Earning a $150,000 annual salary is a significant professional achievement, placing you well above the national median income. According to the U.S. Bureau of Labor Statistics (BLS), the median weekly earnings for full-time wage and salary workers in the U.S. was $1,145 in the fourth quarter of 2023, which annualizes to approximately $59,540. Your income level opens up substantial opportunities, particularly when it comes to one of the biggest financial decisions you'll ever make: buying a home.

But a high salary alone doesn't translate to a specific home price. Your actual purchasing power is a complex equation involving debt, savings, interest rates, and location. This guide will break down the numbers, rules, and key factors to give you a clear, data-driven answer to the question: "How much house can I afford with a $150k salary?"

Deconstructing the $150K Salary: What It Means for Homebuying

Before we talk about home prices, we need to understand what a $150,000 salary looks like to a mortgage lender. Lenders primarily work with your gross monthly income (GMI), which is your salary before any taxes or deductions.

- Annual Salary: $150,000

- Gross Monthly Income (GMI): $150,000 / 12 = $12,500

This $12,500 figure is the starting point for all affordability calculations. While your take-home pay (after taxes, 401(k) contributions, and health insurance) is what you'll use to actually pay the bill, lenders use your gross income to determine the maximum loan you qualify for based on established industry standards.

The General Rules of Home Affordability

Lenders use debt-to-income (DTI) ratios to assess risk and determine your maximum monthly housing payment. The most common guideline is the 28/36 rule.

- The 28% "Front-End" Rule: This rule dictates that your total housing costs—including principal, interest, property taxes, and homeowners' insurance (PITI)—should not exceed 28% of your gross monthly income.

- $12,500 (GMI) x 0.28 = $3,500 per month

- The 36% "Back-End" Rule: This rule states that your total monthly debt payments—including your PITI plus all other recurring debts (car loans, student loans, credit card payments)—should not exceed 36% of your gross monthly income.

- $12,500 (GMI) x 0.36 = $4,500 per month

Lenders will typically approve you for a mortgage that satisfies the lower of these two calculations. Therefore, your other debts play a crucial role in determining your final housing budget.

Key Factors That Influence Your Home Affordability

Your $150,000 salary provides a strong foundation, but these five factors will ultimately determine the price tag of the home you can purchase.

###

1. Debt-to-Income (DTI) Ratio

This is the most critical factor after your income. It’s your back-end ratio in action. Let's look at two scenarios:

- Scenario A: Low Debt

- Car Payment: $400

- Student Loans: $300

- Total Monthly Debt: $700

- Max Debt Allowed (36% Rule): $4,500

- Amount Remaining for Housing (PITI): $4,500 - $700 = $3,800. Since this is higher than the $3,500 from the 28% rule, your maximum PITI is capped at $3,500.

- Scenario B: High Debt

- Car Payment: $650

- Student Loans: $800

- Credit Card Minimums: $200

- Total Monthly Debt: $1,650

- Max Debt Allowed (36% Rule): $4,500

- Amount Remaining for Housing (PITI): $4,500 - $1,650 = $2,850. In this case, your back-end DTI is the limiting factor, and your max housing payment is $2,850, significantly less than in Scenario A.

###

2. Down Payment Amount

The size of your down payment directly impacts your loan amount and monthly payment. The magic number is 20%. Putting down 20% of the home's purchase price allows you to avoid Private Mortgage Insurance (PMI), an extra fee that protects the lender if you default. PMI can cost 0.5% to 2% of your loan amount annually, adding hundreds of dollars to your monthly payment.

- On a $600,000 loan, PMI could cost an extra $250 - $1,000 per month.

- A larger down payment reduces your loan principal, lowers your monthly P&I payment, and gives you more equity from day one.

###

3. Geographic Location

Location is a major variable due to dramatic differences in property taxes and homeowners' insurance.

- Property Taxes: According to the Tax Foundation, the average effective property tax rate can be as high as 2.23% in New Jersey or 2.11% in Illinois, but as low as 0.51% in Hawaii or 0.57% in Alabama. On a $600,000 home, the difference between a 2.2% rate ($1,100/month) and a 0.6% rate ($300/month) is $800 every month.

- Homeowners' Insurance: Rates vary based on risk. States prone to natural disasters like hurricanes (Florida, Louisiana) or wildfires (California) have significantly higher insurance premiums than less disaster-prone states.

###

4. Credit Score and Interest Rates

Your credit score is a direct lever on the interest rate you'll receive from lenders. A higher score signifies lower risk and earns you a lower rate, saving you tens of thousands of dollars over the life of your loan.

Consider a $550,000 loan over 30 years:

- Excellent Credit (760+) at 6.5% Interest: Monthly P&I = ~$3,476

- Good Credit (680) at 7.2% Interest: Monthly P&I = ~$3,744

That $268 difference per month adds up to over $96,000 in extra interest paid over 30 years.

###

5. Company Type (Loan Type)

The type of mortgage you get also matters. While most high-income earners will use a Conventional Loan, other options exist.

- FHA Loans: Allow for lower down payments but have stricter DTI limits and mandatory mortgage insurance.

- VA Loans: Available to service members and veterans, offering 0% down payment options with no PMI.

- Jumbo Loans: For loan amounts exceeding the conforming loan limits set by the FHFA (in 2024, this is $766,550 for most of the U.S.). These often have stricter credit and down payment requirements.

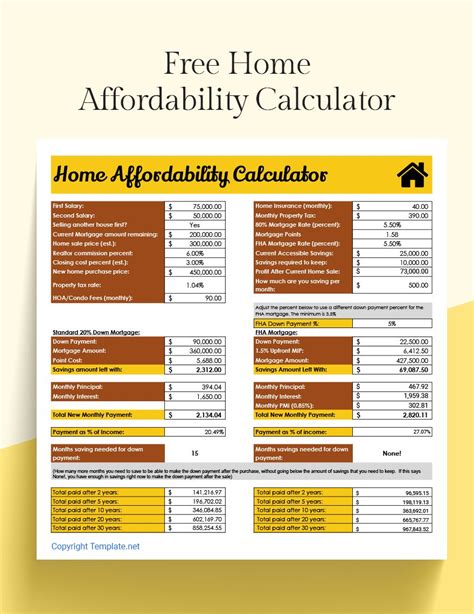

Putting It All Together: A Sample Calculation

Let's create a realistic profile for someone earning $150,000 and calculate their affordability.

Assumptions:

- Gross Monthly Income: $12,500

- Monthly Non-Housing Debt: $600 (car loan, student loans)

- Credit Score: Excellent (qualifying for a good interest rate)

- Down Payment: 20% to avoid PMI

- Estimated Interest Rate: 6.75% (30-year fixed)

- Estimated Property Tax & Insurance (annual): 1.5% of home value

Calculation:

1. Max Housing Payment (PITI): The 36% rule allows for $4,500 in total debt. Subtracting the $600 of existing debt leaves $3,900. The 28% rule caps the payment at $3,500. The lender will use the lower number.

- Max Monthly PITI = $3,500

2. Estimate Taxes & Insurance: On a hypothetical $600,000 home, 1.5% would be $9,000/year, or $750/month.

3. Calculate Max Principal & Interest (P&I): $3,500 (PITI) - $750 (T&I) = $2,750 for P&I.

4. Determine Supported Loan Amount: At a 6.75% interest rate, a monthly P&I payment of $2,750 supports a loan of approximately $425,000.

5. Calculate Final Home Price: With a $425,000 loan and a 20% down payment, the home price is calculated as: Loan / 0.80.

- $425,000 / 0.80 = $531,250

Affordability Range with a $150k Salary:

- Conservative (Higher Debt, Lower Down Payment): $400,000 - $500,000

- Moderate (As calculated above): $525,000 - $600,000

- Aggressive (Zero Debt, 20%+ Down Payment): $650,000 - $750,000+

Conclusion: You're in a Strong Position

A $150,000 salary gives you powerful home-buying potential, allowing you to comfortably afford a home in the $500,000 to $650,000 range in most markets, assuming you have managed your debt well and saved a 20% down payment.

However, the key takeaway is that affordability is deeply personal. Your spending habits, financial goals, and risk tolerance matter just as much as the lender's formula. Before you start house hunting, take these steps:

1. Calculate your DTI to see where you stand.

2. Use an online mortgage calculator to play with different scenarios for down payments, interest rates, and home prices.

3. Get pre-approved for a mortgage to understand exactly what a lender will offer you.

By grounding your expectations in this data-driven approach, you can move forward with confidence and make a smart, sustainable investment in your future.