Considering a career move that combines high-level financial expertise with strategic business leadership? The Certified Management Accountant (CMA) certification might be your ideal path. This globally recognized credential positions professionals not just as number-crunchers, but as vital strategic partners within an organization. But what does that mean for your bottom line?

The answer is significant. Pursuing the CMA certification is a powerful investment in your career, with the potential to dramatically increase your earning power. While salaries vary, it's common for CMAs to command compensation packages well into the six figures, often earning substantially more than their non-certified peers in similar roles. This article will break down the CMA salary landscape, exploring the key factors that determine your earning potential.

What Does a Certified Management Accountant Do?

Before diving into the numbers, it's crucial to understand why CMAs are so valuable. Unlike traditional accounting roles that often focus on historical data, taxes, and external audits, a CMA specializes in management accounting. This means they use financial data to inform internal business strategy and drive decision-making.

Key responsibilities include:

- Financial Planning & Analysis (FP&A): Creating budgets, forecasting future performance, and analyzing financial results to guide corporate strategy.

- Cost Management: Analyzing and controlling operational costs to improve profitability.

- Performance Management: Developing metrics (KPIs) to measure and improve business performance.

- Internal Controls and Risk Management: Ensuring the integrity of financial data and mitigating business risks.

- Strategic Decision Support: Providing data-driven advice to senior leadership on major initiatives like pricing, product launches, and capital investments.

In short, a CMA helps answer the "why" behind the numbers and charts a course for the company's future.

Average Certified Management Accountant (CMA) Salary

The compensation for a CMA is consistently strong, reflecting the high-demand skill set they bring to an organization. While figures fluctuate based on several factors, we can establish a reliable baseline using data from authoritative sources.

According to Salary.com (as of late 2023), the average salary for a Certified Management Accountant in the United States is approximately $128,500. However, the typical salary range is quite broad, generally falling between $116,800 and $141,900.

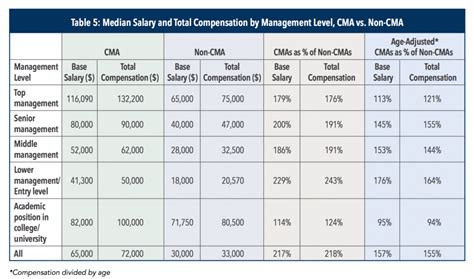

Perhaps the most compelling data comes from the Institute of Management Accountants (IMA), the body that issues the CMA certification. Their 2023 Global Salary Survey (reporting on 2022 data) provides a direct comparison:

> CMAs in the Americas earn a 35% higher median total compensation than non-CMAs. This salary advantage underscores the direct return on investment (ROI) the certification provides.

This premium demonstrates that employers explicitly recognize and financially reward the advanced skills and strategic knowledge validated by the CMA exam.

Key Factors That Influence CMA Salary

While the averages are impressive, your individual salary as a CMA will be influenced by a combination of personal and market factors. Understanding these variables can help you maximize your earning potential throughout your career.

###

Level of Education

While a bachelor's degree is a prerequisite for earning the CMA certification, pursuing an advanced degree can provide an additional salary boost. Professionals holding a Master's degree, particularly an MBA or a Master's in Accounting/Finance, often command higher starting salaries and have a faster track to senior leadership positions. An advanced degree signals a deeper level of expertise and dedication, which top-tier employers are willing to pay for.

###

Years of Experience

Experience is one of the most significant drivers of salary growth for any professional, and CMAs are no exception. Your earning potential will climb as you move from entry-level analysis to senior-level strategic oversight.

- Early Career (0-3 years): CMAs starting their careers in roles like Financial Analyst or Staff Accountant can expect salaries typically ranging from $70,000 to $90,000, according to data from Payscale and Glassdoor. This is already a strong start, often higher than non-certified peers.

- Mid-Career (4-9 years): With solid experience, CMAs move into roles like Senior Financial Analyst, Cost Accounting Manager, or Senior Accountant. In this bracket, salaries frequently climb to the $95,000 to $130,000 range.

- Senior/Executive Level (10+ years): This is where the CMA certification truly shines. Experienced CMAs are prime candidates for high-impact leadership roles such as Controller, Director of FP&A, or even Chief Financial Officer (CFO). In these positions, total compensation, including bonuses and equity, can easily exceed $150,000 to $200,000+.

###

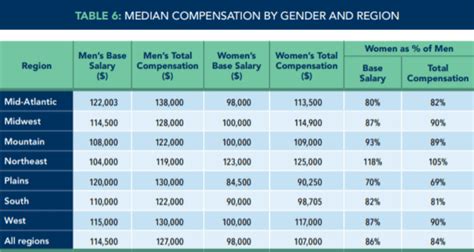

Geographic Location

Where you work matters. Salaries for CMAs vary significantly by state and metropolitan area due to differences in cost of living and demand for skilled financial professionals. Major business hubs with a high concentration of corporate headquarters typically offer the highest salaries.

According to data compiled from various salary aggregators, states with top-tier compensation for CMAs include:

- California (especially in San Francisco and Los Angeles)

- New York (New York City metro area)

- Massachusetts (Boston metro area)

- Texas (in major cities like Houston and Dallas)

- Washington D.C. and the surrounding metro area

Salaries in these regions can be 15-25% higher than the national average, while compensation in more rural states or those with a lower cost of living may be slightly below average.

###

Company Type

The size and type of your employer play a major role in your compensation. Large, publicly traded corporations (e.g., Fortune 500 companies) generally offer the highest salaries and most robust benefits packages. They have complex financial operations and a greater need for strategic management accountants.

- Publicly Traded Companies: Highest salary potential.

- Large Private Companies: Very competitive salaries, often close to public company levels.

- Small to Medium-Sized Businesses (SMBs): Salaries may be slightly lower, but can offer greater responsibility and potential for equity.

- Non-Profit/Government: Tend to offer lower base salaries but may compensate with excellent benefits and work-life balance.

Furthermore, industry matters. CMAs in high-growth, high-margin sectors like technology, pharmaceuticals, and financial services often earn more than those in manufacturing or retail.

###

Area of Specialization

Within the broad field of management accounting, certain specializations are more lucrative than others. Roles that are more forward-looking and strategic tend to be compensated more highly. The most sought-after and highest-paying roles for CMAs include:

- Director of Financial Planning & Analysis (FP&A): A top-tier role focused on forecasting, budgeting, and strategic guidance.

- Corporate Controller: Oversees all accounting operations, from financial reporting to internal controls.

- Chief Financial Officer (CFO): The highest financial position in a company, for which the CMA provides an excellent foundation.

- Risk Manager: Specializes in identifying and mitigating financial and operational risks.

Job Outlook

The career outlook for accountants and auditors is stable and positive. According to the U.S. Bureau of Labor Statistics (BLS) Occupational Outlook Handbook, employment for these professionals is projected to grow 4 percent from 2022 to 2032, which is about as fast as the average for all occupations.

However, this number doesn't tell the whole story. As automation and AI handle more routine accounting tasks (like data entry and reconciliation), the demand for accountants with strategic, analytical, and decision-making skills will grow much stronger. This is precisely the skill set the CMA certification develops, positioning holders for greater job security and career advancement in a changing economy.

Conclusion

Becoming a Certified Management Accountant is a strategic career move with a clear and compelling financial payoff. The data consistently shows that CMAs earn significantly more than their peers, benefit from greater career opportunities, and are better positioned for high-level leadership roles.

The path to higher earnings is influenced by your education, experience, location, and choice of industry. However, the certification itself is the foundational key that unlocks this potential. For any financial professional looking to move beyond traditional accounting and become a strategic partner in business success, the CMA certification offers a well-defined and highly lucrative path forward.