Introduction

Have you ever looked at a global giant like McDonald's and wondered about the person at the very top—the one steering a ship with thousands of locations, millions of employees, and a brand recognized in virtually every corner of the world? It's a role of immense pressure, staggering responsibility, and, as you might expect, extraordinary compensation. In 2023, the total compensation for McDonald's CEO Chris Kempczinski soared to over $19.2 million. This figure isn't just a salary; it's a testament to the immense value, strategic vision, and relentless leadership required to command one of the planet's most iconic companies.

But that multi-million dollar number is the destination, the peak of a monumental career climb. For aspiring leaders, entrepreneurs, and ambitious professionals, the real story isn't just the final paycheck—it's the journey. It's about understanding the skills, the experience, the strategic moves, and the sheer grit required to even be considered for such a position. The path to the C-suite is a marathon, not a sprint, paved with challenges that forge exceptional leaders.

Early in my career as a business analyst, I had the opportunity to sit in on a quarterly review led by the COO of a major logistics firm. I remember being struck not by his authority, but by the weight of the data he was processing in real-time—from fuel costs in Southeast Asia to union negotiations in North America. I realized then that his substantial compensation wasn't for showing up; it was for his capacity to synthesize immense complexity into a clear, decisive path forward. That moment solidified my fascination with executive leadership and the intricate relationship between responsibility and reward.

This guide is designed to be your comprehensive map for that journey. We will deconstruct the role of a top executive, using the McDonald's CEO salary as our North Star. We will dive deep into compensation structures, explore the critical factors that dictate earning potential, and lay out a strategic, step-by-step plan for anyone who aspires to reach the highest echelons of corporate leadership.

### Table of Contents

- [What Does a Chief Executive Officer (CEO) Do?](#what-does-a-ceo-do)

- [Average CEO Salary: A Deep Dive](#average-ceo-salary)

- [Key Factors That Influence a CEO's Salary](#key-factors)

- [Job Outlook and Career Growth for Top Executives](#job-outlook)

- [How to Get Started on the Path to CEO](#how-to-get-started)

- [Conclusion: Is the Journey to the C-Suite Right for You?](#conclusion)

---

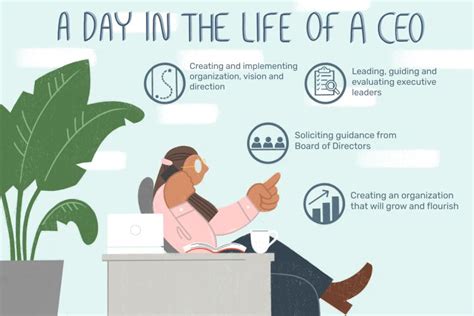

What Does a Chief Executive Officer (CEO) Do?

Beyond the glamorous image often portrayed in media, the role of a Chief Executive Officer is one of the most demanding and multifaceted in the business world. The CEO is the highest-ranking executive in a company, and their primary responsibility is to maximize the organization's value for its stakeholders—shareholders, employees, customers, and the public. They don't just "run the company"; they embody its vision, drive its strategy, and are ultimately accountable for its every success and failure.

The core responsibilities of a CEO can be broken down into four key pillars:

1. Strategic Vision and Direction: The CEO is the chief strategist. They work with the board of directors and the executive team to define the company's long-term vision, mission, and overarching goals. This involves analyzing market trends, competitive landscapes, technological shifts, and geopolitical factors to decide where the company should go and how it will win. For a company like McDonald's, this means making decisions about everything from plant-based menu items and digital ordering platforms to global expansion and sustainability initiatives.

2. Capital Allocation and Financial Oversight: A CEO is the ultimate arbiter of how the company's resources—its capital, people, and time—are allocated. They have the final say on major investments, budgets, acquisitions, and divestitures. They work closely with the Chief Financial Officer (CFO) to ensure the company maintains financial health, meets its profitability targets, and delivers returns to shareholders. This requires a deep understanding of financial statements, capital markets, and risk management.

3. Leadership and Organizational Culture: The CEO sets the tone from the top. Their leadership style, values, and behaviors permeate the entire organization, shaping its culture. They are responsible for recruiting, retaining, and developing a high-performing senior leadership team. A great CEO fosters a culture of innovation, accountability, and collaboration, ensuring that thousands of employees are aligned and motivated to execute the company's strategy.

4. Stakeholder Management and Public Representation: The CEO is the public face of the company. They are the primary point of contact for the board of directors, investors, major clients, regulators, and the media. They must be able to communicate the company's story compellingly and build trust with all key stakeholders. This requires exceptional communication, negotiation, and public relations skills.

### A "Day in the Life" of a CEO

To make this tangible, let's imagine a typical day for the CEO of a large, publicly-traded company like McDonald's.

- 6:00 AM - 7:30 AM: The day begins before sunrise, reviewing overnight market performance, key industry news from global markets, and a digest of internal performance metrics (e.g., same-store sales, supply chain alerts).

- 8:00 AM - 9:30 AM: Weekly Executive Leadership Team Meeting. The CEO, CFO, COO, CMO, and other C-suite leaders review progress against quarterly goals, tackle major operational challenges, and make key strategic decisions. The agenda could range from a marketing campaign review to a major technology investment.

- 10:00 AM - 11:30 AM: Investor Relations Call. The CEO and CFO meet with major institutional investors to discuss the company's performance, answer tough questions about strategy, and reinforce confidence in the company's future.

- 12:00 PM - 1:30 PM: Working Lunch with a Key Government Official or Industry Partner. This is about building relationships and navigating the complex regulatory or partnership landscape.

- 2:00 PM - 4:00 PM: Deep-Dive Strategy Session. The CEO might meet with the product innovation team to review the pipeline for the next 18 months or with the digital team to assess the performance of a new app. This is where the CEO gets into the weeds on a critical growth area.

- 4:30 PM - 5:30 PM: Board of Directors Committee Call. The CEO prepares with or presents to a committee of the board (e.g., the Compensation Committee or the Governance Committee) ahead of the next formal board meeting.

- 6:30 PM onwards: Business Dinner or Charity Event. The role often extends into the evening, with networking events that are critical for building the company's brand and influence. Interspersed throughout the day are countless emails, urgent calls, and brief check-ins with direct reports.

This schedule highlights the relentless pace and the constant need to switch between high-level strategy, detailed operations, and external diplomacy.

---

Average CEO Salary: A Deep Dive

The compensation for a CEO is far more complex than a simple annual salary. It's a carefully constructed package designed to reward performance, align the executive's interests with those of shareholders, and retain top talent in a highly competitive market.

Let's first address the specific query: the CEO of McDonald's salary. According to the company's 2024 proxy statement filed with the U.S. Securities and Exchange Commission (SEC), the total compensation for CEO Chris Kempczinski for the fiscal year 2023 was $19,206,944. This number is not a simple paycheck; it's broken down as follows:

- Base Salary: $1,595,833

- Stock Awards: $11,003,710

- Option Awards: $3,665,998

- Non-Equity Incentive Plan Compensation (Cash Bonus): $2,692,800

- All Other Compensation (Perks, 401k match, etc.): $248,603

As you can see, over 85% of his compensation is "at-risk," meaning it's tied directly to the company's performance through stock value and performance-based bonuses. This is typical for CEOs of large, publicly-traded companies.

### Broader CEO Compensation Landscape

While the McDonald's figure represents the pinnacle, what does compensation look like for CEOs across the United States? The figures vary dramatically based on company size, industry, and performance.

According to the U.S. Bureau of Labor Statistics (BLS), the median annual wage for "Top Executives" was $194,920 in May 2023. However, this figure is heavily skewed by the inclusion of executives at smaller and mid-sized companies. The BLS notes that wages in the top 10 percent exceeded $239,200, but it does not fully capture the multi-million dollar equity packages common at large corporations.

For a more granular view, we turn to specialized salary aggregators that factor in total compensation (salary, bonus, equity).

- Salary.com reports that the median total compensation for a Chief Executive Officer in the United States, as of late 2024, is approximately $833,900. The typical range falls between $628,800 and $1,085,000.

- Payscale provides a similar range, with the average base salary for a CEO being around $175,000, but total pay—including bonuses and profit sharing—can extend well over $500,000 even before considering significant equity grants.

- Glassdoor data shows an average total pay for a CEO in the U.S. at around $250,000, again reflecting a blend of small, medium, and large companies in its user-submitted data.

The key takeaway is that the "average" is misleading. The journey to the C-suite involves a significant progression in compensation at each stage.

### CEO Compensation by Experience and Company Size

To provide a more realistic picture, it's helpful to break down compensation by the executive's career stage and the size of the company they lead.

| Company Size / Career Stage | Typical Base Salary Range | Typical Total Compensation Range (incl. Bonus/Equity) | Notes |

| --------------------------------- | ----------------------------- | ----------------------------------------------------- | ---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------- |

| Director/VP (Pre-CEO) | $150,000 - $250,000 | $200,000 - $500,000+ | This is the training ground for future CEOs. Compensation includes a solid base, annual bonus, and often a smaller grant of restricted stock units (RSUs). |

| CEO, Small Business / Startup | $100,000 - $220,000 | $150,000 - $400,000 + significant equity | Cash compensation is often lower to preserve capital. The real prize is a large equity stake (e.g., 2-10%) that could be worth millions upon a successful exit (IPO or acquisition). |

| CEO, Mid-Sized Company | $250,000 - $500,000 | $500,000 - $2,000,000+ | Compensation becomes more structured. Includes a larger base salary, performance-based cash bonuses, and a mix of profit sharing and long-term incentive plans (LTI). |

| CEO, Large Public Company | $750,000 - $2,000,000 | $5,000,000 - $25,000,000+ | This is the McDonald's tier. Base salary is a smaller portion of the total package. The majority comes from massive annual stock and option grants tied to performance metrics like Total Shareholder Return (TSR). |

*(Data compiled and synthesized from reports by Salary.com, Payscale, and analysis of public company proxy statements.)*

### Deconstructing the Compensation Package

Understanding the components is crucial:

- Base Salary: The fixed, guaranteed portion of cash compensation. It reflects the core responsibilities of the role, the executive's experience, and market rates.

- Short-Term Incentives (STI): Typically an annual cash bonus. It's tied to achieving specific, pre-defined goals for the year, such as revenue growth, profit margins, or operational efficiency targets.

- Long-Term Incentives (LTI): This is the wealth-creation engine for top executives. It's designed to align their interests with long-term shareholder value.

- Stock Options: The right to buy company stock at a predetermined price in the future. They become valuable only if the stock price increases.

- Restricted Stock Units (RSUs): A grant of company shares that vest (become fully owned by the executive) over a period of time, typically 3-4 years.

- Performance Shares: A type of RSU where the number of shares that ultimately vest depends on the company achieving specific long-term performance goals (e.g., outpacing a stock market index).

- Perquisites ("Perks"): These include non-cash benefits like a car allowance, personal use of the corporate jet, financial planning services, enhanced security, and premier health insurance plans.

---

Key Factors That Influence a CEO's Salary

The vast range in CEO compensation isn't arbitrary. It's driven by a complex interplay of factors. Aspiring executives who understand these levers can strategically position themselves for higher earning potential throughout their careers. This is the most critical section for anyone mapping their journey to the top.

###

1. Level of Education: The Foundation and the Network

While there's no single mandatory degree to become a CEO, education plays a foundational role in both skill development and network building.

- The MBA Advantage: The Master of Business Administration (MBA) remains the most common and influential advanced degree for C-suite executives. An MBA from a top-tier business school (e.g., Harvard, Stanford, Wharton, Booth) provides three distinct advantages:

1. Core Business Acumen: Rigorous training in finance, marketing, operations, and strategy.

2. Prestigious Signaling: The degree acts as a powerful signal to boards and recruiters, signifying a certain level of intellect and commitment.

3. The Elite Network: Perhaps most importantly, it provides access to a powerful global network of alumni who become future colleagues, investors, and partners.

- Salary Impact: Executives with an MBA from a top 20 program often command a significant salary premium. While difficult to quantify at the CEO level (where performance matters more), it dramatically accelerates the early and mid-career salary trajectory needed to reach the C-suite.

- Other Relevant Degrees: Other educational paths are also common. A Juris Doctor (JD) is frequent for CEOs who rise through the legal or regulatory ranks. Degrees in Finance, Engineering, or Computer Science are increasingly valuable for CEOs of financial or technology-driven companies.

- Continuous Learning: The diploma is just the start. The best leaders are perpetual learners. Participating in executive education programs at top universities (e.g., Harvard's Advanced Management Program) throughout one's career is crucial for staying current and signals a commitment to growth.

###

2. Years of Experience: The Path of Proven Performance

Experience is arguably the single most important factor. No one becomes the CEO of a major corporation without a long and proven track record of leadership and results. The salary growth trajectory is a staircase, with each step representing a higher level of responsibility and impact.

- Entry-Level to Manager (0-7 years): This is the foundation-building phase. As an analyst or specialist, you prove your competence. As a manager, you learn to lead people and projects. Compensation grows steadily but is primarily base salary and a small annual bonus. (Typical Total Comp: $70k - $150k)

- Director (7-15 years): At this level, you begin to manage managers and oversee a significant function or department. You are responsible for a budget and key performance indicators (KPIs). Long-term incentives (RSUs) may be introduced into your compensation package. (Typical Total Comp: $180k - $300k+)

- Vice President (15-20+ years): As a VP, you are a senior leader, often responsible for an entire business line or a critical corporate function (e.g., VP of Sales, VP of Engineering). You are part of the senior leadership team and are deeply involved in strategy. Your compensation package becomes heavily weighted toward performance-based bonuses and equity. This is a critical stepping stone to the C-suite. (Typical Total Comp: $300k - $700k+)

- C-Suite (20+ years): This is the executive level (CFO, COO, CMO, etc.). You have a proven ability to operate at the highest level of the organization.

- CEO: The final step is reserved for those who have demonstrated exceptional strategic vision, leadership, and the ability to deliver consistent results across multiple business cycles. The compensation reflects this immense responsibility and the scarcity of individuals who possess this full skillset.

A critical milestone on this path is gaining P&L (Profit & Loss) responsibility. This means running a business unit where you are directly responsible for both revenue and costs. It's the ultimate test of business leadership and a near-universal prerequisite for becoming a CEO.

###

3. Geographic Location: Where You Work Matters

Executive compensation varies significantly by geographic location, driven by the cost of living, the concentration of corporate headquarters, and the competition for talent.

Major metropolitan hubs with a high concentration of Fortune 500 headquarters and a thriving tech or finance scene consistently offer the highest executive salaries.

Top-Paying Metropolitan Areas for Executives:

- New York, NY: The epicenter of finance and media, offering top-tier compensation packages.

- San Jose & San Francisco, CA: The heart of Silicon Valley, where lucrative equity grants in tech companies can lead to astronomical total compensation.

- Boston, MA: A hub for biotech, finance, and technology.

- Los Angeles, CA: A center for entertainment, media, and a diverse range of industries.

- Chicago, IL: A major hub for a wide variety of industries, including the headquarters of McDonald's.

According to data from the BLS, states like New York, California, New Jersey, and Massachusetts consistently rank among the highest for executive pay. Conversely, salaries for similar roles in smaller cities or states with a lower cost of living in the South or Midwest will generally be lower in terms of cash compensation, though purchasing power may be comparable. An executive role in Omaha, Nebraska, will almost certainly have a lower base salary than the equivalent role in San Francisco, but the cost of living difference can be immense.

###

4. Company Type, Size, and Industry: The Context of Compensation

The context of the company is a massive driver of pay.

- Fortune 500 / Large Public Corporations (e.g., McDonald's, Coca-Cola): These offer the highest potential for total compensation. Their boards have access to extensive market data and compensation consultants to structure competitive packages to attract the best global talent. The emphasis is heavily on long-term incentives tied to stock performance.

- Venture-Backed Startups: The compensation model here is a trade-off. The CEO (often a founder) will typically take a well-below-market cash salary to preserve capital for growth. The real reward is a substantial equity stake (often 5-15%). If the company achieves a massive exit (IPO or acquisition), this equity can be worth tens or even hundreds of millions of dollars. It's a high-risk, high-reward path.

- Private/Family-Owned Companies: Compensation is often less transparent and more variable. It can be very generous but may rely more on profit-sharing and cash bonuses rather than stock-based compensation. The pressure from public shareholders is absent, but the accountability to the owners is direct and personal.

- Non-Profit Organizations: Leading a large non-profit (e.g., a major university or foundation) is still a highly demanding CEO role. However, compensation is significantly lower and is scrutinized by donors and the public. Salaries for CEOs of large non-profits can range from $300,000 to over $1 million, but lack the massive equity upside of the corporate world.

- Industry Impact: Industry plays a huge role. CEOs in industries with high-profit margins and intense competition for talent, such as Financial Services, Technology, and Healthcare/Biotechnology, typically receive the highest compensation. CEOs in more traditional industries like manufacturing or retail (with exceptions for giants like McDonald's) may see slightly lower, though still substantial, packages.

###

5. Area of Specialization: The Path You Take to the Top

CEOs come from diverse functional backgrounds, but certain paths have historically been more common and can influence both the likelihood of reaching the top and the type of company one might lead.

- The Operations Path (COO -> CEO): This is a classic route. Leaders who rise through operations have a deep, granular understanding of how the business runs. They are experts in efficiency, supply chain, and execution. This is a very common path in manufacturing, logistics, and retail companies.

- The Finance Path (CFO -> CEO): This path has become increasingly common. Leaders with a finance background are masters of capital allocation, M&A, and investor relations. They are seen as "safe hands" by boards focused on financial discipline and shareholder returns.

- The Sales/Marketing Path (CMO/CRO -> CEO): In consumer-facing or high-growth companies, a leader who deeply understands the customer and knows how to drive revenue growth can be an ideal choice. They are storytellers and brand-builders.

- The Technology Path (CTO/CPO -> CEO): In the modern economy, this is a rapidly emerging path. As every company becomes a technology company, leaders with a deep understanding of digital transformation, product development, and data are increasingly tapped for the top job.

###

6. In-Demand Skills: The Differentiators That Command a Premium

Beyond a resume, certain skills dramatically increase an executive's value and, consequently, their compensation. These are the abilities that boards are actively seeking in a 21st-century leader.

- Strategic Digital Transformation: The ability to lead a legacy company through a fundamental digital shift is perhaps the most valuable skill today. This means understanding AI, data analytics, e-commerce, and new business models.

- Financial Acumen: You don't have to be a CFO, but you must be able to speak the language of finance fluently. You need to understand capital markets, valuation, and how decisions impact the balance sheet.

- ESG Expertise (Environmental, Social, and Governance): Modern investors and consumers demand that companies operate responsibly. A CEO who can skillfully navigate ESG issues—from climate strategy to diversity & inclusion—is highly valued and can mitigate significant brand and financial risk.

- Exceptional Communication and Media Savvy: A CEO is a chief communicator. The ability to articulate a clear vision to employees, inspire confidence in investors on a quarterly call, and handle a crisis interview with poise is non-negotiable.

- Global Mindset and Cultural Intelligence: For a company like McDonald's, the ability to understand and operate effectively across diverse global markets is essential.

- Resilience and Crisis Management: The modern CEO operates in a state of "perma-crisis." The ability to lead calmly and decisively through supply chain disruptions, PR nightmares, or economic downturns is a trait that boards will pay a premium for.

---

Job Outlook and Career Growth for Top Executives

The path to becoming a CEO is, by its very nature, a highly competitive and narrow one. There is only one CEO per company, making the raw number of available positions inherently limited. However, the demand for exceptional, visionary leadership remains constant.

### Official Job Growth Projections

The U.S. Bureau of Labor Statistics (BLS) projects that employment for "Top Executives" is expected to grow by 3 percent from 2022 to 2032. This is on par with the average for all occupations.

While a 3% growth rate may seem modest, it's important to interpret this figure correctly.