For ambitious professionals in the finance industry, securing a senior role at a "bulge bracket" investment bank like JPMorgan Chase represents a pinnacle of career achievement. The title of Executive Director (ED) is a significant milestone, signifying deep expertise, leadership, and substantial responsibility. Naturally, a role of this caliber comes with significant compensation.

But what does an Executive Director at JPMorgan Chase actually earn? While the exact number varies, the total compensation package is substantial, often ranging from $450,000 to well over $750,000 annually. This article provides a data-driven analysis of the Executive Director salary at JPMorgan Chase, the key factors that influence it, and the career outlook for aspiring financial leaders.

What Does an Executive Director at JPMorgan Chase Do?

Before diving into the numbers, it's crucial to understand the role. In the unique hierarchy of investment banking, an Executive Director is not a C-suite or board-level position. Instead, it is a senior-level rank, typically positioned between a Vice President (VP) and a Managing Director (MD).

An ED is a seasoned professional responsible for driving business results. Their key responsibilities often include:

- Leading Deal Execution: Managing complex transactions, from mergers and acquisitions (M&A) to capital raises and corporate restructuring.

- Client Relationship Management: Serving as a primary point of contact for key institutional or corporate clients, providing strategic advice and building long-term partnerships.

- Team Leadership and Mentorship: Overseeing teams of Associates and VPs, guiding their work, and fostering their professional development.

- Business Development: Identifying new opportunities and contributing to the strategic direction of their division.

In essence, an ED is an expert practitioner and a leader, critical to the firm's revenue generation and market reputation.

Average Executive Director Salary at JPMorgan Chase

Compensation for an Executive Director at JPMorgan Chase is multifaceted, comprising a base salary and a significant performance-based bonus (and sometimes stock awards). It is crucial to look at total compensation for an accurate picture of earnings.

- Base Salary: The fixed portion of the pay typically ranges from $250,000 to $325,000 per year. (Source: [Glassdoor](https://www.glassdoor.com/Salary/JPMorgan-Chase-and-Co-Executive-Director-Salaries-E145_D_KO26,44.htm), 2023 data).

- Performance Bonus: This is the most variable and substantial component. The annual bonus is tied to individual, team, and firm-wide performance. It can range from $150,000 to over $500,000, often exceeding the base salary.

- Total Compensation: When combined, the total annual compensation for a JPMorgan Chase ED typically falls between $450,000 and $750,000. Top performers in high-earning divisions can even surpass the $800,000 mark. (Source: [Levels.fyi](https://www.levels.fyi/companies/jpmorgan-chase/salaries/executive-director), 2023 data).

Key Factors That Influence Salary

Multiple factors determine where an individual's compensation will fall within this range. Understanding these variables is key for anyone aspiring to reach this level.

### Level of Education

While a bachelor's degree in finance, economics, or a related field is a prerequisite, a Master of Business Administration (MBA) from a top-tier business school (such as Wharton, Harvard Business School, or Chicago Booth) is a common and highly valuable credential. An MBA not only provides advanced knowledge and a powerful network but also acts as a significant accelerator for both career progression and earning potential in investment banking.

### Years of Experience

The Executive Director role is not an entry-level position. It is a senior rank that requires extensive experience. Typically, a professional will have 10 to 15+ years of industry experience before reaching the ED level. The career ladder usually follows this path:

1. Analyst (2-3 years)

2. Associate (3-4 years)

3. Vice President (VP) (4-6+ years)

4. Executive Director (ED)

An ED with more years of experience, a proven track record of successful deals, and a robust client book will command a higher salary and bonus.

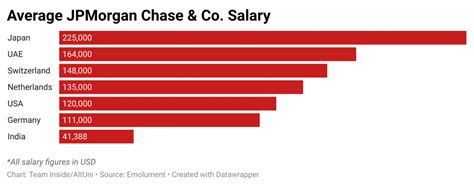

### Geographic Location

Where you work matters immensely. Financial hubs command the highest salaries due to the concentration of business activity and a higher cost of living.

- New York City: As the headquarters for JPMorgan's investment bank and the financial capital of the world, NYC offers the highest compensation packages.

- Other Major Hubs: Other key financial centers like London, Hong Kong, and San Francisco also offer highly competitive salaries for EDs, often comparable to or slightly below New York levels. Salaries in smaller regional offices will generally be lower.

### Company Type

While this article focuses on JPMorgan Chase—a top-tier "bulge bracket" bank—it's worth noting that compensation at such firms is at the peak of the industry. Salaries for similar roles at smaller, "boutique" investment banks or regional commercial banks may be lower, although top-performing boutique firms can also be extremely lucrative. The prestige, deal flow, and resources of a firm like JPMC allow it to attract and retain top talent with market-leading pay.

### Area of Specialization

Within a massive organization like JPMorgan Chase, what you *do* is as important as your title. "Front-office" roles that directly generate revenue typically have the highest earning potential.

- Top-Earning Divisions: Executive Directors in Investment Banking (M&A), Sales & Trading (especially in quantitative or derivatives desks), and Private Equity divisions are often the highest earners due to the direct link between their performance and the firm's profits.

- Other Divisions: EDs in crucial support functions like Technology, Risk Management, Compliance, or Corporate Strategy are also highly compensated, but their bonus potential may be structured differently and might not reach the same peaks as their front-office counterparts.

Job Outlook

The U.S. Bureau of Labor Statistics (BLS) does not track data for "Executive Directors" specifically, but we can look at the broader category of Financial Managers for a general industry trend.

The BLS projects that employment for financial managers will grow 16% from 2022 to 2032, which is much faster than the average for all occupations. The BLS states, "Services provided by financial managers, such as planning, directing, and coordinating investments, will continue to be in demand as the economy grows." (Source: [U.S. Bureau of Labor Statistics, Financial Managers Outlook](https://www.bls.gov/ooh/management/financial-managers.htm)).

However, it is critical to add a major caveat: competition for senior roles at elite firms like JPMorgan Chase is exceptionally fierce. While the financial industry is growing, these specific positions are limited and are awarded only to the highest-performing and most dedicated professionals.

Conclusion

The role of an Executive Director at JPMorgan Chase is one of the most demanding yet financially rewarding positions in the modern economy. It requires a decade or more of relentless dedication, superior analytical skills, and exceptional leadership ability.

For those aspiring to this career path, the key takeaways are:

- Aim for Total Compensation: The salary is far more than the base pay; the performance bonus is where true earning potential is unlocked.

- Education and Experience are Paramount: A top-tier education (often including an MBA) and a proven track record are non-negotiable.

- Location and Specialization Matter: Your earnings will be maximized in a major financial hub and in a revenue-generating, front-office role.

While the path is challenging, the professional growth, intellectual stimulation, and financial rewards make the role of Executive Director at JPMorgan Chase a coveted goal for the best and brightest in finance.