Introduction

Earning $28 an hour represents a significant milestone in any professional's journey. It's the point where a "job" begins to transform into a "career," a threshold that often separates entry-level work from a stable, professional role with a promising future. This wage, which translates to an annual salary of approximately $58,240, is more than just a number; it’s a gateway to greater financial independence, more complex and fulfilling work, and a launchpad for significant long-term growth. If you're currently earning this wage or aspiring to, you're standing at a pivotal point, ready to leverage your skills and experience into a sustainable and rewarding career path.

The leap from hourly pay to a salaried position at this level signifies a fundamental shift in how you work and how you are perceived by employers. It implies a level of trust, responsibility, and expertise that commands a consistent, predictable income along with benefits like paid time off, health insurance, and retirement plans. But what kind of careers operate in this sphere? What skills do you need to not only enter this bracket but excel within it and advance beyond it? This guide is designed to be your definitive resource, providing an exhaustive look at the world of a $28-per-hour professional.

I've spent over two decades as a career analyst, and I once coached a young data analyst who was thrilled to receive her first offer at exactly this rate. She saw it as her "arrival" moment, but I encouraged her to see it as her "starting line." Within five years, by strategically developing niche skills in data visualization and mastering new software, she more than doubled that salary. Her story underscores a critical truth: reaching the $28-an-hour mark isn't the destination; it's the beginning of a deliberate and exciting journey of professional development.

This article will break down everything you need to know. We will dissect the roles and responsibilities, perform a deep dive into salary data and influencing factors, analyze the long-term job outlook, and provide a concrete, step-by-step plan to help you get started.

### Table of Contents

- [What Does a Professional Earning $28/Hour Do?](#what-does-a-professional-earning-28-an-hour-do)

- [Average Salary for a $28/Hour Role: A Deep Dive](#average-salary-for-a-28-an-hour-role-a-deep-dive)

- [Key Factors That Influence Your Salary](#key-factors-that-influence-your-salary)

- [Job Outlook and Career Growth](#job-outlook-and-career-growth)

- [How to Get Started and Secure a $28/Hour Career](#how-to-get-started-and-secure-a-28-an-hour-career)

- [Conclusion: Your Future Starts Now](#conclusion-your-future-starts-now)

---

What Does a Professional Earning $28 an Hour Do?

A $28-per-hour role, equivalent to a ~$58,000 annual salary, is not tied to a single job title. Instead, it represents a *tier* of professionalism characterized by a specific blend of skill, responsibility, and experience. These are not typically beginner roles, nor are they senior management. They are the critical "doer" and "implementer" positions that form the backbone of almost every industry. Professionals at this level have moved beyond basic task execution and are expected to operate with a degree of autonomy, problem-solve independently, and contribute meaningfully to team and company goals.

The core of these roles revolves around specialized knowledge. Whether you're a paralegal navigating legal documents, a graphic designer creating visual assets for a marketing campaign, or an IT support specialist troubleshooting complex network issues, you possess a skill set that required dedicated training, education, or significant on-the-job experience to acquire.

Common Roles and Industries:

This salary level spans a vast array of professions, including:

- Business and Finance: Project Coordinator, Junior Financial Analyst, Staff Accountant, Market Research Analyst, Human Resources Generalist.

- Technology: IT Support Specialist (Tier 2/3), Junior Web Developer, QA Tester, Junior Data Analyst.

- Healthcare: Licensed Practical Nurse (LPN), Medical Coder, Dental Hygienist, Health Information Technician.

- Creative and Marketing: Graphic Designer, Content Writer/Copywriter, Social Media Manager, Marketing Coordinator.

- Skilled Trades and Technicians: Electrician, Plumber, HVAC Technician (with experience), Automotive Service Technician, Engineering Technician.

- Legal and Administrative: Paralegal, Executive Assistant, Office Manager.

Breakdown of Daily Tasks and Typical Projects:

While the specifics vary wildly by job title, the *nature* of the work shares common threads. A professional at this level can expect their days to be filled with:

- Applying Specialized Skills: This is the primary function. It could be writing code, drafting legal briefs, analyzing financial statements, or executing a digital marketing strategy.

- Project Management & Coordination: Many roles involve overseeing smaller projects or specific parts of larger ones. This includes tracking timelines, coordinating with team members, managing resources, and reporting on progress.

- Data Analysis and Reporting: The ability to gather, interpret, and present data is increasingly crucial. This could mean creating a monthly sales report, analyzing website traffic data for a marketing campaign, or compiling patient data for a healthcare facility.

- Client/Stakeholder Communication: Interacting with clients, customers, vendors, or internal stakeholders is a common duty. This requires strong communication skills to manage expectations, provide updates, and resolve issues.

- Problem-Solving: You are no longer just escalating problems. You are expected to be the first line of defense, capable of troubleshooting issues, identifying root causes, and implementing effective solutions within your domain of expertise.

- Utilizing Specialized Software: Mastery of industry-specific software is non-negotiable. This could be QuickBooks for an accountant, Salesforce for a sales operations specialist, Adobe Creative Suite for a designer, or a specific Electronic Health Record (EHR) system in healthcare.

### A "Day in the Life" Example: Alex, a Marketing Coordinator

To make this tangible, let's imagine a day for "Alex," a Marketing Coordinator at a mid-sized tech company, earning a salary equivalent to $28 per hour.

- 9:00 AM - 9:30 AM: Alex starts the day by reviewing analytics dashboards (Google Analytics, social media insights). She checks the performance of the latest email campaign, noting open rates and click-throughs to include in the weekly report.

- 9:30 AM - 10:30 AM: Alex joins the weekly marketing team meeting. She presents her findings from the email campaign and provides an update on the social media content calendar she manages. She actively participates in a brainstorming session for the upcoming Q3 product launch.

- 10:30 AM - 12:00 PM: Alex's main project for the week is coordinating a webinar. She spends this time drafting promotional copy for emails and social posts, coordinating with the guest speaker to get their bio and headshot, and setting up the registration page using the company's marketing automation software (like HubSpot or Marketo).

- 12:00 PM - 1:00 PM: Lunch break.

- 1:00 PM - 2:30 PM: Alex works on creating a batch of social media graphics using Canva or Adobe Express, scheduling them out for the next two weeks. She responds to comments and messages on the company's LinkedIn and Twitter pages.

- 2:30 PM - 3:00 PM: A sales team member messages Alex, asking for a specific case study to send to a potential client. Alex quickly locates the PDF on the shared drive and sends it over, demonstrating her role as a key support resource for other departments.

- 3:00 PM - 4:30 PM: Alex focuses on writing a draft for the company's next blog post. She's been tasked with a piece on "5 Emerging Trends in Cybersecurity," which requires her to do some light research to ensure the content is accurate and valuable.

- 4:30 PM - 5:00 PM: Alex wraps up her day by organizing her task list for tomorrow in a project management tool like Asana or Trello. She sends a brief end-of-day summary to her manager about the webinar progress and flags a technical issue she found with the registration page for the IT team to review.

This day illustrates the blend of independent creative work (writing, design), analytical tasks (reviewing data), project coordination, and collaborative communication that defines many roles at the $28-per-hour level.

---

Average Salary for a $28 an Hour Role: A Deep Dive

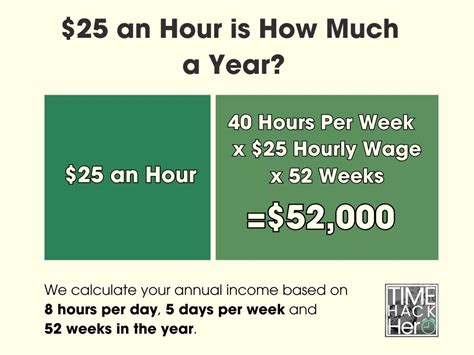

Converting an hourly wage to an annual salary is the first step in understanding your total earning potential. The standard calculation assumes a 40-hour workweek for 52 weeks a year.

$28 per hour x 40 hours per week x 52 weeks per year = $58,240 per year

This figure, just shy of $60,000, places you comfortably within the range of the national median household income in the United States. According to the U.S. Census Bureau, the median household income was approximately $74,580 in 2022. While this is a household figure, a salary of $58,240 for an individual is a solid, middle-class income in many parts of the country.

However, this number is just a baseline. Your actual salary can vary significantly based on your experience, location, industry, and specific role. A $28/hour wage is often a mid-career salary for some professions, while it might be an entry-level or even slightly below-market rate for others in high-demand, high-cost-of-living areas.

### Salary Benchmarks and Ranges by Experience Level

To provide a clearer picture, let's analyze salary data from reputable sources and break it down by experience level. The $58,240 figure often sits squarely in the "mid-career" bracket for many skilled professions.

| Experience Level | Typical Years of Experience | Typical Salary Range (National Average) | Context and Role Examples |

| :--- | :--- | :--- | :--- |

| Entry-Level | 0-2 Years | $45,000 - $55,000 | Recent graduates, individuals new to the field. Roles might include Junior Accountant, Marketing Assistant, IT Helpdesk Technician (Tier 1). The focus is on learning and execution of defined tasks. |

| Mid-Career | 3-8 Years | $55,000 - $75,000 | This is the sweet spot where the $58,240 salary lies. Professionals have proven competence and operate independently. Roles include Staff Accountant, Marketing Coordinator/Specialist, Network Administrator, Paralegal. |

| Senior/Experienced| 8+ Years | $75,000 - $100,000+ | Deep expertise, potential leadership or mentorship responsibilities. Roles include Senior Accountant, Marketing Manager, Senior Systems Administrator, Senior Paralegal, Project Manager. |

*(Source: Data compiled and synthesized from Payscale, Salary.com, and Glassdoor, 2023-2024 reports. Ranges are illustrative and vary by specific profession and other factors discussed below.)*

As Salary.com notes, the median salary for a Project Coordinator in the U.S. is around $62,000, placing our target salary right in the middle of the typical range. Similarly, a Staff Accountant's median salary is approximately $64,000. This confirms that the $28/hour ($58k/year) figure is a very realistic and common salary for a professional with a few years of experience and a defined skill set.

### Beyond the Base Salary: Understanding Total Compensation

One of the biggest shifts when moving from hourly to salaried work is the concept of total compensation. Your salary is just one piece of the puzzle. A comprehensive offer at this level should include a package of benefits and potential bonuses that can add significant value. When evaluating an offer, you must look beyond the base number.

Key Components of Total Compensation:

1. Base Salary: The fixed, predictable amount you earn, in this case, $58,240 per year.

2. Bonuses: These are variable and often performance-based.

- Performance Bonus: An annual or quarterly bonus tied to your individual performance and/or the company's profitability. For a role in the ~$58k range, a typical performance bonus might be 3-8% of the base salary ($1,750 - $4,650).

- Signing Bonus: A one-time bonus offered to entice you to accept the job. This is more common in competitive fields or for candidates with highly sought-after skills.

3. Profit Sharing: A plan that gives employees a share in the company's profits. This is typically paid out annually and can add a significant percentage to your income, though it's not guaranteed.

4. Stock Options/Equity: More common in startups and tech companies, this gives you the option to buy company stock at a predetermined price. While it carries risk, it offers the potential for a large financial payoff if the company does well.

5. Retirement Savings Plans:

- 401(k) or 403(b): A tax-advantaged retirement account. The most critical component is the employer match. A common match is 50% of your contribution up to 6% of your salary. For a $58,240 salary, if you contribute 6% ($3,494), a 50% match adds another $1,747 of free money to your retirement account each year. This is a crucial part of your compensation.

6. Health and Wellness Benefits:

- Health Insurance (Medical, Dental, Vision): Employer-sponsored health insurance is a massive financial benefit. A good plan can be worth thousands of dollars a year. Pay close attention to the monthly premiums, deductibles, and co-pays.

- Health Savings Account (HSA) / Flexible Spending Account (FSA): Tax-advantaged accounts to pay for medical expenses. Some employers even contribute seed money to your HSA.

7. Paid Time Off (PTO):

- Vacation Days: The standard is typically 2-3 weeks (10-15 days) for professionals at this level, increasing with tenure.

- Sick Days: Separate or combined with vacation days into a single PTO bank.

- Paid Holidays: Typically includes 8-12 public holidays per year.

8. Professional Development: Many companies will offer a budget for courses, certifications, and conferences. This is an investment in your future earning potential and a valuable, often overlooked, benefit.

9. Other Perks: Can include life insurance, disability insurance, commuter benefits, wellness stipends (gym memberships), and flexible work arrangements (remote/hybrid).

Example Total Compensation Breakdown:

| Component | Value | Notes |

| :--- | :--- | :--- |

| Base Salary | $58,240 | The foundation of your pay. |

| Potential Bonus (5%) | $2,912 | Variable, based on performance. |

| 401(k) Match (3%) | $1,747 | "Free money" for your retirement. |

| Health Insurance Value | ~$6,000+ | Employer's contribution to premiums. |

| Estimated Total Value | ~$68,900+ | Your actual "take home" value is much higher than the salary number suggests. |

This illustrates why simply looking at the $28/hour figure is insufficient. A robust benefits package can increase the real value of your compensation by 15-30% or more.

---

Key Factors That Influence Your Salary

While $58,240 is a solid benchmark, it's a national average. Your personal earning potential can swing dramatically based on a combination of powerful factors. Understanding and strategically navigating these elements is the key to not only achieving a $28/hour wage but quickly surpassing it. This is the most critical section for anyone looking to maximize their income.

###

1. Level of Education and Certifications

Your educational background provides the foundation upon which your career is built. While a four-year degree is often a prerequisite for many professional roles, the type of degree and any additional certifications can significantly impact your starting salary and long-term trajectory.

- Associate's Degree (A.A., A.S.): For many technical and healthcare roles, an associate's degree is the standard entry point. Think of roles like Dental Hygienist, Radiologic Technologist, or Web Developer (when combined with a strong portfolio). While you can certainly reach the $28/hour mark, your ceiling may be lower without further education. According to the U.S. Bureau of Labor Statistics (BLS), workers with an associate's degree have median weekly earnings of $1,005 (~$52,260/year), putting our target salary within easy reach after a few years of experience.

- Bachelor's Degree (B.A., B.S.): This is the most common requirement for salaried professional jobs in business, finance, marketing, and IT. The field of study matters immenseley. A Bachelor of Science in Computer Science or Finance will typically lead to a higher starting salary than a Bachelor of Arts in a less quantitative field. The BLS reports median weekly earnings for bachelor's degree holders at $1,432 (~$74,464/year), demonstrating that a $58k salary is a very typical mid-career wage for this group.

- Master's Degree (M.A., M.S., MBA): An advanced degree can act as a significant salary accelerator, especially in specialized fields. An MBA can propel a business professional into management roles far more quickly. A Master's in Data Science or Engineering almost guarantees a starting salary well above the $28/hour mark. Median weekly earnings for master's degree holders are $1,661 (~$86,372/year), according to the BLS.

- Professional Certifications: This is one of the most powerful tools for increasing your value. Certifications validate specific, in-demand skills. They show employers you have proven expertise in a particular domain.

- Project Management: A Project Management Professional (PMP) certification can add a 15-20% premium to a project coordinator's salary.

- IT/Cybersecurity: Certifications like CompTIA Security+, Certified Information Systems Security Professional (CISSP), or AWS Certified Solutions Architect can dramatically increase an IT professional's earnings.

- Marketing: Certifications in Google Analytics (GAIQ), HubSpot Inbound Marketing, or Salesforce Marketing Cloud can make a marketing coordinator more valuable and lead to specialized, higher-paying roles.

- Finance: A Certified Public Accountant (CPA) license is the gold standard for accountants and leads to significantly higher salaries and career opportunities.

###

2. Years of Experience

Experience is arguably the single most important factor in salary growth. Employers pay for proven results and reduced risk. An experienced employee requires less supervision, makes fewer mistakes, and can often mentor more junior colleagues.

- 0-2 Years (Entry-Level): At this stage, your salary is based more on your potential (and educational credentials) than your track record. You might start closer to $22-$25/hour ($45k-$52k). Your goal is to absorb as much knowledge as possible and build a portfolio of successful projects.

- 3-8 Years (Mid-Career): This is where you hit your stride and are most likely to be earning in the $28/hour ($58k) range. You have demonstrated your ability to handle core responsibilities independently. You've likely navigated complex projects, resolved challenging issues, and become a reliable team member. Your salary negotiations can now be based on specific accomplishments and the value you've brought to previous employers.

- 8+ Years (Senior/Lead): With close to a decade of experience, you should be earning well above the $28/hour mark. You're now valued not just for your skills, but for your strategic insight, mentorship ability, and deep industry knowledge. Your salary may be in the $35-$50/hour range ($72k-$104k) or higher, as you transition into roles like Senior Specialist, Team Lead, or Manager. Your value is in your ability to multiply the efforts of others and solve high-level business problems.

###

3. Geographic Location

Where you live and work has a massive impact on your salary. A $58,000 salary can provide a very comfortable lifestyle in a low-cost-of-living (LCOL) area but might be a struggle in a high-cost-of-living (HCOL) metropolis. Companies adjust their pay scales based on the local market rate for talent and the cost of living.

High-Paying Metropolitan Areas:

In cities like San Francisco, San Jose, New York City, Boston, and Washington D.C., salaries are significantly inflated to account for the high cost of housing, taxes, and daily expenses. A role that pays $58,000 in the Midwest might command $75,000-$85,000 in one of these cities. According to Payscale, the cost of living in San Francisco is over 90% higher than the national average. Therefore, a "comparable" salary to $58k would need to be over $110,000.

Average and Low-Paying Areas:

In many cities in the Midwest and South, such as St. Louis, MO, Indianapolis, IN, or Birmingham, AL, the cost of living is below the national average. Here, a $58,000 salary is very strong and provides a high quality of life. The trade-off may be fewer job opportunities in certain niche industries compared to major coastal hubs.

The Rise of Remote Work:

The explosion of remote work has complicated geographic pay. Some companies have adopted a single national pay scale, regardless of location. This is a huge benefit for employees in LCOL areas. More commonly, companies use location-based pay bands, adjusting salaries based on the employee's home address. When considering remote roles, it's critical to clarify the company's policy on geographic pay adjustments.

###

4. Company Type, Size, and Industry

The type of organization you work for is a major salary determinant. Each has its own compensation philosophy and budget constraints.

- Startups: Often cash-poor but equity-rich. A startup might offer a base salary slightly below the market rate (e.g., $55,000 instead of $58,000) but supplement it with stock options that could be worthless or incredibly valuable. The environment is fast-paced, with high risk and high potential reward.

- Large Corporations (Fortune 500): These companies typically offer the most competitive and structured compensation packages. Salaries are often at or above market rate, with well-defined bonus structures, excellent benefits, and clear paths for advancement. A role at a large tech or financial services firm will almost always pay more than the equivalent role at a smaller company.

- Small to Medium-Sized Businesses (SMBs): Compensation can vary widely. Some SMBs compete fiercely for talent and pay well, while others may be more budget-constrained. Benefits might be less comprehensive than at a large corporation, but you may have a greater impact on the business and more direct access to leadership.

- Non-Profit Organizations: Driven by mission rather than profit, non-profits typically offer lower salaries than their for-profit counterparts. The trade-off is often meaningful work, a strong sense of community, and sometimes better work-life balance. A $58k salary would be considered quite good for a mid-