Earning $52 an hour is a significant financial milestone. It places you firmly in the six-figure income bracket, a goal many professionals strive for throughout their careers. This rate translates to an annual salary of approximately $108,160, opening doors to greater financial security, personal freedom, and professional opportunity. But what does it truly take to reach this level of compensation? It’s not just about finding a single job; it’s about building a strategic, high-value career. This guide is for the ambitious professional—the recent graduate eyeing a lucrative future, the mid-career worker looking to break through a plateau, or the hourly employee ready to understand their full earning potential. We will move beyond the simple math and explore the professions, skills, and strategies that command this impressive wage.

I remember the first time I coached a client who had just received a job offer that crossed the six-figure threshold. For them, it wasn't just a number; it was validation for years of late-night studying, taking on challenging projects, and strategically building their network. It represented a fundamental shift in what they could provide for their family and the kind of future they could build. This guide is designed to be that coach for you—providing a comprehensive, data-driven roadmap to not only reach the $52-an-hour mark but to thrive and grow far beyond it.

### Table of Contents

- [What Kinds of Professionals Earn $52 an Hour?](#what-kinds-of-professionals-earn-52-an-hour)

- [Understanding Your Total Compensation at the $108,000 Level](#understanding-your-total-compensation-at-the-108000-level)

- [Key Factors That Influence Your Earning Potential Beyond $52/Hour](#key-factors-that-influence-your-earning-potential-beyond-52hour)

- [Job Outlook and Growth for High-Earning Professions](#job-outlook-and-growth-for-high-earning-professions)

- [How to Build a Career that Pays $52+ an Hour](#how-to-build-a-career-that-pays-52-an-hour)

- [Conclusion: Charting Your Path to Six-Figure Success](#conclusion-charting-your-path-to-six-figure-success)

What Kinds of Professionals Earn $52 an Hour?

An hourly rate of $52 is not tied to a single job title. Instead, it represents a level of expertise, responsibility, and market demand that spans multiple industries. Professionals earning in this range are typically not in entry-level positions; they are experienced specialists, team leaders, or highly skilled individual contributors whose work has a direct and significant impact on their organization's success. They are problem-solvers, strategists, and creators who possess a combination of technical mastery and essential soft skills.

To illustrate, let's explore some common professions where earning $52 an hour (or a ~$108,160 salary) is a realistic benchmark for those with solid experience:

- Senior Software Engineer: These professionals are the architects behind the digital tools we use every day. They design, develop, and maintain complex software systems. Their role involves writing clean, efficient code, collaborating with product managers and designers, and mentoring junior developers. Their high compensation is driven by the universal demand for technology across all sectors of the economy.

- Nurse Practitioner (NP): Combining clinical expertise with a focus on patient wellness, NPs are advanced practice registered nurses who provide primary, acute, and specialty healthcare. They can diagnose and treat illnesses, order and interpret diagnostic tests, and prescribe medications. With an aging population and a growing need for accessible healthcare, the demand and compensation for NPs are exceptionally strong.

- Financial Manager: Tasked with the financial health of an organization, financial managers oversee investment activities, produce financial reports, and develop long-term financial strategies. They analyze market trends to maximize profits and ensure compliance with regulations. Their expertise is critical for navigating economic uncertainty and driving sustainable growth.

- Senior Marketing Manager: In a world saturated with information, a senior marketing manager is responsible for cutting through the noise. They develop and execute comprehensive marketing strategies to build brand awareness, drive customer acquisition, and increase revenue. This involves managing campaigns, analyzing data, overseeing creative teams, and controlling significant budgets.

- Construction Manager: These professionals plan, coordinate, budget, and supervise construction projects from start to finish. They are the central point of contact for architects, engineers, and skilled laborers, ensuring projects are completed on time, within budget, and to the required standards of quality and safety.

### A Day in the Life of a "$52/Hour Professional"

To make this tangible, imagine a composite "Day in the Life" blending elements from these roles. This isn't one person's day, but rather a snapshot of the *level of activity* and responsibility common to this earning bracket.

8:30 AM - 9:30 AM: Strategic Alignment & Planning

The day begins not with simple tasks, but with strategy. A Senior Software Engineer joins a "sprint planning" meeting to prioritize features for the next two weeks. Simultaneously, a Marketing Manager reviews the previous day's campaign analytics to adjust ad spend. A Nurse Practitioner huddles with her clinic's medical team to review the day's patient load and discuss complex cases. The common thread is forward-looking, data-driven planning that sets the tone for productive work.

9:30 AM - 12:00 PM: Deep Focus & Execution

This block is for focused, high-value work. The software engineer is deep in code, building a new API. The financial manager is buried in spreadsheets, modeling different financial scenarios for a potential acquisition. The construction manager is on-site, troubleshooting a supply chain issue with a subcontractor and ensuring safety protocols are being followed. This is "head-down" time where their core expertise is applied directly to solving complex problems.

12:00 PM - 1:00 PM: Lunch & Networking

Lunch is often more than just a break. It might involve mentoring a junior colleague, having an informal catch-up with a cross-functional team lead, or reading an industry journal to stay current on emerging trends.

1:00 PM - 4:00 PM: Collaboration & Communication

The afternoon is filled with collaborative efforts. The Marketing Manager presents their quarterly strategy to executive leadership. The Nurse Practitioner conducts patient consultations, blending medical diagnosis with empathetic communication. The Construction Manager leads a progress meeting with the client, architects, and key contractors. Professionals at this level must be able to clearly articulate complex ideas and influence stakeholders.

4:00 PM - 5:30 PM: Problem-Solving & Future-Proofing

The day winds down with resolving unforeseen issues and planning for the future. An unexpected bug requires the software engineer to collaborate with the QA team. A sudden market shift prompts the financial manager to update their risk analysis. The professional at this level doesn't just clock out; they ensure the day's fires are extinguished and tomorrow is set up for success. They are paid for their judgment and their ability to handle complexity.

Understanding Your Total Compensation at the $108,000 Level

A wage of $52 an hour seems straightforward, but how it translates into your annual earnings and overall financial picture is more complex. Understanding the nuances between being an hourly worker and a salaried employee at this income level is critical for making informed career decisions.

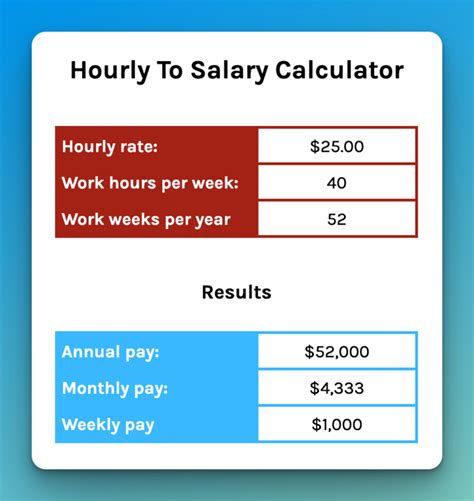

First, let's establish the baseline calculation. Assuming a standard 40-hour workweek and 52 weeks in a year, the math is simple:

> $52/hour × 40 hours/week × 52 weeks/year = $108,160 per year

This $108,160 figure is the gross annual salary equivalent of a $52 hourly wage. However, this number is just the beginning of your total compensation story. The structure of your pay—hourly versus salaried—has significant implications for your income stability, work-life balance, and overall benefits.

### Hourly vs. Salaried: The Great Debate at Six Figures

Many associate hourly work with lower-wage jobs, but numerous high-skilled professions, particularly for contractors, consultants, and certain healthcare or skilled trade roles, are paid hourly. At the $52/hour level, you are often classified as a non-exempt employee under the Fair Labor Standards Act (FLSA), though this can vary. Salaried professionals earning over a certain threshold (currently $35,568 per year) who perform executive, administrative, or professional duties are typically considered exempt. This distinction is the most critical factor.

Here's a detailed comparison:

| Feature | $52/Hour (Typically Non-Exempt) | $108,160 Salary (Typically Exempt) |

| :--- | :--- | :--- |

| Overtime Pay | Major Advantage. You are legally entitled to overtime pay, usually 1.5 times your regular rate ($78/hour), for every hour worked over 40 in a week. If a project demands a 50-hour week, you get paid for all 50 hours, with 10 at the premium rate. | Major Disadvantage. You are generally not eligible for overtime pay. Your salary is fixed, regardless of whether you work 40, 50, or 60 hours in a given week. This can lead to a lower effective hourly rate during busy periods. |

| Income Predictability | Variable. Your monthly income can fluctuate. If you work fewer than 40 hours (due to holidays, slow periods, or personal time), your paycheck will be smaller. However, it can also be significantly larger during periods of high demand. | Stable. You receive the same base pay every pay period, making budgeting easier and more predictable. Your income doesn't decrease if you work a 35-hour week. |

| Work-Life Balance | Clear Boundaries. There's a direct financial incentive for the company to respect your time. Managers are less likely to ask you to work late or on weekends without clear justification and budget approval for overtime. Your time is literally money. | Blurred Boundaries. The "always on" culture can be more prevalent. Answering emails after hours or taking on extra work doesn't result in extra pay, which can sometimes lead to burnout if boundaries aren't self-enforced. |

| Benefits Eligibility | Variable. Full-time hourly employees often receive the same benefits as salaried staff. However, contractors or consultants paid hourly may not receive any benefits, such as health insurance, paid time off, or retirement contributions. This is a critical point to clarify. | Consistent. Typically includes a comprehensive benefits package as part of the total compensation offer. This usually includes health, dental, and vision insurance, a 401(k) or other retirement plan, and paid time off. |

| Paid Time Off (PTO) | When you take a vacation or sick day, you are generally not paid for those hours unless you have a specific PTO benefit pool to draw from. Unpaid time off directly reduces your income. | Paid time off is a standard benefit. You can take vacation or sick days without a reduction in your paycheck, as your salary covers this time. |

| Perception & Status | In some traditional corporate cultures, there can be an outdated perception that salaried roles are more "professional." However, in modern and project-based industries (like tech and consulting), high-end hourly work is common and respected. | Often perceived as a more senior or permanent position within a company's structure, which can sometimes come with more strategic responsibilities and a clearer path to leadership. |

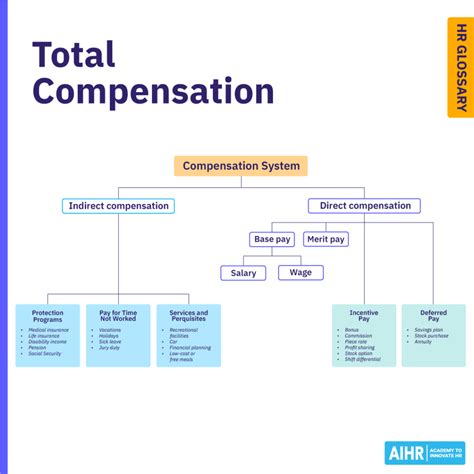

### Beyond the Paycheck: The Components of Total Compensation

Whether you're hourly or salaried, your pay is only one part of the equation. At the $108k+ level, other forms of compensation become increasingly significant. When evaluating an offer, you must look at the total compensation package.

- Bonuses: Many professional roles include performance-based bonuses. These can be tied to individual, team, or company performance and can range from a few thousand dollars to 10-20% or more of your base salary. A $108,160 salary with a consistent 15% annual bonus is effectively a $124,384 compensation package.

- Retirement Plans (401k/403b): A company match on your retirement contributions is essentially free money. A common match is 50% of your contributions up to 6% of your salary. On a $108,160 salary, if you contribute 6% ($6,490), the company adds another $3,245 to your retirement account. This is a vital long-term wealth-building tool.

- Health Insurance: Employer-sponsored health insurance is a massive financial benefit. A quality family plan can cost over $20,000 per year on the open market. A company that covers 80% of that premium is providing a non-taxable benefit worth $16,000. Pay close attention to premiums, deductibles, and out-of-pocket maximums.

- Equity and Stock Options: Particularly common in the tech industry and startups, equity gives you a small ownership stake in the company. This can include Restricted Stock Units (RSUs) or stock options. While riskier than cash, a successful company's equity can result in a life-changing financial windfall, far surpassing your salary.

- Paid Time Off (PTO): A generous PTO policy is a significant component of work-life balance and overall well-being. Four weeks of PTO (20 days) on a $108,160 salary is a paid benefit worth approximately $8,320.

- Other Perks: Don't underestimate the value of other benefits, such as tuition reimbursement, professional development stipends, wellness programs, paid parental leave, and flexible work arrangements (remote or hybrid). These perks contribute to your financial health and job satisfaction.

In summary, a $52/hour rate or a $108,160 salary is a fantastic benchmark, but a savvy professional analyzes the entire offer. The choice between hourly and salaried depends on your personal preference for stability versus flexibility, your ability to control your work hours, and the completeness of the benefits package offered.

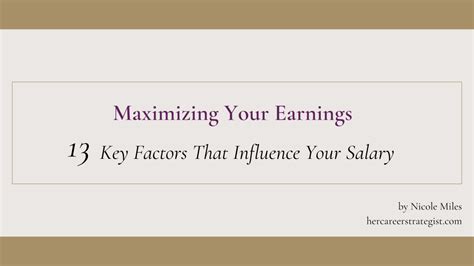

Key Factors That Influence Your Earning Potential Beyond $52/Hour

Reaching the $52-per-hour mark is an achievement, but it's rarely a final destination. Your earning potential is not a static number; it's a dynamic figure influenced by a powerful combination of personal attributes, professional choices, and market forces. Understanding these factors is the key to not just maintaining this income level, but strategically increasing it over time. Think of $108,160 not as a ceiling, but as a launchpad.

Here we'll dissect the six primary levers you can pull to influence your salary trajectory.

### 1. Level of Education & Certifications

While experience often trumps education later in a career, your academic foundation sets the initial trajectory and can unlock higher earning brackets.

- Bachelor's Degree: For most professional roles in the $100k+ range (like software engineering, finance, and marketing), a bachelor's degree is the standard entry requirement. The field of study is critical; degrees in STEM (Science, Technology, Engineering, and Math), finance, and economics have a statistically higher earning potential than those in the humanities, though this can be overcome with relevant skills.

- Master's Degree/MBA: In many fields, an advanced degree is the key to unlocking senior and leadership roles. A Nurse Practitioner, for example, is required to have a Master of Science in Nursing (MSN) or a Doctor of Nursing Practice (DNP). According to the BLS, professionals with a master's degree had median weekly earnings 18% higher than those with only a bachelor's degree in 2022. For business roles, a Master of Business Administration (MBA) from a reputable university can significantly accelerate a career in management, consulting, or finance, often leading to salaries well above the $108k mark immediately upon graduation.

- Professional Certifications: In the fast-moving world of technology and specialized finance, targeted certifications can be more impactful than a traditional degree. For an IT professional, certifications like Certified Information Systems Security Professional (CISSP) or Google Certified Professional Cloud Architect can add thousands to their salary. For a financial analyst, becoming a Chartered Financial Analyst (CFA) is a rigorous process that signals elite expertise and commands a premium salary. For project managers, a Project Management Professional (PMP) certification is the global gold standard. These credentials validate specific, in-demand skills and demonstrate a commitment to continuous learning.

### 2. Years and Quality of Experience

Experience is arguably the most powerful driver of salary growth. However, it's not just about the number of years you've been working; it's about the *quality* and *relevance* of that experience.

- Entry-Level (0-2 years): In this phase, professionals are learning the ropes and proving their value. Salaries will typically be below the $52/hour mark, but this is where the foundation is built. Focus is on mastering core skills and being a reliable team member. For example, a junior software developer might earn $75,000-$90,000.

- Mid-Career (3-8 years): This is where many professionals cross the $100k threshold. You've moved from just executing tasks to managing small projects, mentoring junior staff, and contributing to strategy. You have a track record of successful outcomes. A mid-career Marketing Manager or Financial Analyst can comfortably command a salary in the $95,000 to $130,000 range. At this stage, your salary history begins to compound.

- Senior/Lead Level (8-15+ years): At this level, you are a subject matter expert, a team lead, or a principal contributor. Your value lies not just in what you can do, but in your strategic insight and ability to influence the business. You are solving the most complex problems and are responsible for significant outcomes. Senior Software Engineers, Nurse Practitioners with specialized experience, or Financial Managers can see salaries ranging from $140,000 to $200,000+. Your experience is now a primary asset that companies are willing to pay a premium for.

- Leadership/Executive Level: This is the trajectory beyond senior roles, moving into positions like Director, Vice President, or C-suite executive. Compensation here is heavily weighted towards bonuses and equity and can reach well into the multiple six-figures and beyond.

### 3. Geographic Location

Where you live and work is one of the most significant—and often least flexible—factors affecting your salary. A $108,000 salary provides a comfortable lifestyle in a low-cost-of-living (LCOL) area but might feel tight in a high-cost-of-living (HCOL) metropolis. Companies use cost-of-labor data, not just cost-of-living, to set salary bands.

Let's use the example of a Senior Software Engineer to illustrate the dramatic differences, using data aggregated from sources like Glassdoor and Salary.com for 2023-2024:

- High-Cost-of-Living (HCOL) / Tech Hub:

- San Jose, CA / San Francisco Bay Area: Base salary often starts at $160,000 and can easily exceed $200,000. Total compensation with stock and bonuses can push this to $250,000-$350,000+.

- New York, NY: Base salaries typically range from $150,000 to $190,000.

- Seattle, WA: Expect base salaries in the $145,000 to $180,000 range.

- Medium-Cost-of-Living (MCOL) / Growing Hub:

- Austin, TX: A competitive salary would be in the $130,000 to $160,000 range.

- Denver, CO: Similar to Austin, with salaries often falling between $125,000 and $155,000.

- Chicago, IL: A robust market where salaries range from $120,000 to $150,000.

- Low-Cost-of-Living (LCOL) / Regional Market:

- Kansas City, MO: Salaries might range from $110,000 to $135,000.

- St. Louis, MO: Expect similar figures, perhaps $105,000 to $130,000.

- Birmingham, AL: A typical salary might be in the $100,000 to $125,000 range.

The rise of remote work has complicated this, but not eliminated it. Many companies now use location-based pay tiers, offering a San Francisco-level salary only to those living in that high-cost area, while adjusting it downwards for employees in less expensive regions.

### 4. Company Type & Size

The type of organization you work for has a profound impact on both your salary and the overall compensation structure.

- Large Tech Corporations (FAANG - Meta, Amazon, Apple, Netflix, Google): These companies are known for paying top-of-market salaries, often 20-40% above the industry average. A significant portion of compensation is delivered via RSUs, leading to massive total compensation packages for senior talent.

- Early-Stage Startups: Cash compensation is typically lower than at large corporations. A startup might offer a salary of $100,000 for a role that a large company would pay $140,000 for. However, they compensate for this with potentially lucrative stock options. It's a high-risk, high-reward environment.

- Established Non-Tech Corporations: A large bank, retailer, or healthcare system will offer competitive, market-rate salaries that are stable and often come with strong benefits and bonus structures. They are generally less volatile than startups and less stratospheric than Big Tech.

- Government & Public Sector: Federal, state, and local government jobs typically offer lower base salaries than the private sector. However, they often compensate with exceptional job security, defined-benefit pension plans, and generous healthcare benefits. A $108k salary in a government role often comes with a total benefits package that is hard to match in the private sector.

- Non-Profits: Compensation in the non-profit sector is almost always lower than in the for-profit world due to budget constraints. While it's possible to earn a six-figure salary, it's typically reserved for senior leadership and executive roles.

### 5. Area of Specialization

Within any given profession, specializing in a high-demand niche can dramatically increase your earning potential. Generalists are valuable, but specialists solve expensive, critical problems.

- In Technology: A generalist web developer is valuable. A software engineer specializing in Artificial Intelligence/Machine Learning, Cybersecurity, or Cloud Infrastructure (AWS/Azure/GCP) is in a different league of demand and compensation.

- In Healthcare: A general Nurse Practitioner is well-compensated. An NP who specializes in a field like Psychiatry (PMHNP) or Anesthesiology (CRNA) can earn significantly more due to the specialized training and acute demand for those skills.

- In Finance: A corporate financial analyst has a solid career. An analyst who specializes in Mergers & Acquisitions (M&A), Quantitative Analysis ("Quants"), or Private Equity is operating in a more lucrative segment of the industry.

- In Marketing: A general marketing manager is important. A manager who is a specialist in Marketing Automation (e.g., Marketo, HubSpot), Search Engine Optimization (SEO), or Performance Marketing/Data Analytics has hard skills that directly tie to revenue and are therefore compensated at a premium.

### 6. In-Demand Skills (Technical & Soft)

Finally, your unique combination of skills is your currency in the job market. Beyond your core job function, cultivating a portfolio of high-value skills is the fastest way to increase your worth.

- High-Value Technical Skills:

- Data Analysis & Visualization: The ability to work with tools like Python (with Pandas), R, SQL, Tableau, or Power BI is in demand across nearly every profession—from marketing to finance to operations.

- Cloud Computing: Understanding platforms like Amazon Web Services (AWS), Microsoft Azure, or Google Cloud Platform is essential for a vast number of tech and tech-adjacent roles.

- AI/Machine Learning Literacy: Even for non-engineers, understanding the principles of AI and how to leverage AI tools is quickly becoming a differentiator.

- Project Management Methodologies: Proficiency in Agile, Scrum, or other project management frameworks demonstrates an ability to deliver results efficiently.

- Essential Soft Skills:

- Communication & Presentation: The ability to articulate complex ideas clearly to diverse audiences (technical peers, non-technical stakeholders, executive leaders) is a hallmark of a senior professional.

- Leadership & Influence: This isn't just about managing people. It's the ability to persuade, mentor, and lead projects and initiatives even without formal authority.

- Negotiation: The ability to skillfully negotiate your salary, promotions, and project resources can have a greater impact on your lifetime earnings than almost any other skill.

- Strategic Thinking: Moving beyond day-to-day tasks to understand how your work fits into the bigger picture and contributes to the company's long-term goals is what separates a $100k employee from a $200k one.

By strategically developing these six areas, you can create a compelling professional narrative that justifies not just a $52-an-hour wage, but a continuous upward trajectory throughout your career.

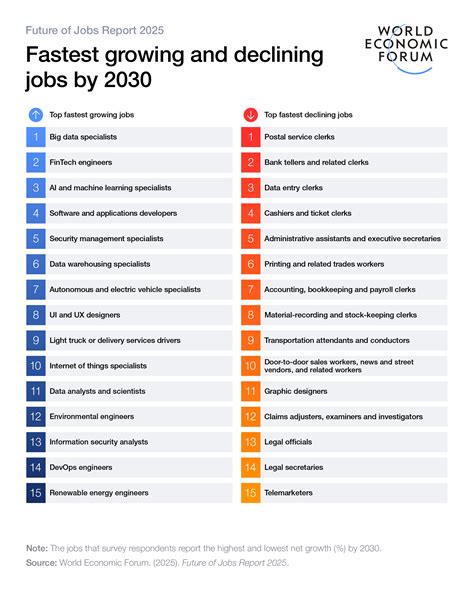

Job Outlook and Growth for High-Earning Professions

Earning a high wage is one thing; sustaining and growing it over the course of a career is another. This requires positioning yourself in a field with strong, long-term demand. A robust job outlook means more opportunities, greater negotiating power, and better job security, even during economic downturns.

Fortunately, many of the professions that command a $52/hour wage are in sectors projected for significant growth. The U.S. Bureau of Labor Statistics (BLS) provides ten-year forecasts that are the gold standard for this type of analysis. Let's examine the outlook for the representative careers we've discussed.

### Projected Growth (2022-2032) for High-Earning Roles

| Profession | Median Pay, 2022 (BLS) | Projected Job Growth (2022-2032) | Comparison to Average Growth |

| :--- | :--- | :--- | :--- |

| Software Developers | $127,260 per year | 25% | Much faster than average (3%) |

| Nurse Practitioners | $121,610 per