For those driven by integrity, curiosity, and a desire to be the bedrock of corporate governance, a career as a Certified Internal Auditor (CIA) is not just a job—it's a calling. It's a path that places you at the nerve center of an organization, tasked with ensuring its health, efficiency, and ethical conduct. While the responsibilities are significant, the rewards—both professional and financial—are equally substantial. A career as a Certified Internal Auditor promises not only a competitive salary but also immense influence and a direct line to executive leadership.

The earning potential for a CIA is compelling, with national averages comfortably sitting in the six-figure range and senior professionals commanding salaries upwards of $200,000 when bonuses and other compensation are factored in. But what does it truly take to reach these figures? Early in my career advising young finance professionals, I worked with a newly-minted CIA who, in her first major audit, uncovered a systemic invoicing flaw that was costing her mid-sized company nearly a million dollars annually. Her meticulous work didn't just earn her a promotion; it fundamentally changed how the C-suite viewed the audit function—from a compliance checkbox to a strategic, value-driving partner. That is the power and potential of this career.

This comprehensive guide will illuminate every facet of a Certified Internal Auditor's salary and career trajectory. We will dissect compensation data, explore the critical factors that influence your pay, and provide a step-by-step roadmap to help you launch or advance your career in this esteemed profession.

### Table of Contents

- [What Does a Certified Internal Auditor (CIA) Do?](#what-does-a-cia-do)

- [Average CIA Salary: A Deep Dive](#average-cia-salary)

- [Key Factors That Influence Your CIA Salary](#key-factors)

- [Job Outlook and Career Growth for CIAs](#job-outlook)

- [How to Become a Certified Internal Auditor](#how-to-get-started)

- [Conclusion: Is a CIA Career Right for You?](#conclusion)

What Does a Certified Internal Auditor (CIA) Do?

Before we dive into the numbers, it's crucial to understand what the role of a Certified Internal Auditor entails. The common misconception is that auditors are simply "number crunchers" who live in spreadsheets, checking for financial errors. While financial acumen is essential, the modern CIA's role is far more strategic, dynamic, and influential.

A Certified Internal Auditor is a trusted advisor who provides independent, objective assurance and consulting services designed to add value and improve an organization's operations. They are the guardians of the organization's internal control environment, risk management processes, and governance frameworks. Their ultimate goal is to help the organization achieve its objectives by evaluating and improving the effectiveness of its processes.

The "Certified" designation, granted by The Institute of Internal Auditors (IIA), is the only globally recognized certification for internal auditors and signifies a high level of professionalism, competence, and ethical conduct.

Core Responsibilities and Daily Tasks:

An internal auditor's work is project-based, revolving around an annual audit plan approved by the organization's audit committee (a subset of the Board of Directors). Daily tasks can vary significantly depending on the specific audit engagement, but a typical workflow includes:

- Planning the Audit: Defining the scope, objectives, and timeline for an audit. This involves understanding the business process, identifying key risks, and developing a testing strategy.

- Fieldwork and Testing: This is the investigative heart of the job. It involves:

- Interviewing key personnel to understand processes and controls.

- Reviewing documents, policies, and procedures.

- Performing data analysis to identify anomalies or trends.

- Testing internal controls to ensure they are designed appropriately and operating effectively.

- Documenting Findings: Meticulously documenting the work performed, the evidence gathered, and any identified issues or control weaknesses.

- Developing Recommendations: Collaborating with management to develop practical and effective solutions to address identified issues. This is a crucial, value-added part of the role.

- Reporting and Communicating: Drafting formal audit reports that are clear, concise, and impactful. This culminates in presenting findings and recommendations to management and, for significant issues, to the audit committee.

### A "Day in the Life" of a Senior Internal Auditor

To make this tangible, let's follow "Alex," a Senior CIA at a publicly-traded tech company:

- 8:30 AM: Alex starts the day with a team huddle for the ongoing IT General Controls audit. They discuss progress, roadblocks, and a plan to test user access controls for the new ERP system.

- 9:30 AM: Alex meets with the Director of Software Engineering to walk through the company's software development lifecycle (SDLC) process. Alex asks probing questions, guided by professional skepticism, to understand how changes are tested and approved before being deployed.

- 11:00 AM: Back at their desk, Alex begins documenting the interview, mapping the process flow, and selecting a sample of recent system changes to test later.

- 12:30 PM: Lunch with a mentor from the finance department to discuss career paths and the company's upcoming ESG (Environmental, Social, Governance) initiatives.

- 1:30 PM: Alex pulls a data set of all user accounts with administrative privileges in the company's core financial application. Using data analysis software, they filter for dormant accounts and unauthorized access, identifying a few potential exceptions for further investigation.

- 3:30 PM: Alex drafts a section of the previous quarter's audit report on inventory management, clearly articulating a control weakness found and outlining the practical recommendations management has agreed to implement.

- 5:00 PM: Before logging off, Alex reviews the workpapers of a junior auditor on the team, providing constructive feedback and guidance.

This snapshot reveals a role that is part investigator, part consultant, part data scientist, and part communicator—a far cry from the stereotype of a solitary accountant.

Average Certified Internal Auditor (CIA) Salary: A Deep Dive

The financial compensation for a Certified Internal Auditor is a significant draw, reflecting the critical nature of the role and the high level of expertise required. Holding the CIA certification acts as a powerful salary accelerant, often creating a substantial pay gap compared to non-certified peers.

According to data from Salary.com updated in 2024, the median salary for an Internal Auditor in the United States is approximately $98,300, but this figure represents a broad range of roles. For professionals who hold the CIA designation, the figures are considerably higher. Payscale.com reports that the average salary for a professional with a Certified Internal Auditor (CIA) designation is approximately $102,000 per year, with a typical range falling between $69,000 and $149,000.

However, these national averages only tell part of the story. The true earning potential unfolds as you progress through the career stages.

### CIA Salary by Experience Level

Salary growth in internal audit is steep and rewarding. As auditors gain experience, take on more complex projects, and move into leadership, their compensation grows exponentially.

Here is a breakdown of typical salary brackets by experience level, compiled from data from The IIA's 2023 Internal Audit Compensation Study, Salary.com, and Glassdoor. These ranges represent base salary and do not include bonuses, which can add another 10-30% (or more) to total compensation.

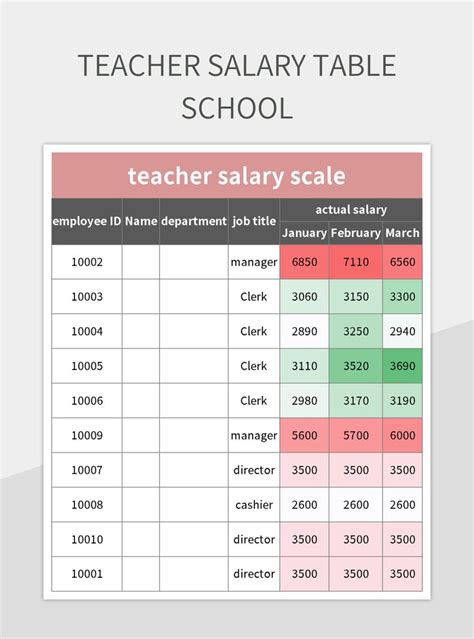

| Career Stage | Typical Title(s) | Years of Experience | Typical Base Salary Range |

| ---------------------------- | -------------------------------------------------- | ------------------- | ----------------------------- |

| Entry-Level | Staff Auditor, Internal Auditor I | 0-3 Years | $65,000 - $85,000 |

| Mid-Career | Senior Internal Auditor | 3-7 Years | $85,000 - $115,000 |

| Experienced / Managerial | Internal Audit Manager, Senior Audit Manager | 7-12 Years | $115,000 - $160,000 |

| Senior Leadership / Executive | Director of Internal Audit, Chief Audit Executive (CAE) | 12+ Years | $160,000 - $250,000+ |

*(Source: Data synthesized from Salary.com, Payscale.com, and industry reports like The IIA's compensation study, accessed in 2024. Ranges are illustrative and vary based on the factors discussed below.)*

### Beyond the Base Salary: Understanding Total Compensation

A CIA's compensation package is more than just a base salary. It's a comprehensive suite of financial rewards that reflects their value to the organization.

- Annual Bonuses: This is a significant component of pay, especially at the senior and manager levels. Bonuses are typically tied to a combination of company performance (e.g., revenue or profit targets) and individual performance (e.g., quality of audits, successful identification of risks). An annual bonus can range from 10% of base salary at the senior level to 30% or more for managers and directors.

- Stock Options and Restricted Stock Units (RSUs): In publicly traded companies, equity is a common and lucrative part of the compensation package for managerial and executive-level auditors. This aligns their long-term interests with those of the shareholders.

- Retirement Plans: Robust 401(k) or 403(b) plans with generous employer matching contributions are standard. For those in government roles, pensions may be offered.

- Health and Wellness Benefits: Comprehensive medical, dental, and vision insurance is a given. Many companies also offer wellness stipends, gym memberships, and mental health support.

- Professional Development: Companies that value their audit function typically invest heavily in their employees' growth. This includes paying for the CIA exam, review materials, annual certification maintenance fees, and sending auditors to industry conferences.

When evaluating a job offer, it is essential to consider this "total compensation" picture, as it can significantly increase your overall earnings and quality of life.

Key Factors That Influence Your CIA Salary

While the national averages provide a baseline, your individual salary as a Certified Internal Auditor will be determined by a complex interplay of several key factors. Understanding these variables is the first step to maximizing your earning potential throughout your career. This section provides an exhaustive breakdown of the elements that have the most significant impact on your paycheck.

### ### 1. Level of Education and Professional Certifications

Your educational and professional credentials are the foundation upon which your career and salary are built. They signal to employers a baseline of knowledge and a commitment to the profession.

Educational Background:

A bachelor's degree is the non-negotiable entry ticket into the field. The most common and preferred degrees are:

- Accounting: The traditional and most direct route, providing a deep understanding of financial statements, controls, and reporting standards.

- Finance: Also highly valued, especially for audits in financial services or those focused on treasury and investment functions.

- Business Administration/Management: Provides a broad understanding of business operations, which is valuable for operational audits.

While a bachelor's degree gets you in the door, a Master's Degree can provide a significant salary boost and open doors to leadership roles more quickly. An MBA, Master of Accountancy (MAcc), or a Master's in a specialized field like Data Analytics can differentiate you. According to The IIA, auditors with a master's degree often earn a premium of 5-15% over those with only a bachelor's.

The Power of the CIA Certification:

The CIA designation itself is the single most powerful salary driver. The IIA's own data consistently shows that professionals holding the CIA certification earn significantly more than their non-certified peers—often an average of 40% more over their careers. This premium exists because the CIA is the global gold standard, demonstrating mastery of the International Standards for the Professional Practice of Internal Auditing, risk management, and governance.

Complementary Certifications:

Top earners often "stack" certifications to build a unique and in-demand skill set. Each additional credential can add thousands to your base salary and make you a prime candidate for specialized, high-paying roles. Key complementary certifications include:

- Certified Public Accountant (CPA): The premier certification for external auditors and accountants. For internal auditors focused on financial reporting and Sarbanes-Oxley (SOX) compliance, having both a CIA and CPA is a powerful combination that can command a top-tier salary.

- Certified Information Systems Auditor (CISA): Essential for auditors specializing in IT. As technology risk becomes a primary concern for every board, CISA-certified professionals are in extremely high demand and often have a separate, elevated pay scale. The salary for an IT Audit Manager often exceeds that of a general Internal Audit Manager.

- Certified Fraud Examiner (CFE): The key credential for those specializing in forensic audits and fraud investigations. It positions you as an expert in uncovering and preventing corporate malfeasance.

- Certification in Risk Management Assurance (CRMA): An IIA certification that signals expertise in providing advice and assurance on risk management to audit committees and executive management.

### ### 2. Years of Experience and Career Progression

Internal audit is a field where experience is directly and handsomely rewarded. Your salary grows in distinct stages as you move from executing tasks to leading teams and setting strategy.

- Staff Auditor (0-3 Years | $65k - $85k): In this initial phase, you are learning the fundamentals. Your focus is on executing pre-defined audit programs, testing controls, documenting workpapers, and clearing review notes from your senior. Your salary is competitive for a recent graduate, but the real value is the foundational experience you're gaining.

- Senior Auditor (3-7 Years | $85k - $115k): This is where you see the first major salary jump. As a senior, you are now "in-charge" of smaller audits or significant sections of larger ones. You lead fieldwork, mentor staff auditors, interact directly with mid-level management, and are responsible for drafting initial audit findings. Obtaining your CIA certification during this phase is a key catalyst for promotion and higher pay.

- Audit Manager (7-12 Years | $115k - $160k): Promotion to manager marks your transition into leadership. Your focus shifts from "doing" to "managing." You are responsible for the annual audit planning process, managing a team of auditors, reviewing all workpapers, negotiating findings with senior management, and presenting reports to business leaders. Bonuses become a much larger part of your compensation at this level.

- Director / Chief Audit Executive (CAE) (12+ Years | $160k - $250k+): At the top of the profession, you are a strategic leader. As a Director or CAE, you report directly to the audit committee of the Board of Directors and the CEO/CFO. You set the vision and strategy for the entire internal audit function, manage the department's budget, recruit and develop talent, and provide high-level assurance on the organization's most critical risks. At this level, total compensation, including long-term incentives and significant bonuses, can easily push earnings well into the high six-figures, especially at large, public companies.

### ### 3. Geographic Location

Where you work has a direct and significant impact on your paycheck. Salaries for CIAs are not uniform across the country; they are adjusted to reflect the local cost of living and the demand for talent in a specific market.

High-Paying Metropolitan Areas:

Major financial centers and tech hubs consistently offer the highest salaries for internal auditors due to a high concentration of large public companies and a higher cost of living. According to data from Salary.com's "Salary Wizard," an Internal Audit Manager in one of these cities can expect to earn well above the national average:

- San Jose, CA: ~25% above the national average

- San Francisco, CA: ~24% above the national average

- New York, NY: ~18% above the national average

- Boston, MA: ~10% above the national average

- Washington, D.C.: ~9% above the national average

Mid-Tier and Lower-Paying Regions:

While salaries in other major cities like Chicago, Dallas, and Atlanta are still very competitive, they tend to be closer to the national average. Salaries in smaller cities and rural areas will be lower, but this is often offset by a significantly lower cost of living, meaning your purchasing power may be similar or even greater.

The Impact of Remote Work:

The rise of remote work has introduced a new dynamic. While some companies are adopting national pay scales, many are still implementing location-based pay, adjusting salaries based on the employee's home address. This is a critical point of negotiation for remote-only roles.

### ### 4. Company Type, Size, and Industry

The type and size of your employer are massive determinants of salary.

- Publicly-Traded, Large Corporations (Fortune 500): These companies typically pay the most. They are subject to complex regulations like the Sarbanes-Oxley Act (SOX), which necessitates a large, highly skilled, and well-compensated internal audit department. The risks are higher, the scope is global, and the budgets are larger.

- Professional Services Firms (e.g., "The Big Four"): Firms like Deloitte, PwC, EY, and KPMG have large Internal Audit & Enterprise Risk practices. They "rent out" auditors to companies that co-source or outsource their audit function. While starting salaries here are very competitive, the work-life balance can be more demanding due to client travel and tight deadlines. It is, however, an exceptional training ground.

- Private Companies: Large private companies also have robust audit functions and pay competitively, though perhaps slightly less than their public counterparts. Their audits may focus more on operational efficiency and preparation for a potential IPO.

- Government and Non-Profit: These sectors generally offer lower base salaries than the private sector. However, they often compensate with superior benefits, including pensions, excellent job security, and a much better work-life balance.

Industry also plays a key role. Highly regulated and complex industries typically pay more for audit talent:

- Financial Services (Banking, Insurance, Investments): Top-tier pay due to complex financial instruments and a heavy regulatory burden.

- Technology & Software: High demand for IT auditors with cybersecurity skills drives salaries up.

- Energy and Utilities: Complex operational and regulatory environments command high pay.

- Healthcare and Pharmaceuticals: Strict regulations (like HIPAA) and complex operations require specialized audit talent.

### ### 5. Area of Specialization

Within internal audit, specialization is a direct path to higher earnings. By developing deep expertise in a high-demand niche, you become a more valuable and less replaceable asset.

- IT Audit: This is arguably the most lucrative specialization today. Every company is a tech company, and the risks associated with cybersecurity, data privacy, and IT infrastructure are top-of-mind for every board. An IT Auditor with a CISA certification can command a 10-20% salary premium over a generalist auditor at the same level.

- Operational Audit: This specialty focuses on evaluating the efficiency and effectiveness of business processes—from supply chain and manufacturing to marketing and sales. It requires a deep understanding of business operations and is highly valued for its ability to identify cost savings and process improvements.

- Forensic Audit / Fraud: These specialists are brought in to investigate allegations of fraud, corruption, and financial misconduct. It's a high-stakes field requiring a unique skill set, and those with a CFE certification are well-compensated for their expertise.

- ESG (Environmental, Social, Governance) Audit: This is the newest and fastest-growing specialization. As investors and regulators demand more transparency around a company's sustainability and social impact, auditors who can provide assurance over ESG reporting are becoming invaluable.

### ### 6. In-Demand Skills

Beyond certifications and experience, a specific set of modern skills can directly impact your salary and career velocity.

High-Value Hard Skills:

- Data Analytics and Visualization: Proficiency in tools like SQL, Python, R, Tableau, or Power BI is no longer a "nice-to-have"; it's becoming a core competency. Auditors who can independently query large datasets and visualize their findings are more efficient and can uncover insights that manual testing would miss.

- Robotic Process Automation (RPA): Understanding how to use or audit RPA tools (like UiPath or Automation Anywhere) to automate repetitive audit tasks is a highly sought-after skill.

- Cybersecurity Knowledge: Even for non-IT auditors, a strong understanding of cybersecurity risks and frameworks (like NIST) is crucial and valued.

- Sarbanes-Oxley (SOX) Expertise: Deep knowledge of SOX 404 and 302 requirements remains a cornerstone for auditors in public companies and is compensated accordingly.

Critical Soft Skills:

- Communication and Influence: Your value is not in what you find, but in your ability to communicate it in a way that drives action. The ability to write clear, concise reports and present findings persuasively to senior executives is paramount.

- Critical Thinking and Professional Skepticism: The ability to "trust but verify," ask probing questions, and connect disparate pieces of information to see the bigger picture is the essence of a great auditor.

- Stakeholder Management: Building strong, collaborative relationships with management and the business units you audit is essential for success. Auditors are no longer seen as internal police but as collaborative partners.

Job Outlook and Career Growth for CIAs

For those considering this career path, the future is exceptionally bright. The demand for skilled and certified internal auditors is robust and projected to grow, driven by an increasingly complex business and regulatory landscape.

The U.S. Bureau of Labor Statistics (BLS), in its Occupational Outlook Handbook, projects that employment for "Accountants and Auditors" will grow by 6 percent from 2022 to 2032, which is faster than the average for all occupations. This translates to about 126,500 openings for accountants and auditors each year, on average, over the decade. Much of this demand stems from the need to replace workers who transfer to different occupations or exit the labor force.

However, the outlook for *certified* internal auditors is even stronger than this general data suggests. Several macro-trends are fueling a specific and growing demand for the strategic skills of CIAs:

Emerging Trends Shaping the Profession:

1. Heightened Focus on Risk Management: In a world of geopolitical instability, supply chain disruptions, and economic uncertainty, boards of directors are demanding more sophisticated and forward-looking risk assurance. CIAs are uniquely positioned to provide this, moving beyond traditional financial audits to assess strategic and emerging risks.

2. The Explosion of Data: Companies are collecting more data than ever before. This creates both opportunities and risks. Internal auditors who are proficient in data analytics can provide more comprehensive assurance over larger populations of data, identify fraud and inefficiencies more effectively, and become true data-driven advisors.

3. Cybersecurity as a Top-Tier Risk: High-profile data breaches and the rise of ransomware have made cybersecurity a permanent fixture on the audit committee's agenda. This has created an unprecedented demand for IT auditors and CIAs with a deep understanding of cyber risks and controls, driving up salaries for this specialty.

4. The Rise of ESG (Environmental, Social, and Governance): Stakeholders—from investors to customers—are demanding greater transparency and accountability on ESG matters. As companies begin to make public commitments and report on ESG metrics, internal audit will be called upon to provide assurance over the accuracy and reliability of this information. This is a massive new growth area for the profession.

5. Increasingly Complex Regulations: From data privacy laws like GDPR and CCPA to ever-evolving financial regulations, the compliance landscape is constantly changing. Organizations rely on their internal audit function to help them navigate this complexity and ensure they are meeting their obligations.

How to Stay Relevant and Advance Your Career:

To thrive in this evolving landscape and maximize your career growth, you must embrace a mindset of continuous learning.

- Never Stop Learning: Go beyond the minimum continuing professional education (CPE) requirements. Actively seek out training in high-demand areas like data analytics, cybersecurity, or ESG.

- Embrace Technology: Don't be intimidated by new technologies. Learn the basics of data visualization tools, explore how RPA works, and understand the fundamentals of cloud security.

- **Develop