Thinking about a career in accounting in the Golden State? You're on the right track. California is not only a hub for innovation and business but also one of the most lucrative markets for accounting professionals in the United States. With its diverse economy spanning tech, entertainment, agriculture, and international trade, the demand for skilled accountants is consistently high.

But what can you actually expect to earn? An accountant's salary in California can range significantly, from a strong starting salary of around $70,000 for entry-level positions to well over $150,000 for experienced, specialized professionals. This guide will break down the salary data, explore the key factors that influence your earning potential, and provide a clear picture of what a successful accounting career in California looks like.

What Does an Accountant Do?

At its core, accounting is the language of business. An accountant is a professional who prepares, analyzes, and maintains financial records. They ensure financial accuracy, compliance with laws and regulations, and provide critical insights that help organizations make sound business decisions.

Key responsibilities often include:

- Preparing financial statements, such as balance sheets and income statements.

- Managing ledgers and reconciling accounts.

- Filing tax returns and ensuring compliance with tax laws.

- Auditing financial records for accuracy and efficiency.

- Advising on financial strategy, budgeting, and cost management.

- Leveraging accounting software and data analytics tools to improve financial processes.

Whether working for a global "Big Four" firm, a tech startup in Silicon Valley, or a government agency, an accountant's role is fundamental to financial health and integrity.

Average Accountant Salary in California

California consistently ranks as one of the top-paying states for accountants in the nation. The exact average salary can vary slightly depending on the data source, but they all point to a robust earning potential.

According to the most recent data from the U.S. Bureau of Labor Statistics (BLS) Occupational Employment and Wage Statistics (May 2023), accountants and auditors in California earn a mean annual wage of $104,770.

To provide a more detailed picture, let's look at the salary distribution:

- Median Salary: The median wage—the point where half of the workers earned more and half earned less—was $99,350 per year.

- Entry-Level to Senior Range: The lowest 10% of earners made around $64,250, representing entry-level or junior positions. In contrast, the top 10% of earners commanded salaries exceeding $152,700, reflecting the pay for senior, specialized, or managerial roles.

Reputable salary aggregators provide similar insights. For example, Salary.com often places the average salary range for a mid-level accountant in California between $85,000 and $105,000, while Glassdoor reports an average base pay in a similar range, with additional compensation like bonuses and profit-sharing.

Key Factors That Influence Salary

Your salary isn't just one number; it's a dynamic figure influenced by a combination of your skills, choices, and environment. Here are the most critical factors that will impact your earnings as an accountant in California.

### Level of Education & Certification

Your educational background and professional certifications are the foundation of your career. While a Bachelor's degree in Accounting is the standard entry point, pursuing advanced credentials can significantly boost your income.

- Bachelor's Degree: This is the minimum requirement for most staff accountant positions.

- Master's Degree: A Master of Science in Accountancy (MSA or MAcc) or an MBA with a concentration in accounting can make you a more competitive candidate and often leads to a higher starting salary.

- Certified Public Accountant (CPA): This is the gold standard in the accounting profession. Earning your CPA license demonstrates a high level of expertise and ethical standards. It is often a requirement for managerial positions and roles in public accounting. According to industry reports from sources like the Association of International Certified Professional Accountants (AICPA), CPAs can expect to earn a salary premium of 5-15% over their non-certified peers.

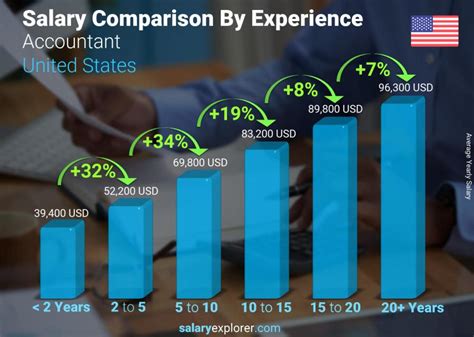

### Years of Experience

Experience is arguably the most significant driver of salary growth. As you gain practical skills and take on more responsibility, your value to employers increases exponentially.

- Entry-Level (0-2 years): As a Staff Accountant or Junior Accountant, you'll focus on foundational tasks like bookkeeping, reconciliations, and supporting senior staff. Expect a salary in the $65,000 to $80,000 range.

- Mid-Career (3-5 years): As a Senior Accountant, you'll handle complex accounting tasks, manage month-end closes, and may begin to supervise junior staff. Your salary will typically rise to the $85,000 to $110,000 range.

- Senior/Managerial (5+ years): With significant experience, you can move into roles like Accounting Manager, Controller, or Senior Auditor. These positions involve strategic oversight, team management, and high-level financial reporting, with salaries often starting at $120,000 and climbing well into the $180,000+ range, especially for Controller and Director roles.

### Geographic Location

In a state as large and diverse as California, where you work matters. Major metropolitan areas with a higher cost of living and a greater concentration of large corporations offer higher salaries.

- San Francisco Bay Area (San Jose-Sunnyvale-Santa Clara & San Francisco-Oakland-Hayward): This region offers the highest salaries in the state due to the high cost of living and the presence of major tech companies and financial institutions. BLS data shows mean salaries in these metro areas often exceed $115,000 - $120,000.

- Los Angeles-Long Beach-Anaheim: As a massive economic center for entertainment, trade, and manufacturing, the LA metro area also offers competitive salaries, with a mean wage typically just above the state average, around $103,000.

- Sacramento and San Diego: These major cities offer strong opportunities with salaries that are slightly lower than the Bay Area and LA but still highly competitive, often aligning closely with the statewide average.

- Central Valley (e.g., Fresno, Bakersfield): In areas with a lower cost of living, accountant salaries will be lower than in coastal metros but are often very strong relative to the local economy.

### Company Type

The type of organization you work for has a major impact on your salary, work-life balance, and career trajectory.

- Public Accounting: This includes firms that provide audit, tax, and advisory services to other businesses. The "Big Four" firms (Deloitte, PwC, EY, KPMG) are known for paying top-tier starting salaries and offering exceptional training, though they often demand long hours. Mid-size and regional firms also offer competitive pay and a potentially better work-life balance.

- Corporate (Industry) Accounting: Working "in-house" for a company in sectors like tech, healthcare, entertainment, or manufacturing. Salaries are often very competitive, especially in high-growth industries, and the work-life balance can be more predictable than in public accounting.

- Government: Accountants for federal, state, and local government agencies (e.g., the IRS, Franchise Tax Board, or city finance departments) may have a slightly lower starting salary than the private sector, but they often receive excellent benefits, job security, and a pension.

- Non-Profit: These organizations need skilled accountants to manage grants, donations, and operational budgets. While salaries may be lower than in for-profit sectors, the work provides a strong sense of mission and purpose.

### Area of Specialization

General accounting is a solid career, but specializing in a high-demand niche can unlock higher earning potential.

- Audit & Assurance: Verifying the accuracy of financial records. This is a core function of public accounting firms.

- Tax Services: Specializing in tax planning, preparation, and compliance for individuals or corporations.

- Forensic Accounting: Investigating financial discrepancies and fraud. This is a highly specialized and often lucrative field.

- Advisory or Consulting: Providing strategic advice on mergers & acquisitions (M&A), risk management, or IT systems. These roles are often among the highest-paid.

- Managerial Accounting: Focusing on internal financial reporting to help management make strategic decisions.

Job Outlook

The future for accountants in California is bright and stable. According to the BLS Occupational Outlook Handbook, employment for accountants and auditors nationwide is projected to grow 4% from 2022 to 2032, which is about as fast as the average for all occupations.

This steady demand is driven by several factors, including:

- Economic growth and globalization.

- Increasingly complex tax laws and financial regulations.

- A heightened focus on preventing financial fraud and ensuring data integrity.

This translates to roughly 126,500 projected job openings for accountants and auditors each year, on average, over the decade across the country. California, as the nation's largest state economy, will continue to be a primary source of these opportunities.

Conclusion

Pursuing an accounting career in California is a financially rewarding and professionally stable choice. While a six-figure salary is well within reach, your ultimate earning potential is in your hands. To maximize your salary, focus on a multi-faceted strategy:

1. Invest in Your Credentials: A CPA license is the single most effective way to increase your value and open doors to leadership roles.

2. Gain Diverse Experience: Don't be afraid to start in a demanding public accounting role to build a strong foundation before moving into a specialized industry position.

3. Choose Your Location Strategically: Target major metropolitan areas like the Bay Area or Los Angeles for the highest salary potential, while balancing cost-of-living considerations.

4. Never Stop Learning: Develop a specialization in a high-growth area like forensic accounting, data analytics, or advisory services to become an indispensable expert.

By combining a strong educational foundation with strategic career choices, you can build a prosperous and fulfilling accounting career in the dynamic California market.