A career at JPMorgan Chase & Co. represents an opportunity to work at the pinnacle of the global financial industry. As a leader in investment banking, financial services, and asset management, the firm is known for attracting top-tier talent and compensating them accordingly. For prospective professionals, this translates to significant earning potential, with average total compensation packages often exceeding $100,000 and climbing well into the high six or even seven figures for senior-level positions.

This article provides a data-driven analysis of salaries at JPMorgan Chase, breaking down the key factors that determine your potential earnings and offering a clear view of what to expect on your career journey.

What Do Professionals at JPMorgan Chase Do?

Before diving into salary figures, it's crucial to understand that "a job at JPMorgan Chase" is not a single role. The firm is a massive, multifaceted organization with several distinct business divisions, each containing hundreds of different job functions. Your role and responsibilities will dictate your compensation.

Key business areas include:

- Corporate & Investment Bank (CIB): This is the division most people associate with high finance. It includes roles in investment banking (mergers & acquisitions, capital raising), sales & trading, and research.

- Asset & Wealth Management (AWM): This division manages investments for institutions and high-net-worth individuals, involving roles like portfolio manager, private banker, and financial advisor.

- Commercial Banking (CB): This group provides services to mid-sized businesses, including lending, treasury solutions, and credit management.

- Consumer & Community Banking (CCB): This is the retail side of the bank, under the "Chase" brand, encompassing roles in branch banking, credit cards, mortgages, and auto finance.

- Technology: A critical, cross-functional division that employs a vast number of software engineers, data scientists, cybersecurity experts, and project managers who build and maintain the firm's global technology infrastructure.

Average JPMorgan Chase Salary

While a single "average" salary can be misleading due to the wide variety of roles, it provides a useful baseline. According to data from Payscale, the average base salary at JPMorgan Chase is approximately $105,000 per year. Glassdoor reports a higher average total pay (including bonuses and other compensation) of around $120,535 per year.

However, these company-wide averages blend high-earning front-office roles with essential corporate and operational functions. A more accurate picture emerges when we examine salaries by specific job titles, which often include a base salary and a significant performance-based bonus.

Here are typical compensation ranges for popular roles:

- Investment Banking Analyst: Base salary often starts between $100,000 and $125,000, with a year-end bonus that can range from 50% to 100% of the base, depending on individual and firm performance (Source: Wall Street Oasis, Industry Reports).

- Software Engineer: Entry-level (Analyst/Associate level) base salaries typically range from $110,000 to $140,000. Total compensation, including stock and bonus, can push this to $140,000 - $180,000+ (Source: Levels.fyi).

- Associate (Post-MBA or Promoted Analyst): In investment banking, base salaries for new Associates often start at $175,000, with bonuses making total compensation well over $250,000 (Source: Industry Reports).

- Vice President (VP): Base salaries in finance roles typically range from $200,000 to $275,000, but the bonus component becomes a much larger part of total pay, often leading to total compensation packages of $400,000 - $600,000+.

Key Factors That Influence Salary

Your specific salary at JPMorgan Chase is not a fixed number. It is determined by a combination of powerful factors that you can strategically leverage throughout your career.

### Level of Education

A bachelor's degree is the standard entry requirement for most professional roles at the firm. However, advanced degrees can unlock higher starting salaries and more senior entry points. An MBA from a top-tier business school is a traditional pathway to an Associate-level position in the Investment Bank, commanding a significantly higher starting salary than an undergraduate-level Analyst role. Similarly, a Master's in Financial Engineering, Computer Science, or Quantitative Finance can provide a competitive edge and higher starting pay for specialized roles in trading and technology.

### Job Title and Seniority

Experience is one of the most significant drivers of compensation, reflected directly in the firm's hierarchical structure. As you advance, both your base salary and, more dramatically, your bonus potential increase. The typical progression in front-office finance roles is:

1. Analyst: The entry-level position for recent graduates.

2. Associate: A mid-level role for promoted analysts or new hires with an MBA.

3. Vice President (VP): A senior professional responsible for managing projects and client relationships.

4. Executive Director (ED) / Managing Director (MD): The most senior levels, focused on business generation and firm strategy, with compensation heavily weighted toward performance bonuses that can reach seven figures.

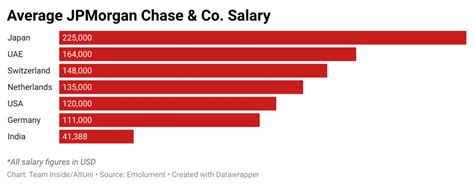

### Geographic Location

Where you work matters immensely. JPMorgan Chase has a global footprint, and salaries are adjusted based on the cost of living and market rates in different cities. Major financial centers command the highest salaries.

- Top-Tier Hubs (New York City, London, Hong Kong): Expect the highest salaries to compensate for the high cost of living and intense competition.

- Major US Hubs (Chicago, San Francisco): Salaries remain very competitive, though slightly below New York levels.

- Strategic Hubs (Plano, TX; Columbus, OH; Wilmington, DE): While the base salaries in these lower-cost-of-living areas are lower than in NYC, the purchasing power can be comparable or even greater. The firm has concentrated many technology and operations roles in these locations.

### Business Division and Area of Specialization

Your specific division and role have a profound impact on pay. Compensation is generally highest in "front-office" roles that directly generate revenue.

- Front-Office (e.g., Investment Banking, Sales & Trading): These roles offer the highest earning potential due to large, performance-based bonuses tied directly to revenue.

- Middle-Office (e.g., Risk Management, Compliance, Credit): These roles offer strong, competitive salaries but generally have smaller bonus components than front-office positions.

- Back-Office (e.g., Operations, HR, Corporate Services): These essential roles are compensated in line with general corporate market rates and have the most predictable, stable salary structures.

Furthermore, specialization in a high-demand area, such as an AI/Machine Learning Engineer within the Technology division or a Quantitative Analyst in the CIB, can command a salary premium over more generalized roles.

Job Outlook

Working for a market leader like JPMorgan Chase provides a degree of career stability. However, the outlook for specific professions within the firm varies.

The U.S. Bureau of Labor Statistics (BLS) provides valuable context. The job outlook for Financial Analysts is projected to grow 4% from 2022 to 2032, which is about as fast as the average for all occupations. This indicates steady, consistent demand for core finance skills.

In contrast, the outlook for Software Developers is projected to grow by 25% over the same period, which is much faster than average. This highlights the firm's massive investment in technology and the growing demand for tech talent within the financial services industry. A career path in technology at JPMorgan Chase, therefore, offers exceptionally strong growth prospects.

Conclusion

A career at JPMorgan Chase offers a pathway to outstanding financial rewards and professional growth. While headline-grabbing salaries in the hundreds of thousands exist, it's vital for aspiring professionals to understand the nuances of compensation at the firm.

Key Takeaways:

- Compensation is Role-Dependent: Your salary is primarily determined by your specific job function, division, and seniority.

- Bonuses are a Major Factor: Especially in front-office roles, performance-based bonuses constitute a significant portion of total annual earnings.

- Experience Pays: Advancing from Analyst to Associate to VP and beyond results in substantial increases in both base pay and bonus potential.

- Location and Specialization Matter: Working in a major financial hub or possessing high-demand skills (like AI or quantitative analysis) will boost your earning potential.

Whether you are a student planning your first career move or a seasoned professional considering a change, understanding these salary dynamics is the first step toward building a successful and rewarding career at this financial powerhouse.