A career as a financial analyst offers a dynamic and rewarding path for those with a keen analytical mind and a passion for markets and business strategy. It's a role that places you at the heart of major financial decisions, offering significant potential for growth and impact. But for those considering this path, one of the most pressing questions is: what can you expect to earn when you're just starting out?

While an entry-level financial analyst salary can vary widely, a typical starting base salary in the U.S. falls between $65,000 and $85,000 per year. However, this is just a starting point. Factors like your location, the company you work for, and your specific role can push that figure—especially when including bonuses—well into the six-figure range, even in your first year.

This article will break down what you need to know about your potential earnings and the key factors that will shape your compensation as you launch your career.

What Does an Entry-Level Financial Analyst Do?

Before diving into the numbers, it's essential to understand the role. An entry-level financial analyst is the engine room of a finance team. They don't just crunch numbers in a spreadsheet; they transform raw data into actionable intelligence. Their primary responsibility is to help their organization make smarter, more profitable decisions.

Core duties for a junior analyst typically include:

- Financial Modeling: Building models to forecast future earnings, project the outcome of a business decision, or value a company.

- Data Analysis: Analyzing historical financial statements (income statements, balance sheets, cash flow statements) to identify trends and insights.

- Reporting: Creating clear, concise reports and presentations to communicate findings to senior management, clients, or investors.

- Industry Research: Monitoring economic trends, market conditions, and competitor performance to provide context for financial decisions.

- Supporting Senior Staff: Assisting senior analysts and portfolio managers with due diligence, valuations, and ad-hoc analysis.

Average Financial Analyst Salary

To understand entry-level pay, it's helpful to look at the profession's overall salary landscape. The most authoritative data from the U.S. Bureau of Labor Statistics (BLS) shows that the median annual wage for all financial analysts was $99,890 in May 2023. The lowest 10 percent earned less than $62,130, while the top 10 percent of earners brought in more than $178,260. This wide range highlights the significant earning potential as you gain experience.

For those just starting out, salary aggregators provide a more focused look:

- Salary.com reports that a Financial Analyst I (their designation for entry-level) in the United States typically earns a base salary between $66,901 and $78,501 as of mid-2024.

- Payscale estimates the average entry-level financial analyst salary to be around $68,500 per year.

- Glassdoor places the estimated total pay (including bonuses and other compensation) for a financial analyst with 0-1 years of experience at approximately $84,000 per year.

The inclusion of bonuses is a critical point. In many finance roles, especially in investment banking or asset management, the annual bonus can be a significant portion of total compensation, even at the junior level.

Key Factors That Influence Salary

Your starting salary isn't set in stone. Several key variables will determine where you fall on the spectrum. Understanding these factors can help you maximize your earning potential from day one.

###

Level of Education

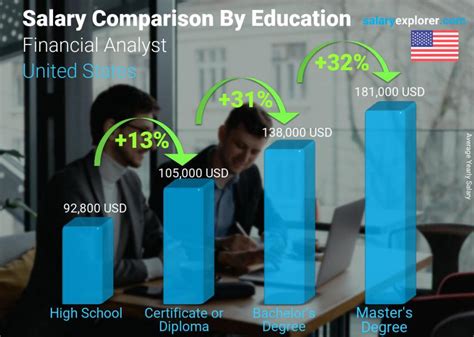

A bachelor’s degree in finance, economics, accounting, or a related field is the standard entry requirement. However, advanced degrees can provide a competitive edge and a higher starting salary. A Master of Science in Finance (MSF) or a Master of Business Administration (MBA) can often lead to more senior entry positions or higher pay grades. Furthermore, pursuing prestigious certifications like the Chartered Financial Analyst (CFA) designation will significantly boost your earning power throughout your career, though most candidates begin the program after gaining some work experience.

###

Years of Experience

Experience is arguably the single biggest driver of salary growth. While this article focuses on entry-level (0-2 years) roles, it's motivating to see the potential trajectory:

- Entry-Level (0-2 years): Focuses on learning the fundamentals, supporting the team, and building models.

- Mid-Level Analyst (3-5 years): Takes on more autonomy, manages complex projects, and may begin mentoring junior analysts. Salaries often move into the $90,000 - $120,000+ range.

- Senior Analyst (5+ years): Leads major analyses, presents directly to C-suite executives, and plays a key strategic role. Base salaries can easily exceed $130,000, with total compensation being much higher.

###

Geographic Location

Where you work matters—a lot. Salaries are adjusted for the local cost of living and the concentration of finance jobs. Major financial hubs naturally offer the highest compensation.

- Top-Tier Cities: New York City, San Francisco, Boston, and Chicago lead the pack. Entry-level analysts in these cities can expect salaries at the highest end of the range, often starting above $85,000, to compensate for the high cost of living and intense competition.

- Mid-Tier Cities: Locations like Dallas, Atlanta, Charlotte, and Denver offer strong opportunities with salaries that are competitive when adjusted for a lower cost of living.

- Lower-Tier Markets: Smaller cities and rural areas will generally offer lower starting salaries but may provide a better work-life balance.

###

Company Type

The type of firm you work for is a massive differentiator in pay. Analysts across different sectors perform similar tasks, but the compensation structures vary dramatically.

- Investment Banking & Private Equity (The "Buy-Side" and "Sell-Side"): These are the most lucrative areas. Firms like Goldman Sachs, J.P. Morgan, or KKR pay top-dollar to attract the best talent. Entry-level base salaries can start at $100,000 or more, with bonuses that can add another 50-100% on top. The trade-off is notoriously long hours and high pressure.

- Corporate Finance (FP&A): This involves working within a non-financial company (e.g., Apple, Ford, Procter & Gamble) in their Financial Planning & Analysis department. The pay is very competitive, and the work-life balance is generally much better than in investment banking.

- Asset Management & Equity Research: These roles, focused on managing investments and analyzing stocks, also offer very high compensation, though perhaps slightly less than top-tier investment banking.

- Commercial Banking & Insurance: These sectors offer stable, solid careers with good pay, though typically less than the high-finance world.

- Government & Non-Profit: These roles offer the lowest salaries but provide excellent job security, great benefits, and a strong sense of public service.

###

Area of Specialization

Within the broader "financial analyst" title, various specializations exist, each with its own pay scale. An investment banking analyst focused on mergers and acquisitions (M&A) will earn significantly more than a treasury analyst in a corporate setting. An equity research analyst's bonus may be tied to the performance of their stock recommendations, while a corporate FP&A analyst's bonus is tied to overall company performance.

Job Outlook

The future for financial analysts looks bright. According to the BLS, employment for financial analysts is projected to grow 8 percent from 2022 to 2032, which is much faster than the average for all occupations.

This growth is fueled by an increasingly complex global economy, a wide array of financial products, and the continuous need for companies to make data-driven decisions to navigate markets and remain competitive. This strong demand ensures that a career as a financial analyst will remain a stable and valuable profession for years to come.

Conclusion

For aspiring finance professionals, the entry-level financial analyst salary offers a very comfortable starting point with an exceptionally high ceiling for growth. While a national average provides a useful benchmark, your personal earnings will be a product of your choices.

Here are the key takeaways:

- Expect a Strong Start: A base salary in the $65k - $85k range is a realistic expectation, but total compensation including bonuses can be much higher.

- Location and Industry are King: Your biggest salary levers at the entry-level are choosing to work in a major financial hub and targeting high-paying sectors like investment banking or corporate finance at a large company.

- Your First Job is a Launchpad: See your entry-level role not as a destination, but as a paid learning experience. The skills, experience, and professional network you build in your first few years are the true foundation for a seven-figure career down the line.

A career as a financial analyst is challenging but immensely rewarding. By understanding the factors that drive compensation, you can strategically position yourself for a successful and lucrative career in finance.