As a professional in California's dynamic and competitive job market, understanding your compensation structure is just as critical as the work you do. One of the most important figures to know is the "exempt salary threshold." This number isn't just a legal detail; it's a benchmark that defines a baseline for professional salaried roles and determines your eligibility for overtime pay.

For 2024, the minimum salary for an exempt employee in California is $66,560 per year. While the 2025 figure is projected to increase, understanding this threshold is the first step in ensuring you are compensated fairly and can strategically navigate your career path toward higher earnings. This guide will break down what it means to be a salary-exempt employee in California, the specific salary requirements for 2025, and how you can position yourself to earn well above this baseline.

What Does it Mean to be "Salary Exempt" in California?

In the context of California labor law, employees are classified as either "non-exempt" or "exempt." This classification determines whether an employer is required to pay you overtime.

- Non-Exempt Employees: These employees are typically paid hourly and must be paid overtime (1.5 times their regular rate) for any work over 8 hours in a day or 40 hours in a week. They are protected by minimum wage laws for every hour worked.

- Exempt Employees: These employees are paid a flat salary regardless of the hours worked in a week. To qualify as exempt, an employee must meet both a "salary basis test" and a "duties test."

The duties test requires that an employee's primary responsibilities are executive, administrative, or professional in nature. This means they regularly exercise discretion and independent judgment in performing their job.

The salary basis test is the focus of this article. It requires that an employee earn a minimum annual salary. If you don't meet *both* the salary and duties tests, you are considered non-exempt and are eligible for overtime pay, even if you are paid a "salary."

The 2025 California Minimum Salary Threshold for Exempt Employees

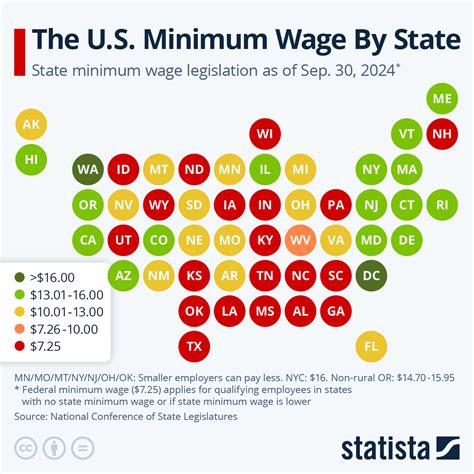

California law sets a clear formula for the minimum salary an exempt employee must earn: it must be at least two times the state's minimum wage for full-time employment. Full-time employment is defined as 40 hours per week for 52 weeks a year (2,080 hours).

Formula: (State Minimum Wage x 2) x 2,080 hours = Annual Minimum Exempt Salary

### 2024 Threshold (The Current Benchmark)

As of January 1, 2024, the California state minimum wage is $16.00 per hour.

- Calculation: ($16.00/hour x 2) x 2,080 = $66,560 per year (or $5,546.67 per month).

### Projecting the 2025 Threshold

The minimum wage for 2025 will be announced by the Director of the California Department of Finance by August 1, 2024. The adjustment is based on inflation as measured by the Consumer Price Index (CPI). Given recent economic trends, it is widely expected that the state minimum wage will increase for 2025, which will, in turn, raise the exempt salary threshold. Professionals should monitor announcements from the California Department of Industrial Relations (DIR) for the official 2025 figure.

Important Industry-Specific Exception: As of April 1, 2024, a new law established a $20.00 per hour minimum wage for fast-food workers at large national chains. For employees in this specific sector to be classified as exempt, their minimum salary threshold is significantly higher:

- Calculation: ($20.00/hour x 2) x 2,080 = $83,200 per year.

Key Factors That Influence Your Ability to Exceed the Exempt Salary Threshold

While the state sets the minimum floor, your actual salary is determined by a combination of factors. Focusing on these areas is key to building a career that compensates you far beyond the legal minimum.

### Level of Education

A higher level of education is one of the most reliable paths to a salary that surpasses the exempt threshold. Many roles that satisfy the "duties test" (e.g., lawyers, engineers, accountants) require a Bachelor's degree or higher. Advanced degrees (Master's, MBA, Ph.D., J.D.) can open doors to specialized, high-paying positions. For example, roles requiring an MBA often have starting salaries well into the six figures, making the exempt threshold a distant baseline.

### Years of Experience

Experience is a powerful driver of salary growth. An entry-level professional may start near or just above the exempt threshold, but with each year of demonstrated success, their earning potential increases significantly.

- Entry-Level (0-2 years): Salaries often start just above the threshold. For instance, an entry-level Staff Accountant in California might earn between $68,000 and $75,000, according to Salary.com.

- Mid-Career (5-10 years): Professionals with proven skills can command much higher salaries. A Senior Accountant with a CPA license can earn an average of $95,000 to $120,000.

- Senior/Lead (10+ years): At this level, experience in management and strategy is highly valued. A Finance Manager in California can expect to earn an average salary of over $145,000, as reported by Glassdoor.

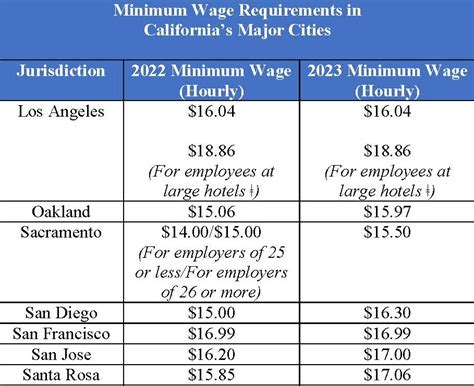

### Geographic Location

In a state as large and diverse as California, where you work matters immensely. Major metropolitan areas with a higher cost of living and a greater concentration of high-paying industries offer significantly higher salaries.

- San Francisco Bay Area / Silicon Valley: This region has the highest salaries in the state to offset the extraordinary cost of living. A Software Engineer here can expect an average base salary of over $160,000, according to data from the BLS.

- Los Angeles and San Diego: These major hubs also offer competitive salaries that are well above the state average, particularly in entertainment, biotech, and logistics.

- Sacramento and Central Valley: While salaries here are generally lower than in coastal metros, they are often still robust and can provide a higher quality of life due to a lower cost of living. However, professional salaries in these regions may be closer to the state's exempt minimum.

### Company Type

The size, industry, and financial health of your employer directly impact compensation.

- Large Tech Companies (e.g., Google, Apple): These firms are known for offering top-tier salaries, stock options, and benefits that place employees in the highest income brackets.

- Startups: While early-stage startups might offer salaries closer to the exempt threshold, they often compensate with significant equity, which can have a massive upside if the company succeeds.

- Non-Profit and Government: These sectors typically offer lower base salaries than the private sector. While many professional roles in government and non-profits will meet the exempt salary threshold, they may not exceed it by the same margin as for-profit companies.

### Area of Specialization

Specializing in a high-demand field is a direct route to higher pay. General administrative roles may pay less than highly technical or niche professional roles. According to the BLS, some of the highest-paying occupational groups in California include management, computer and mathematical, and legal professions, all of which command salaries that far exceed the state's exempt minimum. For example, an experienced Marketing Manager specializing in digital analytics will earn substantially more than a generalist.

Job Outlook for Professional Roles in California

Despite headlines about tech layoffs, the long-term job outlook for professional and management occupations in California remains strong. The U.S. Bureau of Labor Statistics projects that employment in management occupations is expected to grow faster than the average for all occupations from 2022 to 2032.

The rising exempt salary threshold itself can subtly influence the job market. Companies may re-evaluate roles near the threshold, potentially reclassifying some positions to non-exempt to control overtime costs. For job seekers, this legal standard serves as a powerful negotiating tool and a clear indicator of the minimum compensation to expect for a true salaried, professional position in the state.

Conclusion: Key Takeaways for Your Career

Understanding the California exempt salary threshold is essential for every ambitious professional. It's more than a number—it's a critical piece of information that empowers you.

Here are the key takeaways:

1. Know the Standard: The current (2024) exempt salary minimum is $66,560/year. Be prepared for this number to increase in 2025.

2. Understand Your Rights: If your salary is below this threshold, you are entitled to overtime pay, regardless of your job title or duties.

3. Aim Higher: Treat the exempt threshold as the starting line, not the finish line. A truly competitive professional salary in California should significantly exceed this minimum.

4. Invest in Your Growth: The most effective way to increase your earnings is by focusing on the key drivers: advancing your education, gaining valuable experience, specializing in a high-demand field, and strategically targeting high-paying industries and locations.

By using this knowledge, you can better advocate for yourself in salary negotiations, make informed career choices, and build a prosperous professional life in the Golden State.