Earning $60 an hour is a significant financial milestone that places you in an upper-middle-class income bracket in the United States. This equates to an annual salary of approximately $124,800 per year, a figure that offers substantial financial security and opportunities. But what does it take to reach this level of compensation? Which careers offer this potential, and what factors can influence your ability to command such a wage?

This article provides a data-driven analysis for ambitious professionals and students aiming for a high-earning career path. We will break down what a $60/hour salary truly means, explore the jobs that pay this rate, and detail the key factors—from education to location—that can help you achieve this impressive goal.

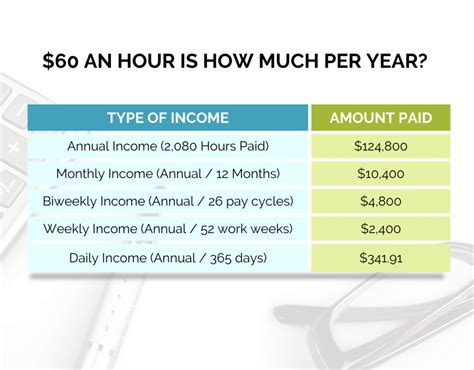

How Much is $60 an Hour Annually?

Before diving into career paths, it's essential to understand the numbers. A $60 hourly wage translates into a strong annual income, but the exact amount can vary based on your work schedule.

Here is a simple breakdown based on a standard full-time role:

- Yearly Salary: $60/hour x 40 hours/week x 52 weeks/year = $124,800

- Monthly Gross Income: $124,800 / 12 months = $10,400

- Weekly Gross Income: $60/hour x 40 hours/week = $2,400

To put this in perspective, the U.S. Bureau of Labor Statistics (BLS) reported the median weekly earnings for full-time wage and salary workers was $1,145 in the fourth quarter of 2023. At $2,400 per week, a $60/hour wage is more than double the national median, signifying a very comfortable income for individuals and families in most parts of the country.

It's also important to note the difference between a W-2 employee and a 1099 independent contractor. While both might earn $60/hour, a contractor is responsible for paying the full self-employment tax (Social Security and Medicare), which is roughly 15.3%, in addition to income taxes. They must also cover their own benefits, like health insurance and paid time off.

What Kinds of Jobs Pay $60 an Hour?

A $60 per hour wage is not tied to a single profession but is achievable across several high-demand industries, particularly for individuals with specialized skills and significant experience. Here are some examples of roles where this level of compensation is common:

- Information Technology (IT) & Software Development: This sector is a leading source of high-paying jobs.

- Senior Software Engineer: Responsible for designing, developing, and deploying complex software systems. According to Glassdoor, the average salary for a Senior Software Engineer in the U.S. is around $155,000 per year, well within the $60+/hour range.

- Cybersecurity Analyst: With cyber threats on the rise, experienced analysts who protect computer networks are in high demand. Payscale reports that senior-level cybersecurity professionals can easily exceed an annual salary of $120,000.

- Data Scientist: These professionals analyze large datasets to extract actionable insights. The BLS notes that the median pay for data scientists was $133,310 per year in 2023.

- Healthcare: Advanced education and licensure in healthcare often lead to high earnings.

- Physician Assistant (PA): PAs diagnose illnesses, develop treatment plans, and prescribe medication under the supervision of a physician. The BLS reports the median pay for PAs was $126,010 per year in 2022.

- Nurse Practitioner (NP): NPs provide advanced primary and specialty care. The median salary for NPs was $121,610 per year in 2022, according to the BLS.

- Pharmacist: Pharmacists dispense prescription medications and offer expertise in their safe use. The median pay for pharmacists was $132,750 per year in 2022.

- Business, Management & Finance: Leadership and specialized financial knowledge are highly compensated.

- Management Consultant: Professionals who advise companies on improving efficiency and performance. Experienced consultants at top firms frequently earn salaries exceeding $150,000.

- Senior Financial Analyst: These roles involve in-depth financial planning, analysis, and forecasting for major corporations. Salary.com shows that a Financial Analyst IV (senior level) can earn an average of $118,000, with top earners pushing past $130,000.

Key Factors That Influence Salary

Reaching the $60/hour benchmark rarely happens by chance. It is the result of a strategic combination of several key factors.

###

Level of Education

Higher education is one of the strongest predictors of higher income. For many roles that pay over $120,000 annually, a bachelor's degree is the minimum requirement. However, advanced degrees often unlock the highest earning potential.

- Master's Degree: Roles like Physician Assistant, Nurse Practitioner, and Data Scientist typically require a Master's degree. This advanced training justifies a higher starting salary and faster career progression.

- Professional Degrees: Fields like law (Juris Doctor), pharmacy (Pharm.D.), and medicine (MD) require extensive, specialized education that directly correlates with high compensation.

###

Years of Experience

Experience is paramount. While an entry-level software developer might start around $80,000 per year, that same individual with 5-10 years of experience can command a salary of $150,000 or more—eclipsing the $60/hour mark. Salary progression typically follows this pattern:

- Entry-Level (0-2 years): Focus on building foundational skills.

- Mid-Career (3-8 years): Develop specializations and begin leading projects.

- Senior/Lead (8+ years): Take on leadership, mentorship, and high-impact strategic responsibilities. It is at this stage that a $60/hour wage becomes most attainable in many fields.

###

Geographic Location

Where you work can have a dramatic impact on your salary due to variations in cost of living and local demand for talent. A $125,000 salary provides a very different lifestyle in San Francisco, CA, compared to Omaha, NE.

According to BLS data, metropolitan areas with major tech, finance, or healthcare hubs offer the highest wages. Cities like San Jose, San Francisco, New York City, Boston, and Seattle consistently report higher average salaries. However, the rise of remote work has begun to level the playing field, allowing professionals in lower-cost-of-living areas to access high-paying jobs previously concentrated in major cities.

###

Company Type & Industry

The type of company you work for and its industry are critical. A software engineer at a large tech firm like Google or Microsoft will almost certainly earn more than one at a small non-profit.

- Top-Tier Tech Companies & Investment Banks: These are known for offering top-of-market compensation packages, including high base salaries, bonuses, and stock options.

- Startups: While early-stage startups may offer lower base salaries, they often provide significant equity, which can lead to a massive financial windfall if the company succeeds.

- Public vs. Private Sector: Private sector jobs generally offer higher salaries than public sector (government) roles, though government jobs often come with superior benefits and job security.

###

Area of Specialization

Within any given profession, specialization pays. Developing expertise in a niche, in-demand area can significantly increase your earning power.

- In IT: A generalist software developer may earn less than a specialist in a high-demand field like Artificial Intelligence (AI), Machine Learning, or cloud architecture (e.g., AWS, Azure).

- In Healthcare: A general practice nurse earns a solid wage, but a highly specialized Nurse Anesthetist has a median salary of $203,090 per year, according to the BLS.

- In Law: A corporate lawyer specializing in mergers and acquisitions will typically earn far more than a general practice attorney.

Job Outlook

The future is bright for professions that command a $60/hour salary. The U.S. Bureau of Labor Statistics' Occupational Outlook Handbook projects strong growth in the very sectors where these jobs are concentrated.

- Employment of software developers, quality assurance analysts, and testers is projected to grow 25 percent from 2022 to 2032, much faster than the average for all occupations.

- Employment of physician assistants is projected to grow 27 percent over the same period.

- Employment of data scientists and management analysts is also projected to grow much faster than average.

This sustained demand for high-skilled labor ensures that compensation in these fields will remain competitive, making a $60/hour wage an increasingly attainable goal for those with the right qualifications.

Conclusion

A salary of $60 an hour, or approximately $124,800 annually, represents a remarkable achievement in today's economy. It is a testament to an individual's expertise, dedication, and strategic career planning.

For those aspiring to reach this income level, the path is clear:

- Invest in Education: Pursue degrees and certifications that are valued in high-growth industries like tech, healthcare, and finance.

- Gain Valuable Experience: Focus on building a strong track record of success and progressively taking on more responsibility.

- Specialize Your Skills: Develop deep expertise in a niche, in-demand area to make yourself indispensable.

- Be Strategic About Location & Company: Target industries and geographic areas known for high compensation.

Earning $60 an hour is not just about a number; it's about building a career that provides financial freedom, professional fulfillment, and the opportunity to make a significant impact in your field. With the right strategy and perseverance, it is a goal well within your reach.