Introduction

Imagine the moment you cross a significant career threshold—the point where your skills, experience, and dedication translate into a level of compensation that provides not just comfort, but true financial security and opportunity. For many aspiring and mid-career professionals, earning $48 an hour is precisely that milestone. It represents the gateway to a six-figure annual income, a testament to your value in the modern workforce, and a launchpad for even greater achievements.

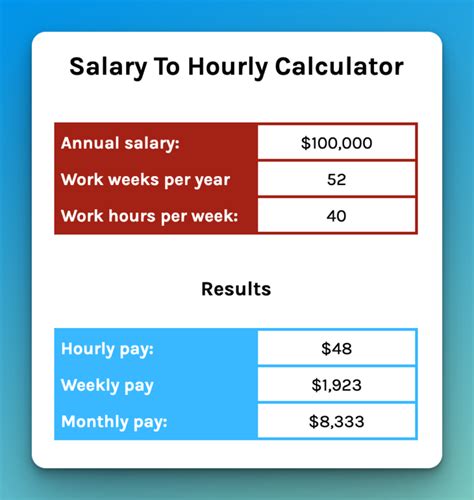

Converting an hourly wage to an annual salary is more than just a mathematical exercise; it's an evaluation of your career's trajectory. A rate of $48 per hour, based on a standard 40-hour workweek for 52 weeks, calculates to an impressive $99,840 per year. This figure places you well above the national median individual income and signifies that you possess a sought-after combination of specialized knowledge, technical skill, and practical experience. But what does it truly take to reach this level? And more importantly, how do you sustain and grow from there?

Throughout my career as a professional development analyst, I've guided countless individuals through this very transition. I once worked with a talented project coordinator who was stuck in a series of contract roles, her income fluctuating with every project's end. By strategically focusing on acquiring a Project Management Professional (PMP) certification and highlighting her proven results, she secured a salaried role that started at the equivalent of $50 an hour. The stability and benefits didn't just change her finances; they transformed her confidence and allowed her to plan for a future she previously only dreamed of. This article is designed to be your comprehensive roadmap to achieve a similar transformation, turning the aspiration of a $48-per-hour role into a tangible reality.

This guide will dissect every facet of earning a $48 hourly wage, from the types of jobs that offer this compensation to the intricate factors that can increase your earning potential. We will explore the long-term outlook for these careers and provide a step-by-step plan to help you get there.

### Table of Contents

- [What Does a $48-an-Hour Professional Do?](#what-does-a-48-an-hour-professional-do)

- [Average $48-an-Hour Salary: A Deep Dive](#average-48-an-hour-salary-a-deep-dive)

- [Key Factors That Influence Salary](#key-factors-that-influence-salary)

- [Job Outlook and Career Growth](#job-outlook-and-career-growth)

- [How to Get Started in This Career](#how-to-get-started-in-this-career)

- [Conclusion](#conclusion)

What Does a $48-an-Hour Professional Do?

A $48-per-hour wage isn't tied to a single job title. Instead, it represents a compensation benchmark achieved by skilled professionals across a diverse range of industries. These are not typically entry-level positions. They are roles that demand a foundation of formal education, several years of hands-on experience, and often, a specialized skillset that is in high demand.

The common thread linking these professionals is the ability to solve complex problems, manage significant responsibilities, and deliver measurable value to their organizations. They have moved beyond simply executing tasks and are now influencing outcomes, leading projects, or providing critical expert analysis.

Core Roles and Responsibilities:

Professionals earning in this bracket are often found in fields like technology, healthcare, skilled trades, finance, and management. Their responsibilities typically include:

- Specialized Knowledge Application: Whether it's a Registered Nurse administering complex patient care, a Software Developer writing clean and efficient code, or a Senior Electrician designing a building's entire electrical system, these roles require a deep and applicable knowledge base.

- Project and Process Management: Many roles at this pay grade involve overseeing projects from conception to completion. This includes planning, budgeting, coordinating teams, and ensuring deadlines are met, common for Construction Managers or IT Project Coordinators.

- Data Analysis and Strategic Decision-Making: Financial Analysts, Marketing Managers, and Data Scientists in this bracket are expected to interpret complex data, identify trends, and provide insights that inform key business strategies.

- Client or Stakeholder Management: Building and maintaining relationships with clients, vendors, or internal stakeholders is crucial. This requires excellent communication, negotiation, and problem-solving skills.

- Compliance and Quality Assurance: In fields like healthcare, engineering, and finance, adherence to strict regulatory standards is paramount. These professionals are often responsible for ensuring their work meets all legal, safety, and quality benchmarks.

### A Day in the Life: "Maria," a Mid-Career User Experience (UX) Designer

To make this tangible, let's imagine a day in the life of "Maria," a UX Designer for a mid-sized tech company, earning approximately $48 an hour.

- 9:00 AM - 9:30 AM: Maria starts her day with a daily stand-up meeting with her agile team, including developers, a product manager, and a quality assurance (QA) engineer. She briefly outlines her progress on the new user dashboard redesign, mentions a usability issue she uncovered, and confirms her plan for the day.

- 9:30 AM - 12:00 PM: She dedicates this block to "deep work." Using design software like Figma, she works on wireframes for the new dashboard, incorporating feedback from yesterday's stakeholder review. She focuses on creating an intuitive flow that will reduce user clicks and improve task completion rates, referencing user research data to justify her design choices.

- 12:00 PM - 1:00 PM: Lunch break.

- 1:00 PM - 2:30 PM: Maria leads a usability testing session with five external users. She observes how they interact with her latest prototype, taking detailed notes on their pain points and moments of confusion. This direct feedback is invaluable and will form the basis for the next design iteration.

- 2:30 PM - 3:30 PM: Maria synthesizes her notes from the testing session, creating a concise report with actionable recommendations for the product manager and development team. She identifies two critical design flaws that need immediate attention.

- 3:30 PM - 4:30 PM: She meets with a junior designer to provide mentorship and feedback on a smaller project they are leading. Part of her role involves elevating the skills of the entire design team.

- 4:30 PM - 5:00 PM: Maria updates her project documentation, archives her design files, and plans her priorities for the next day before logging off.

Maria's day is a blend of creative problem-solving, collaborative teamwork, data-driven analysis, and strategic communication—hallmarks of a professional whose expertise commands a significant wage.

Average $48-an-Hour Salary: A Deep Dive

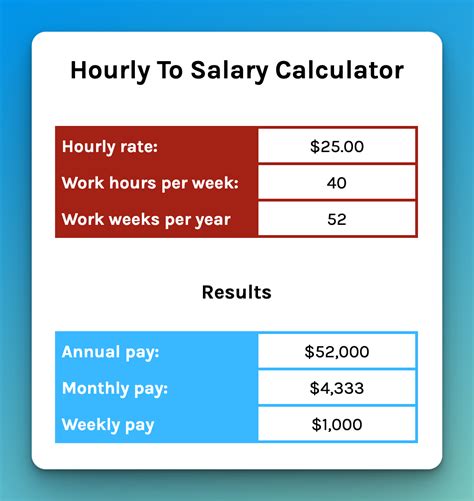

As established, a rate of $48 per hour directly translates to an annual gross salary of $99,840, assuming a standard 2,080-hour work year (40 hours/week x 52 weeks). This powerful figure serves as our baseline, but the reality of compensation is far more nuanced. It’s essential to understand where this number fits within the broader economic landscape and how it breaks down into a complete compensation package.

### Contextualizing a $100,000 Salary

To appreciate the significance of this income level, let's compare it to national averages. According to the U.S. Bureau of Labor Statistics (BLS), the median annual wage for all workers in the United States was $48,060 in May 2023. This means that an income of nearly $100,000 is more than double the median, placing a $48-per-hour earner in a high percentile of individual earners nationwide. It is a salary that reflects significant skill, experience, and demand.

However, "average" is a deceptive term. This salary is not an average for all jobs but rather a target figure common in specific, skilled professions. For these roles, $100,000 may be a mid-career salary, not an endpoint.

### Salary Brackets by Experience Level

Salary growth is not linear; it accelerates as you accumulate experience, specialize, and take on more responsibility. For a typical professional role that pays in this range, such as a Software Developer or a Registered Nurse, the salary progression might look like this:

| Experience Level | Years of Experience | Typical Annual Salary Range | Equivalent Hourly Rate | Notes |

| ------------------- | ------------------- | ----------------------------- | ---------------------- | --------------------------------------------------------------------------------------------------- |

| Entry-Level | 0-2 years | $65,000 - $80,000 | $31 - $38 | Focus is on learning core competencies, executing tasks under supervision, and proving reliability. |

| Mid-Career | 3-8 years | $85,000 - $115,000 | $41 - $55 | This is the sweet spot where the $48/hour rate is most common. Professionals work independently, manage small projects, and begin to specialize. |

| Senior/Lead | 8-15 years | $120,000 - $160,000+ | $58 - $77+ | Manages complex projects, mentors junior staff, influences strategy, possesses deep specialized expertise. |

| Principal/Manager | 15+ years | $160,000 - $250,000+ | $77 - $120+ | Leads entire teams or functions, responsible for business outcomes, sets technical or strategic direction. |

*Sources: Salary data is synthesized from ranges reported by Payscale, Glassdoor, and Salary.com for roles like Software Developer, Marketing Manager, and Financial Analyst, updated for 2023-2024 trends.*

This table clearly illustrates that a $48/hour wage is a fantastic mid-career milestone, but it is by no means the ceiling. It is the solid foundation upon which a truly lucrative long-term career is built.

### Beyond the Paycheck: Understanding Total Compensation

One of the biggest mistakes a professional can make is focusing solely on the hourly rate or base salary. To truly understand your earnings, you must evaluate the Total Compensation (Total Comp) package. This is particularly important when comparing a salaried offer to an hourly one, as salaried positions often come with a richer suite of benefits.

Here’s a breakdown of the components that make up a comprehensive compensation package for a professional earning ~$100,000:

- Base Salary ($99,840): This is your guaranteed, pre-tax income.

- Performance Bonus: This is a variable cash payment tied to individual, team, or company performance. For mid-career professionals, this can range from 5% to 15% of the base salary.

- *Example:* A 10% bonus would add $9,984 to your annual earnings.

- Retirement Savings Plan (401(k) or 403(b)): This is a critical wealth-building tool. Many employers offer a "match," where they contribute a certain amount based on your own contributions. A common match is 50% of your contributions up to 6% of your salary, or a dollar-for-dollar match up to 3-5%.

- *Example:* If you contribute 6% of your salary ($5,990), a 50% match adds an extra $2,995 of "free money" to your retirement account.

- Health Insurance Premiums: Employer-sponsored health, dental, and vision insurance is a major financial benefit. The value can be substantial, as the employer often covers 70-90% of the monthly premium.

- *Example:* If the total monthly premium for a family plan is $1,500, and your employer covers 80%, that's a pre-tax benefit of $1,200 per month, or $14,400 per year.

- Paid Time Off (PTO): This includes vacation days, sick leave, and holidays. While not direct cash, it's a valuable part of work-life balance. 3-4 weeks of PTO is standard at this career level.

- Equity/Stock Options (Especially in Tech): Companies, particularly startups and large tech firms, may offer Restricted Stock Units (RSUs) or stock options. These give you a stake in the company's success and can have enormous upside potential.

- *Example:* A grant of $40,000 in RSUs vesting over 4 years adds $10,000 in value each year, assuming the stock price remains stable.

- Other Perks: These can include tuition reimbursement, professional development stipends, wellness programs, and commuter benefits, all of which have a tangible financial value.

Putting It All Together: A Total Compensation Example

| Component | Value |

| ------------------- | ----------------- |

| Base Salary | $99,840 |

| Performance Bonus (10%) | $9,984 |

| 401(k) Match (3%) | $2,995 |

| Health Insurance Value | $14,400 |

| Total Compensation | $127,219 |

This demonstrates that a role advertised with a $100,000 salary can easily be worth over $125,000 when all benefits are accounted for. When evaluating job offers, always look beyond the base number and calculate the total value.

Key Factors That Influence Salary

Reaching the $48-per-hour mark—and surpassing it—is not a matter of luck. It's the result of a strategic combination of factors that collectively determine your market value. Understanding and actively managing these elements is the key to maximizing your earning potential throughout your career. This section provides an exhaustive breakdown of the levers you can pull to drive your salary upward.

### Level of Education

Your educational foundation is often the first filter used by employers and directly impacts your starting salary and long-term trajectory.

- Bachelor's Degree: For most professional roles in the $100k bracket (e.g., tech, finance, marketing, engineering), a bachelor's degree in a relevant field (like Computer Science, Finance, or Mechanical Engineering) is the standard entry requirement. It signals that you have the foundational knowledge and analytical skills to succeed.

- Master's Degree: Pursuing a master's degree can provide a significant salary bump and open doors to leadership roles. An MBA (Master of Business Administration) is highly valued for management tracks, often leading to a 15-25% salary increase compared to candidates with only a bachelor's degree, according to reports from Payscale. Similarly, a specialized Master of Science (M.S.) in fields like Data Science, Cybersecurity, or Financial Engineering can command a premium salary due to the depth of expertise it confers.

- Professional Certifications: In many fields, certifications are just as, if not more, important than advanced degrees for salary negotiation. They demonstrate specific, verifiable skills.

- Technology: Certifications like AWS Certified Solutions Architect, Certified Information Systems Security Professional (CISSP), or Google Professional Data Engineer can add $10,000-$20,000 to your annual salary.

- Project Management: The Project Management Professional (PMP) certification is a global standard. PMI's "Earning Power" salary survey consistently shows that PMP-certified professionals earn a significant premium—up to 16% more on average—than their non-certified peers.

- Skilled Trades: For a master electrician or plumber, advanced licenses and certifications in specialized areas like industrial automation or medical gas piping are essential for commanding top-tier hourly rates.

- Healthcare: For a Registered Nurse, obtaining a specialty certification such as CCRN (Critical Care Registered Nurse) or CEN (Certified Emergency Nurse) validates advanced clinical knowledge and can lead to higher pay and specialized roles.

### Years of Experience

Experience is arguably the single most powerful determinant of your salary. Employers pay for proven results and the wisdom that comes from navigating real-world challenges.

- 0-2 Years (The Foundation): In this early stage, your primary goal is learning. Your salary will be in the lower range for your profession as you build your core skills. Focus on being a reliable and eager team member, and absorb as much knowledge as possible.

- 3-8 Years (The Growth Spurt): This is where you transition from junior to mid-level. You've mastered the fundamentals and can now work autonomously. You begin to lead smaller initiatives and mentor new hires. It is within this window that most professionals first cross the $48/hour ($100k/year) threshold. Your salary growth is often fastest during this period as you can leverage your proven track record to secure promotions or higher-paying external roles. Data from Salary.com shows that professionals with 5-7 years of experience can earn 25-40% more than their entry-level counterparts.

- 8-15 Years (The Senior/Expert Stage): At this point, you are a senior practitioner or an emerging leader. Your value lies in your deep expertise and your ability to handle the most complex, high-impact projects. You're not just solving problems; you're anticipating them. Salaries for senior-level individual contributors and new managers often range from $120,000 to $160,000+, well beyond the $48/hour mark.

- 15+ Years (The Leadership/Strategic Stage): Professionals with over 15 years of experience typically move into principal, director, or executive roles. Their focus shifts from individual execution to setting strategy, leading large teams, and managing budgets. Compensation at this level is heavily weighted towards bonuses and equity, with total packages frequently exceeding $200,000 or $250,000.

### Geographic Location

Where you work has a dramatic impact on your paycheck. Companies adjust salaries based on the local cost of labor and cost of living. This geographic variance is one of the most significant factors in compensation.

- High-Cost-of-Living (HCOL) Areas: Major technology and finance hubs pay a substantial premium to attract talent. Cities like San Jose, San Francisco, New York City, Boston, and Seattle have some of the highest salaries in the country. A software developer earning $150,000 in San Jose might earn $110,000 for the exact same role in a lower-cost city. According to Glassdoor's salary data, tech salaries in the Bay Area can be 20-35% higher than the national average.

- Medium-Cost-of-Living (MCOL) Areas: Cities like Austin, Denver, Chicago, and Atlanta offer a strong balance of high salaries and a more manageable cost of living. These "tier-two" tech hubs are increasingly popular as they offer excellent career opportunities without the extreme expense of coastal cities. Salaries here are competitive and well above the national average.

- Low-Cost-of-Living (LCOL) Areas: In smaller cities and rural regions, salaries are generally lower. However, the decreased cost of housing, transportation, and daily goods can mean your disposable income is surprisingly high. A $90,000 salary in Kansas City might afford a similar or better lifestyle than a $120,000 salary in Boston.

- The Rise of Remote Work: The pandemic accelerated the trend of remote work, which has complicated geographic pay scales. Some companies have adopted a location-agnostic pay model, offering the same salary regardless of where the employee lives. More commonly, however, companies use a location-based tiered system, adjusting salary bands based on the employee's geographic region. This is a critical point of negotiation for remote roles.

### Company Type & Size

The type and size of your employer create different compensation philosophies and financial realities.

- Large Corporations (Fortune 500, Big Tech): These companies (e.g., Google, Microsoft, Johnson & Johnson, JPMorgan Chase) typically offer the highest base salaries, structured bonus programs, and exceptional benefits. They have the resources to pay top-of-market rates to attract and retain the best talent. The career path is well-defined, but bureaucracy can sometimes slow things down.

- Startups (Early-Stage to Pre-IPO): Startups often offer a lower base salary compared to large corporations. The trade-off is the potential for significant wealth through equity (stock options). If the company succeeds and goes public or is acquired, that equity can be worth far more than the foregone salary. This is a high-risk, high-reward environment that appeals to those who value impact and speed.

- Mid-Sized Companies: These firms offer a blend of both worlds. Salaries are often competitive with larger companies, but the culture may be more agile and offer greater individual visibility. They provide stability without the immense scale of a Fortune 500 firm.

- Government & Public Sector: Government roles (federal, state, and local) are known for their exceptional job security, robust pension plans, and generous benefits. However, the base salary ceiling is often lower than in the private sector. A senior IT specialist in a federal agency might earn $130,000 with an excellent pension, while their counterpart at a private tech company could earn $180,000 with a less certain bonus and 401(k).

- Non-Profits: Driven by mission rather than profit, non-profits typically offer lower salaries. Professionals who choose this path are often motivated by the cause. However, larger non-profits (like major hospitals or universities) can offer competitive compensation packages that approach private-sector levels for senior roles.

### Area of Specialization

Within any given profession, specialization is the fast track to higher pay. By becoming an expert in a niche, in-demand area, you make yourself more valuable and less replaceable.

- Technology Example: A generalist "Software Developer" might earn $110,000.

- A DevOps Engineer specializing in cloud infrastructure automation might earn $135,000.

- An AI/Machine Learning Engineer specializing in natural language processing might earn $160,000+.

- Healthcare Example: A general "Registered Nurse" on a med-surg floor might earn $85,000.

- A Critical Care (ICU) Nurse with a CCRN certification might earn $95,000.

- A Certified Registered Nurse Anesthetist (CRNA), a highly specialized advanced practice role, has a median salary well over $200,000, according to the BLS.

- Finance Example: A general "Financial Analyst" might earn $90,000.

- A Financial Analyst specializing in Mergers & Acquisitions (M&A) at an investment bank could