The dream of homeownership is deeply woven into the fabric of personal aspiration. It represents stability, a place to build a life, and a cornerstone of financial security. For many professionals reaching the significant milestone of a six-figure income, the natural next question is: what kind of home can this salary unlock? A $100,000 annual salary feels substantial, yet in today's housing market, a $500,000 price tag can feel equally daunting. The question, "Can I afford a $500k house on a $100k salary?" isn't a simple yes or no. It's a complex equation with numerous variables, where the answer lies at the intersection of your income, your debts, your savings, and your lifestyle.

This guide is designed to be your definitive resource, moving beyond simplistic online calculators to provide an in-depth, expert analysis. We will dissect every component of home affordability, empowering you with the knowledge to not only answer this question for yourself but to build a strategic plan to achieve your homeownership goals. The difference between comfortably affording a home and becoming "house poor" lies in understanding the details. As a career and financial analyst, I’ve seen countless individuals achieve ambitious goals by replacing financial anxiety with a data-driven strategy. I recall a client who, despite a solid income, felt their goal of owning a home was perpetually out of reach until we meticulously broke down their finances, identified key leverage points, and charted a clear, actionable path forward. Within two years, they were unlocking the door to their first home, a testament to the power of informed planning.

This article will serve as that comprehensive plan for you. We will explore the fundamental rules of affordability, dissect the true cost of a $500,000 home, and analyze the critical factors—from your down payment to your credit score—that will ultimately determine your purchasing power.

### Table of Contents

- [Understanding the Core Numbers: The 28/36 Rule and Your Budget](#understanding-the-core-numbers-the-2836-rule-and-your-budget)

- [Breaking Down the $500,000 Price Tag: A Deep Dive into Total Housing Costs](#breaking-down-the-500000-price-tag-a-deep-dive-into-total-housing-costs)

- [Key Factors That Influence Your Home Affordability](#key-factors-that-influence-your-home-affordability)

- [Strategic Planning: Creating a Path to a $500k Home](#strategic-planning-creating-a-path-to-a-500k-home)

- [Your Step-by-Step Action Plan to Homeownership](#your-step-by-step-action-plan-to-homeownership)

- [Conclusion: The Final Verdict](#conclusion-the-final-verdict)

Understanding the Core Numbers: The 28/36 Rule and Your Budget

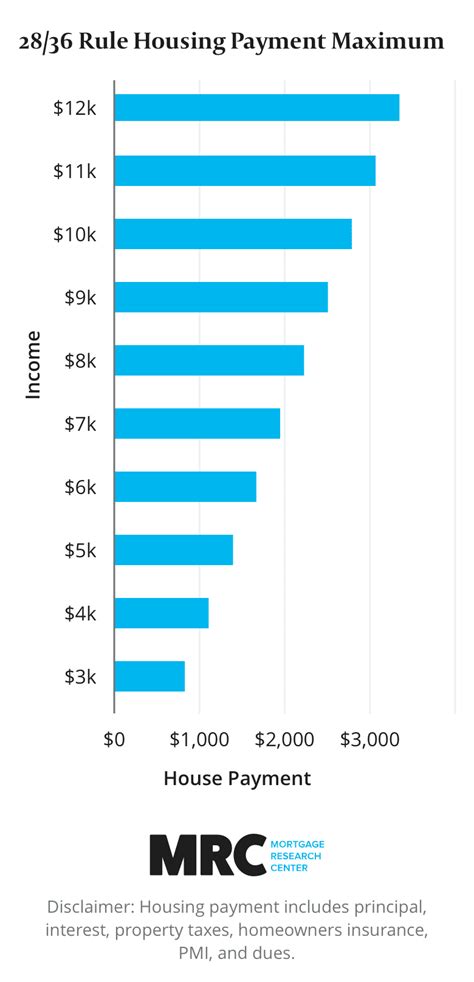

Before you can determine if a $500,000 house is within reach, you must first understand the language of lenders and the fundamental principles of personal finance. Banks and mortgage institutions don't just look at your salary; they analyze your capacity to handle debt. The most widely accepted guideline for this is the 28/36 rule. This rule is a cornerstone of mortgage underwriting and a crucial tool for your own financial assessment.

The 28/36 Rule Explained:

This rule establishes two key debt-to-income (DTI) ratios:

1. The Front-End Ratio (The "28"): This guideline stipulates that your total housing costs—which include your mortgage principal, interest, property taxes, and homeowners' insurance (collectively known as PITI)—should not exceed 28% of your *gross monthly income*.

2. The Back-End Ratio (The "36"): This guideline states that your *total monthly debt payments* should not exceed 36% of your *gross monthly income*. This includes your potential PITI plus all other recurring debts, such as car loans, student loans, credit card payments, and personal loans.

Some lenders, particularly for government-backed loans like FHA loans, may allow for higher DTI ratios, sometimes stretching into the 43% to 50% range. However, for the purpose of responsible financial planning, adhering to the 28/36 rule is a far safer benchmark. Exceeding it significantly is the fastest path to becoming "house poor," where the vast majority of your income is consumed by housing costs, leaving little room for savings, investments, emergencies, or discretionary spending.

Applying the 28/36 Rule to a $100k Salary:

Let's break down the math for a $100,000 annual salary.

- Gross Monthly Income (GMI): $100,000 / 12 months = $8,333

Now, let's apply the rule:

- Maximum Recommended Housing Cost (28%): $8,333 * 0.28 = $2,333 per month

- Maximum Recommended Total Debt (36%): $8,333 * 0.36 = $3,000 per month

This is your starting point. The absolute maximum your PITI should be is $2,333 per month. Furthermore, your PITI *plus* all other monthly debt payments should not exceed $3,000. This immediately highlights the first major hurdle: your existing debt. If you have a $500 monthly car payment and a $400 monthly student loan payment, you've already used $900 of your $3,000 back-end DTI allowance. This means your maximum housing payment would be reduced to $2,100 ($3,000 - $900) to stay within the 36% back-end ratio, even though your front-end ratio allows for $2,333.

### A "Day in the Life" of a $100k Budget with a Mortgage

To make this tangible, let's visualize a monthly budget. A $100,000 salary does not mean you have $8,333 in your pocket each month. After taxes, health insurance premiums, and 401(k) contributions, your net (take-home) pay will be significantly lower.

- Gross Monthly Income: $8,333

- Estimated Federal/State/FICA Taxes (approx. 25-30%): -$2,300

- Health Insurance Premium: -$300

- 401(k) Contribution (6%): -$500

- Net Monthly Take-Home Pay (Estimate): ~$5,233

Now, let's slot in that maximum recommended housing payment:

- Net Monthly Pay: $5,233

- Max PITI Payment (from 28% rule): -$2,333

- Remaining for All Other Expenses: $2,900

Out of that $2,900, you still need to cover:

- Utilities (Electric, Gas, Water, Internet): $300 - $500+

- Groceries: $500 - $800+

- Transportation (Gas, Maintenance, Public Transit): $200 - $400+

- Existing Debt (Student Loans, Car Payments): This is the variable that can break the budget.

- Cell Phone Bills: $100+

- Savings & Investments (beyond 401k): Essential for emergencies and future goals.

- Discretionary Spending (Dining out, entertainment, travel, hobbies).

- Home Maintenance Fund (The recommended 1% of home value per year is ~$417/month for a $500k house).

As you can see, even with the "safe" 28% rule, a $2,333 mortgage payment on a $100k salary creates a tight budget. We haven't even determined if a $500k house *fits* into that $2,333 payment yet. That's the next crucial step.

Breaking Down the $500,000 Price Tag: A Deep Dive into Total Housing Costs

The $500,000 sticker price of a home is only the beginning of the story. Your monthly mortgage payment, the number that truly matters for your budget, is determined by a host of other factors that constitute the total cost of housing. Understanding each component of PITI (Principal, Interest, Taxes, Insurance) and the additional "hidden" costs is non-negotiable.

### PITI: The Four Pillars of Your Mortgage Payment

1. Principal (P): This is the portion of your payment that goes toward paying down the actual amount you borrowed (the loan balance). In the early years of your mortgage, this is a surprisingly small part of your payment.

2. Interest (I): This is the cost of borrowing the money, paid to the lender. In the early years, the vast majority of your payment is interest. The interest rate you secure is one of the most impactful variables in your entire affordability calculation.

3. Taxes (T): Property taxes are levied by local governments (city, county, school district) to fund public services. They are unavoidable and can vary dramatically by location. They are typically paid into an escrow account managed by your lender, who then pays the tax authorities on your behalf. A national average might be around 1.1% of the home's value annually, but this can range from 0.3% in Hawaii to over 2.2% in New Jersey, according to the Tax Foundation.

4. Insurance (I): Homeowners' insurance is required by lenders to protect their investment against damage from fire, storms, and other disasters. Like property taxes, costs vary based on location (e.g., higher in hurricane or wildfire zones), the age and construction of the home, and your coverage amount.

### The Power of the Down Payment and Interest Rate

Let's run the numbers for a $500,000 house to see how these factors create a monthly payment. Our goal is to see if we can get this payment under the $2,333 monthly maximum we established with the 28% rule.

We'll consider three down payment scenarios and two interest rate environments. A 20% down payment ($100,000) is the traditional benchmark to avoid Private Mortgage Insurance (PMI). PMI is an extra insurance policy that protects the lender—not you—in case you default on the loan, and it's typically required for down payments under 20%. It can add $100-$300+ to your monthly payment.

For our calculation, we'll assume an annual property tax rate of 1.2% ($6,000/year or $500/month) and annual homeowners' insurance of $1,500 ($125/month).

Scenario A: 20% Down Payment ($100,000)

- Loan Amount: $400,000

- Taxes & Insurance (T&I): $500 + $125 = $625/month

| Interest Rate | Principal & Interest (P&I) | Total PITI | Affordable on $100k? (Under $2,333) |

| :--- | :--- | :--- | :--- |

| 5.5% | $2,271 | $2,896 | No |

| 6.5% | $2,528 | $3,153 | No |

| 7.5% | $2,797 | $3,422 | No |

The immediate takeaway is stark. Even with a substantial $100,000 down payment, at current interest rate environments (typically 6-7%+ as of late 2023/early 2024), the PITI payment for a $500,000 house *exceeds* the 28% rule's recommendation.

Let's see what happens with a smaller down payment.

Scenario B: 10% Down Payment ($50,000)

- Loan Amount: $450,000

- T&I: $625/month

- Estimated PMI (approx. 0.5% of loan/year): $2,250/year or $188/month

- Total "Extras" (T&I + PMI): $813/month

| Interest Rate | Principal & Interest (P&I) | Total PITI + PMI | Affordable on $100k? (Under $2,333) |

| :--- | :--- | :--- | :--- |

| 6.5% | $2,844 | $3,657 | No |

| 7.5% | $3,146 | $3,959 | No |

Scenario C: 3.5% Down Payment (FHA Loan Minimum) ($17,500)

- Loan Amount: $482,500

- T&I: $625/month

- FHA Mortgage Insurance Premium (MIP is for the life of the loan): approx. 0.55% of loan/year = $2,654/year or $221/month

- Total "Extras" (T&I + MIP): $846/month

| Interest Rate | Principal & Interest (P&I) | Total PITI + MIP | Affordable on $100k? (Under $2,333) |

| :--- | :--- | :--- | :--- |

| 6.5% | $3,050 | $3,896 | No |

| 7.5% | $3,374 | $4,220 | No |

Conclusion from the numbers: Based on standard financial rules and recent interest rate environments, a $500,000 house is not comfortably affordable on a $100,000 salary. The monthly payment consistently comes in hundreds, if not thousands, of dollars above the recommended 28% threshold.

### Beyond PITI: The Other Costs of Homeownership

The analysis doesn't stop with the mortgage payment. A responsible homeowner must budget for a slew of other expenses:

- Closing Costs: These are fees paid at the closing of a real estate transaction. They typically range from 2% to 5% of the purchase price. For a $500k house, that's an additional $10,000 to $25,000 in cash you need on top of your down payment.

- Maintenance and Repairs: The "1% Rule" is a popular guideline, suggesting you budget 1% of your home's value for annual maintenance. For a $500k house, that's $5,000 per year, or about $417 per month. This covers things like servicing your HVAC, cleaning gutters, and landscaping, but not major replacements like a new roof ($10,000+) or a new furnace ($5,000+).

- HOA Fees: If your home is in a community with a Homeowners Association, you'll have monthly or annual fees. These can range from $50 to over $500 per month and cover maintenance of common areas, amenities like pools or gyms, and sometimes services like trash removal. This fee is counted in your DTI ratio by lenders.

- Utilities: Utilities are often higher in a larger single-family home than in an apartment. Budget for increased costs for electricity, gas, water, sewer, and trash.

- Moving Costs: Whether you hire a professional moving company or rent a truck and do it yourself, moving costs money—easily $1,000 to $5,000 or more.

When you add these costs to the tight budget we outlined earlier, the financial picture becomes even more challenging. To make this work, several key factors would need to align perfectly in your favor.

Key Factors That Influence Your Home Affordability

The calculations above provide a sobering baseline, but they are not the final word. Your ability to afford a $500,000 home hinges on a collection of personal financial variables. By optimizing these factors, you can dramatically improve your purchasing power and potentially turn a "no" into a "yes." Think of these as the levers you can pull to change your financial equation.

###

1. Your Down Payment

The single most powerful lever you control is your down payment. It impacts your financial situation in four profound ways:

- Reduces Loan Amount: This is the most obvious benefit. A larger down payment means a smaller loan, which directly translates to a lower monthly principal and interest payment for the entire life of the loan.

- Eliminates or Reduces PMI: As demonstrated in our scenarios, crossing the 20% down payment threshold saves you from Private Mortgage Insurance. This can easily save you $150-$250 per month, which is a significant reduction in your mandatory housing cost.

- May Secure a Better Interest Rate: Lenders view a large down payment as a sign of financial stability and lower risk. Borrowers with higher equity (a larger down payment) are often rewarded with a slightly better interest rate, further reducing the monthly payment.

- Increases Immediate Equity: Starting with 20% equity gives you a substantial financial cushion. If the market dips slightly after you buy, you are less likely to be "underwater" (owing more than the home is worth).

The Strategy: To make a $500k house viable on a $100k salary, a down payment significantly *larger* than 20% is almost a necessity. Imagine if you could put down 30% or 40% ($150k - $200k). This would drastically lower the loan amount and the resulting P&I payment, potentially bringing it into the affordable range. This often requires years of aggressive saving, a windfall, or help from family (a "gifted" down payment).

###

2. Your Debt-to-Income (DTI) Ratio

Your existing debt is the anchor that can weigh down your homeownership dreams. Lenders look at your back-end DTI just as closely as your front-end DTI.

- Student Loans: According to the Education Data Initiative, the average federal student loan debt is over $37,000, with many professionals carrying balances well over $100,000. A $400 monthly payment uses up 4.8% of your $8,333 gross monthly income.

- Car Loans: The average new car payment in the U.S. is now over $700, according to Experian. A $700 payment eats up a staggering 8.4% of your gross monthly income.

- Credit Card Debt: High-interest credit card debt is a DTI killer. Lenders look at the minimum monthly payment required, but the high interest rates cripple your ability to save for a down payment.

The Strategy: Before seriously considering a home purchase, the most impactful financial move you can make is to aggressively pay down high-interest debt. Eliminating a $500 car payment frees up $500 in your back-end DTI calculation, which could be the difference between approval and denial. It also frees up $500 in your monthly budget that can be redirected to savings or your future housing payment. A borrower with a $100k salary and zero non-mortgage debt is in an infinitely stronger position than a borrower with the same salary and $1,200 in monthly debt payments.

###

3. Geographic Location

The "where" is just as important as the "how much." A $500,000 home in one city is a completely different financial proposition than the same-priced home in another.

- Property Taxes: This is a massive variable. Let's revisit our $400,000 loan at 6.5% interest ($2,528 P&I).

- Location A (High Tax): New Jersey (avg. 2.23%). Taxes on a $500k home would be ~$11,150/year or $929/month. Total PITI: $2,528 + $929 + $150 (insurance) = $3,607/month.

- Location B (Low Tax): Colorado (avg. 0.51%). Taxes on a $500k home would be ~$2,550/year or $213/month. Total PITI: $2,528 + $213 + $125 (insurance) = $2,866/month.

That's a difference of nearly $750 per month on the exact same house price and loan.

- Homeowners' Insurance: States prone to natural disasters like Florida (hurricanes), California (wildfires, earthquakes), and Texas (hail, tornadoes) have significantly higher insurance premiums. This can add another $100-$300+ to your monthly PITI compared to a lower-risk state.

- State and Local Income Taxes: The amount of take-home pay you have from your $100k salary is also location-dependent. Living in a state with no income tax (like Texas, Florida, or Washington) versus a high-income tax state (like California, New York, or Oregon) can mean a difference of several hundred dollars in your pocket each month.

The Strategy: If your job allows for remote work or relocation, "shopping" for a lower-cost-of-living area can be the key that unlocks affordability. The same $100k salary has far more purchasing power in a city like Indianapolis, Indiana, than in San Diego, California.

###

4. Your Credit Score

Your credit score is your financial report card, and it directly dictates the interest rate you'll be offered. A higher score signifies lower risk to the lender, who passes the savings on to you. The difference between a good score and an excellent score can save you tens of thousands of dollars over the life of the loan.

According to FICO, a borrower with a 760-850 score might get an interest rate of 6.3%, while a borrower with a 660-679 score might be offered 7.0%. Let's see how this impacts a $400,000 loan:

- Excellent Credit (760+ score) @ 6.3%: Monthly P&I = $2,476

- Good Credit (660-679 score) @ 7.0%: Monthly P&I = $2,661

That's a difference of $185 per month, or $2,220 per year, or $66,600 over a 30-year loan.

The Strategy: Well before you apply for a mortgage, obtain your credit report and score. Work diligently to improve it by:

- Paying every bill on time.

- Keeping your credit utilization low (ideally below 30% on each card).

- Not closing old credit accounts (this shortens your credit history).

- Disputing any errors on your report.

###

5. Loan Type and Interest Rates

The mortgage product you choose and the prevailing interest rate environment are crucial.

- Loan Types:

- Conventional Loan: The most common type, not insured by the government. Often requires a higher credit score and a down payment of at least 3-5%.

- FHA Loan: Insured by the Federal Housing Administration. Allows for lower credit scores and down payments as low as 3.5%, but requires MIP for the life of the loan if you put down less than 10%.

- VA Loan: For eligible veterans and service members. Offers the incredible benefit of 0% down payment and no PMI. This can be a game-changer.

- Adjustable-Rate Mortgage (ARM): Offers a lower "teaser" interest rate for an initial period (e.g., 5 or 7 years), after which the rate adjusts based on the market. This can be a strategic tool if you plan to sell or refinance before the adjustment period ends, but it carries risk.

- Interest Rates: Rates are cyclical. Buying a home when rates are at 3.5% is a world apart from when they are at 7.5%. While you can't control the Federal Reserve, you can position yourself to act when rates are favorable or consider options like an ARM to get a lower initial payment.

The Strategy: Speak with multiple mortgage brokers to understand all your options. A VA loan recipient or someone using an ARM for a strategic short-term hold is in a very different position than someone seeking a standard 30-year fixed conventional loan.

###

6. Your Lifestyle and Financial Habits

This final factor is entirely personal. A $100k salary can support wildly different lifestyles. If you are single, a natural saver, enjoy low-cost hobbies, and have no other significant financial obligations, dedicating a larger portion of your income to housing might feel comfortable. Conversely, if you have a family to support, value international travel, enjoy frequent fine dining, and have expensive hobbies, a high mortgage payment will feel extremely restrictive and stressful. Be honest with yourself about what you value and how much "breathing room" you need in your budget to live a happy life, not just a house-poor one.

Strategic Planning: Creating a Path to a $500k Home

Given that a $500,000 house is a significant stretch on a $100,000 salary under typical conditions, achieving this goal requires a deliberate, long-term strategic plan. It's not about whether you can get a lender to approve the loan—it's about building a financial foundation that allows you to afford the home comfortably and sustainably.

### The Long-Term Financial Play

Homeownership is a marathon, not a sprint. Your strategy