The idea of a salaried position often brings to mind a fixed paycheck, regardless of whether you work 35 hours or 55 hours in a given week. This leads to one of the most common and critical questions in the professional world: Can salaried employees receive overtime pay? The answer is a resounding "it depends," and understanding the nuances can significantly impact your earnings and work-life balance.

This guide will demystify the rules, explain the key classifications, and empower you to understand your rights to overtime compensation.

The Core Distinction: Exempt vs. Non-Exempt Employees

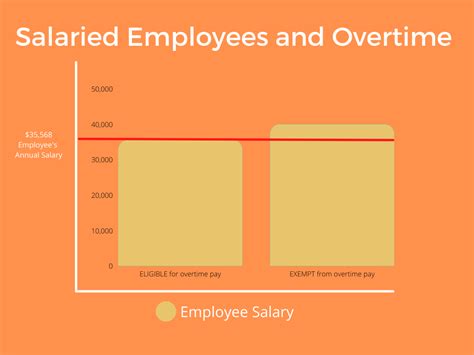

The eligibility for overtime pay doesn't hinge on whether you receive a salary. Instead, it is determined by the Fair Labor Standards Act (FLSA), a federal law that establishes minimum wage, overtime pay, recordkeeping, and youth employment standards. The FLSA classifies all employees as either non-exempt or exempt.

- Non-Exempt Employees: These employees are covered by the FLSA and are entitled to overtime pay. Overtime is calculated at a rate of at least 1.5 times their regular rate of pay for all hours worked over 40 in a workweek. Both hourly and salaried employees can be classified as non-exempt.

- Exempt Employees: These employees are not covered by the FLSA's overtime rules and are therefore not legally entitled to overtime pay. To be classified as exempt, an employee must meet specific criteria related to both their salary amount and their job duties.

The Two-Part Test for Exemption

For an employer to legally classify a salaried employee as "exempt" from overtime, the employee must pass both a Salary Basis Test and a Duties Test.

### 1. The Salary Basis Test: A Minimum Earnings Threshold

This is a straightforward financial test. To be considered exempt, an employee must be paid a predetermined, fixed salary that is not subject to reduction because of variations in the quality or quantity of work performed.

Critically, this salary must meet a minimum threshold set by the U.S. Department of Labor (DOL).

- The Federal Salary Threshold: According to the DOL's final rule issued in 2024, the minimum salary threshold for exemption is increasing.

- Effective July 1, 2024, the threshold rises to the equivalent of an annual salary of $43,888 ($844 per week).

- Effective January 1, 2025, the threshold rises again to $58,656 ($1,128 per week).

Source: U.S. Department of Labor, "Final Rule: Restoring and Extending Overtime Protections."

If you are a salaried employee earning less than these amounts, you are automatically considered non-exempt and are eligible for overtime, regardless of your job title or duties.

Important Note on State Laws: Many states have their own, more generous laws. For example, California and New York have significantly higher salary thresholds for exempt status than the federal level. Always check your specific state's labor laws.

### 2. The Duties Test: What Kind of Work Do You Do?

If you pass the salary basis test, your specific job responsibilities must then fall into one of the FLSA's defined exemption categories. A job title alone is not enough to determine exempt status; the day-to-day reality of your work is what matters.

Here are the primary exemption categories:

Executive Exemption

To qualify, an employee’s primary duty must be managing the enterprise or a recognized department. They must also customarily and regularly direct the work of at least two or more other full-time employees and have the authority to hire or fire other employees (or their suggestions on these matters must be given particular weight).

Administrative Exemption

The employee’s primary duty must be the performance of office or non-manual work directly related to the management or general business operations of the employer or its customers. This role must also include the exercise of discretion and independent judgment with respect to matters of significance. This is one of the most commonly misapplied exemptions.

Professional Exemption

This category is split into two types:

- Learned Professional: The primary duty is work requiring advanced knowledge in a field of science or learning, customarily acquired by a prolonged course of specialized intellectual instruction (e.g., lawyers, doctors, accountants, engineers). For example, a Senior Accountant, with a median salary around $78,000 according to Salary.com, would typically fall under this exemption if they meet the duties test.

- Creative Professional: The primary duty is work requiring invention, imagination, originality, or talent in a recognized field of artistic or creative endeavor (e.g., musicians, writers, actors).

Computer Employee Exemption

To qualify, an employee must be a skilled worker in the computer field. Their primary duties must consist of roles like systems analysis, computer programming, software engineering, or other similarly skilled work. The average Software Engineer in the U.S. earns approximately $129,637 per year, according to Glassdoor (data from 2024), and is a prime example of a role that often meets this exemption.

Outside Sales Exemption

The employee’s primary duty must be making sales or obtaining orders/contracts for services, and they must be customarily and regularly engaged *away from* the employer’s place of business. There is no salary threshold for this specific exemption.

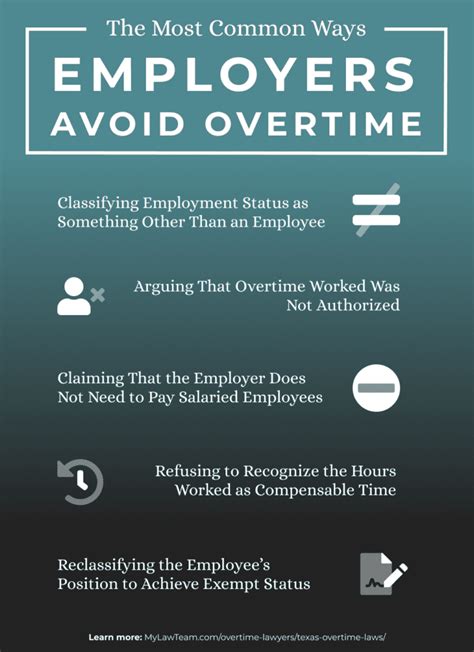

Misclassification: A Common and Costly Mistake

A frequent issue is employee misclassification, where a company incorrectly labels a non-exempt employee as exempt to avoid paying overtime. If an employee is salaried and meets the salary threshold but does *not* perform the high-level duties described above, they may be misclassified.

Example: A salaried retail "assistant manager" who earns $50,000 per year but spends 90% of their time stocking shelves, running the cash register, and cleaning—the same duties as hourly employees—is likely misclassified. Their primary duty is not management, and they should be classified as non-exempt and paid for their overtime hours.

What to Do If You Believe You're Owed Overtime

If you are a salaried employee who regularly works over 40 hours a week and you believe you might be misclassified as exempt, you have several options:

1. Review the FLSA Duties Tests: Carefully compare your actual, day-to-day responsibilities against the official criteria.

2. Document Everything: Keep a detailed, private log of all the hours you work each day.

3. Speak with Your HR Department: Professionally inquire about how your position was classified and present your understanding of the rules.

4. Contact a Labor Agency: If you are not satisfied with your employer's response, you can file a complaint with the U.S. Department of Labor's Wage and Hour Division (WHD) or your state's equivalent labor agency. They can investigate on your behalf.

Conclusion: Know Your Rights and Your Classification

Being a salaried employee does not automatically disqualify you from earning overtime pay. The law is clear: eligibility is determined by your salary level and, most importantly, the specific nature of your job duties.

Key Takeaways:

- Exempt vs. Non-Exempt is Key: This classification, not your pay structure (salaried vs. hourly), determines overtime eligibility.

- Mind the Thresholds: If your salary is below the federal (or stricter state) threshold, you are entitled to overtime. Remember the new federal levels: $43,888 as of July 1, 2024, and $58,656 as of January 1, 2025.

- Duties Matter More Than Titles: Your actual responsibilities must align with the FLSA’s executive, administrative, professional, or other specific exemption categories.

By understanding these fundamental rules, you can ensure you are being compensated fairly for all of your hard work and make more informed decisions throughout your career.