One of the most persistent myths in the modern workplace is that accepting a salaried position means giving up the right to overtime pay. Many professionals work well beyond the standard 40-hour week, believing it's simply part of the "deal" of a salaried role. However, the reality is far more nuanced and is governed by specific federal and state laws.

The truth is: some salaried employees are legally entitled to overtime pay. Understanding whether you fall into this category is crucial for protecting your rights and ensuring you are compensated fairly for your time. This guide will break down the complex rules surrounding overtime for salaried workers, explaining who qualifies, the key factors involved, and how to determine your status.

The Salaried Employee Misconception: Exempt vs. Non-Exempt Explained

The core of the overtime issue doesn't revolve around whether you are paid a salary or by the hour. Instead, it hinges on your legal classification under the Fair Labor Standards Act (FLSA), the federal law that establishes minimum wage, overtime pay, recordkeeping, and youth employment standards.

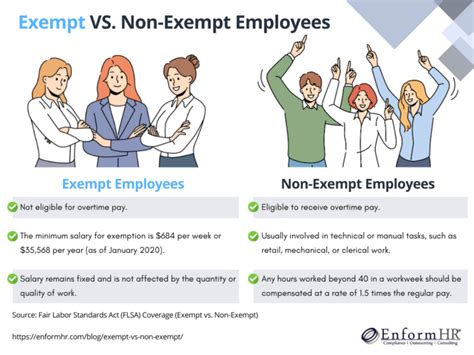

The FLSA divides all employees into two categories:

- Non-Exempt Employees: These employees are "not exempt" from the FLSA's overtime rules. They must be paid overtime at a rate of at least 1.5 times their regular rate of pay for any hours worked over 40 in a single workweek. Most hourly workers fall into this category, but so do many salaried employees.

- Exempt Employees: These employees are "exempt" from the FLSA's overtime rules because of the nature of their job duties and their salary level. They are not legally entitled to overtime pay, no matter how many hours they work.

The crucial takeaway is that your employer cannot simply declare you "exempt" because you are paid a salary. To be legally classified as exempt, you must meet a specific set of criteria established by the U.S. Department of Labor (DOL).

Average Overtime Pay: The Core Rules and Tests

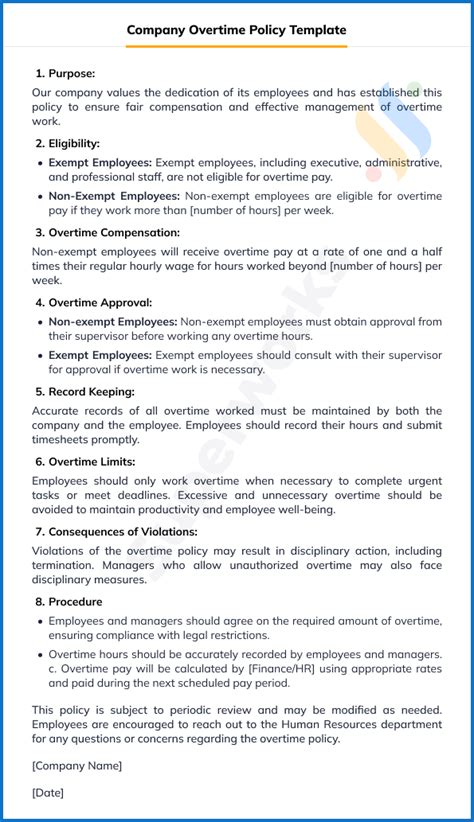

For a salaried employee to be legally considered "exempt" from overtime, they must generally meet all three of the following tests:

1. The Salary Basis Test: The employee must be paid on a salary basis, meaning they receive a predetermined, fixed salary each pay period that is not subject to reduction because of variations in the quality or quantity of work.

2. The Salary Level Test: The employee's salary must meet a minimum threshold. As of the latest federal update, this threshold is $684 per week, which equates to $35,568 per year. If a salaried employee earns less than this amount, they are automatically considered non-exempt and are eligible for overtime, regardless of their job duties.

3. The Duties Test: The employee's primary job duties must involve tasks that are considered executive, administrative, or professional in nature. This is often the most complex part of the classification.

If a salaried employee does not meet all three of these tests, they are legally considered non-exempt and must be paid 1.5 times their "regular rate of pay" for all hours worked over 40 in a workweek.

Key Factors That Influence Overtime Eligibility

Your job title alone is not enough to determine your status. The DOL looks at the actual tasks you perform. Here’s how various factors influence whether you are classified as exempt or non-exempt.

### Job Duties and Area of Specialization

This is the most critical factor. To be exempt, your primary responsibilities must align with one of the DOL's defined categories:

- Executive Exemption: Primary duty is managing the enterprise or a recognized department. Must regularly direct the work of at least two other full-time employees and have the authority to hire or fire (or have significant influence on these decisions). *Example: A retail store manager who supervises a team and manages store operations.*

- Administrative Exemption: Primary duty is performing office or non-manual work directly related to the management or general business operations of the employer or the employer’s customers. The role must include the exercise of discretion and independent judgment with respect to matters of significance. *Example: An HR manager who develops company policy, a financial analyst who provides strategic advice, or a project manager who oversees major business initiatives.* This is not for clerical or secretarial work.

- Professional Exemption: Primary duty is work requiring advanced knowledge in a field of science or learning, customarily acquired by a prolonged course of specialized intellectual instruction (Learned Professional). Or, the work is original and creative in a recognized artistic field (Creative Professional). *Examples: Doctors, lawyers, engineers, architects, artists, writers.*

### Level of Education and Years of Experience

While education and experience are not direct tests under the FLSA, they heavily influence the "Duties Test."

- Level of Education: Roles that meet the "Learned Professional" exemption test often require advanced degrees (e.g., law, medicine, engineering). A higher level of education makes it more likely your role will fall into this category.

- Years of Experience: Experience is a key factor in moving from a non-exempt to an exempt role. For example, an entry-level marketing coordinator who primarily executes tasks given by a manager may be non-exempt. After several years, they may become a Marketing Manager who develops strategy and exercises independent judgment, thus meeting the criteria for the administrative exemption. According to Payscale, progression from entry-level to senior roles can see salary increases of 50-100% or more, which often corresponds with a shift from non-exempt tasks to exempt strategic responsibilities.

### Geographic Location

Federal law provides the minimum standard, but your state can offer greater protections. Several states have stricter overtime laws and, most importantly, higher salary thresholds for an employee to be considered exempt.

For example:

- California: As of 2024, the minimum salary for an exempt employee is $66,560 per year, regardless of company size. This is significantly higher than the federal threshold of $35,568.

- New York: The 2024 salary threshold varies by location, reaching as high as $68,250 per year in New York City, Westchester, and Long Island.

- Washington: The state's 2024 minimum salary for exemption is tied to its minimum wage and is approximately $67,724.80 per year.

Always check your state and local labor department websites, as their rules supersede federal law if they are more favorable to the employee.

### Company Type and Industry

The industry you work in can influence the prevalence of non-exempt salaried roles. Industries like retail, hospitality, and customer service often have salaried "managers-in-training" or assistant managers whose duties may not meet the executive test, making them eligible for overtime despite their title and salary.

Conversely, industries like technology, finance, and law have a high concentration of roles that clearly meet the professional and administrative exemption tests. However, company policy also matters. Some companies choose to pay overtime to exempt employees as a perk to attract and retain talent, even when not legally required.

Job Outlook: The Future of Overtime Regulations

The rules surrounding overtime are not static. The U.S. Department of Labor periodically reviews and proposes updates to the FLSA, particularly the salary level test.

In late 2023, the DOL proposed a new rule that would significantly increase the minimum salary threshold for exemption to approximately $1,059 per week ($55,068 per year). While this is still a proposal and not yet law, it signals a trend toward expanding overtime eligibility to millions more salaried workers. Staying informed about these potential changes is crucial for both employees and employers. This reflects a broader societal and governmental focus on ensuring fair compensation for a wider range of the workforce.

Conclusion: Know Your Rights and Get Compensated Fairly

Navigating overtime pay as a salaried employee requires moving beyond common assumptions and understanding the specific legal criteria.

Here are the key takeaways:

- "Salaried" does not automatically mean "ineligible for overtime." Your classification as exempt or non-exempt is what matters.

- Eligibility is based on three tests: The Salary Basis, Salary Level (currently $35,568/year federally), and Duties tests. You must meet all three to be exempt.

- Your actual job duties matter more than your title. Review your primary responsibilities against the executive, administrative, and professional definitions.

- State and local laws are critical. Your state may have a higher salary threshold or stricter duty requirements, granting you overtime rights even if you are exempt under federal law.

If you believe you are being improperly classified as exempt, the first step is to carefully review your job description and compare it to the FLSA guidelines. Document the hours you work. You can then have a conversation with your HR department or, if necessary, consult your state's labor agency or an employment lawyer to understand your options. Being an informed professional is the first step toward building a sustainable and fairly compensated career.