federal minimum wage has been $7.25 per hour for over a decade. However, many states and cities have enacted much higher minimums. For example, as of 2023, the minimum wage in California is $15.50/hour, and in cities like Seattle and Denver, it's even higher. In these locations, $15/hour is at or below the legal minimum, making it an absolute floor, not a competitive wage. Conversely, in a state with a $7.25 minimum wage, a $15/hour job is considered well-paying for an entry-level position.

Cost of Living: This refers to the amount of money needed to cover basic expenses like housing, food, transportation, and healthcare in a particular place. Salary data aggregator Payscale maintains a cost-of-living index where the national average is 100.

- High Cost-of-Living City (e.g., San Francisco, CA): Cost of living is 192% higher than the national average. A salary of $31,200 would have the purchasing power of roughly $16,250 in a city with an average cost of living. It is not a sustainable wage here.

- Average Cost-of-Living City (e.g., Indianapolis, IN): Cost of living is 6% below the national average. A $31,200 salary provides a more manageable, though still tight, lifestyle.

- Low Cost-of-Living City (e.g., Brownsville, TX): Cost of living is 24% lower than the national average. Here, a $31,200 salary would have the purchasing power of over $40,000, making it a much more comfortable income.

How to Leverage This:

- Research Before You Move: If you have flexibility, use online cost-of-living calculators (like those from NerdWallet or Bankrate) to compare your potential salary against expenses in different cities.

- Look for Remote Work: The rise of remote work has created a unique opportunity. If you can secure a remote customer service or data entry job based in a high-wage area while living in a low-cost-of-living area, you can maximize the power of your paycheck.

###

Industry, Company Type & Size

The context of your employer matters immensely. The same job title can come with different pay and, more importantly, different opportunities for advancement.

Industry Differences:

- Retail/Food Service: Often have lower starting wages but may offer clear, albeit sometimes slow, paths to management (Shift Lead -> Assistant Manager -> Store Manager).

- Healthcare: Entry-level support roles might start at $15/hour, but the industry has a highly structured and lucrative career ladder for those who pursue certifications and degrees (e.g., CNA -> LPN -> RN).

- Tech/E-commerce (Warehousing/Support): Companies like Amazon or Chewy often use a higher starting wage (at or above $15/hour) as a competitive advantage. They are large-scale operations and may offer more technology-driven roles and internal transfer opportunities.

Company Type & Size:

- Large Corporations (e.g., Walmart, Target, Bank of America): These companies typically have standardized pay bands, structured training programs, and formal internal promotion processes. They are more likely to offer robust benefits like tuition assistance and 401(k) matching. The path upward is often clearer, but can also be more competitive.

- Startups and Small Businesses: Pay can be more variable. A small business may not be able to offer $15/hour, while a well-funded tech startup might offer more. Benefits can be less comprehensive, but you may have the opportunity to take on more responsibilities and learn a wider range of skills faster, which can be a powerful resume-builder.

- Non-Profits and Government: Government jobs at the local, state, and federal levels often have very defined pay scales (like the GS scale for federal jobs) and excellent job security and benefits, though starting pay may not be as high as in the private sector. Non-profits' pay is often budget-dependent but can offer mission-driven work that is highly rewarding.

How to Leverage This:

- Target industries with built-in career ladders (like healthcare or logistics).

- If you're at a large corporation, proactively seek out information on training programs and internal job boards. Express your interest in advancement to your manager.

###

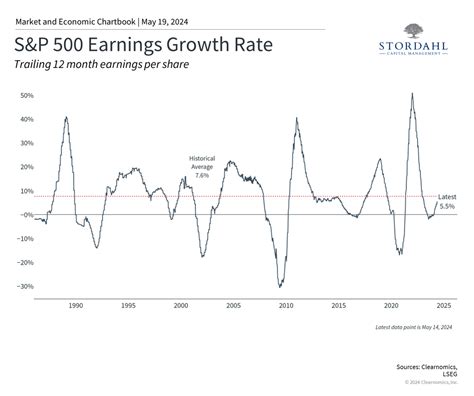

Years of Experience & Career Progression

Experience is the most reliable driver of wage growth. While you might start at $15/hour, you should not be earning the same rate three years later in the same role.

Salary Growth Trajectory (Example: Customer Service Representative):

- Entry-Level (0-1 year): $15.00/hour ($31,200/year). Focus is on learning core processes and meeting basic performance metrics.

- Mid-Career (2-4 years): $18.50/hour ($38,480/year). You are now a proficient team member, possibly training new hires or handling more complex customer issues. (Source: Salary.com, average hourly rate for CSR I vs CSR II).

- Senior/Team Lead (5+ years): $22.70/hour ($47,216/year). You may now be a subject matter expert, a supervisor, or a team leader, responsible for the performance of a small group of representatives.

How to Leverage This:

- Document Your Accomplishments: Don't just list your duties on your resume. Quantify your achievements. Instead of "Answered customer calls," write "Handled 50+ customer inquiries daily with a 95% satisfaction rating."

- Be Patient but Proactive: Don't expect a raise every six months, but do have a career conversation with your manager annually. Ask, "What do I need to do to get to the next level?"

- Know When to Leave: If you have been in a role for 2-3 years with no significant increase in pay or responsibility, and there are no internal opportunities, it may be time to leverage your experience to get a higher-paying job at another company. Job-hopping strategically can be one of the fastest ways to increase your income.

###

In-Demand Skills & Specializations

This is where you have the most direct control over your earning potential. Acquiring specific, valuable skills can quickly move you out of the $15/hour bracket. Think of this as investing in your own "human capital."

Transferable Skills (to perfect in your current role):

- Communication (Written and Verbal): Essential in every higher-paying job.

- Problem-Solving: The ability to analyze a situation and find a solution.

- Teamwork and Collaboration: Working effectively with colleagues.

- Digital Literacy: Proficiency with common software (Microsoft Office/Google Workspace), CRM systems, and communication tools (Slack, Teams).

High-Value Skills (to acquire for your next role):

- Technical Skills: Learning entry-level coding (HTML/CSS), data analysis with Excel or SQL, or becoming a power user of a specific software (like Salesforce or QuickBooks) can open doors to entirely new, higher-paying careers.

- Project Management: Certifications like the Certified Associate in Project Management (CAPM) can transition you from an administrative role to a project coordinator role, which often pays significantly more.

- Bilingualism: In customer-facing roles, fluency in a second language (especially Spanish) is highly sought after and often comes with a pay differential or bonus. Glassdoor data suggests bilingual workers can earn 5-20% more per hour.

- Specialized Certifications:

- Healthcare: Certified Nursing Assistant (CNA), Phlebotomy Technician, Medical Assistant. These often require a short-term training program and can immediately boost your wage to the $18-$25/hour range.

- Skilled Trades: Forklift Operator Certification, CompTIA A+ (for entry-level IT), Welding certifications. These lead to in-demand jobs with strong earning potential.

How to Leverage This:

- Use Tuition Assistance: If your company offers it, this is the #1 way to skill up for free.

- Explore Low-Cost Online Learning: Platforms like Coursera, edX, and Udemy offer professional certificates from companies like Google and IBM in high-growth fields like Data Analytics, IT Support, and UX Design, often for a low monthly fee.

###

Level of Education

While a four-year degree is not required for a $15/hour job, higher education remains a powerful tool for long-term salary growth.

- High School Diploma/GED: This is the typical requirement for most $15/hour jobs.

- Associate's Degree (2-year degree): Often earned at a community college, this can be a highly efficient way to increase earnings. An Associate's in fields like Nursing (to become an RN), Computer Science, or Business Administration can lead directly to jobs paying $50,000+ annually. According to the BLS, workers with an Associate's degree had median weekly earnings of $963 in 2022, compared to $853 for those with just a high school diploma. That's over a 12% increase.

- Bachelor's Degree (4-year degree): This opens the door to the widest range of professional careers. The median weekly earnings for Bachelor's degree holders in 2022 was $1,432 (BLS), equating to an annual income of over $74,000—more than double the $31,200 earned at a $15/hour job.

How to Leverage This:

- Consider Community College: It's an affordable and flexible way to earn credits or a full Associate's degree, often while still working.

- Focus on ROI: If you pursue a degree, choose a field with a strong and clear connection to a well-paying job market.

By understanding and strategically acting on these five factors, you can create a clear and achievable path from earning a wage to building a career.

---

Job Outlook and Building a Career from a $15/Hour Role

Understanding the long-term outlook for jobs in the $15/hour range is crucial for career planning. While many of these roles will continue to be plentiful, some face challenges from automation and changing economic landscapes. The key is to view your starting position not as a final destination, but as a launchpad. This section explores the future of these jobs and outlines concrete career pathways to build a prosperous future.

### Job Outlook for Common Entry-Level Sectors

According to the U.S. Bureau of Labor Statistics (BLS) Occupational Outlook Handbook (2022 data), the outlook for common $15/hour jobs is mixed:

- Retail Salespersons: Employment in this massive field is projected to show little or no change from 2022 to 2032. While e-commerce is growing, the need for in-person customer service and sales expertise remains. However, the lack of growth means competition for better positions (like management) will be keen.

- Cashiers: This role is projected to decline by 10% over the next decade, largely due to the rise of self-checkout kiosks and automated payment systems. This is a clear signal that cashiering is a job to gain initial experience in, but not one to plan a long-term career around without upsk