Earning $20 an hour is a significant financial benchmark for millions of workers across the United States. It represents a substantial step up from the federal minimum wage and translates to an annual income of over $40,000, opening doors to greater financial stability and career opportunities. But what does this figure truly represent in today's economy? Is it a starting wage, a mid-career salary, or a long-term goal?

This article will break down what it means to earn $20 an hour, explore the types of jobs that offer this pay rate, and detail the key factors that can help you reach—and exceed—this important milestone.

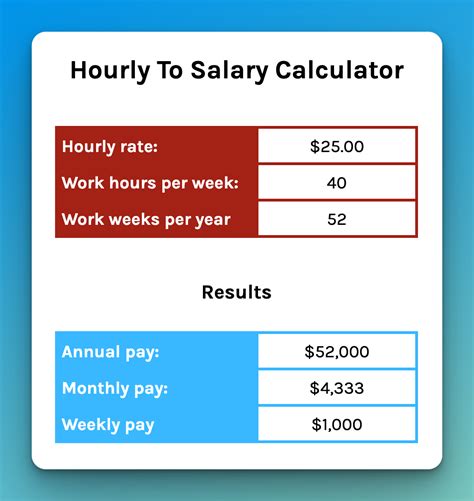

Understanding the Numbers: From Hourly to Annually

First, let's translate that hourly rate into figures you can use for budgeting and financial planning. Assuming a standard 40-hour work week with no overtime, a $20 per hour wage breaks down as follows:

- Weekly Gross Income: $20/hour x 40 hours = $800

- Monthly Gross Income: $800/week x 4.33 weeks/month ≈ $3,467

- Annual Gross Income: $20/hour x 2,080 hours/year = $41,600

This pre-tax income of $41,600 per year places an individual firmly in the lower-middle-income bracket in most parts of the country. It's crucial to remember that this is a gross figure; your take-home (net) pay will be lower after federal, state, and local taxes, Social Security, Medicare, and any deductions for benefits like health insurance or a 401(k) are taken out.

How Does $20 an Hour Compare? A National Perspective

To understand the value of $20 an hour, it's essential to view it in context.

- Federal Minimum Wage: The current federal minimum wage is $7.25 per hour. Earning $20 an hour is nearly three times this amount, showcasing a significant increase in earning power.

- State Minimum Wages: Many states and cities have set their own higher minimum wages. For example, in states where the minimum wage is $15 an hour, the leap to $20 is a meaningful but less dramatic step.

- National Median Wage: According to the U.S. Bureau of Labor Statistics (BLS), the median hourly wage for all workers in the U.S. was $23.77 in May 2023. The median weekly earnings for full-time wage and salary workers were $1,145 in the fourth quarter of 2023, which equates to roughly $28.63 per hour.

This data shows that a $20 an hour salary is a respectable wage but falls below the national median, suggesting it often represents an entry-level or early-career pay rate for skilled positions or a solid, experienced-level wage for less-skilled industries.

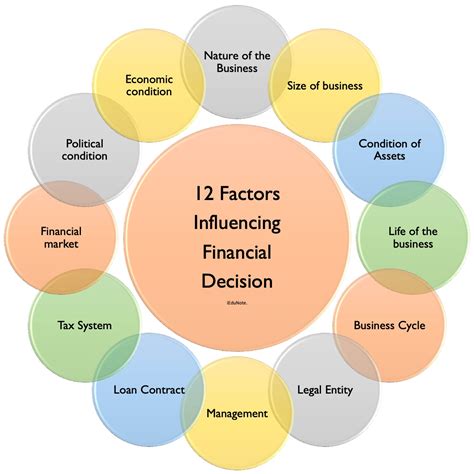

Key Factors That Influence Your Ability to Earn $20/Hour

Achieving a $20 per hour wage isn't just about finding the right job; it's about building a professional profile that commands that level of compensation. Several key factors directly influence your earning potential.

### Level of Education

While a four-year degree is not always necessary to reach this pay level, education is a powerful lever.

- High School Diploma/GED: With a high school diploma, reaching $20/hour is often achievable through experience in roles like skilled customer service, administrative support, or entry-level trades.

- Associate's Degree or Certifications: A two-year degree or a specialized certification can qualify you for technical roles that start at or near $20/hour. Fields like medical assisting, paralegal studies, and IT support are prime examples.

- Bachelor's Degree: For many professional careers (e.g., in business, communications, or science), $20/hour ($41,600/year) is a common starting salary for recent graduates in entry-level positions.

### Years of Experience

Experience is one of the most significant determinants of pay. A $20/hour wage can be an entry-level salary for one profession and a mid-career salary for another. For instance, a new graduate with a bachelor's degree might start as a Junior Analyst at this rate. Conversely, a retail associate might need 5-7 years of experience and a promotion to a supervisory role to achieve the same wage.

### Geographic Location

Where you live and work dramatically impacts the value of your salary. A $41,600 annual salary provides a much more comfortable lifestyle in a low-cost-of-living area like Houston, Texas, than it does in a high-cost-of-living city like San Francisco or New York. According to Payscale's Cost of Living Calculator, the cost of living in San Francisco is 79% higher than the national average, meaning a $41,600 salary would have the purchasing power of less than $24,000 in that market. Always research the cost of living in your target location to understand what a $20/hour wage can truly afford.

### Industry and Company Size

The industry you work in and the size of your employer play a huge role.

- Industry: A technician role in the manufacturing or aerospace industry is likely to pay more than a similar-level role in hospitality or retail.

- Company Size: Large, multinational corporations often have more structured compensation bands and may offer higher starting salaries and better benefits than a small, local business.

### Jobs That Commonly Pay Around $20 an Hour

This wage is attainable across a wide variety of industries and roles. Here are some examples of jobs where the median pay hovers around the $19-$23 per hour mark, according to the BLS (May 2023 data):

- Bookkeeping, Accounting, and Auditing Clerks: With a median pay of $22.61 per hour, these professionals are crucial to business operations and often only require an associate's degree or relevant experience.

- Administrative Assistants and Executive Assistants: The median pay for this broad category was $21.18 per hour, with executive assistants who support C-level staff earning significantly more.

- Pharmacy Technicians: Working under pharmacists to dispense medication, these technicians earned a median wage of $18.82 per hour, with opportunities for advancement and higher pay through certification.

- Veterinary Technologists and Technicians: Caring for animals in clinics and hospitals, these professionals had a median pay of $19.13 per hour.

- Medical Assistants: A vital role in healthcare clinics, medical assistants perform administrative and clinical duties and earned a median of $19.23 per hour.

Career Trajectory: Moving Beyond $20 an Hour

For many professionals, earning $20 an hour is a fantastic stepping stone, not a final destination. The jobs listed above often provide clear pathways for growth. For example:

- An Administrative Assistant can pursue further education or certifications to become an Executive Assistant, Office Manager, or Paralegal, with significantly higher earning potential.

- A Bookkeeping Clerk can gain certifications (like becoming a Certified Public Bookkeeper) or complete a bachelor's degree to become an Accountant, a role with a median pay of $38.60 per hour (BLS, May 2023).

- A Skilled Tradesperson can advance from an apprentice to a journeyman and eventually a master craftsman, seeing their wages increase at each stage.

The key is continuous learning, upskilling, and strategically seeking roles with greater responsibility.

Conclusion

A $20 an hour salary, equating to $41,600 a year, is a strong and achievable wage that serves as a solid foundation for a career. It represents a significant jump in earning power over minimum wage and provides a livable income in many parts of the country. However, its true value is shaped by critical factors like your location, experience, industry, and education.

For those aspiring to this level, focus on gaining valuable skills and experience. For those already there, view it as a launchpad. By continuing to invest in your professional development, you can leverage a $20-an-hour job into a long and prosperous career with ever-increasing financial rewards.