You've seen the number: $22,000 a year. Perhaps it was in a job offer for your first full-time position, a part-time role you’re considering while in school, or it’s what you’re currently earning. The immediate question that follows is almost always, "Can I live on this?" followed closely by, "How do I earn more?" This guide is designed to answer those questions not with a simple yes or no, but with a comprehensive, data-driven, and compassionate roadmap. Earning $22,000 a year presents significant financial challenges in most parts of the country, but it does not have to be your final destination. It can be a starting line.

This article is for anyone who sees that number and feels a mix of apprehension and ambition. We will dissect the financial realities of this income level, explore the types of jobs that typically pay this amount, and—most importantly—lay out a strategic, step-by-step plan to help you leverage this starting point into a thriving, sustainable career. We will go beyond budgeting tips and delve into the world of career analytics, showing you how education, skills, and strategic choices can exponentially increase your earning potential.

In my early 20s, I worked a series of jobs that, when combined, barely scraped past this income level. I vividly remember the constant mental calculus of every purchase and the feeling that I was treading water. That experience, however, became the bedrock of my understanding of career capital—the idea that every job, regardless of pay, offers a chance to build skills, experience, and connections that you can cash in for a better future. This guide is the advice I wish I’d had then, blending hard data with actionable career strategy.

---

### Table of Contents

- [What Does a $22,000 a Year Salary Actually Mean?](#what-does-a-22000-a-year-salary-actually-mean)

- [Is $22,000 a Year a Good Salary? A Deep Dive into the Financial Reality](#is-22000-a-year-a-good-salary-a-deep-dive-into-the-financial-reality)

- [Key Factors to Increase Your Earning Potential Beyond $22,000](#key-factors-to-increase-your-earning-potential-beyond-22000)

- [Job Outlook and Career Growth: Your Path Up from a $22k Salary](#job-outlook-and-career-growth-your-path-up-from-a-22k-salary)

- [How to Build a Career Path Beyond $22,000 a Year: A Step-by-Step Guide](#how-to-build-a-career-path-beyond-22000-a-year-a-step-by-step-guide)

- [Conclusion: From a Starting Salary to a Sustainable Career](#conclusion-from-a-starting-salary-to-a-sustainable-career)

---

What Does a $22,000 a Year Salary Actually Mean?

Before we can strategize, we need to understand the raw numbers. A salary figure on its own is abstract. Let's break down what $22,000 a year translates to in practical terms and explore the types of jobs that commonly fall into this pay bracket.

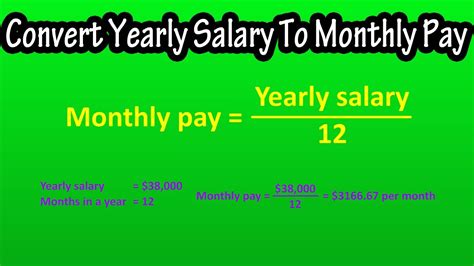

### The Numbers Broken Down

Assuming a standard full-time work schedule of 40 hours per week for 52 weeks a year (a total of 2,080 hours), here’s how a $22,000 annual salary looks:

- Hourly Rate: $10.58 per hour

- Gross Weekly Pay: $423.08

- Gross Monthly Pay: $1,833.33

This hourly rate of $10.58 is higher than the federal minimum wage of $7.25 per hour. However, it falls below the state-mandated minimum wage in numerous states, including California, New York, Washington, and many others. It's crucial to check your state and city's minimum wage laws to ensure you are being compensated legally.

It’s also critical to remember that these are *gross* figures—your pay before any deductions. After federal, state, and local taxes, plus FICA (Social Security and Medicare) contributions, your take-home pay (net pay) will be significantly lower. A single person with no dependents earning $22,000 might see their take-home pay closer to $1,500 per month, depending on their state's tax laws and personal filing situation.

### Context is Everything: Comparison to National Averages

To understand where this salary stands, let's compare it to some key economic benchmarks from authoritative sources:

- Federal Poverty Line (2024): The federal poverty guideline for a one-person household in the 48 contiguous states is $15,060. For a two-person household, it is $20,440. A $22,000 salary is above the poverty line for an individual but just barely above it for a two-person household, underscoring the financial strain it can create.

- Median Personal Income (2022): According to the U.S. Census Bureau, the median personal income in the United States was $40,480 in 2022. A $22,000 salary is roughly half of the national median, placing it in the lower income bracket.

- Median Household Income (2022): The median household income was $74,580. This figure often includes multiple earners, but it highlights the significant gap between a $22k salary and the typical American household's earnings.

### Common Jobs That Pay Around $22,000 a Year

A $22,000 annual salary ($10.58/hour) is characteristic of many entry-level, part-time, or service-sector jobs. According to data from the U.S. Bureau of Labor Statistics (BLS) and salary aggregators like Payscale, roles in this pay range often require a high school diploma or equivalent and minimal prior experience.

Typical Roles Include:

- Retail Salespersons and Cashiers: The median hourly wage for cashiers was $13.43 in May 2022, but the lowest 10 percent earned less than $9.56. Many entry-level retail positions start in the $10-$12/hour range.

- Fast Food and Counter Workers: The median hourly wage for this group was $13.13 in May 2022. Starting wages are often at or just above the local minimum wage.

- Home Health and Personal Care Aides: While the median pay is higher ($14.87/hour), many aides, especially those working for smaller agencies or in low-cost-of-living areas, start in this pay bracket.

- Childcare Workers: With a median hourly wage of $13.71, many entry-level positions in daycare centers or as babysitters fall into the $10-$12/hour range.

- Restaurant Staff (Hosts, Bussers): These roles often pay minimum wage plus a small portion of tips, placing their base earnings in this category.

- Entry-Level Clerical or Office Assistants (Part-Time): Some part-time or temporary office roles may offer hourly rates that equate to a full-time equivalent salary around $22,000.

Understanding that these are typically *starting* points is the first step in reframing this salary not as a career but as a rung on the ladder.

Is $22,000 a Year a Good Salary? A Deep Dive into the Financial Reality

The short, direct answer is no. For a full-time worker in most parts of the United States, $22,000 a year is not a sustainable, long-term living wage. It places an individual in a "cost-burdened" category where more than 30% of their income is spent on housing, leaving very little for other necessities, savings, or emergencies.

However, "good" is subjective and context-dependent. This salary might be considered acceptable or even strategic in specific, temporary situations:

- As a student: Working a part-time job that equates to $22k/year full-time can be a great way to gain experience and cover some expenses while prioritizing your education.

- As a paid intern: The primary value of an internship is experience and networking. The stipend or hourly wage is secondary.

- As a first job out of high school: It's a starting point to learn basic workplace skills like professionalism, time management, and customer service.

- As a secondary household income: If it supplements a primary earner's higher salary, it can contribute meaningfully to household goals.

- In an extremely low cost-of-living area: In some rural parts of the country, this income might be stretchable, though still challenging.

### The Financial Squeeze: A Sample Monthly Budget

To illustrate the challenges, let's create a sample budget based on a monthly take-home pay of $1,500. This budget assumes a low cost-of-living area and does not account for any debt payments (student loans, credit cards) or major unexpected expenses.

| Category | Estimated Cost | Percentage of Income | Notes |

| :--- | :--- | :--- | :--- |

| Housing (Rent/Utilities) | $650 | 43% | This represents finding a roommate or a very small studio in a low-cost area. Finding safe housing at this price is a major challenge. |

| Food (Groceries) | $300 | 20% | Requires careful meal planning, cooking at home, and minimizing eating out. Based on the USDA's "thrifty" food plan. |

| Transportation | $150 | 10% | Assumes reliance on public transit or a very old, paid-off car with minimal fuel and insurance costs. A car repair would be catastrophic. |

| Cell Phone / Internet | $100 | 7% | Basic plans for both services. Internet is a modern necessity for job searching and upskilling. |

| Health Insurance | $50 | 3% | This assumes a heavily subsidized plan through the ACA Marketplace or a minimal employer-sponsored plan with a high deductible. |

| Personal Care / Household | $75 | 5% | Toiletries, cleaning supplies, etc. |

| Discretionary / Savings | $175 | 12% | This is the "flex" money for everything else: clothes, entertainment, and hopefully, putting a small amount into savings. |

| Total | $1,500 | 100% | |

This budget reveals a stark reality: there is almost zero margin for error. A single unexpected event—a medical bill, a car breakdown, a rent increase—could derail the entire budget. Building an emergency fund is incredibly difficult, and saving for long-term goals like retirement or a down payment is nearly impossible.

This financial precarity is the single most compelling reason to view a $22,000 salary as a temporary phase. The goal is not just to survive on it, but to actively and aggressively plan your escape from it. The following sections will show you how.

Key Factors to Increase Your Earning Potential Beyond $22,000

If $22,000 a year is your starting line, your primary objective is to increase your earning potential. Your salary is not a fixed trait; it's a variable that you can influence through strategic effort. This section is the core of our guide—a deep dive into the specific levers you can pull to dramatically increase your income over time.

### 1. Level of Education: The Most Powerful Lever

Education is the single most reliable predictor of higher lifetime earnings. While a four-year degree is a powerful tool, it's not the only path. Every step up the educational ladder unlocks new salary brackets.

Data-Backed Impact:

According to the U.S. Bureau of Labor Statistics (BLS), earnings and unemployment rates are clearly correlated with educational attainment. Here’s the median usual weekly earnings data from 2022 for full-time workers aged 25 and over:

- Less than a High School Diploma: $682/week ($35,464/year)

- High School Diploma, no college: $853/week ($44,356/year)

- Some college, no degree: $935/week ($48,620/year)

- Associate's Degree: $1,005/week ($52,260/year)

- Bachelor's Degree: $1,432/week ($74,464/year)

- Master's Degree: $1,661/week ($86,372/year)

Actionable Strategy:

- If you don't have a high school diploma: Earning your GED or high school equivalency is your first, most critical step. It opens the door to virtually all further training and better jobs.

- Consider Community College: An Associate's Degree can nearly double your earning potential from the $22k level. Focus on high-demand fields like nursing (ADN), computer information systems, or respiratory therapy. Many programs are designed for working adults.

- Pursue Certifications: For a faster, more targeted approach, professional certifications can provide a significant ROI. Examples include:

- Google Career Certificates: (IT Support, Data Analytics, UX Design). These can be completed online in under six months and are recognized by many top employers for entry-level roles.

- CompTIA A+: The industry standard for entry-level IT help desk and technical support roles, which often start at $40,000-$50,000.

- Certified Nursing Assistant (CNA) or Phlebotomy Technician: These healthcare certifications can be completed in a few months and lead to jobs paying well above $22k.

- Bachelor's Degree (Strategic Approach): If you pursue a bachelor's degree, choose your major wisely. STEM (Science, Technology, Engineering, and Math), business, finance, and healthcare fields consistently lead to higher starting salaries.

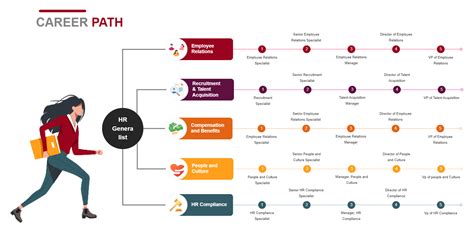

### 2. Years of Experience: The Compounding Effect

While education sets your salary *floor*, experience is what drives its *growth*. Even in low-wage industries, experience leads to promotions and higher pay. The key is to be intentional about the experience you gain.

The Trajectory from $22k:

- 0-1 Year (The Learner): Your focus is on mastering the basics of your role and demonstrating reliability, a positive attitude, and a willingness to learn. At this stage, you're building "soft skills." A retail worker learns customer service; a food service employee learns speed and efficiency. *Expected Salary: $22,000 - $28,000*.

- 2-4 Years (The Contributor): You've mastered your core duties and can now take on more responsibility. You can train new hires, handle difficult customer situations, or manage opening/closing procedures. This is the time to ask for a promotion to a "Shift Lead," "Key Holder," or "Team Supervisor" role. *Expected Salary: $30,000 - $40,000*.

- 5+ Years (The Leader/Specialist): With significant experience, you can move into management (e.g., Assistant Manager, Store Manager) or a specialized role. A clerical assistant with 5 years of experience might become an Executive Assistant or an Office Manager. The key is to transition from "doing the work" to "managing the work" or becoming the go-to expert. *Expected Salary: $45,000+*.

Actionable Strategy:

- Document Your Accomplishments: Don't just list your duties on your resume. Quantify your impact. "Handled customer transactions" becomes "Processed over 100 transactions daily with 99.8% accuracy."

- Seek Out Responsibility: Volunteer for new tasks. Ask your manager what you can do to help them. This signals ambition and makes you the obvious choice for promotion.

- Change Jobs Strategically: The fastest way to get a significant raise is often to change companies. After 1-2 years in a role, if there's no clear path for advancement, start looking for a similar role at another company that pays more.

### 3. Geographic Location: The Cost-of-Living Equation

Where you live has a monumental impact on both your salary and how far that salary goes. A $22,000 salary is functionally different in rural Arkansas versus Boston, Massachusetts.

- High Cost-of-Living (HCOL) Areas: In cities like New York, San Francisco, Boston, and Los Angeles, a $22k salary is not a livable wage for a single person. Housing costs alone would consume nearly all of your income. However, these areas also have higher minimum wages and higher starting salaries for most jobs. An entry-level admin role that pays $35k in a low-cost area might pay $55k in an HCOL city.

- Low Cost-of-Living (LCOL) Areas: In many parts of the Midwest and South, housing and other expenses are much lower. A $22k salary is still a major struggle, but it's not immediately disqualifying. According to Payscale's Cost of Living Calculator, the cost of living in Tupelo, Mississippi is 26% lower than the national average, while New York City is 129% higher.

Actionable Strategy:

- Research Before You Move: If you are considering relocating for a job, use tools like Payscale's or NerdWallet's cost-of-living calculators to compare your current salary to what you'd need to maintain your standard of living in the new city.

- Look for "Sweet Spot" Locations: Consider mid-sized cities with strong job growth in specific sectors but a more reasonable cost of living. Cities in the Sun Belt (like Raleigh, NC; Austin, TX; Phoenix, AZ) or Midwest (like Columbus, OH; Indianapolis, IN) can offer more opportunity than a small town without the extreme costs of a major coastal city.

- Leverage Remote Work: The rise of remote work has created a new opportunity: earning a salary based on a higher-cost area while living in a lower-cost one. This is more common for professional roles, but some entry-level customer service and data entry jobs are now remote, allowing you to escape the geographic salary cap.

### 4. Company Type & Size: Where You Work Matters

The type of organization you work for can influence your pay, benefits, and career trajectory.

- Large Corporations (e.g., Walmart, Amazon, Bank of America): Often have more structured pay scales, better benefits (health insurance, 401k), and formal paths for advancement. An entry-level job at a large company can be a great launchpad due to the training and internal mobility opportunities.

- Small & Medium-Sized Businesses (SMBs): Salaries may be less standardized, but you might have a chance to wear more hats and learn a wider range of skills. A promotion might come faster if you can prove your value directly to the owner.

- Startups: Often cash-poor, they may offer lower base salaries but could include equity (stock options) as part of compensation. These are high-risk, high-reward environments best suited for those passionate about a specific product or industry.

- Non-Profits: Generally pay less than for-profit companies due to budget constraints. People often choose to work here for mission-driven reasons, but it's important to be realistic about the long-term salary potential.

- Government (Local, State, Federal): Government jobs are known for stability, excellent benefits, and defined pension plans. While starting salaries may be modest, the total compensation package (including health benefits and retirement) is often superior to the private sector. A clerk position at a local city hall may offer a clearer path to a stable, middle-class life than a similar role at a small business.

Actionable Strategy:

- Align Your Choice with Your Goals: If your top priority is rapid salary growth, target large corporations in high-growth industries. If it's stability and benefits, look at government jobs.

- Don't Underestimate Benefits: When comparing job offers, look at the *total compensation*. A job paying $28,000 with excellent, low-cost health insurance might be better financially than a job paying $30,000 with no benefits.

### 5. In-Demand Skills: Your Ticket to a Higher Salary Bracket

This is the most actionable area for immediate improvement. Acquiring specific, high-value skills can make you a more attractive candidate and qualify you for jobs that start at $40,000 or more, completely leapfrogging the $22k salary tier.

High-Value, Accessible Skills to Learn:

- Digital Literacy (Advanced): Go beyond basic typing. Master Microsoft Excel (VLOOKUP, pivot tables), Google Workspace, and presentation software. This is a baseline requirement for almost any office job.

- Customer Relationship Management (CRM) Software: Learn the basics of platforms like Salesforce, HubSpot, or Zoho. Many companies use these to manage customer data. Having "Salesforce experience" on your resume is a huge plus for sales, marketing, and customer support roles.

- Basic Bookkeeping/Accounting: Understanding principles of bookkeeping and software like QuickBooks can qualify you for entry-level finance clerk or bookkeeper assistant roles, which have a clear career path to becoming a full-charge bookkeeper or accountant.

- Technical Support Fundamentals: As mentioned, certifications like CompTIA A+ or the Google IT Support Certificate can get you an interview for an IT help desk role. This is an entry point into the lucrative and growing technology sector.

- Digital Marketing Basics: Learn the fundamentals of SEO (Search Engine Optimization), SEM (Search Engine Marketing with Google Ads), and social media management. Many free or low-cost courses are available from Google, HubSpot, and Coursera.

- Skilled Trades: If you enjoy hands-on work, consider a pre-apprenticeship or vocational program in a skilled trade like welding, HVAC repair, plumbing, or electrical work. These careers are in high demand and can lead to six-figure incomes without a four-year degree.

Actionable Strategy:

- Audit Your Current Job for Skill-Building: What software do you use? Can you become the office expert on it? What processes can you improve? Frame your current job as a training ground.

- Use Low-Cost Online Learning: Platforms like Coursera, edX, and Udemy offer thousands of courses, many for under $50. Your local library may also offer free access to platforms like LinkedIn Learning.

- Focus on One Path: Don't try to learn everything at once. Pick one skill path that interests you (e.g., IT Support) and focus your efforts on completing a certification and building a small project portfolio.

By systematically addressing these five factors, you can architect a career path that moves you swiftly and permanently away from a $22,000 annual salary and toward financial stability and professional fulfillment.

Job Outlook and Career Growth: Your Path Up from a $22k Salary

Understanding the long-term outlook for different career paths is essential for making smart choices. Some jobs are shrinking due to automation, while others are exploding with growth. Your goal is to move from a job with a flat or declining outlook into a career with a steep upward trajectory.

### The Outlook for Typical "$22k/Year" Jobs

Let's look at the 10-year job outlook (2022-2032) from the BLS for some of the common jobs in this salary range:

- Retail Salespersons: Projected to decline by 1% over the next decade. The rise of e-commerce continues to put pressure on brick-and-mortar retail roles.

- Cashiers: Projected to decline by a significant 10%. Self-checkout kiosks and automated payment systems are rapidly replacing these roles.

- Fast Food and Counter Workers: Projected to grow by 2%, which is about as fast as the average for all occupations. This sector is relatively stable but offers limited wage growth.

- Home Health and Personal Care Aides: This is a major exception. This field is projected to grow by a staggering 22%, much faster than average. The aging U.S. population is driving massive demand. While starting pay is low, the high demand creates opportunities for wage growth and specialization (e.g., working with clients with specific medical needs).

The takeaway is clear: some starting-point jobs are dead ends, while others are entry points to high-growth fields. A job as a personal care aide, while challenging and low-paying initially, is in a much more promising sector than a job as a cashier.

### Transitioning to High-Growth, Higher-Paying Careers

The key is to use your entry-level job as a launchpad into a role with a better outlook and higher pay. Here are some examples of strategic transitions:

| From (Typical $22k Job) | To (Next-Step Career, ~$40k-50k+) | Skills to Build | 10-Year BLS Outlook |

| :--- | :--- | :--- | :--- |

| Retail Cashier | Administrative Assistant | MS Office Suite, organizational skills, professional communication, basic bookkeeping. | -7% (Decline) |

| Retail Cashier | IT Support Specialist | CompTIA A+, customer service skills, problem-solving, basic networking. | +5% (Faster than avg) |

| Fast Food Worker | Bookkeeping, Accounting, or Auditing Clerk | QuickBooks, Excel, attention to detail, basic accounting principles. | -5% (Decline) |

| Fast Food Worker | Medical Assistant | MA Certificate, anatomy/physiology knowledge, phlebotomy, patient care skills. | +14% (Much faster) |

| Home Health Aide | Licensed Practical Nurse (LPN) | LPN program (typically 1 year), nursing skills, medical terminology. | +5% (Faster than avg) |

| General Laborer |