So, you’re thinking about a career in accounting. You’ve likely heard it’s a stable, respectable profession—a cornerstone of the business world. But let's be honest, you're also asking the big question: what does the money look like, especially when you're just starting out? You're not just looking for a job; you're looking for a foundation upon which to build a prosperous future. The good news is that a career in accounting offers exactly that, with a starting salary that is both competitive and a launchpad for significant financial growth. The national average entry-level accountant salary hovers between $55,000 and $75,000, but as you'll soon discover, that number is just the beginning of a much larger story.

I once worked with a small, family-owned manufacturing business that was on the brink of collapse, not due to a lack of sales, but due to chaotic, unmanaged finances. A young, sharp entry-level accountant they hired didn't just organize their books; she unearthed pricing inefficiencies and identified wasteful spending that, once corrected, completely turned the company around. That experience taught me that accounting isn't just about numbers on a spreadsheet; it's about providing the clarity and insight that allows businesses to thrive, making it one of the most fundamentally valuable roles in any organization.

This guide is designed to be your definitive resource for understanding everything about an entry-level accountant's career. We will dissect salary expectations, explore the factors that can increase your pay, map out your career trajectory, and provide a step-by-step plan to help you land your first role.

### Table of Contents

- [What Does an Entry-Level Accountant Do?](#what-does-an-entry-level-accountant-do)

- [Average Entry-Level Accountant Salary: A Deep Dive](#average-entry-level-accountant-salary-a-deep-dive)

- [Key Factors That Influence Your Accountant Salary](#key-factors-that-influence-salary)

- [Job Outlook and Career Growth for Accountants](#job-outlook-and-career-growth)

- [How to Get Started in an Accounting Career](#how-to-get-started-in-this-career)

- [Conclusion: Is an Accounting Career Right for You?](#conclusion)

What Does an Entry-Level Accountant Do?

Before we dive into the numbers, it's crucial to understand what the job actually entails. The title "Entry-Level Accountant" (often called a Staff Accountant or Junior Accountant) is a foundational role, but it’s far from simple administrative work. You are the frontline soldier in the financial integrity of a company. Your primary objective is to help maintain an accurate and complete record of all the financial transactions that flow through the business.

Your work ensures that senior accountants, controllers, and CFOs have clean, reliable data to make high-level strategic decisions. You are the guardian of the general ledger, the master document that summarizes every financial transaction a company makes.

Core Responsibilities and Daily Tasks:

An entry-level accountant's duties can vary depending on the size and type of the company, but they generally revolve around a core set of responsibilities:

- Recording Financial Transactions: This is the bedrock of accounting. You'll be responsible for posting journal entries for everything from sales revenue and customer payments to vendor invoices and payroll expenses.

- Bank and Account Reconciliations: You will regularly compare the company's internal financial records against bank statements and other external records to ensure they match. This process is critical for catching errors, identifying fraud, and maintaining an accurate cash balance.

- Managing Accounts Payable (AP) and Accounts Receivable (AR):

- AP: You might process vendor invoices, schedule payments, and ensure bills are paid on time to maintain good relationships with suppliers.

- AR: This involves creating customer invoices, tracking payments, and following up on overdue accounts to ensure the company collects the money it's owed.

- Assisting with Month-End and Year-End Close: This is a crucial, often high-pressure period for any accounting department. As an entry-level accountant, you will play a vital support role by preparing supporting schedules, reconciling balance sheet accounts (like pre-paid expenses or accrued liabilities), and ensuring all transactions for the period have been recorded.

- Preparing Financial Reports: While a Senior Accountant or Controller will typically finalize major financial statements, you will be responsible for preparing preliminary drafts, pulling data for specific reports, and conducting basic variance analysis (e.g., comparing actual spending to the budget).

- Maintaining Fixed Asset Schedules: You'll track the company's long-term assets, such as property, vehicles, and equipment, and record the appropriate depreciation expense each month.

- Supporting Audits: When the company undergoes an internal or external audit, you will be tasked with providing supporting documentation, pulling transaction details, and answering questions from the auditors about the areas you manage.

#### A "Day in the Life" of an Entry-Level Accountant

To make this more concrete, let's imagine a typical day for "Maria," a junior accountant at a mid-sized tech company.

- 9:00 AM - 10:30 AM: Morning Reconciliation & AP Review. Maria starts her day by downloading the previous day's bank activity. She reconciles the cash account, matching electronic payments and deposits to the entries in the accounting system. She then reviews the Accounts Payable inbox, coding new vendor invoices and flagging any that need approval from department heads.

- 10:30 AM - 12:00 PM: Journal Entries & AR Follow-up. Maria gets a request from the HR department to record the bi-weekly payroll entry, allocating salary expenses to the correct departments. Afterwards, she runs an aged receivables report, identifies customers with invoices over 30 days past due, and sends out polite reminder emails.

- 12:00 PM - 1:00 PM: Lunch.

- 1:00 PM - 3:00 PM: Month-End Prep & Ad-Hoc Analysis. It’s the third week of the month, so Maria begins preparing some of her month-end reconciliation schedules. Today, she’s tackling the prepaid insurance schedule, calculating and recording the insurance expense for the month. Her manager then asks her to pull a report on all travel and entertainment expenses for the marketing department for the last quarter, which they need for a budget review meeting.

- 3:00 PM - 4:30 PM: System Work & Process Improvement. Maria processes employee expense reports submitted through the company's software. While doing so, she notices a recurring error in how employees are categorizing their expenses. She documents the issue and drafts a quick, one-page guide to send out to the company, hoping to improve the accuracy of future submissions.

- 4:30 PM - 5:00 PM: Plan for Tomorrow. Maria reviews her task list, answers a few final emails, and prepares a list of priorities for the next day, ensuring she’s ready to tackle the most important tasks first.

This role is a dynamic blend of routine processes, problem-solving, and collaboration, providing the essential skills you'll need to advance in your career.

Average Entry-Level Accountant Salary: A Deep Dive

Now for the main event: compensation. Understanding your potential earnings is a key part of your career planning. It's important to look at data from multiple authoritative sources to get a well-rounded picture, as methodologies can vary slightly.

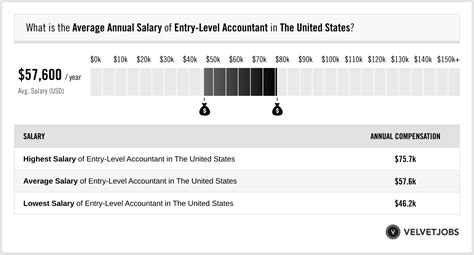

According to the U.S. Bureau of Labor Statistics (BLS), the median annual wage for all accountants and auditors was $78,000 as of May 2022. While this figure includes professionals at all experience levels, the BLS also reports salary percentiles, which give us a better clue for entry-level roles. The lowest 10 percent earned less than $48,560, while the highest 10 percent earned more than $132,690. An entry-level accountant will typically fall in the lower end of this spectrum, likely between the 10th and 25th percentile.

Let's break it down further with data from leading salary aggregators that specialize in entry-level data (data as of late 2023/early 2024):

- Salary.com: Reports the average salary for a Staff Accountant I (their term for entry-level) in the United States is $65,101, with a typical range falling between $59,201 and $71,801.

- Payscale.com: Shows the average entry-level Accountant salary is approximately $57,750 per year. This likely reflects a broader range of company sizes and locations, including smaller firms and lower cost-of-living areas.

- Glassdoor.com: Indicates the estimated total pay for an Entry Level Accountant is $68,485 per year in the United States, with an average base salary of $60,211. The difference is made up of additional compensation like cash bonuses.

Based on this data, a reasonable expectation for a typical entry-level accountant salary in the U.S. is between $58,000 and $72,000 annually. Roles in high cost-of-living cities or at prestigious firms like the "Big Four" can command salaries at the higher end of this range, or even exceed it.

#### Salary Progression by Experience Level

Your starting salary is just that—a start. Accounting is a field where experience and credentials lead to consistent and significant pay increases. Here is a typical salary trajectory you can expect as you build your career:

| Experience Level | Typical Job Title(s) | Years of Experience | Typical Salary Range (National Average) | Key Responsibilities |

| :--- | :--- | :--- | :--- | :--- |

| Entry-Level | Staff Accountant, Junior Accountant, Audit Associate | 0-2 years | $58,000 - $75,000 | Transaction recording, reconciliations, assisting with financial close, supporting senior staff. |

| Mid-Career | Senior Accountant, Senior Auditor | 3-5 years | $75,000 - $100,000 | More complex reconciliations, financial statement preparation, variance analysis, mentoring junior staff. |

| Experienced | Accounting Manager, Controller (at smaller companies) | 5-10 years | $95,000 - $140,000+ | Managing the accounting department, overseeing the financial close, implementing controls, financial planning & analysis (FP&A). |

| Senior/Executive | Controller, VP of Finance, Chief Financial Officer (CFO) | 10+ years | $150,000 - $300,000+ | High-level financial strategy, risk management, investor relations, leading the entire finance function. |

*Source: Data compiled and synthesized from BLS, Salary.com, Robert Half Salary Guide, and industry observations.*

#### Beyond the Base Salary: Understanding Total Compensation

Your base salary is only one piece of the puzzle. When evaluating a job offer, it’s crucial to consider the entire compensation package.

- Bonuses: Annual performance-based bonuses are common in accounting, especially in corporate and public accounting roles. These can range from a modest 3-5% of your salary at the entry-level to 15-25% or more at the manager level. Signing bonuses are also sometimes offered, particularly by large public accounting firms to attract top university talent.

- Profit Sharing: Some firms, particularly smaller or privately held ones, may offer a profit-sharing plan where a portion of the company's profits is distributed among employees.

- Health and Wellness Benefits: This includes medical, dental, and vision insurance. A strong benefits package can be worth thousands of dollars a year. Look at the premiums, deductibles, and out-of-pocket maximums.

- Retirement Savings: A 401(k) or 403(b) plan is standard. The key differentiator is the employer match. A company that matches your contributions up to, say, 5% of your salary is giving you an immediate, guaranteed return on your investment.

- Paid Time Off (PTO): This includes vacation days, sick leave, and paid holidays. The standard is typically 2-3 weeks of vacation to start, but this can vary.

- Professional Development: Many employers will pay for CPA review courses and exam fees, which can cost several thousand dollars. They may also pay for annual professional association dues (like the AICPA) and provide a budget for Continuing Professional Education (CPE) credits required to maintain your license. This is a hugely valuable, non-taxable benefit.

When comparing offers, add up the value of these benefits to understand the true "total compensation" for each role. A job with a $65,000 salary but an excellent 401(k) match and full CPA exam support might be more valuable than a $68,000 offer with minimal benefits.

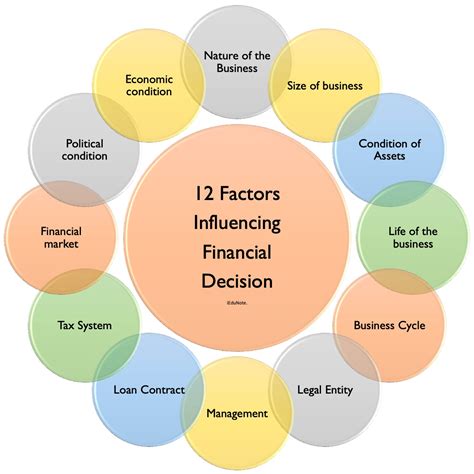

Key Factors That Influence Your Accountant Salary

While we've established a baseline salary range, your specific earnings will be influenced by a powerful combination of factors. This is where you have the most agency to maximize your earning potential throughout your career. Understanding these levers is the key to strategically navigating your path toward a six-figure income and beyond.

### 1. Level of Education & Professional Certifications

Your educational foundation is the first major determinant of your starting salary and long-term potential.

- Bachelor's Degree: A Bachelor's degree in Accounting is the standard, non-negotiable entry ticket. A degree in a related field like Finance or Business Administration with a concentration in accounting is also acceptable. This qualification signals to employers that you have the necessary theoretical knowledge of Generally Accepted Accounting Principles (GAAP), taxation, and audit procedures.

- Master's Degree: Pursuing a Master of Accountancy (M.Acc.), Master of Science in Accounting (MSA), or a Master's in Taxation (MST) can provide a starting salary boost of $5,000 to $10,000 per year. More importantly, it is often necessary to meet the 150-semester-hour requirement to sit for the CPA exam in most states. This makes a master's degree a strategic investment for those committed to the profession.

- The CPA License (Certified Public Accountant): This is the single most impactful credential you can earn in accounting. The CPA is the gold standard, signifying a high level of expertise, ethical grounding, and professional commitment.

- Salary Impact: Obtaining a CPA license can increase your salary by 10-15% immediately. Over a career, CPAs earn, on average, over $1 million more than their non-certified counterparts, according to the AICPA. Many firms offer a one-time bonus of $3,000 to $5,000 just for passing the exam.

- Career Impact: The CPA opens doors to leadership positions (Controller, CFO), specialized fields (forensic accounting), and is a requirement for signing audit reports in public accounting. It's not just a salary booster; it's a career accelerator.

Other valuable certifications include the Certified Management Accountant (CMA), which is highly respected in corporate/industry accounting, and the Certified Internal Auditor (CIA), for those specializing in internal audit.

### 2. Years of Experience

As shown in the salary progression table, experience is a direct driver of compensation. Your value increases as you move from simply executing tasks to managing processes and then to leading strategy.

- 0-2 Years (Entry-Level): Focus is on learning the fundamentals, mastering the accounting software, and demonstrating reliability. Salary growth is steady but modest.

- 3-5 Years (Senior Level): You begin to take ownership of complex areas, mentor junior staff, and interact with other departments. This is often where accountants see their first significant salary jumps, especially if they switch companies or get promoted to Senior Accountant. Earning your CPA during this period is a common and highly effective strategy.

- 5+ Years (Managerial Level): You are now a leader. You manage teams, oversee major processes like the financial close, and contribute to financial planning. Salaries at this level cross the six-figure mark in most markets.

### 3. Geographic Location

Where you work matters—a lot. Salaries are adjusted based on the local cost of living and the demand for accounting professionals in that market.

A role in a major metropolitan hub will pay significantly more than the same role in a rural area. However, it's essential to consider purchasing power. A higher salary in New York City or San Francisco may not go as far as a slightly lower salary in a city like Dallas or Charlotte due to vast differences in housing, taxes, and daily expenses.

Salary Variation by Metropolitan Area (Staff Accountant I):

| City | Average Salary | Comparison to National Average | Rationale |

| :--- | :--- | :--- | :--- |

| New York, NY | $77,900 | +19.7% | High cost of living, massive financial services sector. |

| San Francisco, CA | $77,000 | +18.3% | High cost of living, hub for tech and venture capital. |

| Boston, MA | $72,200 | +10.9% | Strong finance, biotech, and education sectors. |

| Chicago, IL | $68,300 | +4.9% | Major business hub with diverse industries. |

| Dallas, TX | $65,000 | -0.2% | Strong corporate presence, lower cost of living than coasts. |

| Atlanta, GA | $64,800 | -0.5% | Growing business hub, moderate cost of living. |

| Phoenix, AZ | $63,600 | -2.3% | Rapidly growing market with competitive salaries relative to cost of living. |

*Source: Salary.com, Staff Accountant I data, accessed early 2024. Percentages calculated against the national average of $65,101.*

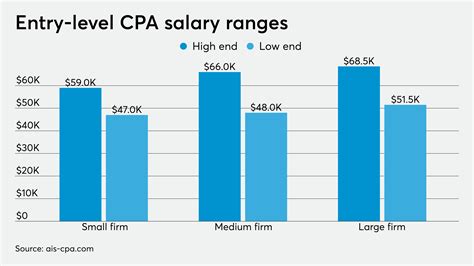

### 4. Company Type & Size

The type of organization you work for has a profound impact on your salary, work-life balance, and career path.

- Public Accounting (especially the "Big Four"): Firms like Deloitte, PwC, EY, and KPMG are known for offering the highest entry-level salaries, often starting in the $70,000 - $80,000+ range in major markets. They provide unparalleled training and a prestigious resume builder. The trade-off is famously long hours, especially during "busy season" (typically January-April).

- Corporate (Industry) Accounting: Working "in-house" for a company in a specific industry (e.g., tech, manufacturing, healthcare, retail). Starting salaries might be slightly lower than the Big Four but are still very competitive, often in the $60,000 - $75,000 range for large corporations. The key benefit is often better work-life balance and the opportunity to deeply understand one specific business. Salaries can vary dramatically by industry; for example, tech and financial services companies tend to pay more than non-profits or retail.

- Government: Working for federal, state, or local government agencies (e.g., IRS, FBI, Government Accountability Office). Starting salaries are typically lower, often in the $50,000 - $65,000 range. However, the trade-offs are significant: excellent job security, fantastic benefits (pensions are common), and a predictable 40-hour work week.

- Non-Profit: Accounting for charities, foundations, and universities. This sector often has the lowest starting salaries, but provides mission-driven work that many find highly rewarding.

### 5. Area of Specialization

As you advance, you can specialize in areas that command higher pay.

- Audit/Assurance: This is the most common starting point, especially in public accounting. It involves examining a company's financial statements for accuracy and compliance.

- Tax Accounting: Specializing in preparing corporate or individual tax returns, ensuring compliance, and developing tax strategies. This is a consistently high-demand field.

- Advisory/Consulting: This is a lucrative and growing field within accounting firms. Instead of looking backward at historical data (like in an audit), advisors use financial expertise to help clients with mergers and acquisitions (M&A), process improvement, risk management, and IT systems implementation. These roles often command the highest salaries.

- Forensic Accounting: These are financial detectives who investigate fraud, embezzlement, and other financial crimes. It's a highly specialized niche with significant earning potential.

- Financial Planning & Analysis (FP&A): This is a forward-looking role within corporate finance that focuses on budgeting, forecasting, and providing strategic analysis to guide business decisions. It’s a common and well-compensated career path for accountants in industry.

### 6. In-Demand Skills

In the 21st century, being a great accountant is about more than just knowing debits and credits. Technology has automated many of the manual tasks, placing a premium on analytical and technical skills. Cultivating these can directly increase your value and salary.

- Advanced Excel Proficiency: This is non-negotiable. You need to be a master of VLOOKUPs, INDEX/MATCH, PivotTables, and data modeling.

- Enterprise Resource Planning (ERP) System Knowledge: Experience with major ERPs like SAP, Oracle NetSuite, or Microsoft Dynamics 365 is highly valued. Companies want accountants who can navigate the systems they use every day.

- Data Analytics and Visualization: Skills in tools like Tableau, Power BI, or Alteryx are becoming game-changers. The ability to extract large datasets, analyze them for trends, and present your findings in a clear, visual way separates you from the pack.

- Soft Skills: Don't underestimate these!

- Communication: Can you clearly explain a complex financial issue to a non-financial manager?

- Problem-Solving: When reconciliations don't work, can you critically think through the problem and find the source?

- Business Acumen: Do you understand how the numbers you work with connect to the company's overall strategy and operations?

By strategically focusing on these six areas, you can transform your career from a standard trajectory to an accelerated path of growth and opportunity.

Job Outlook and Career Growth for Accountants

When choosing a career, long-term stability is just as important as starting salary. Fortunately, accounting excels in this area. The profession is deeply woven into the fabric of our economy, making it remarkably resilient to economic fluctuations.

#### Official Projections: A Stable and Growing Field

The U.S. Bureau of Labor Statistics (BLS) is the gold standard for job outlook projections. According to their 2022-2032 forecast:

- Job Growth: Employment of accountants and auditors is projected to grow 4 percent from 2022 to 2032, which is about as fast as the average for all occupations.

- Job Openings: This steady growth will result in about 126,500 openings for accountants and auditors each year, on average, over the decade.

Why are there so many openings? Many are created not just by new job growth, but by the need to replace workers who transfer to different occupations or exit the labor force, such as through retirement. This creates a constant, healthy demand for new talent entering the field.

What Drives this Demand?

1. Economic Growth: As the economy grows, more businesses are created and existing ones expand. All of these organizations need accountants to manage their finances, ensure compliance, and plan for the future.

2. Globalization: Businesses operating across borders face a dizzying array of international trade laws, tax regulations, and reporting standards. Accountants with expertise in international finance are essential for navigating this complexity.

3. Increasingly Complex Regulations: A constantly changing landscape of tax laws and financial reporting standards (like those from the Financial Accounting Standards Board, or FASB) requires diligent professionals to ensure companies remain compliant. Events like the passage of new tax legislation invariably create a surge in demand for tax accountants.

4. A Focus on Fraud Detection and Risk Management: In the wake of corporate scandals, there is a heightened emphasis on strong internal controls and risk management. Forensic accountants and internal auditors play a crucial role in protecting assets and preventing fraud.

#### Emerging Trends and the Future of Accounting

The role of the accountant is not static; it's evolving. Technology, particularly automation and artificial intelligence (AI), is transforming the profession. While some fear that automation will eliminate jobs, the reality is more nuanced and, for the forward-thinking professional, more exciting.

The Shift from Bookkeeper to Strategic Advisor:

AI and robotic process automation (RPA) are becoming incredibly effective at handling routine, data-intensive tasks like:

- Data entry and transaction categorization

- Basic account reconciliations

- Generating standard reports

This is actually good news. By automating these time-consuming tasks, technology is freeing up accountants to focus on higher-value activities. The future accountant will spend less time on "what happened" (historical reporting) and more time on "why it happened" (analysis) and "what should we do next?" (strategic advising).

Key Future Trends to Watch:

- Data Analytics: As mentioned before, the ability to interpret large datasets will be paramount. Accountants will be expected to identify trends, predict outcomes, and provide data-driven insights that guide business strategy.

- Environmental, Social, and Governance (ESG) Reporting: There is a massive global push for companies to report on their sustainability and social impact. This has created a brand-new field of assurance and advisory services, where accountants help measure, verify, and report on a company's ESG metrics.

- Cybersecurity & IT Audit: As financial data becomes entirely digital, protecting it is critical. Accountants with an understanding of IT systems and cybersecurity controls will be in high demand for roles in IT audit and risk assurance.

- Specialized Advisory Services: The fastest-growing segments of the profession are in advisory. Companies need experts to guide them through complex transactions like M&A, business valuations, and system implementations.

#### How to Stay Relevant and Advance

To thrive in the accounting profession of the future, you must commit to being a lifelong learner.

1. Embrace Technology: Don't just learn Excel. Actively seek out opportunities to learn data visualization tools (Tableau/Power BI), understand how ERP systems work, and familiarize yourself with the