In a world of ever-increasing regulation and corporate accountability, the role of the Compliance Analyst has become more critical—and more lucrative—than ever. These professionals are the guardians of integrity within an organization, ensuring operations align with legal, ethical, and regulatory standards. If you're considering this dynamic career path, you're likely wondering about the financial rewards.

The short answer? A career as a Compliance Analyst offers significant earning potential, with average salaries often starting well above the national median and climbing into six-figure territory with experience and specialization.

This guide will break down everything you need to know about a Compliance Analyst's salary, from average compensation to the key factors that can dramatically increase your paycheck.

What Does a Compliance Analyst Do?

Before diving into the numbers, it's essential to understand the role. A Compliance Analyst is a professional detective, strategist, and educator all in one. They are responsible for ensuring that a company adheres to all external laws and regulations as well as its own internal policies and bylaws.

Key responsibilities typically include:

- Monitoring and Interpreting Regulations: Keeping up with new and changing laws that affect the industry.

- Risk Assessment: Identifying areas within the company that are vulnerable to non-compliance.

- Developing and Implementing Policies: Creating or updating internal policies and procedures to mitigate risk.

- Conducting Audits and Investigations: Reviewing business processes and investigating potential breaches of compliance.

- Training and Education: Ensuring employees understand their compliance obligations.

It's a challenging role that requires a meticulous eye for detail, strong analytical skills, and an unwavering ethical compass.

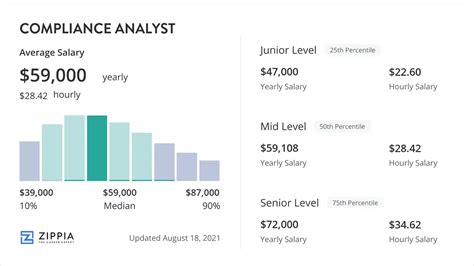

Average Compliance Analyst Salary

So, what can you expect to earn? While exact figures vary, we can establish a reliable baseline by looking at data from several authoritative sources.

The average base salary for a Compliance Analyst in the United States typically falls between $70,000 and $85,000 per year.

However, a more detailed picture emerges when we look at the full salary spectrum:

- Payscale reports a typical range from $56,000 to $99,000, with an average base salary of around $73,500.

- Salary.com provides a tiered view, with a "Compliance Analyst I" (entry-level) earning a median salary of $65,511, while a "Senior Compliance Analyst" can expect a median of $107,329.

- The U.S. Bureau of Labor Statistics (BLS), which groups this role under the broader category of "Compliance Officers," reports a median annual wage of $75,810 as of May 2022. The lowest 10% earned less than $45,670, while the top 10% earned more than $124,510.

These figures show a clear path for salary growth, with significant potential for high earnings as you advance in your career.

Key Factors That Influence Salary

Your base salary is not a fixed number. Several key variables can significantly impact your earning potential. Understanding these factors is crucial for maximizing your income as a Compliance Analyst.

### Level of Education

A bachelor's degree is the standard entry requirement for most Compliance Analyst positions. Degrees in finance, business, accounting, or pre-law are highly relevant. However, pursuing advanced education can unlock higher-level roles and salaries.

- Bachelor's Degree: Qualifies you for entry-level to mid-level analyst roles.

- Master's Degree (MBA, Master's in Law, etc.): An advanced degree can make you a more competitive candidate for senior analyst, manager, or director-level positions, often commanding a salary premium of 15-25% or more.

- Juris Doctor (JD): While not required, a law degree is highly valued in the compliance field and can open doors to the most senior and highest-paying roles, such as Chief Compliance Officer (CCO).

### Years of Experience

Experience is arguably the single most important factor in determining your salary. As you gain expertise and a proven track record, your value to employers skyrockets.

- Entry-Level (0-2 years): Analysts at this stage are learning the ropes. Salaries typically range from $55,000 to $70,000.

- Mid-Career (2-5 years): With a solid foundation of experience, these analysts take on more complex tasks. Salaries often move into the $70,000 to $95,000 range.

- Senior-Level (5+ years): Senior analysts often lead projects, mentor junior staff, and handle high-stakes compliance issues. Their salaries frequently exceed $100,000, with many earning $110,000 to $130,000+.

### Geographic Location

Where you work matters. Major metropolitan areas—especially financial and tech hubs with a high cost of living and a heavy concentration of regulated industries—offer the highest salaries.

According to BLS data, the top-paying states for compliance officers include:

1. District of Columbia: $106,170 (Annual Mean Wage)

2. New Jersey: $98,380

3. Colorado: $93,420

4. California: $92,020

5. New York: $91,920

Working in cities like New York City, San Francisco, Washington D.C., or Boston will almost certainly result in a higher salary than working in a smaller, rural market.

### Company Type

The industry and size of your employer play a massive role in compensation. Companies in highly regulated sectors with high financial risk pay a premium for top compliance talent.

- Finance & Investment Banking: This sector is consistently the highest-paying, as firms face immense regulatory scrutiny from bodies like the SEC and FINRA.

- Healthcare & Pharmaceuticals: With complex regulations like HIPAA, compliance is critical and well-compensated.

- Technology: The growing focus on data privacy (GDPR, CCPA) has created high-paying compliance roles within tech giants.

- Government & Non-Profit: These sectors typically offer lower base salaries but may compensate with excellent benefits, job security, and a better work-life balance.

### Area of Specialization

As you advance, specializing in a high-demand area of compliance can make you an invaluable asset. Niche expertise often commands a significant salary premium.

Popular and lucrative specializations include:

- Anti-Money Laundering (AML) / Know Your Customer (KYC): A cornerstone of financial compliance, these specialists are in perpetual demand.

- Data Privacy & Cybersecurity: With data being the new oil, experts who understand GDPR, CCPA, and cybersecurity frameworks are highly sought after.

- Healthcare Compliance: Specialists in HIPAA and FDA regulations are essential in the medical and pharmaceutical industries.

- Environmental, Social, and Governance (ESG): A rapidly growing field as companies focus on sustainability and ethical operations.

Furthermore, obtaining professional certifications like the Certified Compliance & Ethics Professional (CCEP) or the Certified Anti-Money Laundering Specialist (CAMS) can validate your expertise and boost your earning potential.

Job Outlook

The future for Compliance Analysts is bright. The U.S. Bureau of Labor Statistics projects that employment for "Compliance Officers" will grow by 4 percent from 2022 to 2032, which is about as fast as the average for all occupations.

This steady growth is driven by an increasingly complex global regulatory landscape, a greater focus on data protection, and a corporate push for stronger ethical standards. This means a career in compliance offers not just strong compensation but also excellent job security.

Conclusion

A career as a Compliance Analyst is an excellent choice for analytical, detail-oriented individuals with a strong sense of ethics. It is a field that is both intellectually challenging and financially rewarding.

Here are the key takeaways:

- Strong Earning Potential: Expect an average salary between $70,000 and $85,000, with a clear path to six-figure earnings.

- Growth is Key: Your salary is not static. It grows significantly with experience, advanced education, and professional certifications.

- Location and Industry Matter: Working in a major city and a highly regulated industry like finance or tech will maximize your income.

- Specialize for Success: Developing expertise in a high-demand area like AML or data privacy can make you an indispensable and highly-paid professional.

- A Secure Future: With steady projected job growth, compliance offers a stable and promising long-term career path.

For anyone looking to build a career that is both impactful and prosperous, the role of a Compliance Analyst stands out as a premier opportunity in today's professional landscape.