New York is a global epicenter of finance, commerce, and industry, making it one of the most dynamic and lucrative markets for accounting professionals in the world. If you're considering a career in accounting in the Empire State, you're looking at a path with significant earning potential and robust demand. Salaries for accountants in New York are among the highest in the nation, with experienced and specialized professionals often earning well into six figures.

This guide will break down everything you need to know about an accountant's salary in New York, from average earnings to the key factors that can significantly increase your compensation.

What Does an Accountant Do?

At its core, accounting is the language of business. Accountants are responsible for preparing, maintaining, and analyzing financial records for individuals, businesses, and government agencies. Their work ensures financial accuracy, regulatory compliance, and provides the critical data leaders need to make informed strategic decisions.

Key responsibilities often include:

- Preparing financial statements, such as balance sheets and income statements.

- Managing tax planning and filing tax returns.

- Auditing financial records to ensure accuracy and compliance.

- Advising on financial strategy, budgeting, and cost reduction.

- Ensuring compliance with laws and regulations like the Sarbanes-Oxley Act (SOX).

- Investigating financial discrepancies and potential fraud (forensic accounting).

Average Accountant Salary in New York

New York's status as a financial hub translates directly into higher-than-average compensation for accountants. While salaries can vary widely, we can establish a strong baseline using data from authoritative sources.

According to the U.S. Bureau of Labor Statistics (BLS) May 2022 data, the most recent comprehensive report available, the financial landscape for accountants in New York is robust:

- Mean Annual Wage in New York State: $109,790

- Mean Annual Wage in the New York-Newark-Jersey City metropolitan area: $113,330

This figure is significantly higher than the national mean annual wage of $86,740 for accountants and auditors.

To provide a more granular view, salary aggregator data reflects real-time market conditions and experience levels:

- Salary.com reports that the median salary for a mid-level Accountant (Accountant II) in New York City is approximately $90,500, with a typical range falling between $82,000 and $100,000 as of early 2024.

- Glassdoor places the average total pay (including base salary and additional compensation like bonuses) for an accountant in New York, NY at around $96,000 per year.

The salary range is wide, reflecting the diverse career paths available. An entry-level staff accountant may start around $65,000-$75,000, while a senior accountant with a CPA license and specialized skills can command a salary of $120,000 or more.

Key Factors That Influence Salary

Your salary is not a fixed number. It's a dynamic figure influenced by a combination of your qualifications, choices, and market forces. Here are the most critical factors that determine your earning potential as an accountant in New York.

###

Level of Education

Your educational background forms the foundation of your career. A Bachelor's degree in Accounting or a related field is the standard entry requirement. However, to truly maximize your earnings, pursuing advanced credentials is key.

The Certified Public Accountant (CPA) license is the gold standard in the accounting profession. Earning your CPA demonstrates a high level of expertise and ethical commitment, making you a more valuable asset to employers. Professionals with a CPA license can earn a salary premium of 5% to 15% over their non-certified peers. Furthermore, a Master's degree in Accounting (MAcc) or Taxation (MST) can provide specialized knowledge that leads to higher-paying roles, particularly in complex tax or advisory fields.

###

Years of Experience

Experience is one of the most significant drivers of salary growth. As you gain practical skills and a deeper understanding of business operations, your value to an organization increases exponentially. Here’s a typical progression in New York:

- Entry-Level (0-2 years): A Staff Accountant or Junior Accountant can expect a starting salary in the $65,000 to $80,000 range. The focus at this stage is on learning fundamental processes and supporting senior staff.

- Mid-Career (3-5 years): With a few years of experience, accountants often move into Senior Accountant roles. Salaries typically increase to the $85,000 to $110,000 range. Responsibilities expand to include more complex tasks, financial analysis, and mentoring junior staff.

- Senior/Managerial (5-10+ years): Accountants with significant experience can advance to roles like Accounting Manager, Controller, or Director of Finance. At this level, salaries in New York often range from $120,000 to $180,000+, with compensation heavily influenced by the size and complexity of the organization.

###

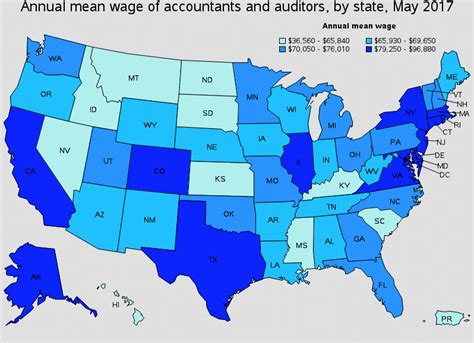

Geographic Location

Even within New York State, location matters. Unsurprisingly, New York City and its surrounding suburbs (like Long Island and Westchester) offer the highest salaries due to the concentration of corporate headquarters, financial institutions, and a higher cost of living.

According to BLS data, the mean salary in the NYC metro area ($113,330) is notably higher than in other metropolitan areas in the state, such as:

- Albany-Schenectady-Troy: $90,950

- Buffalo-Cheektowaga-Niagara Falls: $82,900

- Rochester: $86,760

While salaries are lower in upstate regions, the cost of living is also significantly less, a crucial factor to consider when evaluating a job offer.

###

Company Type

The type of organization you work for has a profound impact on your salary and career trajectory.

- Public Accounting (Big Four): The "Big Four" firms (Deloitte, PwC, EY, and KPMG) and other large national firms are known for offering highly competitive starting salaries and exceptional training. However, they also demand long hours, especially during busy seasons.

- Corporate/Private Industry: Accountants working directly for a company (from startups to Fortune 500 corporations) often find a better work-life balance. Salaries are competitive, and senior-level roles like Controller or Chief Financial Officer (CFO) have extremely high earning potential.

- Government: Federal, state, and local government agencies offer stability, excellent benefits, and a predictable work schedule. While starting salaries may be slightly lower than in the private sector, the long-term benefits can be very attractive.

- Non-Profit: Non-profit organizations also need skilled accountants. Salaries are typically lower than in for-profit sectors, but the work often provides a strong sense of mission and purpose.

###

Area of Specialization

General accounting is a solid career, but specialization can unlock elite earning potential. High-demand, high-salary specializations include:

- Forensic Accounting: These professionals investigate financial crimes and fraud. Their niche expertise commands a premium salary.

- Advisory/Consulting: Accountants who advise on mergers and acquisitions (M&A), risk management, and IT systems are highly valued.

- International Tax: In a global hub like New York, experts in international tax law are in constant demand by multinational corporations.

- Information Technology (IT) Audit: As businesses become more digital, accountants who can audit complex IT systems and ensure data security are critical.

Job Outlook

The future for accountants is bright and stable. According to the U.S. Bureau of Labor Statistics' Occupational Outlook Handbook, employment for accountants and auditors is projected to grow 4 percent from 2022 to 2032, about as fast as the average for all occupations.

This translates to approximately 126,500 openings for accountants and auditors projected each year, on average, over the decade. This consistent demand is driven by economic growth, changing financial regulations, and the need for financial accountability across all sectors of the economy. For those in a major market like New York, the opportunities will remain plentiful.

Conclusion

A career as an accountant in New York offers a rewarding combination of financial stability, intellectual challenge, and professional growth. While the average salary is already impressive, it is by no means a ceiling.

Your earning potential is a direct reflection of the investments you make in your career. By pursuing advanced education like the CPA license, gaining diverse experience, and developing specialized skills, you can build a career path that is not only financially lucrative but also professionally fulfilling. For aspiring and current finance professionals, the New York accounting market remains a land of unparalleled opportunity.