New York City is the undisputed financial capital of the world. For ambitious accounting professionals, earning the Certified Public Accountant (CPA) license and working in the Empire State represents a pinnacle of career achievement. But what does that achievement translate to in terms of salary?

The answer is significant. A CPA in New York commands one of the highest salaries in the profession, with the potential for a six-figure income even in the early stages of their career. While the average salary is impressive, the real story lies in the factors that can drive your earnings well into the $200,000+ range.

This guide provides a data-driven look at what you can expect to earn as a CPA in New York, the key factors that influence your salary, and the robust career outlook for this prestigious profession.

What Does a CPA in New York Do?

A Certified Public Accountant is more than just a number-cruncher; they are a licensed, strategic financial advisor trusted by businesses, governments, and individuals. In the dynamic New York market, CPAs are essential to the health of the economy. Their responsibilities are diverse and critical, often including:

- Assurance and Audit: Examining financial records to ensure accuracy and compliance with regulations for publicly traded companies, private entities, and non-profits.

- Tax Services: Providing tax planning, preparation, and advisory services for complex corporate and individual clients.

- Advisory and Consulting: Offering strategic advice on everything from mergers and acquisitions (M&A) and risk management to forensic accounting and IT system implementation.

- Corporate Finance: Working within a company as a controller, financial analyst, Chief Financial Officer (CFO), or in other high-level finance roles, overseeing budgets, financial reporting, and strategy.

The CPA license signifies a commitment to ethical standards and a mastery of accounting principles, making these professionals highly sought-after in New York’s competitive landscape.

Average CPA Salary in New York

While a precise figure can vary, multiple authoritative sources point to a highly competitive compensation package for CPAs in New York.

According to Salary.com, as of early 2024, the average salary for a Certified Public Accountant in New York, NY, is $116,280, with a typical salary range falling between $104,261 and $129,587.

However, this average includes professionals at various stages of their careers. A more detailed breakdown reveals a wider spectrum:

- Entry-Level CPAs (0-2 years): Typically earn between $75,000 and $95,000, particularly when starting at a large public accounting firm.

- Mid-Career CPAs (3-7 years): Can expect salaries ranging from $110,000 to $150,000 as they move into senior and manager roles.

- Senior-Level CPAs (8+ years): As Senior Managers, Directors, or Partners, earnings can easily surpass $160,000 and reach well over $250,000.

It's important to note the "CPA premium." Data from the U.S. Bureau of Labor Statistics (BLS) for the broad "Accountants and Auditors" category in the New York-Newark-Jersey City metropolitan area shows a mean annual wage of $111,040. Professionals holding a CPA license typically earn a 10-15% salary premium over their non-certified peers, placing them at the higher end of this scale and beyond.

Key Factors That Influence Salary

Your salary isn't a single number; it's a dynamic figure influenced by a combination of your qualifications, choices, and career path. Here are the most significant factors.

###

Level of Education

To become a CPA in New York, you must complete 150 semester hours of education, which is more than a standard bachelor's degree. Many candidates fulfill this requirement by pursuing a Master's degree in Accountancy (MAcc) or Taxation (MST), or an MBA with a concentration in accounting. While a bachelor's degree is the foundation, holding a master's degree can provide a competitive edge, leading to a higher starting salary and opening doors to more specialized, higher-paying roles sooner.

###

Years of Experience

Experience is arguably the most powerful driver of salary growth. The career trajectory in accounting is well-defined, with compensation rising steeply at each promotional level.

- Staff Accountant (0-2 Years): The starting point. Focus is on learning the fundamentals of audit or tax.

- Senior Accountant (2-5 Years): With a few busy seasons under your belt, you take on more responsibility, lead engagements, and supervise junior staff. This is where salaries see their first significant jump.

- Manager / Senior Manager (5-10+ Years): You are now managing client relationships, overseeing multiple teams, and becoming an expert in your field. Compensation becomes highly lucrative.

- Director / Partner / CFO (12+ Years): At the executive level, you are a key strategic leader in your firm or company. Compensation includes a high base salary plus substantial bonuses and, in the case of partnership, a share of the firm's profits.

###

Geographic Location (Within New York)

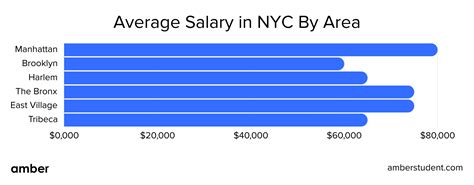

While this article focuses on New York, salaries are not uniform across the state. New York City (specifically Manhattan) offers the highest salaries due to the immense concentration of Fortune 500 companies, financial institutions, and the "Big Four" accounting firms, coupled with a higher cost of living. Salaries in surrounding areas like Long Island and Westchester are also very strong, while locations in Upstate New York like Albany, Buffalo, and Rochester will typically offer lower (though still competitive) salaries that align with their lower cost of living.

###

Company Type

Where you work has a massive impact on your paycheck and career path.

- Public Accounting (Big Four): Deloitte, PwC, EY, and KPMG are known for offering the highest starting salaries, excellent training, and prestigious resume branding. The work is demanding, but the compensation and exit opportunities are unparalleled.

- Public Accounting (Mid-Size & Regional Firms): Firms like Grant Thornton, BDO, and RSM offer competitive salaries that are often close to the Big Four, sometimes with a better work-life balance.

- Industry/Corporate Accounting: Moving into an industry role at a large bank (JPMorgan Chase, Goldman Sachs), media conglomerate, or tech company can be extremely lucrative. Senior financial roles in private industry in NYC often offer some of the highest long-term earning potentials.

- Government & Non-Profit: While typically offering lower base salaries, government jobs (e.g., for the IRS or SEC) provide exceptional job security, great benefits, and a predictable work schedule.

###

Area of Specialization

All CPAs are not created equal in terms of earning potential. Highly specialized skills are in high demand and command a premium salary.

- Advisory/Consulting: This is often the highest-paying field. Specialties like Mergers & Acquisitions (M&A) advisory, Transaction Services, and Forensic Accounting are incredibly lucrative due to the high-stakes nature of the work.

- Information Technology (IT) Audit & Risk: As technology becomes more central to business, CPAs who can audit complex IT systems and advise on cybersecurity risk are in high demand.

- Taxation: Specialized tax knowledge, particularly in international tax or for specific industries like finance, is always valuable and well-compensated.

- Assurance/Audit: While considered the traditional path, it remains the bedrock of the profession and offers a strong, stable, and high-earning career.

Job Outlook

The future for CPAs in New York is exceptionally bright. The U.S. Bureau of Labor Statistics (BLS) projects that employment for accountants and auditors will grow by 4% from 2022 to 2032, which translates to about 126,500 openings each year, on average, over the decade.

In a complex financial hub like New York, the demand is even more acute. Globalization, a constantly evolving tax code, and an increased focus on fraud prevention and data analytics mean that the expertise of a licensed CPA will remain indispensable.

Conclusion

For those considering an accounting career, the path to becoming a CPA in New York is a challenging yet immensely rewarding journey. The earning potential is among the best in the nation, with a clear and structured trajectory for financial growth.

Key Takeaways:

- High Earning Potential: The average CPA salary in New York City hovers around $116,000, with a broad range from $80,000 for entry-level roles to over $250,000 for experienced executives.

- Experience is King: Your salary will grow significantly as you gain experience and move from a staff-level position to a senior, manager, and director.

- Your Choices Matter: Your specialization (advisory often pays the most), company type (Big Four and industry pay top dollar), and education directly impact your compensation.

- Strong & Stable Future: With a positive job outlook projected by the BLS, a career as a CPA in New York offers both high earning potential and long-term job security.

Pursuing a CPA in New York is an investment in a future at the heart of the global economy—a future that is both professionally fulfilling and financially lucrative.