For those navigating the demanding world of high finance, the title "Managing Director at Goldman Sachs" represents a career zenith. It signifies not just immense responsibility and influence but also one of the most lucrative compensation packages in the corporate world. But what does that compensation truly look like?

Aspiring financiers and seasoned professionals alike often wonder about the figures behind the title. While the path is challenging, the financial rewards are substantial, with typical total compensation packages for Managing Directors (MDs) soaring well into the seven figures. This article will break down the salary, the critical factors that shape it, and the career outlook for those aiming for this prestigious role.

What Does a Managing Director at Goldman Sachs Do?

Becoming a Managing Director is the culmination of a 15-to-20-year journey through the ranks of an investment bank. At this level, the role transcends day-to-day execution and becomes focused on strategy, leadership, and revenue generation.

Key responsibilities include:

- Driving Business and Revenue: An MD is primarily responsible for winning new business. In the Investment Banking Division, this means sourcing and executing major deals like mergers and acquisitions (M&A), IPOs, or large-scale debt financing.

- Client Relationship Management: They are the primary contact for the firm's most important clients, including Fortune 500 CEOs, institutional investors, and government entities. Cultivating and maintaining these relationships is paramount.

- Team Leadership and Mentorship: MDs manage large teams of Vice Presidents, Associates, and Analysts. They set the strategic direction for their group and are responsible for mentoring the next generation of leaders.

- Firm-wide Strategy: As senior leaders, MDs contribute to the overall strategic vision and risk management of their division and the firm.

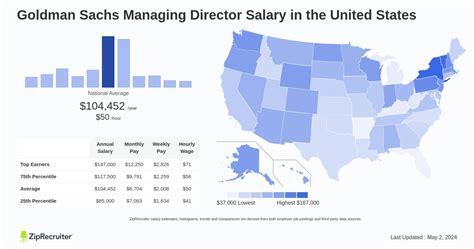

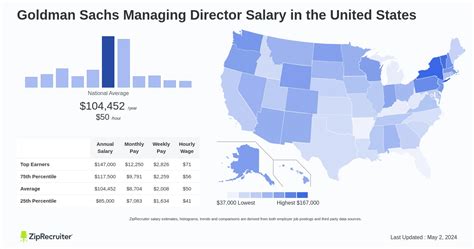

Average Managing Director Salary at Goldman Sachs

It is crucial to understand that compensation for a Goldman Sachs MD is comprised of two main parts: a base salary and a significant, performance-based bonus. The total compensation is the figure that truly reflects their earnings.

- Base Salary: The fixed portion of their pay. According to data aggregated by sources like Glassdoor and Salary.com, the base salary for a Managing Director at Goldman Sachs typically falls within the range of $500,000 to $750,000 per year. Newly promoted MDs may start at the lower end of this scale.

- Variable Compensation (Bonus): This is the most significant and variable part of the package. It is tied directly to individual, divisional, and firm-wide performance. In a strong year for the markets and the firm, an MD’s bonus can be 100% to 300% (or more) of their base salary.

- Total Compensation: Combining these elements, the typical annual compensation for a Goldman Sachs MD ranges from $1 million to $2.5 million. However, for top performers in highly profitable divisions during a bull market, total compensation can climb substantially higher.

*(Note: These figures are estimates based on publicly available, self-reported data from 2022-2024. Actual compensation can vary significantly.)*

Key Factors That Influence Salary

The "average" salary is just a starting point. Several factors can dramatically influence an MD's final take-home pay.

### Years of Experience

Even within the MD tier, experience matters. A first-year MD will earn significantly less than a 10-year veteran who has a more extensive client book and a proven track record of generating revenue. Senior MDs who hold leadership roles, such as group heads or regional leaders, command the highest compensation packages, often including more substantial stock awards.

### Area of Specialization

Not all divisions within Goldman Sachs are created equal in terms of revenue generation. This directly impacts bonus potential.

- Investment Banking Division (IBD): MDs in M&A or capital markets who close multi-billion dollar deals are among the highest earners.

- Sales & Trading (S&T): Top traders and salespeople who manage massive client portfolios or execute profitable strategies can also earn exceptional bonuses.

- Asset & Wealth Management: MDs managing portfolios for ultra-high-net-worth individuals and large institutions have high earning potential tied to assets under management (AUM) and performance fees.

- Support & Corporate Functions: MDs in roles like Compliance, Human Resources, or Technology are vital to the firm but have a different compensation structure. While still extremely well-paid, their bonuses are generally smaller and less volatile than those in revenue-generating roles.

### Geographic Location

While Goldman Sachs is a global firm, compensation is highest in the world's primary financial hubs where the cost of living is high and the deal flow is concentrated.

- New York City: As the firm's headquarters and the epicenter of global finance, New York-based MDs typically command the highest salaries.

- London and Hong Kong: These major international hubs follow closely behind New York in terms of compensation levels.

- Other Major Cities: Locations like San Francisco (especially for tech banking), Chicago, and Frankfurt will also offer very high, competitive salaries, though they may trail slightly behind the top three.

### Firm Performance (Replaces "Company Type")

Since this role is specific to Goldman Sachs, the most relevant factor is the firm's overall annual performance. An MD's bonus is directly linked to the firm's profitability. In a year when Goldman Sachs reports record profits, the bonus pool swells, and MDs are rewarded handsomely. Conversely, during a market downturn or a challenging year for the firm, the bonus pool shrinks, and even high-performing MDs will see their variable compensation decrease.

### Level of Education

At the Managing Director level, education is a foundational element rather than a direct salary driver. A candidate will not earn more simply for having a Ph.D. over an MBA. However, the *right* educational background is essential to getting on the path to becoming an MD in the first place. The standard is an undergraduate degree from a top-tier university, followed by an MBA from an elite business school like Wharton, Harvard, or Stanford. This background provides the analytical rigor, alumni network, and recruiting opportunities necessary to enter and advance within the firm.

Job Outlook

The U.S. Bureau of Labor Statistics (BLS) does not track "Investment Banking Managing Director" as a specific role. However, we can look at the broader category of "Financial Managers" for an industry-level perspective. The BLS projects that employment for financial managers will grow by 16% from 2022 to 2032, which is much faster than the average for all occupations.

This indicates a strong and sustained demand for high-level financial expertise. While the path to MD at a firm like Goldman Sachs is intensely competitive and subject to economic cycles, the need for senior leaders who can navigate complex financial markets and drive growth remains constant.

Conclusion

Reaching the level of Managing Director at Goldman Sachs is the result of relentless dedication, exceptional performance, and strategic career management. The role represents the pinnacle of the investment banking profession, and the compensation reflects this reality.

For students and professionals considering this path, the key takeaways are:

- Total compensation is king: Focus on the all-in number (base + bonus), which routinely exceeds $1 million.

- Performance is everything: Your earnings are directly tied to the value you generate for the firm and its clients.

- It’s a marathon, not a sprint: The journey takes over a decade of high-pressure work and consistent results.

- Specialization matters: Your division and role within the firm will heavily influence your earning potential.

While the demands are immense, the opportunity to lead at the highest level of global finance and achieve extraordinary financial success makes the role of Managing Director at Goldman Sachs a powerful and enduring career ambition.