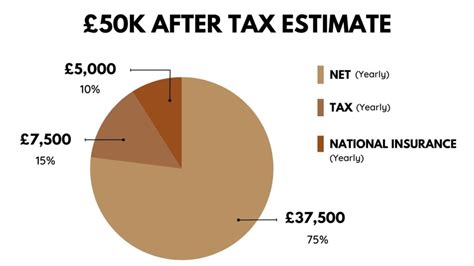

Earning a take-home pay of $50,000 every month is a monumental financial goal, one that places you in the absolute top echelon of earners globally. It translates to an after-tax income of $600,000 per year. To achieve this, your gross annual salary, before any taxes are withheld, must be significantly higher—typically landing somewhere between $900,000 and $1.2 million, depending on federal, state, and local tax laws. This isn't just a salary; it's the result of reaching the pinnacle of a demanding, high-stakes profession. It's a testament to decades of dedication, strategic career moves, and the cultivation of rare and valuable expertise.

This guide isn't about a single job title. No single "job" has an average salary that nets $50k a month. Instead, this is a roadmap to the *types* of elite careers that offer this level of compensation. It's for the ambitious, the driven, and the strategically patient. I once had the opportunity to interview the Chief Financial Officer of a Fortune 100 company, a man whose compensation package was well into the seven figures. I asked him what the most important decision of his career was. He didn't mention a specific deal or a promotion; he said it was the decision, twenty-five years prior, to "play a long game and never stop learning." That philosophy is the bedrock of the journey we're about to explore.

This comprehensive article will deconstruct what it truly takes to reach this career apex. We will explore the roles, the compensation structures, the critical factors that drive multi-million-dollar earning potential, and the concrete steps you can begin taking today, no matter where you are in your career.

### Table of Contents

- [What Does a Top-Earning Professional Do?](#what-does-a-top-earning-professional-do)

- [The Seven-Figure Salary: A Deep Dive](#the-seven-figure-salary-a-deep-dive)

- [Key Factors That Influence a Million-Dollar Salary](#key-factors-that-influence-a-million-dollar-salary)

- [Job Outlook and Career Growth for High Earners](#job-outlook-and-career-growth-for-high-earners)

- [How to Get Started on the Path to a Seven-Figure Income](#how-to-get-started-on-the-path-to-a-seven-figure-income)

- [Conclusion: Is the 50k a Month Goal Right for You?](#conclusion-is-the-50k-a-month-goal-right-for-you)

What Does a Top-Earning Professional Do?

While the specific tasks of a neurosurgeon are vastly different from those of a hedge fund manager or a Chief Technology Officer, the professionals operating at this level share a surprising number of core responsibilities and operational similarities. Their work transcends simple "tasks" and enters the realm of strategic oversight, high-stakes decision-making, and profound accountability. Reaching a seven-figure income means you are no longer just an excellent practitioner; you are a force multiplier for your organization or clients.

The common thread is responsibility for outcomes that have massive financial or human consequences. A surgeon holds a life in their hands. A C-suite executive's decision can affect thousands of employees and billions in market capitalization. A managing director in investment banking pilots deals worth hundreds of millions of dollars. Their daily work revolves around managing complexity, mitigating risk, and creating immense value that far exceeds their own compensation.

Core Roles and Responsibilities of a Top-Tier Professional:

- Strategic Direction and Vision-Setting: These individuals don't just follow a plan; they create it. They are responsible for analyzing market trends, competitive landscapes, and internal capabilities to chart the course for their department, firm, or practice.

- High-Stakes Decision-Making: They are the final arbiters on critical decisions. This could be approving a multi-million dollar acquisition, deciding on a complex surgical approach, green-lighting a new product line, or setting the legal strategy for a landmark case.

- Leadership and Talent Management: A significant portion of their time is spent building, mentoring, and leading elite teams. They are responsible for attracting top talent, cultivating a high-performance culture, and ensuring their team has the resources and direction to succeed. Their success is measured by their team's output.

- Relationship and Stakeholder Management: They operate as the primary interface with crucial stakeholders—the board of directors, major investors, key clients, regulatory bodies, or hospital administrators. Their ability to negotiate, persuade, and build trust is paramount.

- Risk Management and Problem-Solving: At this level, problems are rarely simple. They are complex, multi-faceted, and often unprecedented. A top earner must be adept at identifying potential risks, developing mitigation strategies, and leading their team through crises.

---

### A "Day in the Life" of a Managing Director at a Tech-Focused Investment Bank

To make this concrete, let's imagine a day for "Alex," a Managing Director (MD) whose compensation package is in the low seven figures.

- 6:00 AM - 6:45 AM: Alex is already awake, reading financial news from global markets (Bloomberg, Wall Street Journal). They're looking for M&A rumors, tech funding announcements, and macroeconomic indicators that could impact their clients or active deals.

- 7:30 AM - 9:00 AM: First meeting of the day is an internal strategy session with their team of Vice Presidents (VPs) and Associates. They review the pipeline of potential deals, troubleshoot a roadblock in a current $500M acquisition negotiation, and provide guidance on a valuation model an associate has built. Alex's role here is not to build the model, but to pressure-test its assumptions and question its conclusions.

- 9:30 AM - 11:00 AM: Client call with the CEO of a publicly-traded software company. The topic: a potential "take-private" offer from a major private equity firm. Alex provides expert counsel on the valuation, the strategic rationale, and the likely reaction from the board and shareholders. This is where their reputation and experience are most valuable.

- 11:00 AM - 12:00 PM: Alex dedicates an hour to business development. This involves calling contacts in the venture capital world to understand emerging trends and identify fast-growing companies that might be future clients for an IPO or sale. This is long-term relationship building.

- 12:30 PM - 2:00 PM: A lunch meeting with a partner from a top law firm to discuss the regulatory hurdles of a cross-border tech merger they are both working on. This is a collaborative, problem-solving session between two highly paid experts.

- 2:30 PM - 4:00 PM: Alex sits on the bank's "Commitment Committee," where senior MDs review and approve the firm's involvement in major deals. They must rigorously vet the risks and rewards before allowing the bank's capital and reputation to be put on the line.

- 4:00 PM - 6:00 PM: Time is spent reviewing pitchbooks and documents prepared by their junior teams. Alex provides critical feedback, ensuring the quality of work presented to clients is flawless and the strategic narrative is compelling. They also have a one-on-one with a promising VP to discuss their career progression.

- 6:30 PM - 8:00 PM: Attends a charity gala or industry dinner. While social, this is a critical networking opportunity to maintain relationships with current clients and cultivate new ones in a less formal setting.

- 9:00 PM onwards: After dinner, Alex logs back on to check emails from European and Asian colleagues and review materials for the next day. The work is rarely confined to a 9-to-5 schedule.

This day illustrates that the job is less about "doing the work" and more about directing it, influencing outcomes, managing critical relationships, and shouldering immense responsibility.

The Seven-Figure Salary: A Deep Dive

Achieving a net monthly income of $50,000 requires a gross annual income that consistently crosses the $1 million threshold. This level of compensation is the exception, not the rule, and is concentrated in a few specific industries and roles. It's crucial to understand that at this level, "salary" is often the smallest part of the total compensation package.

The professions capable of generating this income are characterized by one or more of the following: high barriers to entry (e.g., medical school, law school), direct responsibility for massive revenue generation (e.g., investment banking, sales), management of significant assets (e.g., fund management), or creating and scaling a highly successful business (e.g., entrepreneurship).

According to data compiled from sources like the U.S. Bureau of Labor Statistics (BLS), professional recruiting firms like Robert Half, and salary aggregators, the top 1% of earners in the U.S. have an income of over $800,000, which aligns with the gross income needed for our target. Let's examine the primary career paths that lead to this income level.

### Top Professions with Seven-Figure Earning Potential

Below is a table outlining the typical career paths, their compensation ranges at the senior/partner level, and the primary components of their pay. Note that these figures represent the top tier of these professions, not the average.

| Profession/Role | Typical Top-Tier Annual Compensation Range (Gross) | Primary Compensation Components | Authoritative Sources |

| :--- | :--- | :--- | :--- |

| Medical Specialist (e.g., Neurosurgeon, Orthopedic Surgeon, Cardiologist) | $700,000 - $2,000,000+ | Base Salary, Productivity Bonuses, Partnership/Ownership Share in a Practice | Medscape Physician Compensation Report, BLS Occupational Outlook Handbook |

| C-Suite Executive (CEO, CFO, CTO in a large public company) | $1,000,000 - $20,000,000+ | Base Salary, Annual Cash Bonus, Long-Term Incentives (Stock Options, RSUs) | Company Proxy Statements (SEC Filings), Salary.com, Robert Half Salary Guide |

| Investment Banking Managing Director | $1,000,000 - $10,000,000+ | Moderate Base Salary, Extremely Large Year-End Bonus (tied to deal flow) | Wall Street Oasis Reports, Robert Half Salary Guide, Institutional Investor Surveys |

| Hedge Fund / Private Equity Managing Partner | $2,000,000 - $100,000,000+ | Management Fees (2%) and Carried Interest/Performance Fees (20%) | Preqin Reports, Institutional Investor Surveys |

| Big Law Equity Partner | $1,500,000 - $5,000,000+ | Share of Firm Profits (Partnership Draw), Origination Bonuses | The American Lawyer (Am Law 100/200 Reports), Major, Lindsey & Africa Partner Compensation Surveys |

| Successful Entrepreneur / Founder | Highly variable, potentially $0 to $1,000,000,000+ | Salary (often low initially), primarily through Equity and a liquidity event (acquisition/IPO) | Not applicable (driven by company valuation and exit) |

| Elite Sales Professional (e.g., Enterprise SaaS, Medical Devices) | $500,000 - $1,500,000+ | Low Base Salary, High Uncapped Commission Structure | RepVue, Glassdoor, Payscale (for top performers) |

| Top-Tier Management Consultant (Senior Partner/Director) | $1,000,000 - $5,000,000+ | High Base Salary, Performance Bonuses, Profit Sharing | Consulting Magazine Salary Surveys, Management Consulted Reports |

---

### Understanding the Components of Compensation

To truly grasp how these figures are reached, it's essential to look beyond the base salary.

- Base Salary: This is the fixed, predictable portion of pay. For many of these roles, especially in finance and sales, the base salary might only be $250,000 to $500,000. It's enough to live comfortably, but it's not the main wealth-building engine. For surgeons or some executives, the base salary may be a larger component.

- Annual Bonus / Performance Bonus: This is a variable cash payment tied to the performance of the individual, their team, and the company over the past year. In investment banking and management consulting, the bonus can be 100% to 300%+ of the base salary. A surgeon's bonus might be tied to the number of procedures performed (wRVUs) or patient outcomes.

- Long-Term Incentive Plans (LTIPs): This is a cornerstone of executive compensation. LTIPs come in the form of:

- Restricted Stock Units (RSUs): A grant of company shares that vest over a period (typically 3-4 years). Once vested, they are owned outright by the executive.

- Stock Options: The right to buy company stock at a predetermined price (the "strike price") in the future. They become valuable if the company's stock price rises significantly above the strike price.

- These are designed to align the executive's interests with those of the shareholders. A CEO who doubles the company's stock price will see their own net worth increase by millions through their equity holdings.

- Profit Sharing / Partnership Draws: This is the primary compensation method for partners in law firms, consulting firms, and some medical practices. Instead of a salary, equity partners are entitled to a share of the firm's annual profits. The size of their share depends on their seniority, the business they generate ("origination credit"), and their contribution to the firm.

- Carried Interest ("Carry"): This is the holy grail of compensation in private equity and hedge funds. It is a share (typically 20%) of the fund's profits. A private equity partner who helps buy a company for $100M and sell it for $300M generates a $200M profit for the fund's investors. The firm's 20% carry on that profit is $40M, which is then distributed among the partners. This is how finance professionals achieve eight and nine-figure annual incomes.

- Commissions: For elite sales professionals, this is the main event. While a base salary might be $150,000, a top enterprise software salesperson who closes a $10 million annual contract might earn a 10% commission ($1 million) on that single deal.

In summary, the journey to a $50k monthly after-tax income is rarely a salaried one. It is a path of variable, performance-driven compensation where your earnings are directly tied to the immense value you create, the revenue you generate, or the assets you successfully manage.

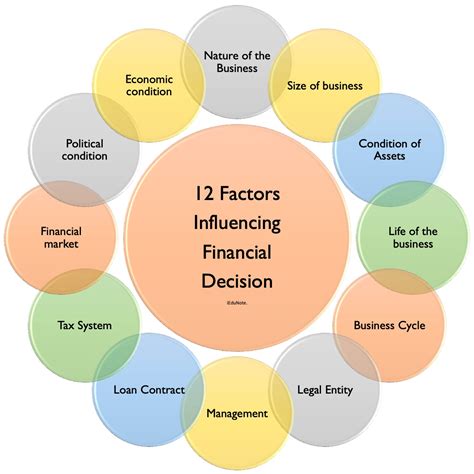

Key Factors That Influence a Million-Dollar Salary

Reaching a seven-figure income is not a matter of luck. It's the culmination of a series of strategic choices and the compounding effect of specific factors over a 15-to-25-year career. Understanding and optimizing for these factors is the most critical part of planning a career that has this level of earning potential.

---

### `

` Level of Education `

`At the highest echelons of professional life, education serves as both a foundational requirement and a powerful signaling mechanism. It's less about the specific knowledge learned and more about the network, prestige, and analytical rigor associated with elite institutions.

- The Non-Negotiable Degrees (MD & JD): For the highest-paying fields of medicine and law, the path is non-negotiable. You must have a Doctor of Medicine (MD) or Doctor of Osteopathic Medicine (DO) for medicine, and a Juris Doctor (JD) for law. Furthermore, the prestige of the institution matters immensely. A graduate of a Top 14 (T14) law school (e.g., Yale, Harvard, Stanford) has a vastly higher chance of landing a job at a "Big Law" firm—the primary gateway to a partnership—than a graduate from a lower-ranked school. Similarly, a doctor who graduates from a top medical school like Johns Hopkins or UCSF and secures a residency at a prestigious hospital is on a faster track to a high-earning specialty.

- The MBA as an Accelerator: For careers in C-suite management, investment banking, and top-tier consulting, a Master of Business Administration (MBA) from a top-ranked program (e.g., M7 schools like Harvard, Stanford, Wharton, Booth, Kellogg) acts as a powerful career accelerator or pivot point. It provides a stamp of elite analytical ability, a world-class network, and direct access to on-campus recruiting from the world's most prestigious firms. For an investment banker, an MBA is the traditional path from a pre-MBA "Associate" role to a post-MBA "Associate" or "Vice President" role, which is the direct path to Managing Director. The median starting salary package for a Harvard Business School graduate in 2023 was over $200,000, but its true value is in unlocking the path to seven-figure roles 10-15 years later.

- Advanced Technical Degrees (PhD): In highly specialized fields like quantitative finance ("quants") or Artificial Intelligence research at major tech companies (e.g., Google's DeepMind, Meta AI), a PhD in a relevant field (Physics, Mathematics, Computer Science) from a top university is often the price of entry. These roles command enormous starting salaries and bonuses because the expertise is exceptionally rare and can generate billions in value. A top AI researcher can command a starting package nearing $1 million annually.

Key Takeaway: For these paths, education is a gatekeeper. Aspiring high-earners must plan to attend the best possible institution they can gain admission to, as it sets the trajectory for their entire career.

---

### `

` Years of Experience `

`A seven-figure income is almost never an early-career phenomenon. It is the reward for surviving a grueling, multi-stage career progression where each level carries more responsibility and higher compensation.

Let's map the typical trajectory for an Investment Banker:

- Analyst (Years 0-2): Age 22-24. Works 80-100 hours a week on financial modeling, pitchbook creation, and grunt work. Compensation: ~$150k - $250k (Base + Bonus).

- Associate (Years 3-6): Age 25-30 (often post-MBA). Manages analysts, refines models, and begins to interface with clients. Compensation: ~$300k - $500k.

- Vice President (VP) (Years 7-10): Age 30-35. Leads deal execution, manages client relationships on a day-to-day basis, and starts to develop their own client network. Compensation: ~$500k - $800k.

- Director / Principal (Years 11-14): Age 35-40. Focuses heavily on originating new business (bringing in deals) and is seen as a senior leader on transactions. Compensation: ~$700k - $1.2M.

- Managing Director (MD) (Years 15+): Age 40+. Purely focused on relationship management and revenue generation. They are the "rainmakers" for the firm. They are judged on the fees they bring in. Compensation: $1M - $10M+.

Now, let's contrast this with a Specialist Surgeon:

- Medical School (4 years): Incurs ~$200k-$400k in debt.

- Residency (5-7 years): e.g., in Orthopedic Surgery. Long hours, intense training. Compensation: ~$60k - $80k per year.

- Fellowship (1-2 years): Sub-specialization, e.g., in Spine Surgery. Still in training. Compensation: ~$70k - $90k per year.

- Attending Physician (Early Career, Years 0-5): Age 33-38. Finally practicing independently. Joins a hospital or private practice. Compensation: ~$400k - $600k.

- Senior Physician / Partner (Years 10+): Age 40+. Has built a reputation, may be a partner in a lucrative private practice, earning a share of profits. Compensation: ~$700k - $2M+.

Key Takeaway: The path is a marathon of paying your dues. The massive income jump happens after 10-15 years of proven performance, specialization, and moving from a "doing" role to a "leading and originating" role.

---

### `

` Geographic Location `

`For top-tier professional roles, geography is destiny. The highest salaries are heavily concentrated in a handful of global "alpha" cities that serve as nerve centers for finance, tech, law, and business. A role in New York City or the San Francisco Bay Area will pay a significant premium over the same role in a smaller metropolitan area.

- Top-Paying Metropolitan Areas:

- New York, NY: The undisputed king for finance (investment banking, hedge funds, private equity) and Big Law. The sheer concentration of corporate headquarters and capital markets creates unparalleled demand for these services.

- San Francisco / Silicon Valley, CA: The global epicenter of technology and venture capital. C-suite executives, top software engineers (Distinguished Engineer, AI leads), and the VCs who fund them command astronomical salaries and equity packages here. The high cost of living is both a result and a driver of these high salaries.

- Los Angeles, CA: A hub for media/entertainment executives and specialized legal practices.

- Boston, MA: A major center for biotech, pharmaceuticals, and asset management.

- Chicago, IL: A significant hub for finance, consulting, and legal services.

A 2023 report from the recruiting firm Robert Half highlights this disparity. A financial executive role that pays a baseline salary of $200,000 nationally would be adjusted upwards by 41% in New York City ($282,000) and 38% in San Francisco ($276,000), but only by 5% in a city like Milwaukee ($210,000). When multi-million dollar bonuses are calculated as a percentage of this higher base, the geographic impact becomes even more profound.

For physicians, salaries can be more complex. While major cities have high-paying roles, some of the highest *average* physician salaries are found in less urbanized states where the demand for specialists is high and the supply is low. For example, states like Wisconsin, Indiana, and Georgia often rank highly for physician compensation according to Medscape. However, the absolute top-end, practice-owning surgeons in niche fields will still find their most lucrative opportunities in major metro areas with a large population of wealthy clients.

Key Takeaway: If your goal is a top-tier salary in finance, law, or tech, a willingness to live and work in a high-cost, high-opportunity city like New York or San Francisco is almost a prerequisite.

---

### `

` Company Type & Size `

`The type of organization you work for dramatically impacts your earning potential and the structure of your compensation.

- Large Public Corporations (Fortune 500): This is the path for C-suite executives (CEO, CFO, etc.). Compensation is highly structured, transparent (disclosed in SEC filings), and heavily weighted towards stock-based LTIPs. The path is long and political, requiring a climb up the corporate ladder.

- Privately Held Firms (Big Law, Consulting, Investment Banking): These are often partnerships. The goal is to become an equity partner. This provides a direct share in the firm's profits, leading to massive annual payouts in good years. The culture is famously "up or out"—you either advance towards partnership or are encouraged to leave.

- Boutique & Specialized Firms: A smaller, specialized investment bank might offer a higher percentage bonus than a large bulge-bracket bank because they have lower overhead. A boutique litigation law firm that wins a massive class-action lawsuit can pay its partners more than a general practice firm. In these firms, your individual contribution is more visible and can be rewarded more directly.

- Startups: This is the high-risk, high-reward path. A founder or early employee (e.g., the first VP of Engineering) may take a very low salary for years. Their compensation is almost entirely in the form of equity. If the startup fails (which most do), they earn little. But if the company becomes a "unicorn" and is acquired or has a successful IPO, that equity can be worth tens or hundreds of millions of dollars, creating generational wealth overnight.

- Hedge Funds / Private Equity: These are the apex predators of the financial world. They are typically small, private partnerships managing immense pools of capital. Compensation is driven by the "2