It's one of the most common—and costly—misconceptions in the modern workplace: if you earn a salary, you aren’t eligible for overtime pay. Many professionals accept long workweeks as a standard part of their salaried role, believing extra hours are simply part of the package. However, the reality of compensation law is far more nuanced.

Whether or not a salaried worker is entitled to overtime pay has less to do with *how* they are paid (a salary vs. an hourly wage) and everything to do with their legal classification under the Fair Labor Standards Act (FLSA). Understanding this distinction is crucial for ensuring you are being compensated fairly for your time and expertise. This guide will demystify the rules, break down the key factors, and empower you to understand your rights.

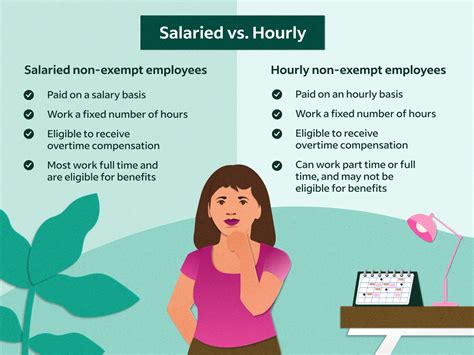

The Salaried vs. Hourly Myth: Understanding Exempt vs. Non-Exempt Status

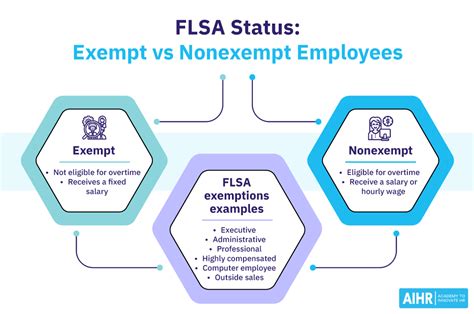

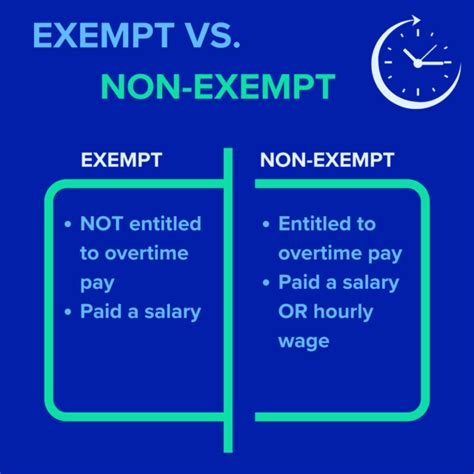

At the heart of the overtime question is the legal distinction between exempt and non-exempt employees. This classification, not your pay structure, dictates overtime eligibility.

- Non-Exempt Employees: These workers are covered by the FLSA's overtime provisions. They must be paid overtime, typically at a rate of 1.5 times their regular rate of pay, for all hours worked over 40 in a workweek. Most hourly workers fall into this category, but many salaried employees do as well.

- Exempt Employees: These workers are "exempt" from the FLSA's overtime rules. To be classified as exempt, an employee must meet very specific criteria related to their salary level and job duties. If they meet these tests, their employer is not required to pay them overtime.

The U.S. Department of Labor (DOL) has established a three-pronged test to determine if a salaried employee can be classified as exempt. An employee must meet all three of the following criteria to be exempt from overtime:

1. The Salary Basis Test: The employee must be paid a predetermined, fixed salary that is not subject to reduction because of variations in the quality or quantity of work performed.

2. The Salary Level Test: The employee's salary must meet a minimum specified amount.

3. The Duties Test: The employee's primary job duties must involve tasks that are considered executive, administrative, or professional in nature.

If a salaried employee does not meet all three of these conditions, they are legally considered non-exempt and are entitled to overtime pay.

The Salary Level Test: The Overtime Pay Threshold

This is one of the most straightforward factors. For an employer to classify you as exempt, they must pay you a salary that meets the federal minimum threshold. This threshold is subject to change, and major updates are taking effect in 2024 and 2025.

According to the U.S. Department of Labor, the federal salary threshold for exemption is undergoing a significant increase:

- Current Threshold (until July 1, 2024): $684 per week, which equals $35,568 per year.

- Effective July 1, 2024: The threshold increases to $844 per week, which equals $43,888 per year.

- Effective January 1, 2025: The threshold increases again to $1,128 per week, which equals $58,656 per year.

This means that, as of January 1, 2025, any salaried employee earning less than $58,656 per year is automatically considered non-exempt and must be paid overtime, regardless of their job title or duties.

There is also a separate threshold for "Highly Compensated Employees" (HCEs), who are subject to a more lenient duties test. This threshold is also increasing from its current level of $107,432 to $132,964 on July 1, 2024, and to $151,164 on January 1, 2025.

Key Factors That Determine Exemption Status

Beyond the salary threshold, the following factors are critical in determining your overtime eligibility.

### Area of Specialization (The Duties Test)

This is the most complex part of the test. Your job title is irrelevant; what matters are your actual, day-to-day responsibilities. To be exempt, your primary duties must fit into one of the DOL's defined categories:

- Executive Exemption: Your primary duty is managing the enterprise or a recognized department. You must customarily and regularly direct the work of at least two other full-time employees and have the authority to hire or fire (or your recommendations on these matters must be given particular weight).

- *Example: A Retail Store Manager who supervises all store employees and makes hiring decisions.*

- Administrative Exemption: Your primary duty must be the performance of office or non-manual work directly related to the management or general business operations of the employer. Critically, this work must include the exercise of discretion and independent judgment with respect to matters of significance.

- *Example: An HR Generalist who interprets company policy or a Financial Analyst who provides strategic recommendations, not just a bookkeeper who performs clerical data entry.*

- Professional Exemption: This falls into two sub-categories:

- Learned Professional: Your primary duty requires advanced knowledge in a field of science or learning, customarily acquired by a prolonged course of specialized intellectual instruction. This directly relates to your level of education.

- *Examples: Lawyers, doctors, certified public accountants (CPAs), engineers, architects, teachers.*

- Creative Professional: Your primary duty requires invention, imagination, originality, or talent in a recognized field of artistic or creative endeavor.

- *Examples: Musicians, writers, graphic artists, actors.*

- Other Exemptions: There are also specific exemptions for Computer Employees (who must be paid either a salary of at least the standard threshold or an hourly rate of at least $27.63) and Outside Sales Employees.

### Geographic Location

Federal law sets the floor, but many states have their own, more stringent overtime laws. If your state's law is more generous to employees, it supersedes the federal FLSA.

- California: As of 2024, the salary threshold for exempt employees is $66,560 per year, regardless of company size. This is significantly higher than the current federal level.

- New York: The 2024 salary threshold varies by region, ranging from $62,400 per year in most of the state to $66,300 in Long Island & Westchester, and $68,250 in New York City.

- Washington: The 2024 threshold is tied to the state minimum wage and is approximately $67,724 per year.

Always check your specific state and local labor laws, as they may provide greater protections and a higher salary threshold for overtime exemption.

### Level of Education & Years of Experience

While not standalone factors, education and experience are woven into the "Duties Test." For the Learned Professional exemption, a specialized degree (e.g., a J.D. for a lawyer, a CPA for an accountant) is often a prerequisite. Experience becomes relevant in the Administrative and Executive exemptions. An entry-level employee is less likely to exercise the "discretion and independent judgment" required for the administrative exemption than a senior analyst with a decade of experience. Similarly, a management trainee is not yet performing the duties of an exempt executive.

How Overtime is Calculated for Salaried, Non-Exempt Employees

If you are a salaried employee who is correctly classified as non-exempt, you are owed overtime. Here’s how it’s calculated:

1. Calculate the Regular Rate of Pay: Divide your weekly salary by the number of hours in your standard workweek (typically 40).

- *Example:* You earn a $52,000 annual salary. Your weekly salary is $1,000. Your regular rate is $1,000 / 40 hours = $25 per hour.

2. Calculate the Overtime Rate: Multiply your regular rate by 1.5.

- *Example:* $25/hour x 1.5 = $37.50 per hour.

3. Calculate Total Pay: If you worked 45 hours in a week, your pay would be (40 hours x $25) + (5 hours x $37.50) = $1,000 + $187.50 = $1,187.50 for that week.

What to Do If You Believe You Are Misclassified

Employee misclassification is a common issue. If you believe your salary or job duties do not meet the exemption criteria, you may be owed back pay for unpaid overtime.

1. Review the Criteria: Carefully compare your salary and daily tasks to the federal and state exemption tests.

2. Document Your Hours: Keep a detailed, personal record of all the hours you work each day.

3. Talk to HR: Approach your Human Resources department professionally. Frame it as a request for clarification: "I've been reviewing the FLSA guidelines and would like to better understand my classification as an exempt employee."

4. Consult Official Resources: Review the detailed fact sheets on the U.S. Department of Labor's website and your state's labor agency website.

5. Seek External Advice: If you are not satisfied with your employer's response, you can file a complaint with the DOL or your state's labor board. You may also wish to consult with an employment attorney to discuss your options.

Conclusion: Empower Yourself with Knowledge

The assumption that a salary automatically disqualifies you from overtime is a myth. Fair compensation is determined by a strict legal framework that considers your salary level, your specific job duties, and your location.

Key Takeaways:

- Exempt vs. Non-Exempt is Key: This legal classification, not your salary, determines overtime eligibility.

- The Salary Threshold is Rising: With the federal threshold increasing to $58,656 on January 1, 2025, millions of salaried workers may become newly eligible for overtime.

- Duties Matter More Than Titles: Your day-to-day responsibilities must fit into specific executive, administrative, or professional categories to be exempt.

- State Laws Can Offer More Protection: Your state may have a higher salary threshold and stricter rules than federal law.

By understanding these rules, you can ensure you are being paid fairly for every hour you contribute. Be proactive, stay informed, and don't be afraid to ask questions to protect your professional and financial well-being.