Introduction

As a salaried professional in Florida, you’ve likely focused on mastering your craft, climbing the career ladder, and maximizing your earning potential. You negotiate your salary, work hard to prove your value, and assume the lump sum you receive each payday is the full and final story of your compensation. But what if it’s not? What if the very classification of "salaried" is misunderstood, potentially costing you thousands of dollars in unpaid overtime and violating your fundamental rights as a worker? The landscape of labor law is complex, and for salaried employees, the nuances can mean the difference between being fairly compensated and being exploited.

Understanding your rights isn't just about legal trivia; it's a critical component of professional self-advocacy and financial well-being. The average salaried worker can lose out on significant earnings simply by not knowing the rules that govern their pay. A 2023 report from the Economic Policy Institute highlighted that millions of workers nationwide are denied overtime pay due to misclassification. Early in my career, a colleague working as a salaried "manager" routinely clocked 60-hour weeks without extra pay, believing it was just part of the job. It wasn't until she consulted an expert that she realized her actual duties didn't meet the legal definition of an exempt manager, and she was entitled to years of back-paid overtime. This common scenario underscores a vital truth: knowledge of labor law is a form of career insurance.

This guide is designed to be your definitive resource for navigating the intricate web of federal and Florida state labor laws that apply to salaried employees. We will move beyond simple definitions to provide a comprehensive, in-depth analysis of what it truly means to be salaried, how your pay is protected, and what you can do if you believe your rights have been violated. Consider this your personal consultation on securing the compensation you’ve rightfully earned.

### Table of Contents

- [Understanding Your Status: What It Means to Be a 'Salaried Employee' in Florida](#understanding-your-status-what-it-means-to-be-a-salaried-employee-in-florida)

- [The Financial Impact of Labor Laws on Your Salary](#the-financial-impact-of-labor-laws-on-your-salary)

- [The Three Crucial Tests for Overtime Exemption](#the-three-crucial-tests-for-overtime-exemption)

- [Key Protections: Deductions, Final Pay, and Minimum Wage](#key-protections-deductions-final-pay-and-minimum-wage)

- [Recent Changes, Future Trends, and How to Protect Your Rights](#recent-changes-future-trends-and-how-to-protect-your-rights)

- [What to Do If You Believe Your Rights Have Been Violated: A Step-by-Step Guide](#what-to-do-if-you-believe-your-rights-have-been-violated-a-step-by-step-guide)

- [Conclusion: Empowering Yourself as a Florida Professional](#conclusion-empowering-yourself-as-a-florida-professional)

---

Understanding Your Status: What It Means to Be a 'Salaried Employee' in Florida

The term "salaried employee" is one of the most misunderstood concepts in the American workplace. Many people believe that if you receive a fixed annual salary instead of an hourly wage, you are automatically ineligible for overtime pay. This is a dangerous and often costly misconception.

In Florida, as in the rest of the United States, labor laws are primarily governed by the federal Fair Labor Standards Act (FLSA). Florida has its own specific laws regarding minimum wage, but for the classification of employees for overtime purposes, the FLSA provides the foundational rules. The FLSA categorizes all employees into one of two groups: non-exempt and exempt.

- Non-Exempt Employees: These employees are covered by the FLSA's overtime provisions. They must be paid at least the minimum wage for all hours worked and receive overtime pay at a rate of one-and-a-half times their regular rate of pay for any hours worked over 40 in a single workweek. The method of payment (hourly or salaried) does not change this requirement.

- Exempt Employees: These employees are *not* covered by the FLSA's overtime provisions. To be considered exempt, an employee must meet very specific criteria related to their pay and job duties.

The critical takeaway is this: You can be a salaried employee and still be entitled to overtime pay. If you are paid a salary but do not meet the strict legal tests for exemption, you are considered a "salaried, non-exempt" employee. Your employer must track your hours and pay you overtime for any week you work more than 40 hours.

### A "Day in the Life" of a Misclassified Employee

To illustrate this, let's consider "Maria," a salaried "Assistant Manager" at a retail store in Miami.

- 8:00 AM: Maria arrives and begins her day. Her official job title is "Assistant Manager," and she's paid a flat salary of $45,000 per year, which she believes makes her exempt from overtime.

- 9:00 AM - 12:00 PM: Maria spends the morning operating the cash register, stocking shelves, and cleaning the store, as two hourly employees have called in sick. Her primary duties are identical to those of the hourly staff.

- 12:00 PM - 1:00 PM: She takes a quick lunch while checking inventory on the store's computer.

- 1:00 PM - 6:00 PM: The store gets busy. Maria continues to run a register, handle customer service issues, and unload a new shipment of inventory. She does not have the authority to hire or fire anyone, and her suggestions about store layout are often ignored by the district manager.

- 6:00 PM - 7:00 PM: After the store closes, Maria stays late to prepare the daily cash deposit and set up a promotional display according to a plan sent from the corporate office. She has no input on the display's design or pricing.

Maria regularly works 50-55 hours per week but receives no additional pay. Despite her "manager" title and salary, her actual job duties—performing manual labor, cashiering, and following direct orders without significant independent judgment—likely mean she is legally non-exempt. Under the FLSA, she should be receiving 10-15 hours of overtime pay every single week. Her employer has misclassified her, saving the company money at her expense. This scenario plays out in countless workplaces across Florida, from offices and restaurants to healthcare clinics and tech startups.

---

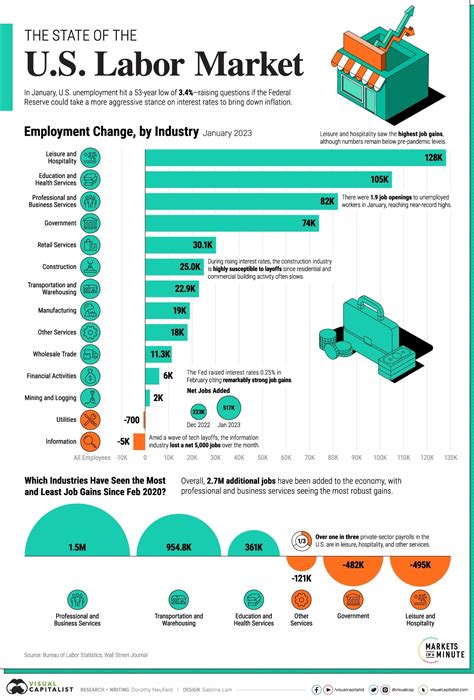

The Financial Impact of Labor Laws on Your Salary

Understanding your classification is not just an academic exercise; it has direct and significant financial consequences. Employee misclassification is a primary driver of wage theft. When an employer wrongly classifies a non-exempt employee as exempt, they are effectively avoiding the legal requirement to pay overtime.

Let's quantify the financial loss using Maria's example.

1. Calculate the Regular Rate of Pay: Her annual salary is $45,000.

- Weekly salary: $45,000 / 52 weeks = $865.38

- Regular hourly rate (for overtime calculation): $865.38 / 40 hours = $21.63 per hour

2. Calculate the Overtime Rate:

- Time-and-a-half rate: $21.63 x 1.5 = $32.45 per hour

3. Calculate Unpaid Overtime: Maria consistently works 15 hours of overtime per week.

- Weekly unpaid wages: 15 hours x $32.45 = $486.75

- Annual unpaid wages: $486.75 x 50 weeks (assuming 2 weeks vacation) = $24,337.50

By misclassifying Maria, her employer is depriving her of over $24,000 a year—more than half her base salary. This is not an uncommon figure. The statute of limitations for filing a wage claim under the FLSA is typically two years, and three years for a "willful" violation. This means a misclassified employee could potentially recover two to three years of unpaid back wages, plus an equal amount in "liquidated damages," effectively doubling the recovery.

This financial reality is why the tests for exemption are so rigorously defined and enforced by the U.S. Department of Labor (DOL). Your title and salary are only the beginning of the story. The heart of the matter lies in your day-to-day responsibilities.

---

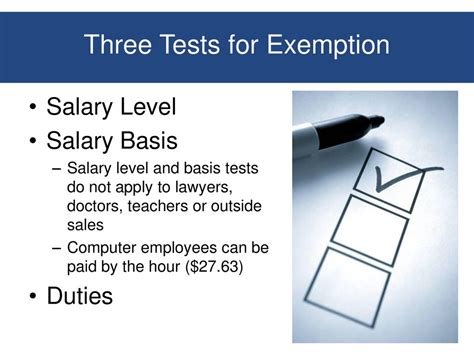

The Three Crucial Tests for Overtime Exemption

For an employer to legally classify you as exempt from overtime, you must meet all three of the following tests. Failing even one of these tests means you are non-exempt and entitled to overtime pay.

### 1. The Salary Basis Test

This test requires that you are paid a predetermined, fixed salary that is not subject to reduction because of variations in the quality or quantity of the work performed.

- What it means: You must receive your full salary for any week in which you perform *any* work, regardless of the number of days or hours worked.

- Permissible Deductions: An employer can generally only make deductions from your salary in a few specific situations:

- Absences of one or more full days for personal reasons, other than sickness or disability.

- Absences of one or more full days due to sickness or disability if the deduction is made under a bona fide sick leave plan.

- To offset amounts received as jury or witness fees.

- For penalties imposed in good faith for infractions of safety rules of major significance.

- For unpaid disciplinary suspensions of one or more full days for infractions of workplace conduct rules.

- Impermissible Deductions: If your employer regularly docks your pay for partial-day absences, for coming in late, or because there wasn't enough work to do, they may have violated the salary basis test. A single improper deduction can invalidate your exempt status for that time period, making the employer liable for overtime.

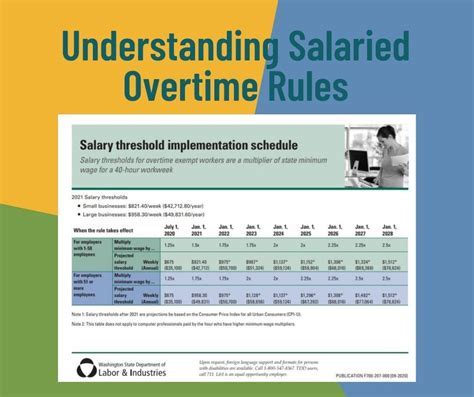

### 2. The Salary Threshold Test

This test requires that your salary meets a minimum specified amount. This threshold is set by federal law and is subject to change.

- Current Federal Threshold (as of late 2023/early 2024): The standard salary level for exemption is $684 per week, which equals $35,568 per year. If you earn less than this amount, you are automatically non-exempt and eligible for overtime, regardless of your job duties.

- Important Note on Upcoming Changes: The U.S. Department of Labor has proposed a new rule to significantly increase this threshold. The proposed rule, expected to be finalized in 2024, would raise the salary threshold to $1,059 per week ($55,068 per year) and automatically update it every three years. If this rule takes effect, millions more salaried workers in Florida and across the country will become eligible for overtime pay.

- Highly Compensated Employee (HCE) Test: There is a separate, more streamlined test for employees who earn a total annual compensation of $107,432 or more. These employees are exempt if they meet the salary basis test and "customarily and regularly" perform at least *one* of the exempt duties of an executive, administrative, or professional employee. The new proposed DOL rule would raise this HCE threshold to $143,988 per year.

### 3. The Job Duties Test

This is the most complex and frequently litigated part of the exemption analysis. Your primary job duty must fall into one of the specific exempt categories defined by the FLSA. Your job title is irrelevant; what matters is what you actually do on a day-to-day basis. The main exemption categories are:

To qualify, an employee must meet all of the following criteria:

1. Their primary duty must be managing the enterprise or a customarily recognized department or subdivision.

2. They must customarily and regularly direct the work of at least two or more other full-time employees (or their equivalent).

3. They must have the authority to hire or fire other employees, or their suggestions and recommendations as to the hiring, firing, advancement, promotion, or any other change of status of other employees must be given particular weight.

- Common Misclassification Trap: The "working foreman" or "assistant manager" who spends the vast majority of their time doing the same work as the employees they supervise (e.g., cashiering, stocking shelves, cooking food) typically does not qualify for this exemption. Their primary duty is not management.

#### The Administrative Exemption

This is one of the most challenging exemptions to apply correctly. To qualify, an employee must meet both of the following:

1. Their primary duty must be the performance of office or non-manual work directly related to the management or general business operations of the employer or the employer’s customers.

2. Their primary duty must include the exercise of discretion and independent judgment with respect to matters of significance.

- Dissecting "Discretion and Independent Judgment": This goes far beyond simply choosing between two prescribed options or applying existing skills. It involves the comparison and evaluation of possible courses of conduct and acting or making a decision after the various possibilities have been considered. Matters of significance refers to the level of importance or consequence of the work performed.

- Common Misclassification Trap: Employees who perform clerical or administrative tasks that are highly routinized or follow prescribed procedures do not qualify. This includes many roles titled "Administrative Assistant," "Executive Assistant," or "Office Manager" where the employee is primarily responsible for scheduling, bookkeeping, processing paperwork, or screening calls according to set rules, rather than formulating company policy, negotiating on behalf of the company, or making significant financial decisions. An HR assistant who simply screens resumes against a checklist is likely non-exempt; an HR manager who develops the company's compensation strategy and has the authority to make job offers is likely exempt.

#### The Professional Exemption

This category is split into two types: Learned Professionals and Creative Professionals.

- Learned Professional:

1. The employee’s primary duty must be the performance of work requiring advanced knowledge.

2. The advanced knowledge must be in a field of science or learning.

3. The advanced knowledge must be customarily acquired by a prolonged course of specialized intellectual instruction.

- Examples: This typically covers traditional professions like doctors, lawyers, registered nurses (but often not LPNs), architects, engineers, accountants, and teachers. The key is that the job *requires* the advanced degree; simply having a degree is not enough.

- Creative Professional:

1. The employee’s primary duty must be the performance of work requiring invention, imagination, originality, or talent in a recognized field of artistic or creative endeavor.

- Examples: This includes musicians, composers, writers, actors, and some painters or cartoonists. This is a fact-specific inquiry. A journalist who simply rewrites press releases is likely non-exempt, while an investigative reporter or opinion columnist who develops their own original content is likely exempt.

#### The Computer Employee Exemption

This is a specific exemption for high-level computer professionals. They can be paid on a salary basis of at least $684/week or on an hourly basis of at least $27.63 per hour. To qualify, their primary duty must consist of:

1. The application of systems analysis techniques and procedures, including consulting with users, to determine hardware, software, or system functional specifications; OR

2. The design, development, documentation, analysis, creation, testing, or modification of computer systems or programs, including prototypes, based on and related to user or system design specifications; OR

3. The design, documentation, testing, creation, or modification of computer programs related to machine operating systems; OR

4. A combination of the aforementioned duties, the performance of which requires the same level of skills.

- Common Misclassification Trap: This exemption does not apply to employees engaged in manufacturing or repairing computer hardware, nor does it cover help desk staff or employees who simply use advanced software in their work. The focus is on high-level programming and systems analysis.

#### The Outside Sales Exemption

To qualify for this exemption:

1. The employee’s primary duty must be making sales or obtaining orders or contracts for services.

2. The employee must be customarily and regularly engaged *away from* the employer’s place of business.

- Key Distinction: This exemption has no salary requirement. However, it does not apply to "inside sales" employees who conduct sales via telephone or email from the employer's office. Those employees must meet the criteria for another exemption (like the administrative one) to be ineligible for overtime.

---

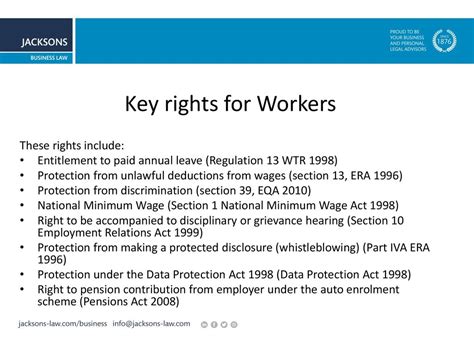

Key Protections: Deductions, Final Pay, and Minimum Wage

Beyond overtime, several other Florida and federal laws protect the integrity of your salary.

### Allowable and Prohibited Deductions from Salary

As discussed under the "Salary Basis Test," an employer's ability to deduct from an exempt employee's salary is highly restricted. Any improper deduction can destroy the exemption and trigger overtime liability.

- Florida-Specific Rules: Florida law (Statute §532.04) requires an employer to obtain written authorization from an employee before making any deductions from their paycheck for things like cash shortages, damaged property, or required uniforms. If a salaried employee's pay is docked for a cash register shortage, it's not only a potential violation of this state statute but could also invalidate their exempt status under the FLSA.

### Final Paycheck Laws in Florida

Florida is unique in that it has no state law dictating when a final paycheck must be issued to a terminated or quitting employee. In the absence of a state law, employers are generally expected to issue the final paycheck on the next regularly scheduled payday for the last pay period worked.

- What This Means for You: You cannot legally demand your final paycheck on your last day of employment. However, the employer is still obligated to pay you for all time worked. This includes any accrued, unused vacation or PTO time *if* the employer has a policy or agreement to pay it out upon separation. Florida law does not require employers to pay out unused PTO unless their own established policy says they will. Review your employee handbook carefully.

### Florida Minimum Wage and Salaried Employees

While it may seem counterintuitive, the minimum wage can still apply to salaried employees. Florida's minimum wage is adjusted annually. As of September 30, 2023, it is $12.00 per hour, and it is scheduled to increase by $1 each year until it reaches $15.00 in 2026.

- The "Salary Equivalent" Rule: For a salaried, *non-exempt* employee, their effective hourly rate must not fall below the Florida minimum wage.

- Example: A non-exempt employee is paid a salary of $400 per week and works 40 hours. Their hourly rate is $10.00/hour ($400/40), which is below Florida's $12.00/hour minimum. The employer is in violation and must increase the salary to at least $480/week ($12 x 40) to be compliant for a 40-hour week.

- Impact of Overtime: If that same employee works 50 hours in a week, their salary of $400 equates to just $8.00 per hour ($400/50). This is a clear violation. The employer would owe not only minimum wage for all 50 hours but also overtime pay based on a compliant regular rate.

This protection is a crucial backstop, ensuring that even if an employee agrees to a low salary, it cannot legally undercut the state's wage floor when their actual hours are factored in.

---

Recent Changes, Future Trends, and How to Protect Your Rights

The world of work is constantly evolving, and labor laws are often racing to keep up. Staying informed about emerging trends and potential legal changes is a key part of protecting your career and your compensation.

### The Looming Overtime Rule Change

The most significant pending change is the U.S. Department of Labor's proposed update to the salary threshold test. As mentioned, the proposal would raise the standard threshold to $55,068 and the Highly Compensated Employee threshold to $143,988.

- Impact on Florida Workers: If this rule is finalized, hundreds of thousands of salaried workers in Florida currently earning between $35,568 and $55,068 will automatically become non-exempt and eligible for overtime. Employers will face a choice:

1. Increase employee salaries to meet the new threshold.

2. Reclassify employees as non-exempt and begin paying them overtime.

3. Reclassify employees and prohibit them from working more than 40 hours per week.

- How to Prepare: If your salary falls within this range, start paying close attention to official announcements from the DOL. Begin privately tracking your hours now so you have a record of how much overtime you typically work. This data will be invaluable if your employer attempts to adjust your duties or pay structure in a way that seems unfair once the rule is enacted.

### The Impact of Remote and Hybrid Work

The massive shift to remote work has created new complexities for tracking work hours and maintaining exemptions.

- For Non-Exempt Employees: Employers are legally required to pay for *all* time worked, even if it's unauthorized overtime, as long as the employer knew or should have known about it. The ease of sending emails late at night or logging on during the weekend from home makes it critical for employers to have clear timekeeping policies for remote non-exempt staff.

- For Exempt Employees: The lines between work and home life have blurred. While exempt employees aren't paid by the hour, a sustained expectation of being "always on" can lead to burnout and may, in some fringe cases, be used as evidence in a misclassification case if the employee's "discretion and independent judgment" are eroded by constant, minute-by-minute demands from management.

### Staying Relevant and Protected: Proactive Steps

1. Read Your Job Description (and Then Ignore It): Your official job description is a starting point, but what matters legally is your *actual* day-to-day work. Keep a private work diary for a few weeks. Write down every task you perform and how much time you spend on it. Compare this real-world log to the duties tests outlined above.

2. Review Your Pay Stubs: Look for any deductions. Are they for permissible reasons? Does your salary amount ever change unexpectedly? Scrutinize every detail.

3. Understand Your Company's Policies: Get a copy of the employee handbook. Read the sections on work hours, overtime, final pay, and paid time off. What the company puts in writing can be used as evidence.

4. Follow Reputable Sources: Keep an eye on the websites for the U.S. Department of Labor's Wage and Hour Division (WHD) and the Florida Department of Economic Opportunity (now FloridaCommerce) for updates on labor laws.

5. Build Your Professional Network: Connect with peers in similar roles at other companies. Discussing general responsibilities (without sharing confidential company information) can help you benchmark whether your duties and compensation are aligned with industry standards.

---

What to Do If You Believe Your Rights Have Been Violated: A Step-by-Step Guide

If, after reading this guide, you suspect you are being misclassified or that your pay is being handled improperly, it's crucial to proceed thoughtfully and strategically. Taking the right steps can preserve your rights and maximize your chances of a successful resolution.

### Step 1: Document Everything (The Foundation)

This is the single most important step. Your memory is not enough. You must create a detailed, contemporaneous record.

- Track Your Hours: Keep a daily log of your start time, end time, and break times. Use a personal notebook, a spreadsheet on your home computer, or a mobile app. Be precise.

- Log Your Duties: For each day, write a brief description of the tasks you performed. Be specific. Instead of "worked on project," write "spent 3 hours entering data into spreadsheet per manager's instructions" or "spent 4 hours on the sales floor operating the cash register."

- Preserve Documents: Keep copies of your pay stubs, your official job description, any performance reviews, the employee handbook, and relevant emails. Important: Only use appropriate methods to preserve these documents. Do not violate company policy on confidential information; for example, forward relevant emails to your personal email account if company policy permits. When in doubt, take detailed notes of the content.

- Record Conversations: If you have conversations with managers or HR about your hours or duties, make a detailed note of the date, time, participants, and what was said immediately afterward.

### Step 2: Anonymously Research and Self-Assess

Use the information in this guide and on the U.S. DOL website to perform a thorough self-assessment. Write down which specific duties test you believe you fail and why. Calculate a rough estimate of the overtime wages you believe you are owed. This will prepare you for future conversations.

### Step 3: The Internal Approach (Proceed with Caution)

You may consider raising the issue internally with your manager or HR department. This can be the quickest way to a resolution, but it also carries risks.

- How to Frame It: Approach it as an inquiry, not an accusation. You could say something like, "I've been reading up on FLSA guidelines to better understand my role, and I'm a bit confused about how the 'administrative exemption' applies to my daily tasks. Could we review it together?"

- The Risks: Be aware that raising the issue could put a target on your back. While retaliation for inquiring about wages is illegal under the FLSA, it can be difficult to prove. Some employers may look for a pretext to terminate your employment. If you feel your workplace is hostile or uncooperative, it may be better to skip this step and proceed directly to legal counsel.

### Step 4: Understand the Clock is Ticking (Statute of Limitations)

Under the FLSA, you have a limited time to file a claim for back wages.

- Standard Limit: Two years from the date of the wage violation.

- Willful Violation Limit: Three years if you can prove the employer knowingly or with reckless disregard violated the law.

Every week that passes is a week of potential back pay that you could lose forever. Do not delay in seeking help.

### Step 5: File a Complaint with the Government

You have the right to file a wage complaint directly with the U.S. Department of Labor's Wage and Hour Division (WHD).

- The Process: You can file online, by phone, or in person at a local WHD office. The process is free and confidential. The WHD will investigate your claim. If they find a violation, they can supervise the payment of back wages.

*