Introduction

Have you ever felt a deep sense of satisfaction from helping someone navigate a complex problem, bringing clarity and confidence to their decision-making process? Imagine building a career on that very foundation—a profession where your guidance empowers individuals and families to achieve their most cherished life goals, from sending a child to college to retiring with dignity. This is the world of the personal financial advisor, a career path that offers not only significant financial rewards, with a median salary approaching six figures, but also immense personal fulfillment.

The need for sound financial advice has never been greater. In a world of volatile markets, complex investment products, and endless online "calculators," people are searching for a trusted professional to help them cut through the noise. This article serves as your definitive roadmap to becoming that trusted guide. It's an in-depth exploration of the personal financial advisor career, covering everything from day-to-day responsibilities and salary potential to the exact steps you need to take to get started.

I spent the early part of my career in a support role at a wealth management firm. I'll never forget witnessing a senior advisor work with a young couple who were overwhelmed by their first major purchase. They came in fixated on a simple question—"how much car can I afford based on my salary calculator?"—but left with a comprehensive plan that not only got them a safe, affordable vehicle but also put them on the path to buying their first home within three years. That moment crystallized for me the profound, life-altering impact a great financial advisor can have, transforming a simple financial query into a foundation for long-term prosperity.

This guide is designed to give you that same sense of clarity about your own career path. We will delve into the data, explore the nuances, and provide you with the actionable advice needed to build a successful and rewarding career in financial planning.

### Table of Contents

- [What Does a Personal Financial Advisor Do?](#what-does-a-personal-financial-advisor-do)

- [Average Personal Financial Advisor Salary: A Deep Dive](#average-personal-financial-advisor-salary-a-deep-dive)

- [Key Factors That Influence an Advisor's Salary](#key-factors-that-influence-salary)

- [Job Outlook and Career Growth for Financial Advisors](#job-outlook-and-career-growth)

- [How to Get Started in a Financial Advisor Career](#how-to-get-started-in-this-career)

- [Conclusion: Is This the Right Path for You?](#conclusion)

What Does a Personal Financial Advisor Do?

At its core, a personal financial advisor is a professional who provides expert guidance to help clients manage their finances and achieve their long-term economic goals. Their work extends far beyond simply picking stocks or managing a 401(k). They act as a financial quarterback, coordinating all aspects of a person's financial life, including budgeting, saving, investing, insurance, taxes, estate planning, and retirement.

The role is built on a foundation of trust. Advisors must first take the time to deeply understand a client's entire financial picture, their life circumstances, their risk tolerance, and their most important aspirations. Is their primary goal to retire early, fund a child's Ivy League education, buy a vacation home, or start a business? The answer shapes every piece of advice that follows.

Core Responsibilities and Typical Projects:

- Financial Planning: This is the cornerstone of the profession. Advisors create comprehensive, written financial plans that act as a roadmap for the client's future. This document outlines the client's current financial standing, their goals, and the specific strategies recommended to reach them.

- Investment Management: Based on the financial plan, advisors recommend and manage investment portfolios. This involves selecting an appropriate mix of assets (stocks, bonds, mutual funds, ETFs, etc.) that aligns with the client's risk tolerance and time horizon.

- Retirement Planning: A significant portion of an advisor's work involves helping clients prepare for retirement. This includes calculating how much they need to save, optimizing retirement accounts like 401(k)s and IRAs, and creating strategies for generating income in retirement.

- Risk Management and Insurance Analysis: Advisors assess a client's exposure to financial risks and recommend appropriate insurance coverage, such as life, disability, and long-term care insurance.

- Client Education and Communication: A crucial part of the job is explaining complex financial concepts in simple, understandable terms. Advisors regularly meet with clients to review their progress, adjust strategies based on life changes (like a marriage, new job, or inheritance), and provide behavioral coaching to help them stay the course during market volatility.

- Business Development: Unless they work in a salaried role, most advisors are also responsible for finding and onboarding new clients. This involves networking, marketing, and demonstrating their value to prospective clients.

### A Day in the Life of a Personal Financial Advisor

To make this more concrete, let's walk through a typical day for a mid-career financial advisor.

- 8:00 AM - 9:00 AM: Market and News Review. The day begins by catching up on overnight market performance, reading key financial news from sources like *The Wall Street Journal* and *Bloomberg*, and reviewing any economic data releases that could impact client portfolios. They check their email for urgent client inquiries.

- 9:00 AM - 10:00 AM: Meeting Preparation. The advisor prepares for their 10:00 AM client meeting. This involves reviewing the client's portfolio, their financial plan, and the meeting agenda. Today's meeting is with a pre-retiree couple, so the prep involves running new retirement income projections and preparing a presentation on Social Security claiming strategies.

- 10:00 AM - 11:30 AM: Client Meeting. The advisor meets with the pre-retiree couple. They review the progress toward their retirement goal, discuss the recent market downturn and why it's important to stick to their long-term strategy, and present the different options for drawing income from their portfolio in retirement. The advisor listens intently to their concerns and answers their questions with empathy and data.

- 11:30 AM - 1:00 PM: Follow-up and Lunch. After the meeting, the advisor writes up detailed notes in the client's CRM (Customer Relationship Management) file and dictates a summary email outlining the key decisions and action items. They then take a quick lunch while scanning industry blogs.

- 1:00 PM - 3:00 PM: Financial Plan Development. The advisor dedicates a block of time to deep work. Today, they are building a comprehensive financial plan for a new client, a 35-year-old doctor. This involves analyzing her cash flow, debt (student loans), current investments, and insurance. The advisor uses financial planning software to model different scenarios, such as helping her decide between aggressively paying down debt or increasing investment contributions. This is where a question like "how much car can I afford based on my salary" is put into the much larger context of her overall financial health.

- 3:00 PM - 4:00 PM: Portfolio Trading and Rebalancing. The advisor executes trades for several client accounts to rebalance their portfolios back to their target asset allocations. This is a detail-oriented task that requires precision and adherence to compliance procedures.

- 4:00 PM - 5:30 PM: Prospecting and Networking. The advisor dedicates the last part of the day to business growth. They make follow-up calls to two prospective clients they met at a seminar last week. They also spend 30 minutes on LinkedIn, sharing a relevant article and engaging with connections in their network.

- 5:30 PM: Wrap-up and Plan for Tomorrow. The advisor reviews their calendar for the next day, creates a to-do list, and handles any final, non-urgent emails before heading home.

This "day in the life" illustrates the dynamic blend of analytical skill, interpersonal communication, strategic thinking, and sales acumen required to excel in the role.

Average Personal Financial Advisor Salary: A Deep Dive

One of the most compelling aspects of a career as a personal financial advisor is its significant earning potential. However, understanding advisor compensation is more complex than looking at a single number, as it can be structured in many different ways. An advisor's income is directly tied to their ability to build a client base, the value of the assets they manage, and the business model they operate under.

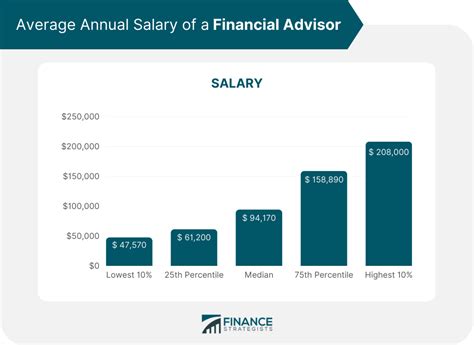

According to the U.S. Bureau of Labor Statistics (BLS) in its Occupational Outlook Handbook, the median annual wage for personal financial advisors was $99,580 as of May 2023. This is a strong figure, well above the median for all occupations. But this median only tells part of the story.

The BLS data also reveals a wide salary spectrum:

- The lowest 10 percent earned less than $49,810.

- The highest 10 percent earned more than $239,200.

This vast range highlights how much an advisor's income depends on factors like experience, location, certifications, and business model—all of which we will explore in the next section. Reputable salary aggregators provide further insight into this range. For instance, Salary.com reports a typical range for a Financial Advisor in the United States between $81,399 and $122,236 as of May 2024, while Payscale shows a range from $50k to $146k for the base salary alone.

### Salary Progression by Experience Level

An advisor's income typically follows a steep upward trajectory as they gain experience, build a client roster, and accumulate assets under management (AUM).

| Experience Level | Typical Title | Average Base Salary Range | Common Compensation Structure |

| :--- | :--- | :--- | :--- |

| Entry-Level (0-2 years) | Financial Advisor Trainee, Paraplanner, Associate Advisor | $50,000 - $70,000 | Primarily salary-based, often with a small bonus. Focus is on learning and support. |

| Mid-Career (3-9 years) | Financial Advisor, Lead Advisor | $75,000 - $120,000 | A mix of salary and commissions/bonuses, or a transition to a fee-based model. |

| Senior/Experienced (10+ years)| Senior Financial Advisor, Wealth Manager, Partner | $125,000 - $250,000+ | Primarily fee-based (AUM), commissions, or partnership income/equity in a firm. |

*Source: Data compiled and synthesized from Payscale, Glassdoor, and industry reports as of 2024.*

It's crucial to note that for experienced advisors, "base salary" can be misleading. Many top earners have a relatively low base salary, with the vast majority of their income coming from variable compensation.

### Breakdown of Compensation Components

Understanding the different ways advisors are paid is key to understanding their potential income. There are four primary models:

1. Salary-Based: Common for entry-level roles or advisors working for banks or some large firms. They receive a set salary and may be eligible for a year-end bonus based on individual and firm performance. This provides stability but often has a lower ceiling than other models.

2. Commission-Based: These advisors earn money from selling financial products, such as mutual funds (loads), annuities, or insurance policies. While the earning potential can be high, this model can create potential conflicts of interest, as the advisor may be incentivized to recommend products that pay a higher commission rather than what is purely best for the client. This model is becoming less common in its pure form.

3. Fee-Only: This is considered the gold standard for fiduciary advice. Fee-only advisors are compensated directly by their clients and do not accept any commissions. This minimizes conflicts of interest. The fees can be structured in several ways:

- Assets Under Management (AUM): The most common model. The advisor charges an annual percentage of the total assets they manage for the client (e.g., 1% of a $1 million portfolio = $10,000 annual fee). This aligns the advisor's interests with the client's—as the client's portfolio grows, so does the advisor's fee.

- Flat Fee / Retainer: The advisor charges a fixed annual or quarterly fee for ongoing financial planning and investment management, regardless of asset size. This is popular for clients with high income but lower investable assets.

- Hourly Rate: The advisor charges for their time, much like a lawyer or accountant. This is common for project-based work, like creating a one-time financial plan.

4. Fee-Based (Hybrid): This is a combination of the fee-only and commission models. An advisor might charge an AUM fee for managing a portfolio but also be licensed to sell insurance or other commission-based products. While this offers flexibility, advisors are required to disclose how they are being compensated clearly.

Successful senior advisors, especially those running their own Registered Investment Advisor (RIA) firms, often see their income primarily derived from a recurring AUM fee stream. A solo advisor managing $50 million in client assets with a 1% average fee would generate $500,000 in gross revenue for their firm. After business expenses (office, technology, staff, compliance), their take-home pay can be substantial. This scalability is what allows top-tier advisors to earn well into the high six or even seven figures.

Key Factors That Influence Salary

While the national averages provide a useful benchmark, an individual financial advisor's earnings are influenced by a powerful combination of factors. Mastering these elements is the key to maximizing your income and career potential in this field. This section breaks down the most critical variables that determine your pay.

###

Level of Education and Professional Certifications

Your educational background and, more importantly, your professional credentials are a primary driver of trust, credibility, and earning power.

- Baseline Education: A bachelor's degree is the standard entry requirement for the profession. Degrees in finance, economics, business, or accounting are most common as they provide a strong foundational knowledge. While a specific major isn't always mandatory, it provides a significant advantage.

- Advanced Degrees: A Master of Business Administration (MBA) or a Master of Science in Finance (MSF) can open doors to more senior roles, particularly within larger corporations or investment banks. An MBA from a top-tier program can significantly boost starting salary and long-term career trajectory.

- Professional Certifications (The Game Changer): This is arguably the most important factor in this category. Certifications signal a level of expertise, ethical commitment, and specialized knowledge that clients and employers value highly.

- CERTIFIED FINANCIAL PLANNER™ (CFP®): This is the undisputed gold standard in the personal finance industry. Achieving CFP® certification requires meeting rigorous standards in education, examination, experience, and ethics (the "4 E's"). CFP® professionals are trained in all facets of financial planning, and studies consistently show they earn significantly more than their non-certified peers. A 2023 survey by the CFP Board found that CFP® professionals report higher median incomes and greater client trust. Holding this designation can increase compensation by 10-25% or more.

- Chartered Financial Analyst (CFA®): This is a highly respected and globally recognized designation focused on advanced investment analysis, portfolio management, and security analysis. While the CFP® is client-facing and holistic, the CFA® is more technical and quantitative. It's ideal for advisors who want to specialize in investment management or work with ultra-high-net-worth clients. CFA® charterholders are among the highest earners in the financial industry.

- Other Key Designations: Other valuable certifications include the Chartered Financial Consultant (ChFC®), which is similar in scope to the CFP®, and the Certified Public Accountant (CPA), which is invaluable for advisors who specialize in tax-advantaged financial planning.

###

Years of Experience

Experience in financial advising is not just about time served; it's about the accumulation of knowledge, client relationships, and assets under management (AUM). The salary growth curve is one of the steepest of any profession.

- 0-2 Years (The Foundation Phase): In this stage, you are typically in a support role like a Paraplanner or an Associate Advisor. Your primary function is to learn the business, support senior advisors, handle administrative tasks, and begin sitting in on client meetings. Compensation is mostly salary-based, ranging from $50,000 to $70,000.

- 3-9 Years (The Growth Phase): You are now a full-fledged Financial Advisor, managing your own client relationships and possibly starting to build your own book of business. Your focus shifts from support to direct client management and business development. Your compensation model likely shifts to a hybrid of salary plus variable pay, or you may move to a fully fee-based model. Earnings can grow rapidly into the $75,000 to $120,000 range, with top performers exceeding this.

- 10-19 Years (The Mastery Phase): As a Senior Advisor or Wealth Manager, you have a well-established practice, a deep roster of loyal clients, and significant AUM. Your expertise is sought after, and you may be mentoring junior advisors. Your income is almost entirely variable (AUM fees, partnership draws) and can range from $150,000 to $300,000+. Your value is directly tied to the success of your clients and your firm.

- 20+ Years (The Legacy Phase): Top advisors at this stage are often partners or owners of their firms. They manage hundreds of millions or even billions in client assets. Their focus may shift to firm strategy, managing other advisors, and working with a select group of ultra-high-net-worth families. Income at this level can easily exceed $500,000 and can reach into the seven figures.

###

Geographic Location

Where you build your practice has a substantial impact on your income, driven by the cost of living and the concentration of wealth. Advisors in major financial hubs and affluent metropolitan areas command higher salaries and have access to a larger pool of high-net-worth clients.

Here's a look at how salaries can vary by location, based on BLS and salary aggregator data:

Top-Paying Metropolitan Areas for Personal Financial Advisors:

| Metro Area | Annual Mean Wage |

| :--- | :--- |

| New York-Newark-Jersey City, NY-NJ-PA | $175,000+ |

| San Francisco-Oakland-Hayward, CA | $160,000+ |

| Bridgeport-Stamford-Norwalk, CT | $155,000+ |

| Boston-Cambridge-Nashua, MA-NH | $145,000+ |

| San Jose-Sunnyvale-Santa Clara, CA | $140,000+ |

States with lower average wages for this profession often include those in the Southeast and non-metropolitan areas of the Midwest, where the cost of living and concentration of wealth are lower. However, a successful advisor can build a thriving practice anywhere, and the rise of virtual meetings has somewhat reduced geographic constraints.

###

Company Type & Size

The type of firm an advisor works for fundamentally shapes their role, culture, and compensation structure.

- Wirehouses (e.g., Merrill Lynch, Morgan Stanley, UBS, Wells Fargo): These are large, national, full-service brokerage firms. Advisors here have access to a huge brand name, extensive resources, research, and technology. They often start in training programs with a base salary that transitions to a commission or fee-based grid payout over time. The culture can be more sales-oriented, with high pressure to meet production goals. Earning potential is very high for top producers.

- Independent Broker-Dealers (IBDs) (e.g., LPL Financial, Raymond James): Advisors here are independent business owners who affiliate with the IBD for compliance, technology, and back-office support. They have more freedom and flexibility than wirehouse advisors but are responsible for their own business expenses. Payouts are typically higher than at wirehouses, but support may be less comprehensive.

- Registered Investment Advisor (RIA) Firms: These firms are legally held to a fiduciary standard, meaning they must always act in their clients' best interests. They are often fee-only. An advisor can work for an existing RIA or, with enough experience, start their own. This model offers the most autonomy and the highest long-term earning potential, as the advisor/owner keeps a larger portion of the revenue. However, it also comes with the full responsibility of running a business.

- Banks and Credit Unions: Financial advisors in a bank setting often work with the bank's existing customers. The role may involve a stable salary plus bonuses for hitting referral or sales targets. This can be a good entry point but may have a lower long-term ceiling compared to independent models.

- Insurance Companies: Many advisors start their careers at insurance companies, where the focus is on selling life insurance, annuities, and other risk management products. Compensation is heavily commission-based.

###

Area of Specialization

Just as doctors specialize, financial advisors can significantly increase their value and income by developing deep expertise in a specific niche.

- High-Net-Worth (HNW) & Ultra-High-Net-Worth (UHNW) Clients: Specializing in clients with $1 million+ (HNW) or $30 million+ (UHNW) in investable assets is highly lucrative. These clients have complex needs involving estate planning, tax optimization, private investments, and philanthropy.

- Retirement Income Planning: With millions of Baby Boomers entering retirement, specialists who can create sustainable income streams from investment portfolios are in high demand.

- Business Owners & Entrepreneurs: This niche involves advising on succession planning, exit strategies, executive compensation, and integrating personal and business finances.

- Doctors and Medical Professionals: This group has high incomes but often high debt and unique financial challenges, making them a prime niche for specialized advice.

- Other Niches: Other popular specializations include advising athletes, entertainers, corporate executives with stock options, or young professionals in the tech industry.

###

In-Demand Skills

Beyond technical knowledge, certain soft and hard skills can directly translate to a higher salary.

- Business Development & Sales: An advisor's income is ultimately tied to their ability to attract and retain clients. Strong networking, prospecting, and sales skills are non-negotiable for success in most advisory models.

- Emotional Intelligence & Behavioral Coaching: The best advisors are part psychologist. They understand that clients often make irrational decisions based on fear and greed. The ability to manage client emotions and coach them through market cycles is an invaluable skill that builds loyalty and trust.

- Holistic Financial Planning: Moving beyond simple investment management to provide comprehensive advice on taxes, estates, insurance, and cash flow adds immense value and justifies higher fees.

- Technological Proficiency: Expertise in financial planning software (e.g., eMoney, MoneyGuidePro), CRM systems (e.g., Salesforce), and portfolio management tools is essential for efficiency and scaling a practice.

- Communication Skills: The ability to explain complex topics simply and build strong, trusting relationships is the bedrock of the entire profession.

Job Outlook and Career Growth

For those considering a career as a personal financial advisor, the future looks exceptionally bright. The demand for qualified financial guidance is not only strong but is projected to grow significantly over the next decade, driven by powerful demographic and economic trends.

### Strong Projected Job Growth

The most authoritative source on this subject, the U.S. Bureau of Labor Statistics (BLS), projects a robust outlook for the profession. According to the 2023 Occupational Outlook Handbook, employment of personal financial advisors is projected to grow 13 percent from 2022 to 2032. This growth rate is much faster than the average for all occupations, which is projected at 3 percent.

The BLS anticipates about 31,000 openings for personal financial advisors each year, on average, over the decade. Many of these openings are expected to result from the need to replace workers who transfer to different occupations or exit the labor force, such as to retire. This "graying" of the advisor workforce, with a large number of experienced advisors nearing retirement, creates a significant opportunity for the next generation to enter and advance in the field.

### Key Trends Fueling Demand

Several major trends are underpinning this impressive growth forecast:

1. The "Great Wealth Transfer" and Retiring Baby Boomers: The Baby Boomer generation is