Earning $40 an hour is a significant financial milestone for many professionals. It represents a substantial income that can support a comfortable lifestyle, facilitate long-term savings, and open doors to new financial goals. But what does that hourly rate actually translate to as an annual salary? And more importantly, what kind of careers command this level of pay?

This article will break down the calculation, explore the types of jobs that pay in this range, and detail the key factors that can help you reach this impressive earning potential.

The Big Calculation: Converting $40 an Hour to an Annual Salary

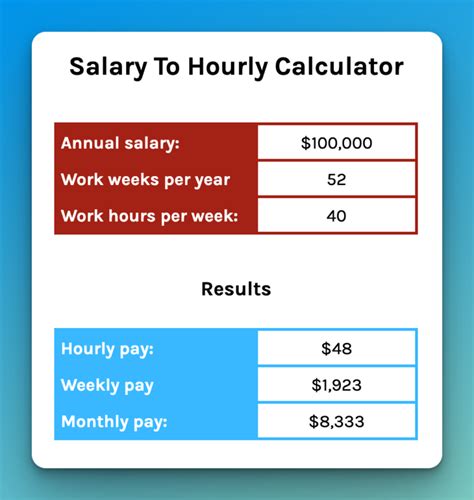

Let's start with the straightforward math. To convert an hourly wage to an annual salary, the standard formula assumes a 40-hour workweek for 52 weeks a year.

The Formula:

`$40 (per hour) x 40 (hours per week) x 52 (weeks per year) = $83,200 (per year)`

So, at a rate of $40 an hour, your gross annual income would be $83,200.

It's crucial to remember this is your *gross* salary—the amount before taxes, insurance premiums, and retirement contributions are deducted. However, it's a powerful benchmark that places you well above the national median household income. For context, the U.S. Bureau of Labor Statistics (BLS) reported the median weekly earnings for full-time wage and salary workers was $1,145 in the fourth quarter of 2023, which equates to an annual salary of approximately $59,540.

What Kind of Jobs Pay $40 an Hour?

An $83,200 salary isn't tied to a single profession. It’s an income level accessible across numerous industries, often requiring a blend of education, specialized skills, and experience. These roles are typically beyond the entry-level and represent a mid-career or high-demand position.

Examples include:

- Registered Nurse (RN): A cornerstone of the healthcare industry, RNs provide and coordinate patient care.

- Software Developer: These tech professionals design, develop, and maintain software applications.

- Marketing Manager: Responsible for planning and executing marketing campaigns to build brand awareness and drive sales.

- Skilled Trades Professional: Experienced electricians, plumbers, or construction managers can easily command this wage.

- Financial Analyst: These experts guide businesses and individuals in making strategic investment decisions.

Average Salary and Earning Potential

While the direct conversion of $40/hour is $83,200, this figure often sits within a broader salary range for a given profession. For jobs in this pay bracket, the typical salary landscape might look like this:

- Entry-to-Mid Level (a few years of experience): $65,000 - $75,000

- Mid-Career (target range): $75,000 - $95,000

- Senior/Experienced Level: $95,000 - $120,000+

For example, according to the BLS Occupational Outlook Handbook, the median pay for Registered Nurses was $86,070 per year in May 2023, placing $40/hour squarely within the typical range for the profession. Similarly, Marketing Managers had a median pay of $140,040 per year, indicating that $40/hour would be an attainable wage early to mid-way through this career path.

Key Factors That Influence Your Salary

Reaching the $40/hour mark isn't just about choosing the right job title; it's about strategically building your career profile. Several key factors will determine how quickly you can achieve this level of income.

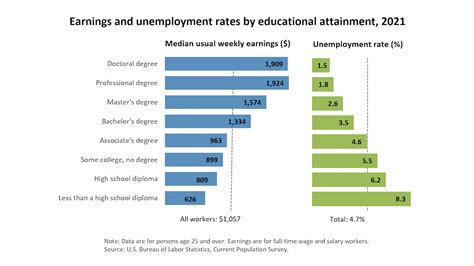

Level of Education

Your educational background is a foundational element of your earning potential.

- Associate or Bachelor's Degree: For many professional roles, a bachelor's degree is the standard entry requirement. In fields like nursing (BSN), finance, or software engineering, a four-year degree is the gateway to salaries that grow to and beyond the $40/hour mark.

- Master's Degree or PhD: Advanced degrees can significantly accelerate earnings. A Master of Business Administration (MBA), a Master of Science in Data Science, or specialized healthcare degrees can qualify you for senior and leadership roles where $40/hour is the starting point, not the goal.

- Certifications and Licenses: In skilled trades and IT, specific certifications can be as valuable as a degree. For an electrician, a master electrician license is key. In tech, certifications in cloud computing (like AWS Certified Solutions Architect) or cybersecurity (like CISSP) can dramatically increase earning potential.

Years of Experience

Experience is arguably the most powerful driver of salary growth.

- Entry-Level (0-2 years): In most professional fields, you'll likely start below the $40/hour mark. This period is crucial for building core competencies and a track record of success.

- Mid-Career (3-8 years): This is the sweet spot where many professionals hit the $40/hour milestone. You've proven your value, can work autonomously, and may begin mentoring others. Salary.com data consistently shows a significant pay increase for most professions after the five-year experience mark.

- Senior/Lead Level (8+ years): With extensive experience, you qualify for leadership roles, high-level individual contributor positions, or specialized expert roles where your hourly rate will substantially exceed $40.

Geographic Location

Where you work matters—a lot. Salaries for the same job can vary by 20-30% or more based on the cost of living and local market demand.

- High Cost of Living (HCOL) Areas: Major metropolitan hubs like New York City, San Francisco, and Washington, D.C., offer higher nominal salaries to compensate for steep housing and living expenses. A software developer in San Jose, CA, might earn $60/hour for the same job that pays $45/hour in Austin, TX.

- Medium to Low Cost of Living (LCOL) Areas: In cities across the Midwest and Southeast, a $40/hour salary ($83,200/year) provides significantly more purchasing power. While the nominal salary might be lower than in an HCOL area, your quality of life could be higher.

- Remote Work: The rise of remote work has complicated this factor, with some companies paying a national standard rate while others adjust pay based on the employee's location.

Company Type

The size, industry, and type of your employer create different compensation structures.

- Large Corporations & Big Tech: Companies like Google, Microsoft, or major financial institutions often offer the highest base salaries and most comprehensive benefits packages.

- Startups: While a startup's base salary might be slightly lower, it could be augmented with stock options, offering a high-risk, high-reward potential.

- Government and Non-Profit: These organizations typically offer lower base salaries than the private sector. However, they often compensate with excellent job security, robust pension plans, and superior work-life balance.

Area of Specialization

Within any given field, specializing in a high-demand niche is a proven strategy for increasing your value.

- In Healthcare: A general-duty Registered Nurse earns a strong wage, but a specialized Nurse Anesthetist or a Critical Care Nurse (ICU) will earn significantly more due to the advanced skills required.

- In Technology: A general web developer is valuable, but a developer specializing in Artificial Intelligence (AI), Machine Learning, or Cybersecurity can command a much higher premium. According to Glassdoor data, specialized tech roles often come with a 15-25% salary bump over generalist positions.

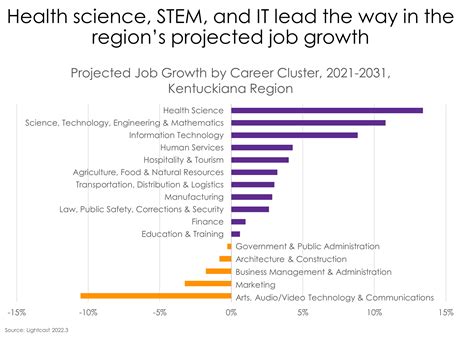

Job Outlook for High-Demand Fields

Fortunately, the outlook for many careers in the $40/hour range is exceptionally strong. According to the BLS Occupational Outlook Handbook (2022-2032 projections):

- Software Developers: Employment is projected to grow 25 percent over the next decade, much faster than the average for all occupations.

- Registered Nurses: Employment is projected to grow 6 percent, creating about 177,400 openings each year.

- Financial Analysts: Employment is projected to grow 8 percent, faster than average, as data-driven financial planning remains critical.

This strong, sustained demand ensures that these professions will continue to offer competitive wages for qualified candidates.

Conclusion: Charting Your Path to $40 an Hour

Reaching a salary of $83,200 per year is a fantastic and achievable career goal. It begins with understanding the simple calculation but is ultimately achieved through intentional career planning. For anyone aspiring to this income level, the key takeaways are:

1. Know Your Worth: $40 an hour equates to a strong gross annual salary of $83,200.

2. Invest in Yourself: Pursue the right education, certifications, and specializations to make yourself a high-demand candidate.

3. Gain Experience: Be patient and strategic in your early career to build the skills that will justify higher pay later on.

4. Be Geographically Aware: Understand how your location impacts your salary and cost of living.

5. Choose a Growth Industry: Aligning your career with a high-growth field provides a natural tailwind for your salary progression.

By focusing on these factors, you can effectively build a roadmap to not only reach the $40-an-hour milestone but to soar far beyond it.