Introduction

Earning a six-figure salary is a significant career milestone that opens up new financial possibilities, with homeownership often being chief among them. A $100,000 annual income places you well above the U.S. median household income, which was $74,580 in 2022 according to the U.S. Census Bureau. This strong earning potential puts you in a solid position to purchase a home.

However, the question "How much house can I afford?" isn't answered with a single number. It’s a complex calculation that depends on your debt, down payment, location, and the current financial market. This guide will break down the key rules, influential factors, and hidden costs to give you a clear and realistic picture of your home-buying power.

The Starting Point: Common Affordability Rules

Financial experts and mortgage lenders use several rules of thumb to get a quick estimate of what you can afford. These are not absolute laws but serve as an excellent starting point for your research.

The 28/36 Rule: This is the most common rule used by lenders. It states:

- The "28" Front-End Ratio: Your total monthly housing costs (principal, interest, taxes, and insurance—or PITI) should not exceed 28% of your gross monthly income.

- The "36" Back-End Ratio: Your total monthly debt payments (including your new housing payment, car loans, student loans, and credit card minimums) should not exceed 36% of your gross monthly income.

Let's do the math for a $100,000 salary:

- Gross Monthly Income: $100,000 / 12 = $8,333

- Maximum Monthly Housing Payment (28%): $8,333 x 0.28 = $2,333

- Maximum Total Monthly Debt (36%): $8,333 x 0.36 = $3,000

This means lenders will look for your potential mortgage payment to be around or below $2,333 per month, assuming your other debts don't push your total above $3,000.

The 3x to 4x Annual Salary Rule: A much simpler, back-of-the-napkin estimate suggests you can afford a home that costs between three and four times your gross annual salary. For a $100k income, this would place your target home price in the $300,000 to $400,000 range. While easy to remember, this rule ignores the critical factors of debt and interest rates.

Key Factors That Influence Your Home Affordability

The rules above provide a ballpark figure, but the final number on your pre-approval letter will be determined by a much more detailed look at your personal finances.

### Your Debt-to-Income (DTI) Ratio

This is the single most important metric for lenders. It’s a refined version of the "36" rule. If you have significant existing debts, your home-buying power decreases. Let’s say you have a $500 monthly car payment and a $300 monthly student loan payment ($800 total).

- Maximum Total Debt Allowed: $3,000

- Existing Debt: $800

- Remaining Amount for Housing: $3,000 - $800 = $2,200

In this scenario, your maximum allowable mortgage payment drops from $2,333 to $2,200, which directly reduces the total loan amount you can secure.

### Your Down Payment

The size of your down payment has a massive impact. A larger down payment:

- Reduces Your Loan Amount: Needing to borrow less means a smaller monthly payment.

- Helps You Avoid Private Mortgage Insurance (PMI): Lenders typically require PMI if your down payment is less than 20% of the home's purchase price. PMI can add $100-$300 (or more) to your monthly payment without building any equity.

- May Secure a Better Interest Rate: A larger down payment demonstrates financial stability to lenders, potentially earning you more favorable loan terms.

Example on a $400,000 Home:

- 20% Down Payment: $80,000 (Loan of $320,000, no PMI)

- 5% Down Payment: $20,000 (Loan of $380,000, plus PMI)

### Geographic Location & Property Taxes

A $100,000 salary affords a very different lifestyle—and house—in Omaha, Nebraska, compared to San Diego, California. According to Payscale, the cost of living in San Diego is 44% higher than the national average, while Omaha's is 8% lower.

Furthermore, property taxes and homeowner's insurance vary dramatically by state and even county. A high property tax rate can add hundreds of dollars to your monthly PITI payment, directly reducing the price of the home you can afford while staying within the 28% rule.

### Interest Rates and Loan Term

Current mortgage rates are a powerful, market-driven force. A 1% difference in the interest rate on a 30-year fixed-rate mortgage can change your monthly payment significantly, altering your total affordability by tens of thousands of dollars.

Example on a $350,000 Loan (30-Year Fixed):

- At 6.0% Interest: Monthly Principal & Interest ≈ $2,098

- At 7.0% Interest: Monthly Principal & Interest ≈ $2,328

That $230 difference per month equates to nearly $2,800 per year, which could be the difference between affording a home and being priced out.

### Your Credit Score

Your credit score is a direct reflection of your financial trustworthiness. According to data from FICO, borrowers with higher scores receive lower interest rates. A score of 760 or above will generally qualify you for the best rates available, while a score in the low 600s will result in a significantly higher rate, making your mortgage more expensive and reducing your buying power.

Job Outlook for High-Earning Professionals

While this article focuses on a financial question, it's relevant to consider the career landscape. A $100,000 salary is achievable across many industries with strong growth outlooks. According to the U.S. Bureau of Labor Statistics (BLS), fields like Software Development (25% projected growth from 2022-2032), Financial Management (16% growth), and Medical and Health Services Management (28% growth) all have median salaries at or above the $100k mark and are expanding much faster than the average for all occupations. Pursuing a career in these stable, high-growth fields provides the long-term income security that makes homeownership a sustainable investment.

Conclusion

So, how much house can you afford on a $100k salary? Based on standard financial rules, you can likely afford a home priced between $300,000 and $450,000.

However, this range is highly flexible. The final answer is deeply personal and can be maximized by following these key takeaways:

- Minimize Your Debt: Pay down high-interest loans and credit cards before applying for a mortgage to maximize your DTI ratio.

- Maximize Your Down Payment: Aim for a 20% down payment to reduce your loan principal and eliminate the extra cost of PMI.

- Know Your PITI: When browsing homes, always factor in local property taxes and insurance estimates, not just the sticker price.

- Polish Your Credit: A strong credit score is your best negotiation tool for securing a low interest rate.

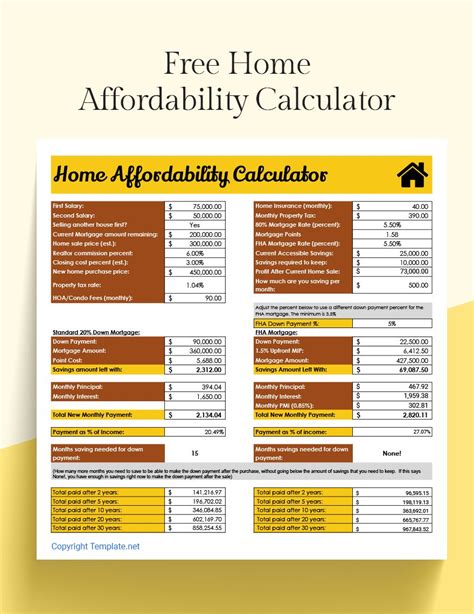

A $100,000 salary is a powerful tool for building wealth through real estate. By understanding the factors at play and strategically managing your finances, you can confidently turn your homeownership dream into a reality. The best next step is to use an online mortgage affordability calculator and then speak with a reputable mortgage lender to get a pre-approval and know your exact numbers.