Earning $20 an hour is a significant milestone for many professionals. It often represents a step up from minimum wage or entry-level pay into a role with more responsibility and earning potential. Annually, this wage translates to $41,600 a year for a full-time position. While this figure sits just below the national median income for individual earners in the United States, it serves as a solid foundation for many careers and a livable wage in many parts of the country.

This article provides a comprehensive analysis of what a $20 per hour salary means for your finances, what kinds of jobs offer this pay rate, and the key factors that can help you earn even more.

What Does a $20 per Hour Job Look Like?

A $20 per hour wage is common across a wide array of essential industries, including healthcare, administration, skilled trades, and customer service. These are not just "jobs," but often the first rungs on a rewarding career ladder.

Professionals earning in this range are typically responsible for specialized tasks that require a degree of training, certification, or on-the-job experience. They are the backbone of many organizations, ensuring that operations run smoothly, customers are supported, and essential services are delivered.

Examples of jobs that often fall into the $18-$22 per hour pay range include:

- Administrative Assistants

- Medical Assistants

- Certified Nursing Assistants (CNAs)

- Bank Tellers

- Experienced Customer Service Representatives

- Veterinary Technicians

- Phlebotomists

- Skilled Labor Apprentices (e.g., electricians, plumbers)

- Bookkeeping Clerks

- Retail Shift Supervisors

Breaking Down the Numbers: From Hourly to Annual

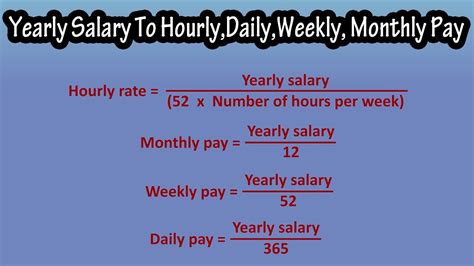

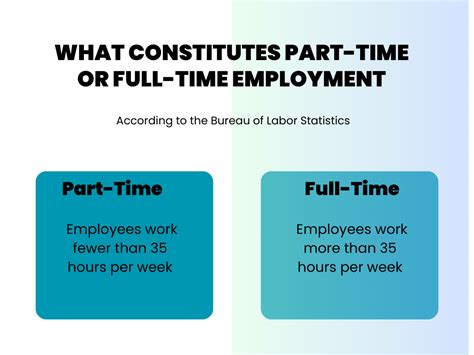

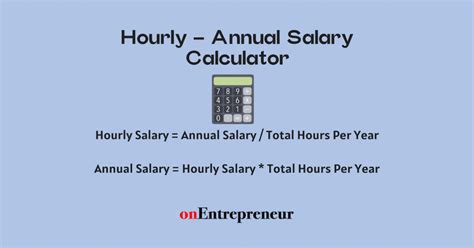

Understanding how your hourly wage translates into weekly, monthly, and annual earnings is crucial for budgeting and financial planning. The calculation is based on a standard 40-hour workweek.

Calculation: $20/hour × 40 hours/week × 52 weeks/year = $41,600 per year

Here’s a simple breakdown of your gross income (before taxes and other deductions):

| Pay Period | Gross Income |

| :--- | :--- |

| Hourly | $20.00 |

| Weekly | $800.00 |

| Bi-Weekly | $1,600.00 |

| Monthly | ~$3,467.00 |

| Annually | $41,600.00 |

It's important to remember that your take-home pay (net income) will be lower after federal, state, and local taxes, as well as deductions for things like health insurance and retirement contributions (e.g., 401(k)).

Key Factors That Influence Salary

While $20 an hour is a useful benchmark, your actual earnings can be higher or lower depending on several critical factors. Understanding these variables can empower you to negotiate a better salary and strategically guide your career.

### Level of Education

Education is a powerful driver of earning potential. According to the U.S. Bureau of Labor Statistics (BLS), median usual weekly earnings increase significantly with educational attainment. For many roles in the $20/hour range, an associate's degree or a professional certification is a common requirement that separates them from lower-paying positions.

- High School Diploma: Often the minimum for entry-level roles that can lead to $20/hour with experience.

- Associate's Degree: Can directly qualify you for roles like medical assistants or paralegals, often starting in the $20/hour range.

- Bachelor's Degree: Typically qualifies candidates for entry-level positions that start above the $20/hour mark, such as analysts or coordinators.

### Years of Experience

Experience is one of the most significant factors in salary determination. In almost any field, a seasoned professional will earn more than a newcomer.

- Entry-Level (0-2 years): In some fields, you may start closer to $16-$18 per hour as you learn the ropes.

- Mid-Career (3-5 years): With a few years of proven experience, reaching or exceeding the $20/hour mark is a realistic and common goal.

- Senior-Level (5+ years): At this stage, professionals often move into supervisory roles or highly specialized positions, with pay significantly exceeding $20 per hour. Payscale.com data consistently shows a strong positive correlation between years of experience and salary across all industries.

### Geographic Location

Where you live and work has a massive impact on your salary and how far it goes. A $41,600 annual salary will feel very different in a low-cost-of-living area compared to a major metropolitan center. Companies use cost-of-living adjustments (COLAs) to set pay scales.

For example, according to data from Salary.com, an administrative assistant role that pays around the national average of $42,000 in Dallas, Texas, might need to pay upwards of $52,000 in New York City to attract similar talent due to the vast difference in living expenses. Earning $20/hour is more common and provides greater purchasing power in states like Alabama, Ohio, or Iowa than in California, New York, or Massachusetts.

### Company Type

The size, type, and profitability of a company influence its compensation strategy.

- Large Corporations: Major national or multinational companies often have more structured (and higher) pay bands, along with more comprehensive benefits packages, compared to smaller businesses.

- Startups: While sometimes offering lower base salaries, startups may compensate with equity or other performance-based incentives.

- Non-Profit vs. For-Profit: For-profit companies generally have higher revenue and can offer more competitive salaries than non-profit organizations.

- Public vs. Private Sector: Government jobs (public sector) often offer excellent benefits and job security, with transparent pay scales that may be comparable to or slightly different from the private sector.

### Area of Specialization

Even within the same job title, specialization can lead to higher pay. Acquiring in-demand skills or certifications makes you a more valuable asset. For instance:

- A general administrative assistant might earn $20/hour.

- An executive assistant supporting C-level management, who has specialized scheduling and software skills, could earn $28/hour or more.

- A Certified Nursing Assistant (CNA) can increase their earning potential by obtaining additional certifications in areas like medication administration or gerontology.

Job Outlook

The future is bright for many of the professions that fall within the $20 per hour salary range. The U.S. Bureau of Labor Statistics projects strong growth in several of these key sectors through 2032.

For example, the BLS Occupational Outlook Handbook projects that employment for Medical Assistants will grow by 14% between 2022 and 2032, which is much faster than the average for all occupations. Similarly, jobs for Bookkeeping, Accounting, and Auditing Clerks remain a stable and necessary part of the economy. These stable or high-growth outlooks provide job security and a clear path for advancement and increased earnings over time.

Conclusion

A salary of $20 per hour, or $41,600 annually, is a respectable and crucial wage that supports millions of professionals and their families across the United States. It serves as a gateway to careers in vital sectors like healthcare, administration, and finance.

For individuals currently earning this wage or aspiring to, the path to higher income is clear. By focusing on gaining experience, pursuing further education or specialized certifications, and making strategic decisions about your industry and location, you can significantly increase your earning potential. A $20/hour job is not just an endpoint; for most, it is a significant and promising step on a rewarding professional journey.