A major federal rule change is set to impact the paychecks and work hours of millions of American professionals. The U.S. Department of Labor has updated the salary threshold for "exempt" employees, with significant changes taking effect in 2024 and 2025. This isn't just an administrative update; it's a pivotal shift that could mean a pay raise or new overtime eligibility for many salaried workers. Understanding this change is crucial for negotiating your salary, managing your team, and planning your career trajectory.

What Does the "Exempt Salary Threshold" Mean?

First, it's important to clarify that "Exempt Salary Threshold" is not a job title. It's a key regulation under the Fair Labor Standards Act (FLSA), the federal law that establishes minimum wage, overtime pay, and other labor standards.

Under the FLSA, employees are classified as either "non-exempt" or "exempt."

- Non-Exempt Employees: Are entitled to overtime pay (at least 1.5 times their regular rate) for any hours worked over 40 in a workweek.

- Exempt Employees: Are *not* entitled to overtime pay. To be classified as exempt, an employee must meet all three of the following criteria:

1. Salary Basis Test: They are paid a predetermined, fixed salary that doesn't change based on the quantity or quality of work performed.

2. Salary Level Test: Their salary is at or above a specific minimum threshold set by the Department of Labor. This is the threshold that is changing in 2024 and 2025.

3. Duties Test: Their primary job duties must involve executive, administrative, or professional (EAP) tasks.

The 2025 Exempt Salary Threshold refers to the new minimum salary an employee must earn to be considered exempt from overtime under the "Salary Level Test."

The New 2025 Exempt Salary Thresholds

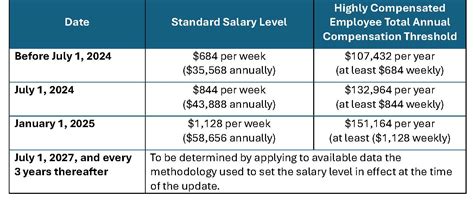

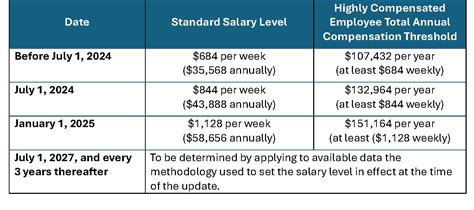

The Department of Labor's Final Rule, announced in April 2024, establishes a two-phased increase to the standard salary level, followed by automatic updates every three years.

According to the U.S. Department of Labor (DOL), the new salary thresholds are:

- Effective July 1, 2024: The threshold will increase from the current $35,568 per year ($684/week) to $43,888 per year ($844/week).

- Effective January 1, 2025: The threshold will increase again to $58,656 per year ($1,128/week).

- Highly Compensated Employees (HCE): The total annual compensation threshold for HCEs will also increase, first to $132,964 on July 1, 2024, and then to $151,164 on January 1, 2025.

Starting July 1, 2027, these salary thresholds will be automatically updated every three years to reflect current wage data.

Key Factors: How Will the New Threshold Impact You?

This national standard will not impact everyone equally. The effect on your career depends heavily on your current salary, job location, industry, and role.

### Years of Experience

Entry-level and early-career salaried professionals are most likely to be affected. These employees often perform professional duties but may have salaries that fall between the old threshold ($35,568) and the new 2025 threshold ($58,656).

- Example: An Assistant Marketing Manager with two years of experience earning $52,000 a year is currently exempt. Come January 1, 2025, their employer must either increase their salary to at least $58,656 or reclassify them as non-exempt, making them eligible for overtime pay if they work more than 40 hours a week.

### Geographic Location

While the salary threshold is a national number, its impact is magnified in regions with a lower cost of living, where wages are generally lower. A salary of $55,000 may be common for a manager in a major metropolitan area but could be well above the median for the same role in a rural state.

- Example: According to Salary.com, the average salary for an Office Manager in New York, NY is around $81,000, well above the new threshold. However, the average for the same role in Jackson, MS, is around $58,000. This puts many managers in lower-cost-of-living areas squarely in the zone of impact, where employers will face a direct choice: raise pay or reclassify.

### Company Type and Industry

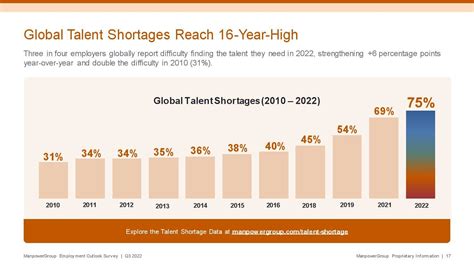

Certain industries that rely heavily on salaried managers and professionals in the $40k-$58k range will feel the most pressure to adapt their compensation structures.

- Retail and Hospitality: These sectors often employ a large number of store managers, assistant managers, and department heads whose salaries may fall below the new threshold.

- Non-Profits: Organizations with tight budgets may find it challenging to increase salaries to meet the new level, potentially leading to more reclassifications and stricter management of work hours.

- Startups: Early-stage companies that offer lower base salaries in exchange for equity may also need to re-evaluate their compensation packages for junior-level salaried employees.

### Area of Specialization

The impact will vary significantly based on your specific job function. Roles that have historically sat in a salary "grey area" are the ones to watch.

- Highly Impacted Roles: Assistant Store Managers, Operations Supervisors, Entry-Level Project Coordinators, Staff Accountants in their first few years, and various administrative management roles. For instance, data from Glassdoor shows the national average salary for a Retail Assistant Manager is approximately $48,000, placing it directly under the 2025 threshold.

- Less Impacted Roles: Fields with higher starting salaries, such as software engineering, finance, and law, will see less of an immediate impact on their entry-level positions, as these roles often start above the $58,656 threshold already.

Employer and Job Market Outlook

For employers, this change necessitates a full audit of their payroll. They have three primary options for employees whose salaries fall below the new thresholds:

1. Increase Salaries: Raise the employee's salary to the new threshold to maintain their exempt status.

2. Reclassify and Pay Overtime: Keep the current salary but reclassify the employee as non-exempt and pay overtime for any hours worked beyond 40 per week.

3. Reclassify and Manage Hours: Reclassify the employee and strictly limit their workweek to 40 hours to avoid incurring overtime costs.

From a job market perspective, the long-term outlook is mixed. Proponents argue the rule will lead to better work-life balance and fairer pay. Some economists suggest it could lead to the creation of new hourly jobs as companies look to distribute workloads. Conversely, others fear it could stifle hiring or lead to a reduction in salaried positions as companies work to control costs. For job seekers, this may lead to more transparency in job descriptions regarding exempt/non-exempt status and expected work hours.

Conclusion: Preparing for the Change

The 2025 exempt salary threshold is more than a number—it's a catalyst for change in the American workplace. It empowers many employees while challenging employers to rethink compensation and workforce management.

Key Takeaways:

- For Employees: If your current salary is below $58,656, have a proactive conversation with your manager or HR department about how the company plans to address the new rule. This is a powerful opportunity to discuss your value and negotiate your compensation.

- For Employers: Begin auditing your payroll now. Analyze the financial impact of raising salaries versus paying overtime and communicate your strategy clearly and transparently to all affected team members.

- For Everyone: This change underscores the importance of knowing your rights and understanding the market value of your skills. Use this as a moment to assess your career path, your earning potential, and the value you bring to your organization.

Staying informed is the best way to navigate this transition and ensure it works to your professional advantage.