In the high-stakes world of corporate leadership, few documents carry as much weight as a CEO's employment contract. Tucked within its legal clauses are the intricate details of salary, bonuses, and equity, and, just as importantly, the terms of a potential departure. You may have found your way here by searching for a phrase like "future separation agreement ceo salary letter," a collection of keywords that points directly to the heart of corporate power and finance. While not a formal job title, this search query reveals a fascination with the professionals who operate at this elite intersection of human resources, finance, and law.

This is the world of the Executive Compensation Professional. These are the strategists, analysts, and advisors who design the multi-million dollar pay packages that attract, retain, and motivate the leaders of the world's largest companies. They are the architects behind the numbers, ensuring that every dollar of compensation is justifiable, competitive, and aligned with the company's long-term goals. The earning potential in this field is immense, with seasoned Directors of Executive Compensation regularly earning salaries well into the $180,000 to $250,000+ range, and top consultants and Vice Presidents earning significantly more.

I recall a time early in my career, sitting in on a board-level meeting (as a junior analyst, mostly taking notes) where the compensation committee was debating the long-term incentive plan for a new CEO. The conversation wasn't just about money; it was about risk, shareholder perception, and the very future of the company. It was then I realized that designing a "salary letter" for a CEO is less about typing up a number and more about crafting a strategic masterpiece. This guide is designed to pull back the curtain on this exclusive and rewarding career path, transforming your curiosity into a clear, actionable roadmap.

### Table of Contents

- [What Does an Executive Compensation Professional Do?](#what-does-an-executive-compensation-professional-do)

- [Average Executive Compensation Salary: A Deep Dive](#average-executive-compensation-salary-a-deep-dive)

- [Key Factors That Influence Salary](#key-factors-that-influence-salary)

- [Job Outlook and Career Growth](#job-outlook-and-career-growth)

- [How to Get Started in This Career](#how-to-get-started-in-this-career)

- [Conclusion](#conclusion)

What Does an Executive Compensation Professional Do?

An Executive Compensation Professional—whether a Manager, Director, or external Consultant—is a specialized strategic advisor responsible for the research, design, implementation, and administration of compensation programs for a company's top-level executives. Their work goes far beyond simply setting a base salary. They construct a "total rewards" package, a complex portfolio of financial incentives designed to drive performance and align the interests of executives with those of shareholders.

The role is a unique hybrid of data scientist, financial analyst, legal expert, and human resources strategist. They must be as comfortable building a complex financial model in Excel as they are presenting their findings to a Board of Directors' Compensation Committee.

Core Responsibilities and Typical Projects:

- Benchmarking and Market Analysis: They meticulously research and analyze the compensation practices of a curated list of "peer" companies. This involves scouring public financial filings (like proxy statements) to understand what competitors are paying their top brass.

- Compensation Package Design: They are the architects of the complete executive pay package, which typically includes:

- Base Salary: The fixed annual salary.

- Short-Term Incentives (STI): Annual bonuses, usually tied to the achievement of specific financial or operational goals (e.g., revenue growth, profitability).

- Long-Term Incentives (LTI): This is often the largest component of CEO pay and includes stock options, Restricted Stock Units (RSUs), and Performance Share Units (PSUs). These incentives vest over several years to keep executives focused on long-term value creation.

- Drafting and Reviewing Agreements: This is where the phrase "future separation agreement ceo salary letter" comes directly into play. These professionals work closely with legal counsel to draft and review employment contracts, offer letters, and, critically, severance or separation agreements. They model the financial implications of these agreements under various departure scenarios (e.g., retirement, termination without cause, change in control).

- Board and Committee Advisory: A primary function is to serve as the key advisor to the Compensation Committee of the Board of Directors. They prepare materials, make recommendations, and provide the data and rationale the committee needs to make defensible pay decisions.

- Regulatory Compliance: They ensure all compensation programs comply with a labyrinth of regulations from the Securities and Exchange Commission (SEC), the Internal Revenue Service (IRS), and stock exchange listing standards. This includes overseeing the preparation of the Compensation Discussion and Analysis (CD&A) section of the company's annual proxy statement.

---

### A Day in the Life of a Director of Executive Compensation

To make this role more tangible, let's imagine a day for "Alex," a Director of Executive compensation at a publicly traded tech company.

- 8:30 AM: Alex starts the day reviewing overnight market news and analyst reports on their company and key competitors. A major competitor just announced a new equity grant for their CEO, and Alex immediately flags it for analysis.

- 9:00 AM: Alex joins a call with the company's external legal counsel and the Chief Human Resources Officer (CHRO) to finalize the terms of a separation agreement for a departing senior vice president. They model the final payout, including pro-rated bonuses and accelerated vesting of stock awards, ensuring it aligns with the original employment contract.

- 11:00 AM: Time for deep-focus work. Alex opens a massive Excel model to begin benchmarking their executive team's proposed salaries and bonuses for the upcoming year against the new peer group data. This involves pulling data from public filings and survey databases.

- 1:00 PM: Alex has a working lunch with the VP of Finance to discuss the financial performance metrics that will be used for the next year's annual bonus plan. They debate the merits of using EBITDA vs. Free Cash Flow as the primary driver.

- 2:30 PM: Alex meets with a junior compensation analyst on their team to review a draft of a presentation for the upcoming Compensation Committee meeting. Alex provides feedback, pushing the analyst to make the data visualizations clearer and the key takeaways more impactful.

- 4:00 PM: Alex receives an urgent email from the CHRO. A top candidate for a critical EVP role is negotiating their offer, specifically asking for a larger initial equity grant. Alex quickly models the potential dilution and cost of the request and provides the CHRO with three counter-offer options and talking points.

- 5:30 PM: Before logging off, Alex spends 30 minutes reading a report from a consulting firm like Willis Towers Watson on emerging trends in Environmental, Social, and Governance (ESG) metrics being tied to executive pay. Staying ahead of these trends is crucial for their advisory role.

---

Average Executive Compensation Salary: A Deep Dive

The field of executive compensation is one of the most lucrative specializations within human resources and corporate finance. Compensation is high precisely because the stakes are high; these professionals are directly responsible for managing a company's largest and most scrutinized expense: the pay of its leaders.

Salary data for this specific niche is best captured by dedicated salary aggregators and industry surveys rather than broad government sources. It's crucial to look at titles like "Executive Compensation Manager" and "Director of Executive Compensation" to get an accurate picture.

According to Salary.com, as of late 2023, the median annual salary in the United States for a Director of Executive Compensation is approximately $191,737. However, this base salary is only part of the story. The typical range for this role is quite broad, generally falling between $163,858 and $224,195, with significant potential for higher earnings based on the factors we'll discuss below.

For an Executive Compensation Manager, a step below the director level, Salary.com reports a median salary of $144,489, with a common range of $129,081 to $161,985.

These figures represent base salary only. The "total compensation" package, which includes annual cash bonuses and other incentives, is substantially higher.

### Salary by Experience Level

Compensation in this field scales dramatically with experience, responsibility, and strategic impact. Here’s a breakdown of the typical career and salary progression:

| Experience Level | Common Job Title(s) | Typical Base Salary Range (USD) | Potential Annual Bonus | Notes |

| :--- | :--- | :--- | :--- | :--- |

| Entry-Level (0-3 years) | Compensation Analyst, Junior Consultant | $70,000 - $95,000 | 5% - 15% | Focus on data gathering, survey participation, spreadsheet maintenance, and supporting senior team members. |

| Mid-Career (4-8 years) | Senior Compensation Analyst, Executive Compensation Manager, Consultant | $100,000 - $150,000 | 15% - 30% | Manages programs, performs complex analyses, begins to interact with business leaders, and may have direct reports. |

| Senior-Level (8-15+ years) | Director of Executive Compensation, Senior Manager, Principal Consultant | $160,000 - $250,000+ | 25% - 50%+ | Sets strategy, presents to the Board's Compensation Committee, manages a team, and is the primary advisor on all executive pay matters. |

| Executive/Partner (15+ years) | VP of Total Rewards, Partner at Consulting Firm, CHRO | $250,000 - $500,000+ | 50% - 100%+ | Oversees all compensation and benefits functions globally. As a partner, compensation is tied to business development and firm profitability. |

*Sources: Data compiled and synthesized from Salary.com, Payscale, and Willis Towers Watson general industry survey reports.*

### Deconstructing the Compensation Package

Understanding the components of pay is essential in this field. Total compensation for a senior professional is a sophisticated blend of different elements:

1. Base Salary: This is the fixed, predictable portion of pay. While important, it often constitutes less than half of the total potential earnings for senior roles.

2. Annual Cash Bonus / Short-Term Incentive (STI): This is a variable cash payment based on performance. For a Director of Executive Compensation, the target bonus is typically set as a percentage of base salary (e.g., 30%). The actual payout can range from 0% (if goals aren't met) to 200% of the target (for exceptional performance). The bonus is often tied to both company performance (e.g., revenue, profit) and individual performance.

3. Long-Term Incentives (LTI): In many public companies, directors and VPs in this role are eligible for the same LTI plans they help administer. These are equity awards designed to retain talent and align their interests with shareholders over a multi-year period.

- Restricted Stock Units (RSUs): A grant of company shares that vest over a set period (e.g., 3-4 years). Once vested, they are owned outright by the employee.

- Stock Options: The right to buy company stock at a predetermined price in the future. They only have value if the company's stock price increases.

- Performance Share Units (PSUs): An equity grant where the number of shares that ultimately vest depends on the company achieving specific long-term performance goals (e.g., total shareholder return vs. peers).

4. Benefits and Perquisites: This includes a comprehensive benefits package (health, dental, vision), a robust 401(k) plan with a generous company match, and sometimes additional "perks" like deferred compensation plans, financial planning services, or an executive car allowance.

For a senior director at a large public company, a total compensation package could look like this:

- Base Salary: $220,000

- Target Bonus (at 40%): $88,000

- Annual LTI Grant Value: $100,000

- Total Target Compensation: $408,000

This demonstrates why the field is so attractive and why expertise is so highly valued.

Key Factors That Influence Salary

While the national averages provide a solid baseline, your actual earning potential as an executive compensation professional is determined by a combination of personal qualifications and market-specific factors. Mastering these elements is the key to maximizing your income throughout your career.

###

Level of Education

Your educational background is the foundation of your career and has a direct impact on your starting salary and long-term trajectory.

- Bachelor's Degree: A bachelor's degree is the minimum requirement. The most relevant and advantageous majors are Finance, Accounting, Economics, Business Administration, and Human Resources. A degree in a quantitative field demonstrates the analytical rigor needed for the role.

- Master's Degree: An advanced degree can significantly accelerate your career.

- Master of Business Administration (MBA): An MBA is highly valued, particularly from a top-tier business school. It provides a holistic understanding of business strategy, finance, and operations, which is crucial for aligning compensation with business goals. An MBA can often lead to higher-level entry points (e.g., Senior Manager) and a salary premium of 15-25%.

- Master's in Human Resources (MHR) or Industrial & Labor Relations (MILR): These specialized degrees provide deep expertise in HR theory, compensation design, and employment law. They are excellent for those committed to a long-term career in HR leadership.

- Juris Doctor (J.D.): A law degree is a powerful, though less common, differentiator. Professionals with a J.D. are exceptionally well-suited for roles that heavily involve contract negotiation, SEC compliance, and the legal intricacies of employment and separation agreements. They often command the highest salaries, especially in senior roles at large public companies or as specialized consultants.

- Professional Certifications: Certifications are a critical way to signal expertise and command a higher salary. The gold standard in the compensation field is offered by WorldatWork, a global professional association.

- Certified Compensation Professional (CCP®): This is the foundational, must-have certification. It demonstrates comprehensive knowledge of compensation principles, including base pay management, variable pay, and market pricing. Earning a CCP can lead to a measurable salary increase.

- Certified Executive Compensation Professional (CECP®): This is the elite, advanced certification for those specializing in executive pay. It covers topics like equity compensation, board governance, and SEC regulations. Holding a CECP is a clear indicator of a senior-level expert and is often a prerequisite for director-level roles, carrying a significant salary premium.

###

Years of Experience

Experience is arguably the single most important factor in salary determination. The career path involves a clear progression from tactical execution to strategic leadership.

- 0-3 Years (Analyst Level): At this stage, you are building your core skills. You spend most of your time in Excel, pulling data from surveys, benchmarking individual jobs, and checking for data integrity. Your salary ($70k - $95k) reflects your role as a learner and doer.

- 4-8 Years (Manager/Senior Analyst Level): You begin to own processes. You might manage the annual salary review cycle or take the lead on benchmarking the entire executive team. You develop more sophisticated financial models and start to interpret the data, providing recommendations instead of just reports. Your salary ($100k - $150k) increases as you take on more project management responsibility and analytical ownership.

- 8-15+ Years (Director/Senior Manager Level): You have transitioned from analyst to advisor. Your primary audience is now the C-suite and the Board of Directors. Your focus is on long-term strategy, designing new incentive plans, managing regulatory risks, and guiding senior leadership through complex decisions. Your salary ($160k - $250k+) reflects your strategic impact and the high level of trust placed in your judgment. At this stage, a significant portion of your compensation becomes variable (bonuses, LTI), directly tying your earnings to the company's success.

- 15+ Years (VP/Partner Level): As a Vice President of Total Rewards or a Partner at a consulting firm, you are a recognized leader in the field. You manage the entire global compensation and benefits function or, in consulting, you are responsible for managing major client relationships and driving business development. Compensation at this level can easily exceed $500,000, with a heavy emphasis on performance-based pay and firm/company equity.

###

Geographic Location

Where you work matters immensely. Salaries for executive compensation roles are significantly higher in major metropolitan areas with a high cost of living and a high concentration of corporate headquarters.

According to data from Salary.com's cost-of-living and salary comparison tools (as of late 2023), here's how the median salary for a Director of Executive Compensation can vary across the United States:

| Metropolitan Area | Median Base Salary (USD) | Difference from National Median |

| :--- | :--- | :--- |

| San Francisco, CA | $240,642 | +25% |

| New York, NY | $230,854 | +20% |

| Boston, MA | $215,860 | +13% |

| Chicago, IL | $200,381 | +4% |

| National Median | $191,737 | - |

| Dallas, TX | $191,545 | ~0% |

| Atlanta, GA | $186,176 | -3% |

| Phoenix, AZ | $183,141 | -4% |

| Tampa, FL | $178,027 | -7% |

*Source: Analysis using Salary.com salary tools, November 2023.*

Working in a high-paying city like San Francisco or New York can increase your base salary by over 20% compared to the national median. While the cost of living is also higher, these locations offer the most abundant opportunities for high-level roles within Fortune 500 companies and leading consulting firms.

###

Company Type & Size

The type and size of your employer create vastly different work environments and compensation structures.

- Large Public Corporations (Fortune 500): These companies offer the highest and most stable base salaries and bonus potential. The work is complex, governed by strict SEC regulations and intense shareholder scrutiny (e.g., "Say-on-Pay" advisory votes). You will be part of a large, specialized team and work on sophisticated global programs.

- Consulting Firms (e.g., Mercer, Korn Ferry, Willis Towers Watson, Aon): Working for a top-tier HR consulting firm can be extremely lucrative. The compensation model is typically a moderate base salary plus a very significant annual bonus tied to billable hours, client management, and business development. The environment is fast-paced and demanding, but you gain exposure to dozens of different companies and industries, accelerating your learning and expertise.

- Private/Pre-IPO Companies (Startups): The compensation structure here is a trade-off. Base salaries and cash bonuses are often lower than at large public companies. The massive upside comes from equity compensation. Joining a successful startup before its Initial Public Offering (IPO) can lead to life-changing wealth if the company's stock performs well. The work involves building compensation structures from the ground up in a fast-changing, less structured environment.

- Non-Profit/Government: These sectors also require compensation professionals, but the pay scales are significantly lower. A role at a large foundation or university will pay more than a government position, but neither will compete with the corporate sector. The work is often mission-driven, focusing on equitable pay structures and responsible stewardship of funds rather than shareholder value.

###

Area of Specialization

Within the broader field of executive compensation, developing deep expertise in a specific niche can make you a more valuable and higher-paid professional.

- Equity Compensation: This is arguably the most valuable specialization. Experts who understand the accounting, tax, and legal implications of stock options, RSUs, PSUs, and Employee Stock Purchase Plans (ESPPs) are in constant demand. Holding a Certified Equity Professional (CEP) designation is highly recommended.

- Sales Compensation: Another lucrative niche involves designing incentive plans for sales forces. This requires a deep understanding of sales cycles, quota setting, and how to motivate sales behavior through commissions and bonuses.

- Global Compensation: For multinational corporations, managing compensation across different countries with varying currencies, tax laws, and cultural norms is a major challenge. Professionals with experience in global mobility and international compensation are highly sought after.

- Mergers & Acquisitions (M&A): During a merger or acquisition, harmonizing the compensation and benefit plans of two different companies is a critical and complex task. Specialists who can manage this process, especially retaining key talent through the transition, are extremely valuable.

###

In-Demand Skills

Beyond your background, a specific set of skills will directly correlate with your ability to command a higher salary.

- Advanced Financial Modeling: You must be a wizard in Microsoft Excel. This means going beyond VLOOKUPs and pivot tables to build dynamic, multi-variable models that can project the cost and impact of different compensation scenarios.

- Data Analysis and Visualization: The ability to take vast amounts of raw data, identify meaningful trends, and present them in a clear, compelling way (using tools like Tableau or PowerPoint) is essential for influencing senior leaders.

- Legal and Regulatory Acumen: You don't need to be a lawyer, but you must have a strong working knowledge of SEC disclosure rules (proxy statements), IRS tax codes (like 409A, which governs deferred compensation), and employment law.

- Exceptional Communication and Presentation Skills: You will regularly present complex, sensitive information to the most powerful people in the company. The ability to be concise, confident, and persuasive is non-negotiable.

- Discretion and Executive Presence: You will be privy to the most confidential information in the company. Demonstrating unwavering discretion, maturity, and a professional "executive presence" is critical for building the trust necessary to succeed in this role.

Job Outlook and Career Growth

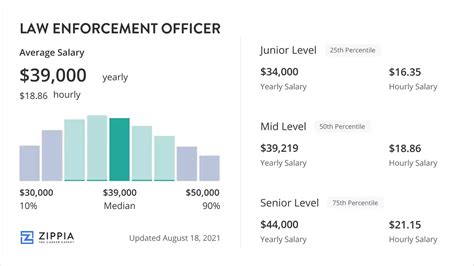

The career outlook for skilled compensation professionals, especially those specializing in executive pay, is strong and stable. While the U.S. Bureau of Labor Statistics (BLS) does not track "Executive Compensation Director" as a distinct profession, we can analyze related, broader categories to understand the general trend.

The BLS projects that employment for Compensation, Benefits, and Job Analysis Specialists will grow by 7 percent from 2022 to 2032, which is faster than the average for all occupations. The BLS states, "As healthcare coverage and retirement plans have become more complex, job prospects are expected to be good for compensation and benefits specialists." This complexity is magnified tenfold at the executive level, ensuring a continued demand for true experts.

Similarly, the outlook for Human Resources Managers, a common career path for senior compensation professionals, is projected to grow by 5 percent over the same period, also faster than average. The BLS anticipates about 16,300 openings for HR managers each year, on average, over the decade.

The demand for this role is driven by several enduring and emerging trends:

### Emerging Trends and Future