Introduction

Imagine earning a salary that offers not just a living, but a foundation for financial security, personal growth, and professional fulfillment. A wage of $40 an hour, which translates to a robust annual income of over $83,000, represents this powerful milestone for millions of professionals. It's a figure that often signifies a departure from entry-level roles into a respected, skilled position with significant responsibility and reward. This salary level can unlock major life goals: purchasing a home, aggressively saving for retirement, investing in your children's future, or simply enjoying life with less financial anxiety. It’s a tangible benchmark of career success.

But what does it truly take to reach this level? It’s not about a single, magical job title. Rather, it’s a level of compensation achieved across a wide spectrum of industries—from healthcare and technology to skilled trades and corporate management. Reaching the $40-per-hour mark is the result of a deliberate combination of education, experience, specialized skills, and strategic career navigation. Early in my own career as a content writer and analyst, I remember looking at job postings and seeing the '$40/hour' figure as a benchmark of true professional competence. It felt like the dividing line between just "having a job" and "building a career," and understanding the pathways to achieve it was a pivotal moment that changed my perspective on my own value and potential.

This comprehensive guide is designed to be your definitive roadmap. We will dissect what a $40 an hour salary looks like in the real world, explore the diverse career paths that can lead you there, and break down the critical factors that influence your earning potential. Whether you're a student planning your future, a professional looking to level up, or someone considering a career change, this article will provide the data-driven insights and actionable steps you need to turn this ambitious goal into your reality.

### Table of Contents

- [What Does a $40 an Hour Salary Really Mean?](#what-does-a-40-an-hour-salary-really-mean)

- [Jobs That Pay $40 an Hour: A Salary Deep Dive](#jobs-that-pay-40-an-hour-a-salary-deep-dive)

- [Key Factors That Influence Your Path to $40 an Hour](#key-factors-that-influence-your-path-to-40-an-hour)

- [Job Outlook and Career Growth for $40/Hour Professions](#job-outlook-and-career-growth-for-40hour-professions)

- [Your Step-by-Step Guide to a $40 an Hour Career](#your-step-by-step-guide-to-a-40-an-hour-career)

- [Conclusion: Your Future at $40 an Hour](#conclusion-your-future-at-40-an-hour)

---

What Does a $40 an Hour Salary Really Mean?

Before diving into the specific jobs, it's essential to understand the financial and professional reality behind the number. A $40 hourly wage is more than just a number on a paycheck; it represents a significant level of earning power and professional standing.

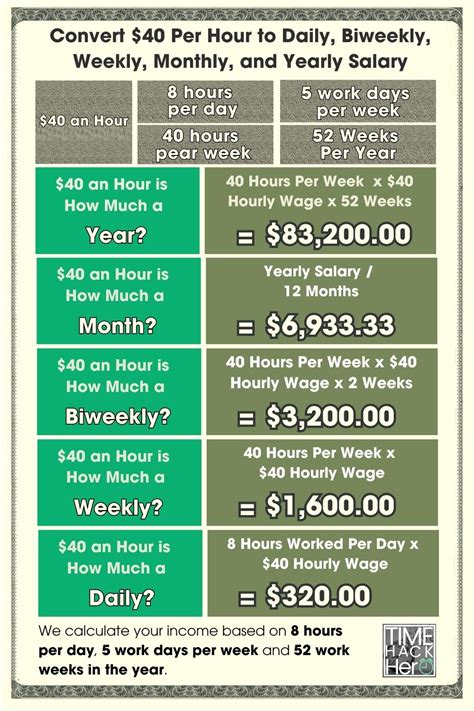

The Annual Breakdown

First, let's do the math. Assuming a standard 40-hour workweek and 52 weeks in a year, the calculation is straightforward:

- $40 per hour

- $1,600 per week (40 hours x $40)

- $6,933 per month (approximately)

- $83,200 per year (52 weeks x $1,600)

This annual figure places an individual or household comfortably within the middle class, and in many parts of the country, the upper-middle class. It's a salary that generally allows for a good quality of life. However, it's crucial to remember that this is the *gross* income. After federal, state, and local taxes, plus deductions for Social Security and Medicare (FICA), your take-home pay (net income) will be lower. The exact amount varies significantly by state, but you can typically expect your net pay to be 20-30% less than your gross pay.

Professionally, earning $40 an hour indicates that you possess valuable, in-demand skills and a proven track record of competence. It's rarely an entry-level wage. It signifies that an employer trusts you with complex tasks, critical projects, and significant responsibilities.

### A "Day in the Life" of a $40/Hour Professional (Example: Management Analyst)

To make this more concrete, let's imagine a day in the life of a professional who earns this wage. We'll use a Management Analyst as our example, a role where the median pay is very close to this mark.

8:30 AM: Sarah, a Management Analyst at a mid-sized consulting firm, arrives at the office (or logs into her remote desktop). She starts her day by reviewing emails and her calendar. She has a client presentation at 2:00 PM, so her morning will focus on finalizing the data and slides.

9:00 AM: She dives into a dataset on her client's operational inefficiencies. Using Excel and a data visualization tool like Tableau, she analyzes production bottlenecks and identifies key areas for cost savings. This requires a sharp analytical mind and technical proficiency—skills that justify her pay rate.

11:00 AM: Sarah meets with her project team. They review her findings, debate the best way to present the recommendations, and delegate final tasks for the presentation deck. This collaborative problem-solving is a core part of her job.

12:30 PM: Lunch break.

1:00 PM: Sarah spends an hour doing a final dry-run of the presentation, anticipating potential questions from the client's executive team. Her ability to communicate complex ideas clearly and persuasively is a critical, high-value skill.

2:00 PM: The virtual client meeting begins. Sarah confidently presents her team's findings, walking the client through the data and outlining a clear, actionable plan to improve their processes. She handles tough questions with poise, backing up her points with evidence.

3:30 PM: After the successful meeting, she debriefs with her team and starts drafting a follow-up email summarizing the key action items for the client.

4:00 PM: She shifts focus to another project, spending the last hour of her day conducting initial research on a new client in the renewable energy sector. This involves reading industry reports and competitor analyses.

5:00 PM: Sarah logs off, her day a blend of deep analytical work, collaborative strategy, and high-stakes communication—all hallmarks of a professional earning a $40/hour wage.

---

Jobs That Pay $40 an Hour: A Salary Deep Dive

A $40 per hour wage ($83,200/year) is not tied to one industry. It's an attainable salary benchmark across numerous fields for individuals with the right qualifications and experience. This section explores a diverse range of professions where this income level is common, relying on data from authoritative sources like the U.S. Bureau of Labor Statistics (BLS) Occupational Outlook Handbook.

It's important to note that the BLS often reports *median* pay, which is the wage at which half the workers in an occupation earned more than that amount and half earned less. This is often a more accurate representation than the *average* pay, which can be skewed by extremely high or low earners. The $40/hour figure often falls near the median for many skilled professions or is a common wage for someone with 3-7 years of experience.

Here is a look at several career paths where earning $40 an hour is a realistic goal.

| Job Title | Median Hourly Wage (BLS, May 2022) | Median Annual Salary (BLS, May 2022) | Brief Job Description & Path to $40/hr |

| :--- | :--- | :--- | :--- |

| Registered Nurse (RN) | $39.05 | $81,220 | Provides and coordinates patient care. Earning $40/hr often requires a few years of experience or specialization in an area like critical care or surgical nursing. |

| Software Developer | $60.03 | $124,860 | Designs, develops, and maintains software applications. While the median is higher, junior to mid-level developers in many regions can expect to earn around $40-50/hr. |

| Management Analyst | $44.17 | $91,870 | Advises managers on how to improve an organization's efficiency and profitability. This wage is typical for analysts with a bachelor's degree and several years of experience. |

| Construction Manager | $48.33 | $100,530 | Plans, coordinates, budgets, and supervises construction projects. The path often involves a degree in a related field and significant on-the-job experience. |

| Financial Analyst | $45.18 | $93,970 | Provides guidance to businesses and individuals making investment decisions. A bachelor's degree is standard; certifications like the CFA can boost earnings significantly. |

| Technical Writer | $38.99 | $81,100 | Prepares instruction manuals, how-to guides, and other supporting documents. Expertise in a technical field (like software or engineering) is key to reaching this pay level. |

| Diagnostic Medical Sonographer | $38.80 | $80,710 | Operates special imaging equipment to create images or conduct tests. Requires an associate's or bachelor's degree and professional certification. |

| Master Electrician/Plumber | Varies (often >$40/hr) | Varies (often >$85,000) | Highly skilled tradespeople who have completed apprenticeships and passed licensing exams. Often run their own businesses or supervise others. (BLS data for general electricians is $30.29/hr, but master level and union roles pay significantly more). |

*(Source: U.S. Bureau of Labor Statistics, Occupational Outlook Handbook, data from May 2022.)*

### Beyond the Hourly Wage: Understanding Total Compensation

A focus solely on the hourly wage can be misleading. When evaluating a job offer, it's crucial to consider the total compensation package, which can add another 20-40% to your base salary's value. Professionals earning $40/hour in established companies often receive a robust benefits package. Key components include:

- Bonuses: Many professional roles, particularly in finance, tech, and sales, offer annual performance bonuses. A bonus could range from 5% to 20% (or more) of your annual salary, significantly boosting your total earnings. An $83,200 salary with a 10% bonus becomes $91,520.

- Health Insurance: Employer-sponsored health, dental, and vision insurance is a major financial benefit. A family plan can cost an employer over $20,000 per year, according to the Kaiser Family Foundation. The portion they pay on your behalf is a significant, non-taxable part of your compensation.

- Retirement Savings: A 401(k) or 403(b) plan with an employer match is essentially free money for your retirement. A common match is 50% of your contributions up to 6% of your salary. On an $83,200 salary, this could mean an extra $2,496 per year directly into your retirement account.

- Paid Time Off (PTO): Generous vacation, sick leave, and holiday policies are a valuable part of compensation, allowing for work-life balance without sacrificing income.

- Stock Options or Equity: Particularly common in the tech industry and startups, equity gives you a stake in the company's success. While riskier, it can have a massive upside potential.

- Other Perks: These can include tuition reimbursement, professional development stipends, wellness programs, and flexible work arrangements (like remote or hybrid work, which saves on commuting costs).

When you are aiming for a "$40 an hour" job, you are truly aiming for a professional role with a total compensation package that reflects that value.

---

Key Factors That Influence Your Path to $40 an Hour

Reaching the $40/hour ($83,200/year) milestone is not a matter of luck. It is the outcome of a series of strategic choices and developments throughout your career. Several key factors directly influence how quickly you can achieve this salary level and how far you can surpass it. This section provides an in-depth analysis of the most critical drivers of your earning potential.

###

Level of Education

Your educational background is often the foundational element that opens the door to higher-paying professions. While a degree is not the only path, it is one of the most common and direct routes.

- Associate's Degree: In certain high-demand fields, a two-year associate's degree is the primary educational requirement and can lead directly to a $40/hour career. Prime examples are in healthcare. Registered Nurses (RNs) can enter the profession with an Associate's Degree in Nursing (ADN), and Diagnostic Medical Sonographers or Radiologic Technologists also typically require an associate's degree. With a few years of experience and potential certifications, reaching and exceeding $40/hour is very common. According to Payscale, an RN with an ADN and 5-9 years of experience earns an average of $38.50/hour, making the $40/hour mark highly attainable.

- Bachelor's Degree: For a vast number of professional roles in business, tech, engineering, and finance, a four-year bachelor's degree is the standard entry requirement. It serves as the ticket to entry-level positions that have a clear trajectory toward the $40/hour mark within 3-5 years. For roles like Financial Analyst, Software Developer, Marketing Manager, or Accountant, the bachelor's degree is the starting line. A graduate in computer science might start at $30-$35/hour but can quickly advance to $45-$50/hour with proven performance.

- Master's Degree: Pursuing a master's degree (e.g., MBA, Master of Science, Master of Public Health) can act as a significant career accelerator. It can help you command a higher starting salary, qualify for senior-level positions more quickly, or pivot into a more lucrative specialization. For example, a Management Analyst with an MBA from a reputable program may start their career at a salary well above $40/hour. Similarly, a Data Scientist, a role that often benefits from a master's degree, has a median salary of over $120,000 (Source: BLS), demonstrating the premium placed on advanced education.

- Professional Certifications: In many fields, certifications are just as, if not more, important than a degree for boosting income. They signal specialized expertise and a commitment to your profession.

- For Project Managers, earning the Project Management Professional (PMP) certification can lead to a salary increase of over 20%, according to the Project Management Institute (PMI). This can easily push a manager from $35/hour to over $45/hour.

- For Accountants, the Certified Public Accountant (CPA) license is the gold standard, unlocking higher-level roles and significantly higher pay.

- In IT, certifications in cloud computing (AWS Certified Solutions Architect), cybersecurity (CISSP), or networking (CCNA) are direct pathways to commanding salaries in the $45-$65/hour range.

###

Years of Experience

Experience is arguably the single most powerful driver of salary growth. Employers pay for proven ability and reduced risk, and a track record of success is the ultimate proof. The journey to $40/hour almost always follows a clear progression.

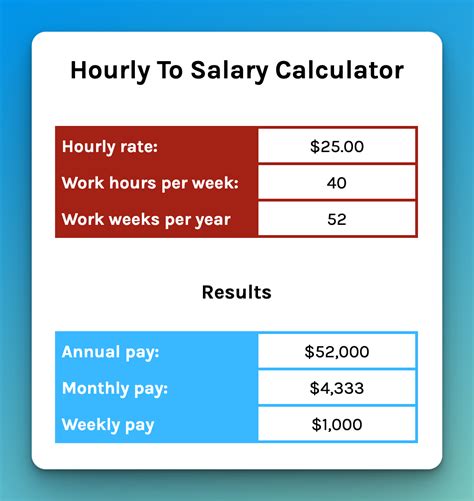

- Entry-Level (0-2 Years): In this stage, you are primarily paid to learn and execute well-defined tasks. For most professional roles requiring a bachelor's degree, salaries typically start in the $25-$35 per hour range ($52,000 - $72,800/year). Your focus should be on absorbing as much knowledge as possible, building a network, and demonstrating reliability and a strong work ethic.

- Mid-Career (3-8 Years): This is the "sweet spot" where many professionals cross the $40/hour threshold. You have moved beyond basic competency and are now an independent, valuable contributor. You can manage small projects, mentor junior colleagues, and solve complex problems without constant supervision. For a role like a Marketing Manager, Payscale data shows an average salary of around $70,000 for those with 1-4 years of experience, but this jumps to over $90,000 ($43/hour) for those with 5-9 years of experience. This is the period of most rapid salary growth.

- Senior/Lead Level (8+ Years): At this stage, you should be comfortably earning above $40/hour. Your value comes not just from your individual contributions, but from your ability to lead teams, set strategy, and influence the direction of the business. Senior Software Engineers, Lead Nurses, Senior Financial Analysts, and Construction Project Executives often earn in the $50-$80+ per hour range ($104,000 - $166,400+). Your experience is now a strategic asset to the company.

###

Geographic Location

Where you live and work has a massive impact on your salary. A $40/hour wage might be considered exceptional in a low-cost-of-living area but may feel closer to average in an expensive metropolitan hub. Companies adjust their pay scales based on the local market rate for talent and the cost of living.

- High-Paying Metropolitan Areas: Major tech and finance hubs are notorious for high salaries, driven by intense competition for top talent. Cities like San Jose, CA, San Francisco, CA, New York, NY, Boston, MA, and Seattle, WA offer the highest wages. According to BLS data, the annual mean wage for Registered Nurses in the San Francisco-Oakland-Hayward, CA metro area is a staggering $151,640 (over $72/hour), more than double what it is in some rural areas. However, this is offset by an extremely high cost of living, particularly for housing.

- Mid-Tier and Average-Cost Cities: Cities like Austin, TX, Denver, CO, Chicago, IL, and Atlanta, GA offer a strong balance. They have thriving job markets that can support $40/hour salaries in many professions, but their cost of living is more manageable than in the top-tier coastal cities. Earning $83,200 a year in these locations can afford a very comfortable lifestyle.

- Lower-Cost-of-Living Regions: In many parts of the Midwest and the South, salaries are generally lower across the board. While achieving a nominal $40/hour might be more challenging, the purchasing power of a slightly lower salary (e.g., $35/hour or $72,800/year) might be equivalent to or greater than the $40/hour in a high-cost area.

- The Rise of Remote Work: The pandemic has profoundly impacted geographical pay. Some companies have adopted location-agnostic pay, meaning you earn the same regardless of where you live. More commonly, companies are implementing location-based pay tiers. This can be an advantage, allowing someone in a lower-cost city to work for a company based in a high-cost hub and earn a salary that is well above their local market rate, making $40/hour a very achievable goal.

###

Company Type & Size

The type of organization you work for plays a significant role in your compensation structure and potential.

- Large Corporations (Fortune 500): These companies typically offer highly structured and competitive compensation. They have defined pay bands for every role, meaning there's a clear, predictable path to hitting and exceeding the $40/hour mark. They also boast some of the best benefits packages (health insurance, 401k matching, PTO), which adds immense value to the total compensation.

- Tech Startups: Startups are a high-risk, high-reward environment. A pre-funding startup might offer a base salary below the $40/hour mark, but compensate with a significant equity (stock options) package. If the company succeeds, that equity could be worth far more than the salary difference. A well-funded, late-stage startup, however, will often compete directly with large corporations on salary to attract top talent.

- Government (Federal, State, Local): Government jobs are known for their stability, excellent benefits, and predictable pay scales. The federal government's General Schedule (GS) pay system clearly outlines salary progression. For example, a role at the GS-12 level in the Washington D.C. area starts at $94,199 per year (approx. $45/hour) in 2024. While the ceiling may be lower than in the private sector, the path to a solid, secure,