For individuals with a keen interest in finance, a talent for sales, and a passion for the automotive industry, the role of a Finance Manager at a car dealership represents a powerful and lucrative career path. Often seen as the dealership's final checkpoint before a customer drives off the lot, this position is critical to profitability and customer satisfaction. But what does this high-stakes role actually pay?

The answer is complex and encouraging. While entry-level positions offer a solid starting salary, the earning potential for experienced, high-performing Finance & Insurance (F&I) Managers is substantial, with many top professionals earning well into the six figures. This article will provide a detailed breakdown of the salary you can expect and the key factors that drive your earning potential.

What Does a Finance Manager at a Car Dealership Do?

Before diving into the numbers, it's essential to understand the responsibilities of a car dealership Finance Manager, often called an F&I Manager. This is far from a simple administrative role; it's a high-pressure, performance-driven position that directly impacts the dealership's bottom line.

Key responsibilities include:

- Securing Financing: Working with a network of lenders to find competitive auto loan options for customers with varying credit profiles.

- Selling Add-On Products: Presenting and selling aftermarket products, which are major profit centers for the dealership. These include extended warranties, Guaranteed Asset Protection (GAP) insurance, tire and wheel protection, and vehicle maintenance plans.

- Ensuring Legal Compliance: Handling all contracts and paperwork meticulously, ensuring that every transaction adheres to strict federal, state, and local regulations.

- Maximizing Profitability: Structuring deals to maximize the profit per vehicle sold through a combination of financing arrangements and product sales.

In essence, the F&I Manager is a unique blend of a finance expert, a compliance officer, and a skilled salesperson.

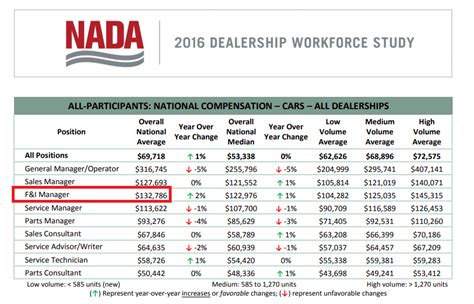

Average Salary for a Car Dealership Finance Manager

The compensation for a car dealership Finance Manager is heavily based on commission and performance bonuses, which means salary figures can vary dramatically. Base salaries are often modest, but total compensation can be very high.

- According to Salary.com, as of late 2023, the median annual salary for an Automotive F&I Manager in the United States is approximately $124,560. The typical range falls between $108,030 and $143,260.

- Payscale.com reports a slightly more conservative median salary of around $77,000 per year, but emphasizes a massive total pay range of $43,000 to $186,000 when including bonuses and commissions.

- Glassdoor data further supports this wide range, showing a "total pay" estimate often exceeding $130,000 annually for experienced managers, with a base pay closer to the $55,000-$65,000 mark.

The significant variance in these figures highlights the most crucial aspect of this role's compensation: performance is everything. An average performer might earn a solid living, but a top-tier F&I Manager at a high-volume dealership can be one of the highest-paid employees in the building.

A realistic salary progression looks something like this:

- Entry-Level (0-2 years): $50,000 - $85,000 total compensation.

- Mid-Career (3-9 years): $90,000 - $150,000+ total compensation.

- Senior/Top Performer (10+ years): $160,000 - $250,000+ total compensation.

Key Factors That Influence Salary

Your specific salary will depend on a combination of factors. Understanding these variables is key to maximizing your earning potential in this field.

###

Level of Education

While a proven track record in sales can sometimes substitute for formal education, a bachelor's degree is increasingly preferred and often required for management roles. A degree in Finance, Business Administration, or Accounting provides a strong theoretical foundation for the role's financial and compliance duties. According to the U.S. Bureau of Labor Statistics (BLS), a bachelor's degree is the typical entry-level education for the broader category of Financial Managers. A degree can make you a more competitive candidate and may lead to a higher starting base salary.

###

Years of Experience

Experience is arguably the most significant factor in determining an F&I Manager's income. An experienced manager has had time to:

- Build Relationships with Lenders: This allows them to get difficult deals approved and secure better rates for customers.

- Master the Sales Process: They know how to effectively present products and overcome objections without being overly aggressive.

- Develop a Reputation: A history of high performance and strong ethics makes them invaluable to a dealership.

As shown in the salary progression above, compensation rises steeply after the first few years as you prove your ability to consistently generate profit.

###

Geographic Location

Where you work matters. Salaries for F&I Managers are higher in major metropolitan areas with a high cost of living and a competitive automotive market. For example, a manager in Los Angeles, CA, or the New York City metro area will almost certainly earn more than a manager in a small, rural town in the Midwest. According to Salary.com's calculator, an F&I manager in San Francisco, CA, can expect to earn about 26% more than the national average. States with large populations and high vehicle sales, like California, Texas, Florida, and New York, generally offer more opportunities and higher pay.

###

Company Type

The type and size of the dealership play a massive role in your earning potential.

- High-Volume Dealerships: A dealership that sells hundreds of cars per month provides far more opportunities for commission than one that sells a few dozen. More transactions mean more chances to secure financing and sell products.

- Luxury vs. Economy Brands: Managing finance for a luxury brand (e.g., BMW, Mercedes-Benz, Lexus) can be more lucrative. The loan amounts are larger, and the associated warranty and insurance products are more expensive, leading to higher commissions per deal.

- Large Dealer Groups vs. Single-Owner Stores: Large, publicly-traded auto groups (like AutoNation or Penske) may offer more structured training, better benefits, and clear paths for advancement, though top-performing managers at successful single-owner stores can also earn exceptionally high incomes.

###

Area of Specialization

Within the F&I role, "specialization" is less about a formal title and more about developing high-value skills. Managers who excel in certain areas can dramatically increase their income. These skills include:

- Subprime Financing: The ability to get financing approved for customers with poor or limited credit is a highly sought-after skill. These deals are often more complex and can be very profitable.

- Product Penetration: Consistently achieving high sales rates for high-margin products like extended warranties and GAP insurance is a direct measure of success and a driver of commission.

- Compliance Expertise: A manager known for their meticulous, error-free paperwork and deep knowledge of compliance laws is invaluable, as they protect the dealership from costly fines and legal action.

Job Outlook

The career outlook for skilled financial professionals remains very positive. The U.S. Bureau of Labor Statistics (BLS) projects that employment for the general category of Financial Managers will grow 16 percent from 2022 to 2032, a rate described as "much faster than the average for all occupations."

While this data applies to all financial managers, the trend is relevant to the automotive sector. As long as consumers continue to buy and finance vehicles, dealerships will require skilled F&I managers to handle transactions, navigate complex regulations, and drive profitability. The role is essential and not easily automated, securing its place in the dealership model for the foreseeable future.

Conclusion

A career as a car dealership Finance Manager offers a direct and powerful path to a six-figure income for motivated individuals. It is a demanding role that requires resilience, sharp financial acumen, and exceptional sales skills.

Key Takeaways:

- Performance is Paramount: Your total compensation is tied directly to your ability to secure financing and sell products.

- Experience Pays: Your value and income will grow significantly as you build a track record of success and develop relationships with lenders.

- Choose Your Dealership Wisely: Your earning potential is heavily influenced by the volume, brand, and location of your dealership.

- The Outlook is Strong: The need for F&I experts remains robust, offering long-term job security.

For those who thrive in a fast-paced, high-reward environment, this career path is not just a job—it's an opportunity to build a prosperous and dynamic professional life in the heart of the automotive industry.