For professionals with a knack for numbers and a strategic mindset, a career as a Finance Manager is one of the most rewarding paths in the business world. It offers a unique blend of analytical rigor and executive influence, placing you at the financial heart of an organization. But beyond the significant responsibilities, what is the earning potential?

This article dives deep into the question, "What is a Finance Manager's salary?" We will explore national averages, break down compensation at top-tier companies like Amazon, and analyze the key factors that can significantly increase your paycheck. For those considering this career, the data is clear: the potential is substantial, with many professionals earning well into the six figures.

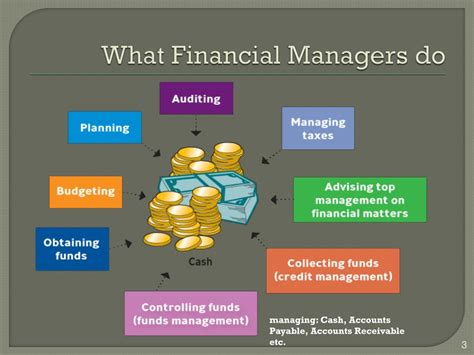

What Does a Finance Manager Do?

Before we talk numbers, it's essential to understand the role. A Finance Manager is a senior professional responsible for the financial health of an organization or a specific department. They are not just number-crunchers; they are strategic partners to business leaders.

Key responsibilities typically include:

- Financial Planning & Analysis (FP&A): Developing budgets, creating forecasts, and analyzing financial performance to guide business decisions.

- Reporting: Producing accurate and timely financial statements and reports for senior management, stakeholders, and regulatory bodies.

- Risk Management: Identifying and mitigating financial risks to the company.

- Investment Strategy: Advising on investment opportunities and capital allocation to maximize returns.

- Team Leadership: Managing a team of financial analysts, accountants, and other finance professionals.

In short, a Finance Manager ensures the company operates efficiently, profitably, and in full compliance with regulations.

Average Finance Manager Salary

Across the United States, the salary for a Finance Manager is impressive. While figures vary, a clear and lucrative picture emerges from leading data sources.

According to Salary.com, as of late 2023, the median base salary for a Finance Manager in the United States is approximately $138,500. The typical salary range falls between $124,000 and $156,000, but this can vary widely based on the factors we'll discuss below.

Glassdoor reports a similar average base pay of around $135,000 per year. However, it's crucial to consider Total Compensation, which includes bonuses, profit sharing, and stock options. Glassdoor estimates the median total pay for a Finance Manager is closer to $168,000 annually.

### The Amazon Factor: Compensation at a Tech Giant

The initial query specifically mentions Amazon, and for good reason. Compensation at major tech companies (often called FAANG: Facebook/Meta, Apple, Amazon, Netflix, Google) operates on a different scale.

For a Finance Manager at Amazon, the numbers are significantly higher. Based on data from Glassdoor and levels.fyi, here’s a typical breakdown:

- Average Base Salary: Approximately $150,000 - $175,000 per year.

- Average Total Compensation (including stock and bonus): Ranges from $200,000 to over $275,000 annually.

The large gap is due to Amazon's heavy reliance on Restricted Stock Units (RSUs) as a major component of compensation. This structure is designed to attract top talent and incentivize long-term performance.

Key Factors That Influence Salary

Your final salary is not determined by a single number. It is a complex calculation based on several critical factors. Understanding these can help you strategically maximize your earning potential.

### Level of Education

A bachelor's degree in finance, accounting, economics, or a related field is the standard entry requirement. However, advanced degrees and certifications provide a significant salary boost.

- Bachelor's Degree: The baseline for entering the field, typically after gaining several years of experience as a financial analyst.

- Master of Business Administration (MBA): An MBA, especially from a top-tier business school, is a powerful accelerator. Employers view MBA holders as having a broader strategic perspective, often leading to higher-level positions and salaries that are 15-25% higher.

- Certifications: Professional certifications like Certified Public Accountant (CPA) or Chartered Financial Analyst (CFA) are highly valued. They demonstrate a proven level of expertise and can add a significant premium to your base salary.

### Years of Experience

Experience is arguably the most influential factor. The career path is progressive, with compensation growing at each stage.

- Early Career (3-5 years): Professionals at this stage are often Senior Financial Analysts or junior Finance Managers, with salaries typically at the lower end of the range, from $95,000 to $120,000.

- Mid-Career (5-10 years): This is the sweet spot for a standard Finance Manager role. With a proven track record, professionals can expect to earn within the national average range of $125,000 to $160,000 in base pay.

- Senior/Experienced (10+ years): With a decade or more of experience, Finance Managers often move into Senior Finance Manager or Director of Finance roles. Base salaries at this level can easily exceed $170,000, with total compensation packages pushing well over $250,000, especially in large corporations.

### Geographic Location

Where you work matters. Salaries are adjusted to the cost of living and the demand for talent in a specific metropolitan area.

- High-Cost-of-Living Hubs: Cities like San Francisco, New York City, and Seattle command the highest salaries, often 20-35% above the national average to compensate for the higher cost of living.

- Major Business Centers: Cities like Boston, Los Angeles, and Washington, D.C. also offer above-average compensation.

- Lower-Cost-of-Living Areas: In many Midwestern and Southern states, salaries may be closer to or slightly below the national average, but the purchasing power of that income is significantly greater.

### Company Type

The size, industry, and prestige of your employer play a massive role.

- Startups & Small Businesses: May offer lower base salaries but could provide significant equity or stock options, which carry high potential rewards.

- Non-Profits & Government: Tend to offer lower salaries than the private sector but often provide excellent benefits and work-life balance.

- Fortune 500 Corporations: These large, established companies offer competitive salaries, structured bonus programs, and robust benefits packages.

- Big Tech & Financial Services: This is the top tier for compensation. Companies like Amazon, Google, Goldman Sachs, and JPMorgan Chase pay a premium to attract and retain the best financial minds, with total compensation packages far exceeding industry averages.

### Area of Specialization

"Finance Manager" can be a broad title. Specializing in a high-demand area can increase your value. Key specializations include:

- Financial Planning & Analysis (FP&A): A very common and central role focused on budgeting and forecasting.

- Treasury: Manages the company's cash, debt, and investment portfolio.

- Corporate Development (M&A): Focuses on mergers and acquisitions, a highly specialized and lucrative field.

- Investor Relations: Manages communication between the company and the investment community.

Job Outlook

The future for Finance Managers is exceptionally bright. The U.S. Bureau of Labor Statistics (BLS) projects that employment for financial managers will grow by 16% from 2022 to 2032, which is "much faster than the average for all occupations."

The BLS attributes this rapid growth to the increasing complexity of the global economy, the need for rigorous financial oversight, and the growing importance of data analysis in corporate strategy. This high demand ensures that skilled finance professionals will remain a valuable and well-compensated asset for years to come.

Conclusion

A career as a Finance Manager offers a powerful combination of intellectual challenge, strategic impact, and outstanding financial reward. While the national average salary is already robust at over $135,000, your individual earning potential is largely in your hands.

For those aiming for the highest salaries, the path is clear:

1. Invest in Education: Pursue an MBA or a key certification like a CPA or CFA.

2. Gain Diverse Experience: Build a strong track record of success over 5-10 years.

3. Be Strategic About Location & Industry: Target high-growth industries and major economic hubs, especially the technology and financial services sectors.

By strategically navigating these factors, you can position yourself to not only meet but significantly exceed the average salary, building a prosperous and impactful career at the center of the business world.