Reaching the $20 per hour mark is a significant milestone in many professional journeys. It represents a level of skill, experience, and value that can provide a more stable financial foundation and open doors to new career possibilities. For many, it's the dividing line between just "getting by" and beginning to build a comfortable life. But what does it truly mean to earn $20 an hour? What kind of annual salary does that translate to, what jobs pay this wage, and most importantly, how can you get there?

This is not just a number—it's a goal post. It represents a tangible step up in earning power, often signifying a move from entry-level positions into roles with more responsibility and potential. In my years as a career analyst, I've guided countless individuals through this exact transition. I recall a client, a former retail associate, who dedicated six months to an online certification program for medical billing and coding. Landing her first job at $19.50 an hour was a victory, but a year later, when she negotiated a raise to $21, the sense of empowerment and security she felt was life-changing. It was the moment she felt her career had truly begun.

This comprehensive guide is designed to be your roadmap to achieving and exceeding that $20 per hour goal. We will dissect the annual salary, explore the diverse jobs available at this pay grade, analyze the factors that can boost your earnings, and provide a step-by-step plan to launch you into a career that values your skills at $20 an hour and beyond.

### Table of Contents

- [What Does a $20/Hour Role Entail? A Look at the Jobs and Responsibilities](#what-does-a-20-dollars-per-hour-annual-salary-do)

- [The $20/Hour Annual Salary: A Deep Dive](#average-20-dollars-per-hour-annual-salary-salary-a-deep-dive)

- [Key Factors That Influence Your Salary](#key-factors-that-influence-salary)

- [Job Outlook and Career Growth in the $20/Hour Range](#job-outlook-and-career-growth)

- [How to Land a $20/Hour Job: Your Step-by-Step Guide](#how-to-get-started-in-this-career)

- [Is a $20/Hour Career Path Right for You?](#conclusion)

What Does a $20/Hour Role Entail? A Look at the Jobs and Responsibilities

Unlike a specific job title like "Accountant" or "Nurse," a "$20 per hour role" isn't a single position. Instead, it’s a wage level that encompasses a vast and diverse array of jobs across nearly every industry. These roles are the backbone of the economy. They are not typically beginner, minimum-wage positions, nor are they senior executive roles. They occupy a critical middle ground, requiring a specific set of skills, a degree of training or certification, and a measure of responsibility.

Professionals earning around $20 an hour are often the skilled "doers" within an organization. They execute critical tasks, support senior staff, interact with clients, and keep the operational wheels turning. The common thread among these roles is the need for specialized knowledge beyond a high school diploma, though a four-year university degree is not always a prerequisite. This specialization can come from a two-year associate's degree, a vocational school certificate, an apprenticeship, or significant on-the-job experience.

Here's a breakdown of the *types* of work and responsibilities you can expect in this pay bracket, categorized by industry:

- Administrative & Office Support: These professionals are the organizational hubs of their departments. Responsibilities include managing schedules for executives, preparing reports and presentations, handling correspondence, organizing company events, and maintaining office systems. An Executive Assistant or a senior Administrative Assistant often falls into this category.

- Healthcare Support: With the healthcare industry booming, support roles are in high demand. A Certified Nursing Assistant (CNA), Phlebotomist, Medical Biller and Coder, or Pharmacy Technician can command around $20/hour. Their tasks are patient-facing and technically specific, involving drawing blood, assisting with patient care, processing complex insurance codes, or dispensing medication under supervision.

- Skilled Trades: These are hands-on, technical roles that build and maintain our physical world. An Apprentice Electrician, a non-journeyman Plumber, a Welder, or an HVAC Technician with a few years of experience can earn this wage. Their work involves installing, repairing, and maintaining critical systems in residential and commercial buildings.

- Information Technology (IT) Support: As every company is now a tech company, the need for IT support is universal. A Help Desk Technician (Tier 1 or 2) or IT Support Specialist earning $20/hour is responsible for troubleshooting hardware and software issues for employees, setting up new workstations, managing user accounts, and maintaining the company's network infrastructure.

- Finance and Bookkeeping: A Bookkeeper or Accounting Clerk at this level handles essential financial tasks. This includes managing accounts payable and receivable, processing payroll, reconciling bank statements, and preparing financial reports for accountants. They need a high degree of accuracy and trustworthiness.

### A Day in the Life: The Executive Assistant

To make this more concrete, let’s imagine a day in the life of an Executive Assistant named Alex, who earns $22 per hour.

8:45 AM: Alex arrives at the office, grabs a coffee, and immediately reviews the calendar of the Vice President she supports. She sees a scheduling conflict for an afternoon meeting and flags it for resolution. She quickly scans and prioritizes the VP's inbox, deleting spam, archiving informational emails, and highlighting three urgent messages that require an immediate response.

9:30 AM: The morning is dedicated to preparing materials for a major client presentation tomorrow. Alex compiles data from three different departments, formats it into a cohesive PowerPoint presentation following brand guidelines, and proofreads the entire deck for errors.

11:00 AM: Alex books travel for the VP's upcoming business trip to a conference. This involves finding cost-effective flights and hotels that align with company policy, arranging ground transportation, and creating a detailed itinerary.

12:30 PM: Lunch break.

1:30 PM: Alex sits in on a departmental meeting to take minutes. Her role is not just to transcribe but to synthesize the key decisions, action items, and assigned owners, which she will type up and distribute before the end of the day.

3:00 PM: Alex shifts to expense reports. She meticulously reviews a month's worth of receipts from her VP, ensuring everything is correctly categorized and compliant with company policy before submitting it to the finance department.

4:30 PM: The day winds down. Alex confirms the VP's schedule for the following day, sends a few final emails to coordinate logistics for an upcoming team off-site she is planning, and tidies her workspace, preparing for tomorrow.

As this example illustrates, a $20/hour role is dynamic, responsible, and essential. It requires a blend of technical skills (PowerPoint, travel booking software) and soft skills (communication, problem-solving, organization).

The $20/Hour Annual Salary: A Deep Dive

First, let's establish the baseline. A wage of $20 per hour translates to an annual salary of $41,600, assuming a standard 40-hour workweek for 52 weeks a year (20 dollars * 40 hours * 52 weeks).

This figure is a crucial benchmark. It sits very close to the median individual income in the United States. According to the U.S. Bureau of Labor Statistics (BLS), the median usual weekly earnings for full-time wage and salary workers was $1,145 in the fourth quarter of 2023, which annualizes to $59,540. However, this median includes everyone from entry-level workers to CEOs. A more relevant comparison is the national median hourly wage for all occupations, which the BLS reported as $23.11 in May 2023.

This data tells us that a $20/hour wage is slightly below the national median but firmly within the typical range for a significant portion of the workforce. It represents a solid, middle-class income in many parts of the country.

### Salary Progression by Experience Level

Your starting wage is just that—a start. Experience is one of the most significant drivers of income growth. A $20/hour wage can be a starting point for some roles, a mid-career salary for others, and a senior-level wage in certain lower-paying fields or regions.

Here’s a general breakdown of how salaries can progress in fields where $20/hour is a common wage, with data synthesized from sources like Payscale and Salary.com:

| Experience Level | Typical Hourly Wage Range | Typical Annual Salary Range | Description |

| ----------------- | ------------------------- | --------------------------- | ----------------------------------------------------------------------------------------------------------------------------------------------------------------------- |

| Entry-Level | $16 - $21 per hour | $33,280 - $43,680 | 0-2 years of experience. The focus is on learning core job functions and demonstrating reliability. Reaching $20/hr at this stage is a strong start. |

| Mid-Career | $20 - $28 per hour | $41,600 - $58,240 | 3-8 years of experience. Professionals at this level have mastered their role, can work independently, and may begin to train junior staff or manage small projects. |

| Senior/Experienced | $25 - $35+ per hour | $52,000 - $72,800+ | 8+ years of experience. These individuals are often experts in their domain, managing complex projects, supervising teams, or holding specialized technical knowledge. |

For example, an IT Help Desk Technician might start at $19/hour. After three years and a new certification, they could advance to a Tier 2 role earning $24/hour. With eight years of experience and specialization in network security, they could become an IT Support Specialist earning $30/hour or more.

### Understanding Your Total Compensation Package

The hourly wage is only one piece of the puzzle. When evaluating a job offer, it's critical to look at the total compensation package. Many roles in the $20/hour range are full-time positions that come with valuable benefits, which can add 20-30% to the total value of your compensation.

Key components beyond the base wage include:

- Health Insurance: This is often the most valuable benefit. A company-sponsored health insurance plan (including medical, dental, and vision) can be worth thousands of dollars per year, especially for family coverage.

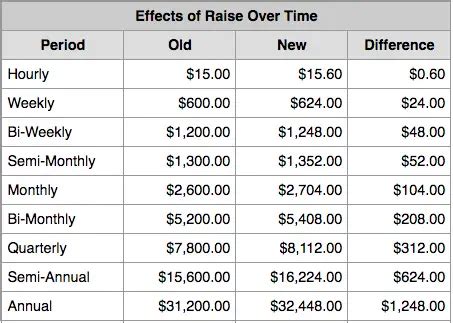

- Retirement Savings Plans: Look for a 401(k) or 403(b) plan, especially one with a company match. A common match is 50% of your contributions up to 6% of your salary. For a $41,600 salary, if you contribute 6% ($2,496), the company adds an extra $1,248 to your retirement account for free. This is a massive boost to your long-term wealth.

- Paid Time Off (PTO): This includes paid vacation days, sick leave, and public holidays. A typical package might offer 10 vacation days, 5 sick days, and 8 paid holidays, totaling 23 paid days off per year. This is equivalent to nearly a full month of paid work.

- Bonuses and Profit Sharing: While less common for hourly roles than for senior salaried positions, some companies offer performance-based bonuses or annual profit-sharing plans. This could be a flat amount (e.g., $1,000 year-end bonus) or a percentage of profits distributed among employees.

- Overtime Pay: One of the key distinctions for hourly (non-exempt) employees is the right to overtime pay. Under the Fair Labor Standards Act (FLSA), you must be paid 1.5 times your regular hourly rate for any hours worked over 40 in a workweek. At $20/hour, your overtime rate would be $30/hour. This can significantly increase your annual earnings if overtime is available and you choose to work it.

- Other Perks: Don't underestimate the value of other benefits like tuition reimbursement, professional development stipends, life insurance, disability insurance, and employee wellness programs. A company that invests in your education or skills is directly investing in your future earning potential.

When comparing a $20/hour job with full benefits to a $22/hour contract role with no benefits, the $20/hour position is almost always the financially superior choice in the long run.

Key Factors That Influence Your Salary

Earning $20 per hour is not a static event; it's a dynamic figure heavily influenced by a combination of personal and external factors. Mastering these levers is the key to not only reaching this wage but surpassing it. As a career analyst, I've seen two people with identical job titles have a salary gap of over $10,000 simply due to these variables. Let's explore them in exhaustive detail.

### `

`Level of Education`

`While a four-year degree isn't always necessary for a $20/hour job, education remains a powerful determinant of pay. It signals to employers that you have a foundational knowledge base and the discipline to complete a program of study.

- High School Diploma or GED: This is the baseline for most of these roles. However, to reach the $20/hour mark with only a diploma, you will likely need significant on-the-job experience or be in a high-demand trade.

- Certifications: This is arguably the most powerful educational tool for this wage bracket. Industry-recognized certifications can provide a direct and rapid path to higher earnings. For example:

- IT: A CompTIA A+ or Network+ certification can take a help desk candidate from $17/hour to $21/hour.

- Healthcare: A Certified Phlebotomy Technician (CPT) or Certified Medical Assistant (CMA) credential is often a prerequisite for jobs paying in this range. A Certified Billing and Coding Specialist (CBCS) can also start near or above $20/hour.

- Skilled Trades: Licensing and certification are paramount. A state-licensed apprentice electrician earns significantly more than an unlicensed helper. A welder with an AWS Certified Welder credential will command a higher wage.

- Project Management: A Certified Associate in Project Management (CAPM) can boost the salary of an administrative professional or project coordinator.

- Associate's Degree (A.A., A.S.): A two-year degree from a community college is an excellent investment. It provides a deeper level of knowledge than a certificate and is highly valued for roles like Paralegal, Radiologic Technologist, or Network Administrator. According to the BLS, workers with an associate's degree had median weekly earnings of $1,005 in 2022, compared to $853 for those with only a high school diploma—a nearly 18% increase.

- Bachelor's Degree (B.A., B.S.): While many $20/hour jobs don't require it, having a bachelor's degree can be a significant advantage. It might make you overqualified for some roles, but for others, like an entry-level Financial Analyst, Marketing Coordinator, or HR Generalist, a bachelor's degree is the standard entry ticket. In these fields, you might start around $20-$25/hour, but your long-term growth ceiling is much higher than in roles that don't require a degree.

### `

`Years of Experience`

`Experience is the currency of the professional world. It demonstrates proven ability, reliability, and a deeper understanding of the nuances of a job that cannot be taught in a classroom. The salary growth trajectory is directly tied to it.

- 0-2 Years (Entry-Level/Beginner): At this stage, you are learning. Your value is in your potential, work ethic, and ability to learn quickly. Jobs that start at precisely $20/hour for a true entry-level candidate are less common but exist in high-demand or high-cost-of-living areas. More often, you might start at $17-$19/hour and target the $20/hour mark after your first or second annual performance review.

- 3-5 Years (Proficient/Mid-Career): This is the sweet spot where many professionals cross the $20/hour threshold and begin to accelerate past it. You have moved beyond basic competency. You can work independently, handle more complex tasks, and begin to mentor newcomers. Your salary data shows a proven track record. For example, Payscale data indicates that the average salary for a Bookkeeper with 1-4 years of experience is around $46,000/year (~$22/hr), but this jumps to over $52,000/year (~$25/hr) with 5-9 years of experience. This is the stage to begin specializing.

- 5-10 Years (Experienced): You are now a highly valuable asset. You've likely seen a wide range of problems and know how to solve them. You may have informal leadership responsibilities. Your hourly wage should be comfortably in the mid-to-high $20s. This is the time to leverage your experience to negotiate a promotion, take on a team lead role, or move to a company that will pay a premium for your expertise.

- 10+ Years (Senior/Expert): At this level, you are a subject matter expert. You might be a Senior Paralegal, a Lead HVAC Technician, or an Office Manager overseeing all administrative functions. Your wage could be $30-$40/hour or more. Your experience allows you to contribute strategically, improve processes, and train the next generation of professionals.

### `

`Geographic Location`

`Where you live is one of the most powerful, and often immovable, factors influencing your salary. A $20/hour wage can feel like a fortune in a low-cost-of-living (LCOL) area and be barely enough to scrape by in a high-cost-of-living (HCOL) city. Employers adjust their pay scales based on the local market rate for talent and the cost of living.

- High-Paying States and Metropolitan Areas: States like California, New York, Massachusetts, Washington, and Maryland consistently have higher wages. Major cities like San Francisco, New York City, Boston, Seattle, and Washington D.C. have even higher pay scales. For instance, according to Salary.com data accessed in early 2024, the median salary for an Administrative Assistant III is around $68,000 in San Francisco, CA (~$32.70/hr) but only $51,000 in Orlando, FL (~$24.50/hr). In these HCOL areas, $20/hour might be the wage for a role that pays $16/hour elsewhere.

- Lower-Paying States and Rural Areas: States in the South and Midwest, such as Mississippi, Arkansas, West Virginia, and Alabama, typically have lower average wages. Living in a rural area versus a city within the same state can also create a significant pay gap. The trade-off is a much lower cost of living. Your $41,600 annual salary will go much further when the median rent for a one-bedroom apartment is $800 instead of $2,800.

- The Rise of Remote Work: The post-pandemic shift to remote work has complicated this factor. Some companies now pay a single national rate regardless of location. Others are implementing location-based pay, adjusting salaries based on where the employee lives. When applying for remote roles, it's crucial to understand the company's pay philosophy. A $20/hour remote job while living in an LCOL area can be a major financial win.

### `

`Company Type & Size`

`The type of organization you work for has a direct impact on your paycheck and overall compensation.

- Large Corporations (e.g., Fortune 500): These companies often have the resources to pay higher wages and offer robust benefits packages. They have structured salary bands, so pay is often less negotiable but more predictable. A large tech company or financial institution will likely pay its IT support staff or administrative assistants more than a smaller company would.

- Startups: Startups can be a mixed bag. Early-stage startups may be cash-strapped and offer lower base salaries, sometimes supplemented with stock options (which are a high-risk, high-reward proposition). Well-funded, later-stage startups, however, may pay very competitively to attract top talent away from established corporations.

- Small and Medium-Sized Businesses (SMBs): These are the most common type of employer. Pay can vary widely. A successful, profitable SMB may pay at or above the market rate. A struggling one may pay less. There is often more room for negotiation and for your individual impact to be recognized.

- Non-Profit Organizations: Non-profits typically have tighter budgets and may pay slightly less than their for-profit counterparts for the same role. However, they often compensate with a strong mission, a positive work culture, and sometimes better work-life balance or more generous PTO policies.

- Government (Federal, State, Local): Government jobs are known for their stability and excellent benefits, particularly pensions and healthcare. The hourly wage might be on par with or slightly below the private sector, but the total compensation package is often superior. Pay is extremely structured, following a General Schedule (GS) pay scale or similar system, with clear steps for advancement based on time and performance. A $20/hour job might correspond to a GS-5 or GS-6 level, depending on the location.

### `

`Area of Specialization`

`Within any given field, specialization is the fast track to higher earnings. Generalists are valuable, but specialists with in-demand expertise are rare and can command a premium. The more technical, complex, or high-stakes your specialty, the more you will earn.

Here’s a comparative look at jobs within the $20/hour ecosystem, highlighting the power of specialization:

| Industry | General Role (Lower End) | Specialized Role (Higher End, around $20+/hr) | Why it Pays More |

| --------------------- | ------------------------------- | --------------------------------------------- | ------------------------------------------------------------------------------------ |

| Administrative | Receptionist (~$16/hr) | Executive Assistant to C-Suite (~$25+/hr) | Manages complex schedules, handles confidential info, requires high emotional intelligence. |

| Healthcare Support | Medical Assistant (~$18/hr) | Certified Surgical Technologist (~$28/hr) | Requires extensive training, works in a high-pressure sterile environment. |

| Finance | Data Entry Clerk (~$17/hr) | Payroll Specialist (~$24/hr) | Manages complex payroll laws, tax withholdings, and time-sensitive processing. |

| Skilled Trades | General Laborer (~$17/hr) | Welder with TIG Certification (~$26+/hr) | TIG welding is a highly skilled, precise technique required in aerospace and manufacturing. |

| IT Support | Tier 1 Help Desk (~$19/hr) | Tier 2/Desktop Support (Mac OS) (~$23+/hr) | Requires specialized knowledge of a specific, widely-used operating system. |

### `

`In-Demand Skills`

`Finally, your specific skill set is your most immediate lever for increasing your pay. These can be broken down into hard skills (teachable, technical abilities) and soft skills (interpersonal traits).

High-Value Hard Skills:

- Software Proficiency: Beyond basic MS Office, expertise in specific software can be a game-changer. Examples: QuickBooks or Xero for bookkeepers, Salesforce for administrative or sales support roles, Adobe Creative Suite for entry-level designers, EHR/EMR systems (like Epic or Cerner) for healthcare staff.

- Technical Knowledge: This is industry-specific. For trades, it's knowing specific electrical codes or welding techniques. For IT, it's understanding network protocols, Active Directory, and cybersecurity fundamentals. For healthcare, it's mastery of medical terminology and coding systems (ICD-10, CPT).

- Data Analysis: Even at a basic level, the ability to work with spreadsheets (Excel, Google Sheets) to sort, filter, and visualize data using pivot tables or charts is a highly valued skill in almost any office role.

- Bilingualism: In customer-facing or diverse workplace roles, being fluent in a second language (especially Spanish in the U.S.) can command a wage premium.

Crucial Soft Skills:

- Communication (Written and Verbal): The ability to write clear, professional emails and communicate effectively with colleagues, clients, and managers is non-negotiable.

- Problem-Solving: Employers want people who can think on their feet, troubleshoot issues independently, and propose solutions rather than just identifying problems.

- Time Management and Organization: In roles that juggle multiple tasks and deadlines, demonstrating a system for staying organized and prioritizing effectively is essential.

- Client Relationship Management: For any role that interacts with external clients or customers, the ability to build rapport, handle complaints gracefully, and represent the company professionally is a skill worth paying for.

- Adaptability: In a fast-changing work environment, the willingness to learn new software, adapt to new processes, and take on new responsibilities is highly valued