Introduction

Have you ever wondered who calculates the financial risks behind your insurance premiums, your pension plan, or even a company's billion-dollar expansion? Are you a natural problem-solver with a passion for mathematics, statistics, and business, seeking a career that offers both immense intellectual challenge and extraordinary financial rewards? If so, you might be destined to become an actuary. This profession, often described as the backbone of the financial and insurance industries, offers a unique blend of analytical rigor and real-world impact—and a compensation package to match.

The journey to becoming an actuary is demanding, but the destination is highly sought after. According to the U.S. Bureau of Labor Statistics, the median annual wage for actuaries was $113,990 in May 2022, with the top 10 percent earning more than $208,000. This isn't just a job; it's a lucrative and stable career path with a projected growth rate that far outpaces the national average. I once spoke with a pension fund manager who referred to his lead actuary as the "guardian of promises." He explained that while he managed the investments, it was the actuary who ensured the fund could meet its obligations to retirees decades from now, a profound responsibility that underscores the critical importance of their work.

This comprehensive guide serves as your definitive resource for understanding the complete financial landscape of an actuarial career. We will dissect the numbers from every angle, moving beyond the national average to explore how factors like experience, specialization, location, and credentials shape your earning potential. Whether you are a student contemplating your major, a professional considering a career change, or an early-stage actuary planning your next move, this in-depth survey will provide the clarity and data you need to navigate your path to success.

### Table of Contents

- [What Does an Actuary Do?](#what-does-an-actuary-do)

- [Average Actuary Salary: A Deep Dive](#average-actuary-salary-a-deep-dive)

- [Key Factors That Influence Actuary Salary](#key-factors-that-influence-salary)

- [Job Outlook and Career Growth for Actuaries](#job-outlook-and-career-growth)

- [How to Get Started in an Actuarial Career](#how-to-get-started-in-this-career)

- [Conclusion: Is a Career as an Actuary Right for You?](#conclusion)

What Does an Actuary Do?

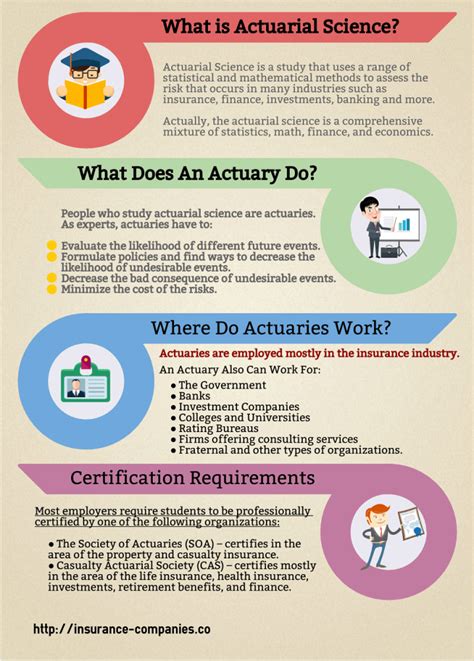

At its core, an actuary is a professional risk manager. They use a powerful toolkit of mathematics, statistics, and financial theory to analyze the financial costs of risk and uncertainty. They are the architects of financial security systems, designing and pricing insurance policies, creating pension plans, and advising companies on how to manage their financial risks to ensure long-term stability.

While the "math wizard" stereotype holds some truth, the modern actuary is also a business strategist, a data scientist, and a communicator. They don't just crunch numbers in isolation; they interpret data to tell a story, build predictive models to forecast future events, and present their complex findings in a clear, actionable way to executives, clients, and regulators. Their work forms the foundation upon which sound financial decisions are made across a vast array of industries.

The primary responsibilities of an actuary often include:

- Data Compilation and Analysis: Gathering and cleaning vast datasets to identify trends and measure risks.

- Statistical Modeling: Building sophisticated models to project the likelihood and potential financial impact of future events, such as accidents, illnesses, natural disasters, or investment returns.

- Pricing and Valuation: Calculating the appropriate price for insurance policies or the amount of money a company needs to set aside (reserves) to cover future claims or pension payouts.

- Financial Reporting: Preparing reports and documentation to comply with industry regulations and explain financial health to stakeholders.

- Collaboration: Working closely with other professionals, including underwriters, accountants, financial officers, and marketing teams, to develop products and business strategies.

- Communication: Clearly explaining complex technical concepts and the implications of their analyses to non-technical audiences.

### A Day in the Life of an Actuarial Associate

To make this role more tangible, let's imagine a day for "Chloe," an Actuarial Associate with three years of experience at a large property and casualty (P&C) insurance company. She has passed four exams and is working toward her Associate credential.

- 8:30 AM - 9:30 AM: Chloe starts her day by reviewing overnight data refreshes. She runs a series of SQL queries to pull the latest claims data for the company's personal auto insurance line in the Midwest region. She checks for anomalies and ensures the data is clean before starting her analysis.

- 9:30 AM - 10:30 AM: She attends a weekly sync-up meeting with her team and the underwriting department. The underwriters are seeing an increase in claims related to distracted driving. Chloe presents her preliminary data, which confirms this trend, and the team brainstorms potential pricing adjustments and new safety discount programs.

- 10:30 AM - 1:00 PM: Chloe's main project is updating the quarterly reserve estimates. This involves using specialized actuarial software to run simulations based on her updated data. She meticulously documents her assumptions about claim frequency and severity, comparing her model's outputs to historical patterns. This is deep, focused work that requires immense concentration.

- 1:00 PM - 1:30 PM: Lunch break.

- 1:30 PM - 3:30 PM: The company is considering launching a new usage-based insurance product that uses telematics to track driving habits. Chloe is tasked with analyzing a pilot dataset to determine the key variables that predict risk (e.g., hard braking, time of day, mileage). She uses the programming language R to build a simple predictive model and visualizes the results to share with the product development team.

- 3:30 PM - 4:30 PM: Chloe dedicates an hour to studying for her next actuarial exam, Exam MAS-I. Her company provides paid study hours, a crucial benefit that helps her maintain progress toward her credentials.

- 4:30 PM - 5:30 PM: She spends the last part of her day documenting her progress on the reserving project and outlining the key findings from her telematics analysis. She sends a summary email to her manager, preparing for a more in-depth presentation later in the week.

This example illustrates the blend of technical analysis, collaborative strategy, and continuous professional development that defines the actuarial profession.

Average Actuary Salary: A Deep Dive

The salary potential is a primary draw for the actuarial profession, and for good reason. Compensation is not only high from the outset but also follows a remarkably predictable and steep growth trajectory tied directly to professional milestones.

According to the most recent data from the U.S. Bureau of Labor Statistics (BLS) Occupational Outlook Handbook, the median annual salary for actuaries was $113,990 in May 2022. This figure represents the midpoint—half of all actuaries earned more than this, and half earned less. The salary landscape, however, is quite broad:

- The lowest 10% earned less than $70,330. These are typically entry-level actuarial analysts who are just beginning the exam process.

- The highest 10% earned more than $208,000. These are typically senior, credentialed actuaries (Fellows) in management or highly specialized consulting roles.

Data from reputable salary aggregators provides a more granular view and often reflects more recent, user-submitted data.

- Salary.com (as of late 2023) reports the median base salary for an Actuary I (entry-level) in the U.S. is around $87,143, while an Actuary V (senior/management) has a median base salary of $205,791.

- Payscale.com indicates an average base salary of approximately $97,148 per year, with a typical range from $65k to $157k.

- Glassdoor.com estimates the total pay for an actuary in the U.S. to be around $139,493 per year, with a likely range of $108k to $181k, which includes base pay and additional compensation like bonuses.

### Actuary Salary by Experience Level

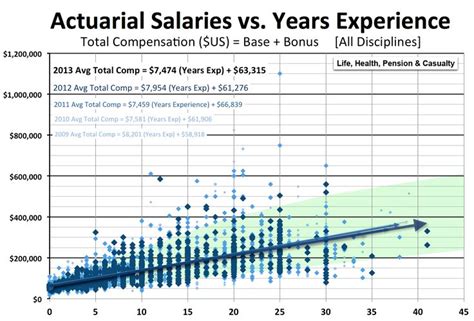

One of the most defining features of an actuary's pay is its strong correlation with experience and, more importantly, exam progress. The profession has a clear-cut ladder, and each rung brings a significant financial reward.

| Career Stage | Typical Experience & Credentials | Typical Base Salary Range (2024 Estimates) | Description |

| :--- | :--- | :--- | :--- |

| Entry-Level Actuarial Analyst | 0-2 years, 1-3 exams passed | $70,000 - $95,000 | A recent graduate learning the ropes. Focus is on data support, running basic models, and passing exams. Salary increases with each passed exam. |

| Actuarial Associate | 2-5 years, 4-6 exams passed | $95,000 - $140,000 | Nearing the Associate credential (ASA/ACAS). Takes on more complex projects, manages smaller components of analyses, and begins to mentor junior analysts. |

| Credentialed Associate (ASA/ACAS) | 4-7 years, Associate Credential Earned | $120,000 - $175,000 | A fully qualified Associate. Recognized as a proficient professional capable of signing off on certain actuarial opinions. Compensation sees a major jump upon credentialing. |

| Senior Actuary / Fellow (FSA/FCAS) | 7+ years, Fellow Credential Earned | $160,000 - $250,000+ | The pinnacle of the technical track. A Fellow is a subject matter expert who leads complex, high-impact projects, sets actuarial methodologies, and manages teams. |

| Actuarial Manager / Director | 10+ years, FSA/FCAS | $180,000 - $300,000+ | Moves into a formal leadership role. Responsible for managing a team of actuaries, overseeing departmental strategy, and interfacing with senior business leaders. |

| Chief Actuary / Partner | 15+ years, FSA/FCAS | $250,000 - $500,000+ | The highest level of leadership. The Chief Actuary is a C-suite or senior executive responsible for the entire actuarial function of a company. Partners in consulting firms have similar earning potential. |

*Sources: Data compiled and synthesized from BLS, Salary.com, Glassdoor, and industry reports from recruiting firms like DW Simpson and Ezra Penland.*

### Beyond the Base Salary: A Look at Total Compensation

An actuary's salary is only part of the story. Total compensation is a critical factor, and it's often exceptionally generous in this field.

- Bonuses: Annual performance bonuses are standard and can range from 10% of base salary at the junior levels to over 50% or more for senior leadership and successful consultants.

- Exam-Related Rewards: This is a unique and powerful incentive. Companies not only provide paid study time (often 100+ hours per exam) and cover the costs of exam fees and study materials, but they also provide immediate salary increases or one-time bonuses for each passed exam. These increases can range from $2,500 to $7,500 *per exam*, meaning a dedicated student can significantly increase their base salary multiple times a year. A large bonus (often $5,000-$10,000+) is also common upon achieving the ASA/ACAS and FSA/FCAS credentials.

- Profit Sharing and Stock Options: Many insurance companies and consulting firms offer profit-sharing plans or stock/equity options, particularly at the mid-to-senior levels. This aligns the actuary's compensation with the company's overall success.

- Retirement Benefits: Given their expertise in the field, it's no surprise that actuaries often enjoy excellent retirement plans. This can include robust 401(k) matching programs and, in some established companies, traditional defined-benefit pension plans—a rarity in today's corporate world.

- Health and Other Benefits: Comprehensive health, dental, and vision insurance, along with generous paid time off, are standard.

When all these components are factored in, the total compensation for an experienced, credentialed actuary can easily be 20-40% higher than their base salary alone.

Key Factors That Influence Actuary Salary

While experience and exams create a clear upward trajectory, several other key factors create significant variations in earning potential. Understanding these levers is crucial for any aspiring or practicing actuary looking to maximize their income.

### ### 1. Level of Education and Professional Credentials

This is, without a doubt, the single most important factor in an actuary's career and salary progression.

- Bachelor's Degree: A bachelor's degree in a quantitative field is the entry ticket. Common majors include Actuarial Science, Mathematics, Statistics, Economics, or Finance. While a degree from a top-tier university or a designated Center of Actuarial Excellence (CAE) can provide a competitive edge in landing the first job, it's what you do *after* graduation that truly defines your salary.

- The Actuarial Exams: The path to becoming a credentialed actuary is a marathon of self-study and rigorous examinations administered by two main professional bodies in the U.S.:

- Society of Actuaries (SOA): Primarily focuses on life insurance, health insurance, retirement benefits, and investments. The path leads to the Associate of the Society of Actuaries (ASA) credential and then the Fellow of the Society of Actuaries (FSA) credential.

- Casualty Actuarial Society (CAS): Focuses on property and casualty (P&C) insurance, which includes auto, home, and commercial liability. The path leads to the Associate of the Casualty Actuarial Society (ACAS) credential and then the Fellow of the Casualty Actuarial Society (FCAS) credential.

Your salary is directly tied to your exam status. An entry-level analyst with two exams will earn more than one with zero exams. An analyst who passes their third exam will receive an immediate raise. Achieving the Associate credential (ASA/ACAS) represents a massive leap in both responsibility and pay, as does reaching the pinnacle Fellow (FSA/FCAS) status. An FSA/FCAS can command a salary that is easily double or triple that of an entry-level analyst.

- Advanced Degrees (Master's/PhD): Unlike some fields, a master's degree or PhD is not required and does not automatically translate to a higher salary in a traditional actuarial track. The professional exams are far more important. However, an advanced degree in a related field like data science, statistics, or financial engineering can be a significant asset, particularly for roles in predictive analytics, quantitative finance, or research and development.

### ### 2. Years of Experience

As detailed in the salary table above, experience builds upon the foundation of exam success. The profession is apprenticeship-based in its early years; what you learn on the job is as critical as what you learn from textbooks.

- 0-2 Years (The Foundation): Focus is on learning fundamental techniques, mastering software (especially Excel, SQL), and passing preliminary exams. Salary growth is almost entirely driven by exam passes.

- 3-7 Years (The Associate Path): Experience allows for greater autonomy. You move from running calculations to designing them. You start managing projects, interpreting results, and communicating findings. Reaching the ASA/ACAS credential during this period is the key inflection point for a major salary jump.

- 7-15+ Years (The Fellow and Leadership Path): As an FSA or FCAS, your value shifts from pure technical execution to strategic insight. You are now a subject matter expert. Your experience allows you to tackle the most ambiguous and complex business problems. This is where leadership, communication, and business acumen amplify your technical skills, leading to senior management roles and the highest salary brackets. An actuary with 15 years of experience and an FSA credential might be a Chief Actuary or a Partner at a consultancy, with earnings well into the $300,000-$500,000+ range, including bonuses.

### ### 3. Geographic Location

Where you work has a substantial impact on your paycheck, largely driven by cost of living and the concentration of industry employers.

- High-Paying Metropolitan Areas: Major insurance and financial hubs offer the highest salaries. These cities have a high demand for actuarial talent and a higher cost of living.

- New York, NY: The financial capital of the world, offering top-tier salaries in insurance, consulting, and finance.

- Hartford, CT: Known as the "Insurance Capital of the World," it's home to numerous major insurance carriers.

- Chicago, IL: A major hub for both insurance and consulting firms.

- Boston, MA: Strong presence in health insurance and asset management.

- Major cities in California (Los Angeles, San Francisco) and Texas (Dallas, Austin): Growing hubs with a high demand for talent.

- Salary Comparison Example: According to Salary.com's calculator, an Actuary II with a national median salary of $108,000 might expect to earn:

- In New York, NY: Approximately $129,500 (19.9% higher)

- In Hartford, CT: Approximately $117,300 (8.6% higher)

- In Des Moines, IA (another city with a strong insurance presence but lower cost of living): Approximately $106,700 (1.2% lower)

- In a lower cost-of-living area with less industry concentration, the salary could be 5-10% below the national average.

The rise of remote work has slightly flattened these geographic differences, but a premium still exists for those working (even remotely) for companies based in high-cost-of-living areas.

### ### 4. Company Type & Size

The type of organization you work for is a significant determinant of both your salary and your work-life balance.

- Insurance Companies: The most common employer. Large carriers (e.g., Prudential, MetLife, Progressive, Allstate) offer well-structured career paths, excellent benefits, strong study programs, and competitive, stable salaries. Work-life balance is often very good.

- Consulting Firms: Firms like Willis Towers Watson, Mercer, Oliver Wyman, and the Big Four accounting firms (Deloitte, PwC, EY, KPMG) hire many actuaries. Consulting typically offers the highest salaries, especially at the senior levels. The trade-off is often longer hours, higher pressure, and more travel. The work is more varied, as you'll work with multiple clients on diverse projects.

- Government Agencies: The Social Security Administration, the Pension Benefit Guaranty Corporation (PBGC), and state insurance departments employ actuaries. Salaries are generally lower than in the private sector, but they are compensated with exceptional job security, robust federal benefits, and a predictable work-life balance.

- Corporations (Non-Insurance): Large companies with significant pension obligations or self-insurance programs (e.g., Boeing, GM) hire in-house actuaries to manage their risks. Compensation is competitive and often comes with the benefits of working for a large corporation in a different industry.

### ### 5. Area of Specialization

Within the actuarial field, your chosen practice area can influence your earning potential.

- Property & Casualty (P&C): This is often cited as the highest-paying specialty. P&C actuaries deal with complex risks like natural catastrophes, cybersecurity, and new forms of liability (e.g., self-driving cars). The CAS exam track is generally considered more mathematically intensive, and the demand for top talent in this innovative space is fierce.

- Health Insurance: A very dynamic and high-demand field, driven by complex regulations (like the Affordable Care Act) and the rising cost of healthcare. Health actuaries are critical for pricing plans, projecting trends, and navigating the changing landscape.

- Life Insurance & Annuities: The traditional bedrock of the profession. This field offers stable, high-paying careers, though it might be seen as less volatile than P&C or Health.

- Pension and Retirement: While the shift from defined-benefit to defined-contribution plans has changed this field, pension actuaries are still in high demand for managing existing plans and consulting on retirement strategies. Salaries are strong, though perhaps with a slightly lower ceiling than P&C.

- Enterprise Risk Management (ERM) & Reinsurance: These are highly specialized and lucrative areas. ERM actuaries take a holistic view of all risks facing a company (financial, operational, strategic). Reinsurance actuaries help insurance companies insure their own risks. Both roles require a deep understanding of the business and command premium salaries.

### ### 6. In-Demand Skills

Beyond the core actuarial toolkit, certain technical and soft skills can significantly boost your value and salary.

- Technical Skills:

- Programming (Python and R): This is the most significant differentiator for the modern actuary. Proficiency in these languages for data manipulation, statistical modeling, and machine learning is no longer a "nice-to-have" but a core competency that can add a significant premium to your salary.

- Database Management (SQL): The ability to independently pull and manipulate large datasets is a fundamental requirement.

- Advanced Excel/VBA: While being replaced by Python/R for heavy lifting, expert-level Excel skills remain essential for analysis, reporting, and ad-hoc tasks.

- Predictive Analytics & Machine Learning: Actuaries who can build and interpret predictive models (e.g., GLMs, decision trees, gradient boosting) are at the forefront of the industry and are compensated accordingly. They are effectively data scientists with deep domain expertise.

- Soft Skills:

- Communication & Presentation: The ability to translate a complex stochastic model into a clear business recommendation for a CEO is an invaluable skill. Actuaries who can do this move into leadership roles faster.

- Business Acumen: Understanding the "why" behind the numbers—how your work impacts the company's bottom line, competitive position, and strategic goals—separates a good actuary from a great one.

- Project Management & Leadership: As you become more senior, your ability to lead projects, mentor junior staff, and manage timelines becomes critical to your success and compensation.

Job Outlook and Career Growth

For those willing to undertake the demanding exam process, the reward is a career field with exceptional stability and a bright future. The job outlook for actuaries is one of the strongest of any profession.

According to the U.S. Bureau of Labor Statistics (BLS), employment of actuaries is projected to grow 22 percent from 2022 to 2032. This is much faster than the average for all occupations, which stands at 3 percent. The BLS projects about 2,600 openings for actuaries each year, on average, over the decade. Most of those openings are expected to result from the need to replace workers who transfer to different occupations or exit the labor force, such as to retire.

### Why is the Demand for Actuaries So High?

The robust growth is driven by several long-term economic and social trends:

1. The Proliferation of Data: We live in a data-driven world. Companies are collecting more information than ever before, and they need professionals who can turn that data into actionable risk management strategies. Actuaries are perfectly positioned to fill this role.

2. Increasingly Complex Risk Landscape: The world is becoming riskier and more interconnected. New and evolving risks—such as climate change, cybersecurity threats, global pandemics, and complex financial instruments—require sophisticated modeling and analysis that actuaries provide.

3. Aging Population: In the U.S. and other developed nations, the large baby-boomer generation is moving into retirement. This creates immense demand for actuaries in the