Introduction

The title "Chief Operating Officer" evokes images of power, influence, and strategic command. It's the pinnacle of an operational career, the role responsible for turning a CEO's vision into a profitable, efficient reality. For those with the ambition, skill, and resilience to climb this corporate ladder, the rewards are substantial. But beyond the prestige, what does the financial compensation for such a demanding role actually look like? Understanding the average salary for a chief operating officer is more than a matter of curiosity; it's a critical data point for anyone mapping out a long-term career trajectory toward the executive suite.

The journey to the COO office is a marathon, not a sprint, demanding a unique blend of strategic foresight, financial acumen, and masterful people skills. While the compensation can be exceptionally high, often reaching well into the six or even seven figures with total compensation, it is not a monolithic figure. The final number on a COO's paycheck is a complex calculation influenced by a vast array of factors, from the size of the company's revenue to the city in which its headquarters is located.

As a career analyst who has guided countless senior leaders, I once worked with a Vice President of Operations at a mid-sized tech firm who was brilliant at optimizing supply chains but struggled to see her path to the C-suite. We mapped her skills, identified a gap in her strategic financial experience, and created a two-year plan that included leading a cross-functional M&A due diligence team. That specific experience was the final piece of the puzzle that made her the undeniable candidate for the COO role when it opened up, dramatically increasing her compensation and impact. It’s this kind of strategic career navigation that separates hopefuls from appointees.

This guide is designed to be your comprehensive roadmap. We will dissect the average salary for a Chief Operating Officer, explore every key factor that shapes your earning potential, and provide a step-by-step plan to help you embark on or advance along this challenging and immensely rewarding career path.

### Table of Contents

- [What Does a Chief Operating Officer Do?](#what-does-a-chief-operating-officer-do)

- [Average Chief Operating Officer Salary: A Deep Dive](#average-chief-operating-officer-salary-a-deep-dive)

- [Key Factors That Influence Salary](#key-factors-that-influence-salary)

- [Job Outlook and Career Growth](#job-outlook-and-career-growth)

- [How to Get Started in This Career](#how-to-get-started-in-this-career)

- [Conclusion](#conclusion)

What Does a Chief Operating Officer Do?

Often referred to as the "second-in-command," the Chief Operating Officer (COO) is the executive engine of an organization. While the Chief Executive Officer (CEO) is typically focused on long-term strategy, investor relations, and the external face of the company, the COO is internally focused, responsible for the design and execution of the company's day-to-day business operations. They are the master implementers, ensuring that all the moving parts of the business—from manufacturing and supply chain to human resources and IT—are working in concert to achieve strategic goals.

The COO's core mandate is to drive efficiency, productivity, and operational excellence. They are accountable for the performance of various departments and must ensure that the company has the effective operational controls, administrative procedures, and people systems in place to grow the organization and ensure its financial strength.

Core Responsibilities Often Include:

- Overseeing Daily Operations: This is the heart of the role. The COO manages the heads of various departments (e.g., operations, production, marketing, sales, HR) to ensure they meet their goals.

- Strategic Execution: Translating the CEO's high-level strategic plans into actionable, step-by-step processes and initiatives that can be implemented across the company.

- Performance Management: Establishing key performance indicators (KPIs) for the company and its departments, and then rigorously monitoring them to identify areas for improvement.

- Financial Management and P&L: Working closely with the Chief Financial Officer (CFO), the COO often has direct or indirect responsibility for the company's profit and loss (P&L), managing budgets, and ensuring resources are allocated effectively.

- Process Improvement: Constantly seeking ways to make the business more efficient, reduce costs, improve quality, and enhance customer satisfaction. This often involves methodologies like Lean Six Sigma or Agile.

- Change Management: Leading the organization through significant changes, such as mergers and acquisitions, technological implementations, or major restructuring.

### A Day in the Life of a COO

To make this tangible, let's walk through a hypothetical day for a COO at a $500 million manufacturing company:

- 7:30 AM - 8:30 AM: Review overnight production reports, global supply chain updates, and key financial dashboards. Flag an unexpected logistics delay from a key supplier in Asia for immediate follow-up.

- 8:30 AM - 9:00 AM: Daily huddle with the CEO and CFO to align on the day's priorities. Discuss the logistics delay and agree on a contingency plan.

- 9:00 AM - 11:00 AM: Lead the weekly Operations Review meeting. Department heads (Production, Logistics, Quality Control, HR) present their KPIs. The COO challenges the team on declining production line efficiency and facilitates a problem-solving session.

- 11:00 AM - 12:00 PM: Meet with the VP of Human Resources to review the talent pipeline for a critical director-level role and discuss a new employee performance management system.

- 12:00 PM - 1:00 PM: Working lunch with the Chief Technology Officer to review the progress of a major ERP system implementation, focusing on user adoption and potential roadblocks.

- 1:00 PM - 2:30 PM: Deep dive into the Q3 budget with the finance team, identifying areas for potential cost savings to re-invest in R&D.

- 2:30 PM - 4:00 PM: Site visit to the main production facility. Walk the floor, speak with line managers and workers to get a firsthand sense of morale and operational challenges.

- 4:00 PM - 5:30 PM: Conference call with the M&A team to assess the operational synergies and integration challenges of a potential acquisition target.

- 5:30 PM - 6:30 PM: Respond to critical emails, sign off on major purchase orders, and map out the agenda for tomorrow's strategic planning offsite.

This "day in the life" illustrates the COO's constant juggling of high-level strategy and granular operational detail, requiring a unique ability to switch contexts rapidly while maintaining a clear focus on the company's core objectives.

Average Chief Operating Officer Salary: A Deep Dive

The compensation for a Chief Operating Officer is among the highest in the corporate world, reflecting the immense responsibility and impact of the role. However, the "average" salary can be misleading without understanding the vast range and the various components that make up total compensation.

National Average and Typical Range

When we analyze data from reputable sources, a clear picture of COO earnings emerges. It's important to look at both base salary and total compensation, which includes bonuses, profit sharing, and equity.

- Salary.com: As of late 2023 / early 2024, the median base salary for a Chief Operating Officer in the United States is approximately $485,000. The salary range is exceptionally wide, typically falling between $370,000 and $630,000. However, total compensation, which is a far more accurate measure of a COO's earnings, tells a more complete story. The median total compensation is around $730,000, with a common range between $515,000 and $1,050,000. Top-tier COOs at major public companies can earn significantly more.

- Payscale: This platform reports a slightly more conservative average base salary of around $181,000. This lower figure likely reflects a broader data set that includes COOs at smaller businesses and non-profits. However, Payscale also highlights the significant impact of bonuses (median of $49,000) and profit sharing (up to $100,000+), bringing the total pay into the $119,000 to $366,000 range for their user-reported data.

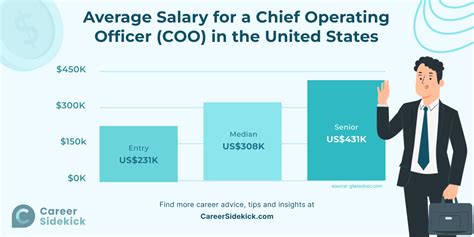

- Glassdoor: Glassdoor's data, which aggregates user-submitted salaries, places the estimated total pay for a COO at $293,000 per year in the United States, with an average base salary of around $182,000. The "likely range" for total pay is listed as $176,000 to $512,000.

The discrepancy between these sources highlights the immense variability of the role. Salary.com's data tends to skew towards larger, more established corporations, while Payscale and Glassdoor capture a wider spectrum, including smaller enterprises. For an aspiring COO at a significant company, the figures from Salary.com are likely a more realistic target.

### COO Salary by Experience Level

Experience is arguably the single most important factor in determining a COO's salary. The journey to this role is long, and compensation grows substantially with each stage of leadership demonstrated.

| Career Stage | Typical Years of Experience | Average Base Salary Range | Typical Total Compensation Range | Notes |

| :--- | :--- | :--- | :--- | :--- |

| Early-Career / Director Level | 5-10 years | $120,000 - $180,000 | $140,000 - $220,000 | This represents a Director of Operations or a COO at a very small company/startup. Focus is on tactical execution. |

| Mid-Career / VP Level | 10-15 years | $180,000 - $275,000 | $250,000 - $450,000 | Typically a VP of Operations at a mid-sized to large company. Increased strategic responsibility and P&L management. |

| Senior / Experienced COO | 15-20+ years | $275,000 - $500,000+ | $450,000 - $1,000,000+ | A seasoned COO at a large corporation or a high-growth, well-funded private company. Deep strategic involvement. |

| Top-Tier / C-Suite Veteran | 20+ years | $500,000 - $1,000,000+ | $1,000,000 - $10,000,000+ | COOs at Fortune 500 companies. Compensation is heavily weighted towards stock options, performance shares, and long-term incentives. |

*(Salary data is an aggregation and interpretation of figures from Salary.com, Payscale, and industry reports as of 2023/2024.)*

### Deconstructing Total Compensation: More Than Just a Salary

For any C-level executive, base salary is only one part of the story. Understanding the full compensation package is crucial.

- Base Salary: This is the fixed, guaranteed portion of your annual pay. It provides stability but often represents less than 50-60% of the total compensation for a senior COO.

- Annual Bonus / Short-Term Incentive (STI): This is a variable cash payment tied to performance over the past year. It is typically based on a combination of company performance (e.g., revenue growth, EBITDA targets) and individual performance (e.g., achieving specific operational milestones). A target bonus might be 50% to 150% of the base salary.

- Long-Term Incentives (LTI): This is where the most significant wealth creation occurs for executives. LTI plans are designed to align the COO's interests with those of the shareholders over a multi-year period. Common forms include:

- Stock Options: The right to buy company stock at a predetermined price in the future. Their value increases as the company's stock price rises.

- Restricted Stock Units (RSUs): A grant of company shares that vest over a period of time (typically 3-4 years). Once vested, they are owned by the executive.

- Performance Shares: A grant of shares that only vests if the company meets specific, long-term performance goals (e.g., total shareholder return vs. a peer group).

- Profit Sharing: A plan that distributes a portion of the company's pre-tax profits to employees. This is more common in private companies and can be a significant addition to cash compensation.

- Executive Perks and Benefits: While less direct, these have substantial value. They can include:

- Executive health insurance plans.

- Company car or car allowance.

- Professional development and executive coaching budgets.

- Club memberships (country clubs, athletic clubs).

- Deferred compensation plans and enhanced 401(k) matching.

- Generous paid time off (PTO) and sabbatical options.

When evaluating a COO offer, it's essential to look at the total compensation package and understand the potential upside of the variable and long-term components.

Key Factors That Influence Salary

The wide salary ranges discussed above are driven by a confluence of factors. A COO candidate with the exact same experience level could earn $250,000 in one role and over $800,000 in another. As a career analyst, I emphasize that understanding these levers is key to maximizing your earning potential. Let's break down the most influential variables.

###

Level of Education

While experience trumps education in the C-suite, the right academic credentials are often a non-negotiable entry ticket and can significantly influence starting salary and advancement speed.

- Bachelor's Degree: This is the absolute minimum requirement. Degrees in Business Administration, Finance, Economics, Engineering, or a related field are most common. They provide the foundational knowledge of how a business operates.

- Master of Business Administration (MBA): The MBA is the gold standard for aspiring C-level executives. It signals a high level of business acumen, strategic thinking, and leadership potential. An MBA from a top-tier business school (e.g., Harvard, Stanford, Wharton, Kellogg) acts as a powerful signaling mechanism to boards and CEOs, often commanding a significant salary premium and opening doors to the most coveted opportunities. The network built during an MBA program is also an invaluable long-term asset. A COO with an MBA from a top program can expect a 15-30% salary premium over a candidate without one, all else being equal.

- Other Advanced Degrees: Specialized master's degrees in fields like Finance (MFin), Engineering Management, or Operations Management can also be highly valuable, particularly for COOs in technical or finance-heavy industries.

- Professional Certifications: While not a substitute for a degree, relevant certifications demonstrate specialized expertise and a commitment to continuous improvement. They can provide a competitive edge and a salary bump. Highly regarded certifications include:

- Six Sigma (Green Belt, Black Belt, Master Black Belt): Demonstrates expertise in process improvement and quality control. Essential for COOs in manufacturing, logistics, and healthcare.

- Project Management Professional (PMP): Validates the ability to manage large, complex projects, a core function of the COO role.

- Certified in Production and Inventory Management (CPIM) / Certified Supply Chain Professional (CSCP): Offered by ASCM (formerly APICS), these are crucial for COOs with a heavy focus on supply chain and logistics.

###

Years of Experience

This is the most heavily weighted factor. A COO is not an entry-level position; it's a destination role that requires a deep and diverse history of progressive leadership and proven results. The salary trajectory mirrors this journey.

- Foundation (0-7 Years): The path begins not as a COO, but as an analyst, engineer, project manager, or team lead. The focus is on mastering a functional area and demonstrating competence.

- Managerial Growth (7-15 Years): This is the critical stage of becoming a Director or Senior Manager of Operations, Finance, or another key business unit. You gain P&L responsibility, manage larger teams, and lead significant projects. Professionals in this stage typically earn in the $150,000 to $250,000 total compensation range. Moving from a single-function leader to a cross-functional leader (e.g., Director of Operations overseeing production *and* logistics) is a key milestone.

- Executive Leadership (15-20+ Years): This is the VP-level stage, the direct precursor to the COO role. As a Vice President of Operations (or a similar title), you are responsible for an entire business division or a major global function. You are part of the senior leadership team and are deeply involved in corporate strategy. Total compensation here often ranges from $250,000 to $500,000+.

- The COO Role (20+ Years): Attaining the COO title represents the culmination of this experience. The salary reflects the trust placed in you to run the entire operational infrastructure of the business. The starting point for a COO at a reputable company is high, and it grows with tenure and, most importantly, with demonstrated success in driving growth and profitability.

###

Geographic Location

Where a company is headquartered has a dramatic impact on COO compensation, largely due to variations in cost of living, talent competition, and the concentration of large corporate headquarters.

According to data from Salary.com (2024), here is how the median COO salary can vary across major U.S. metropolitan areas:

- Top-Tier Markets:

- San Francisco, CA: ~25% above the national average.

- New York, NY: ~20% above the national average.

- Boston, MA: ~15% above the national average.

- Los Angeles, CA: ~12% above the national average.

- Mid-Tier Markets:

- Chicago, IL: Close to the national average.

- Dallas, TX: Slightly below the national average.

- Atlanta, GA: Slightly below the national average.

- Lower-Tier Markets:

- Salaries in smaller cities and rural areas will be significantly lower, often 15-25% below the national average.

An aspiring COO should be aware that the highest-paying jobs are concentrated in a few key economic hubs. While the cost of living is also higher, the sheer scale of compensation in cities like San Francisco and New York is unmatched.

###

Company Type & Size

The nature and scale of the business are massive determinants of a COO's pay.

- Startups:

- Salary: Generally lower cash compensation. A seed-stage or Series A startup might offer a COO a base salary of $150,000 - $220,000.

- Equity: The main attraction. The COO is a founding-level executive and will receive a significant equity stake (e.g., 1-5% of the company). This equity has the potential for a massive payout if the company succeeds (IPO or acquisition) but is high-risk.

- Mid-Sized Private Companies ($50M - $500M Revenue):

- Salary: This is the sweet spot for a strong blend of cash and potential upside. Base salaries might range from $250,000 - $400,000.

- Compensation: Bonuses are significant, and profit sharing or equity-like instruments (e.g., phantom stock) are common. The role is often highly entrepreneurial with direct impact on the company's trajectory.

- Large Public Corporations (>$1B Revenue):

- Salary: This is where the highest cash and total compensation packages are found. Base salaries routinely exceed $450,000 - $500,000.

- Compensation: Total compensation, driven by massive STI and LTI grants, can easily reach $1 million to $5 million+ per year. The role is more complex, often involving global operations, heavy regulatory oversight, and intense pressure from Wall Street.

- Non-Profits and Government:

- Salary: Compensation is significantly lower than in the for-profit sector. A COO (or equivalent title like Chief Administrative Officer) at a large non-profit might earn $150,000 - $250,000.

- Motivation: These roles are driven by mission, not money. The reward is in public service and societal impact.

###

Area of Specialization / Industry

The industry in which a company operates heavily influences the COO's role and pay.

- Technology/SaaS: High salaries driven by rapid growth and the need for scalable operational processes. COOs often come from a product, engineering, or go-to-market background. Pay is competitive with finance.

- Finance/Banking: Extremely high compensation. COOs in investment banking or asset management are responsible for massive, complex, and highly regulated global operations. They must be masters of risk management and compliance.

- Manufacturing/Industrials: Strong, traditional compensation. The COO is the master of the physical world: supply chain, logistics, production, and quality. Expertise in Lean Six Sigma is paramount.

- Healthcare: A complex and growing field. COOs of hospital systems or large healthcare providers manage vast operational challenges, from patient care protocols to billing and regulatory compliance. Compensation is high but can be slightly below finance or tech.

- Retail/Consumer Goods: A fast-paced environment where the COO must manage a complex interplay of supply chain, marketing, and e-commerce operations. Compensation is competitive but highly dependent on the company's performance.

###

In-Demand Skills

Beyond a track record of success, specific skills can make a COO candidate far more valuable. Cultivating these will directly translate to higher compensation.

- Digital Transformation: The ability to lead the integration of technology (AI, machine learning, data analytics, automation) into every facet of a company's operations. This is no longer optional; it's a core competency.

- Financial Acumen: A deep understanding of financial statements, P&L management, budgeting, and capital allocation. The best COOs can think like a CFO.

- Supply Chain Mastery: In a post-pandemic world, the ability to build resilient, efficient, and agile global supply chains is a top priority for nearly every company that deals with physical goods.

- M&A Integration: Experience leading the operational due diligence and post-merger integration of acquired companies is a highly sought-after and lucrative skill.

- Data-Driven Decision Making: The ability to leverage business intelligence and analytics to drive strategy and decision-making, moving beyond intuition to empirical evidence.

- ESG (Environmental, Social, and Governance): A growing number of boards demand that their operations are not only profitable but also sustainable and socially responsible. COOs who can lead ESG initiatives are increasingly in demand.

- Change Management and Inspirational Leadership: The "soft skills" are arguably the hardest. A COO must be able to rally thousands of employees behind a vision, manage them through difficult transitions, and build a culture of accountability and excellence.

Job Outlook and Career Growth

For those investing the decades of effort required to reach the C-suite, understanding the long-term viability and growth prospects of the role is essential. The outlook for top executives, including Chief Operating Officers, is stable and reflects the fundamental need for strong operational leadership in any organization.

Projected Job Growth

The U.S. Bureau of Labor Statistics (BLS) groups Chief Operating Officers under the broader category of "Top Executives." According to the BLS's Occupational Outlook Handbook (2022-2032 projections):

- Projected Growth: Employment of top executives is projected to grow 3 percent from 2022 to 2032, which is about as fast as the average for all occupations.

- New Job Openings: Despite the modest growth rate, the BLS projects about 210,300 openings for top executives each year, on average, over the decade.

- Reason for Openings: Most of these openings are expected to result from the need to replace workers who transfer to different occupations or exit the labor force, such as to retire.

What does this data mean for an aspiring COO?

While the overall number of C-suites isn't exploding, the turnover is constant. The role of COO is incredibly demanding, and burnout is common. Furthermore, as companies grow, evolve, or merge, the need for new operational leadership frequently arises. This creates a steady stream of opportunities for qualified candidates. The competition for these roles is, and will always be, fierce. Success depends on being the absolute best candidate when an opportunity presents itself.

Emerging Trends and Future Challenges

The role of the COO is not static; it is constantly evolving to meet the demands of a changing business landscape. To remain relevant and command a top salary, future COOs must master several key areas:

1. The Rise of the "Digital-First" COO: The COO of tomorrow must be as comfortable with data analytics, AI, and cloud infrastructure as they are with a factory floor or a balance sheet. They will be tasked with leading their company's digital transformation, automating processes, and leveraging technology to create a competitive advantage.

2. Focus on Resilience and Agility: The COVID-19 pandemic and subsequent geopolitical instability exposed the fragility of global supply chains. Future COOs will be judged on