Of course. Here is a comprehensive, in-depth article on the salary potential for professionals with a Master's in Accounting, written in the requested tone and structure.

---

A Master's in Accounting is more than just an advanced degree; it's a strategic investment in a stable, in-demand, and financially rewarding career. For those with a passion for numbers, strategy, and business integrity, this path opens doors to leadership roles and significant earning potential. While salaries can vary, it's common for professionals with a Master of Accountancy (M.Acc. or M.S.A.) to see earnings range from $65,000 at the entry-level to well over $175,000 for senior, specialized positions.

This guide will break down the salary you can expect with a master's in accounting, the key factors that drive your earning power, and the bright future of the profession.

What Roles Can You Pursue with a Master's in Accounting?

A master's degree in accounting prepares you for roles that go far beyond basic bookkeeping. It equips you with the advanced knowledge needed for strategic financial analysis, ethical leadership, and regulatory compliance. Graduates are qualified for a wide array of influential positions across various industries.

Common career paths include:

- Senior or Staff Accountant: Responsible for maintaining and reconciling financial records, preparing reports, and ensuring compliance.

- Auditor (Internal or External): Examining financial records to ensure accuracy and compliance with laws and regulations. External auditors often work for public accounting firms, while internal auditors work within a single organization.

- Forensic Accountant: Investigating financial discrepancies, fraud, and white-collar crime.

- Tax Specialist or Manager: Specializing in tax law, planning, and compliance for corporations or individuals.

- Controller: Overseeing a company’s entire accounting department, including financial reporting, budgets, and internal controls.

- Chief Financial Officer (CFO): A top executive role responsible for the financial health and long-term strategy of an entire organization.

Average Salary for Professionals with a Master's in Accounting

While a bachelor's degree is the standard entry point into the accounting field, a master's degree provides a distinct salary advantage and a faster track to leadership roles.

According to the U.S. Bureau of Labor Statistics (BLS), the median annual wage for all accountants and auditors was $78,000 as of May 2022. However, this figure includes professionals with only a bachelor's degree.

Data from salary aggregators shows a clear "master's premium."

- Payscale reports that the average salary for an individual holding a Master of Science (MS) in Accounting is approximately $85,000 per year.

- Salary.com places the typical salary range for an accountant with a master's degree or CPA designation between $74,000 and $130,000, depending heavily on experience and other factors.

A more realistic breakdown shows a wide spectrum:

- Entry-Level (0-2 years experience): $65,000 - $80,000

- Mid-Career (3-8 years experience): $85,000 - $125,000

- Senior/Executive Level (8+ years experience): $120,000 - $200,000+

Key Factors That Influence Salary

Your salary is not a single number but a dynamic figure influenced by several critical factors. Understanding these can help you maximize your earning potential.

### Level of Education & Professional Certification

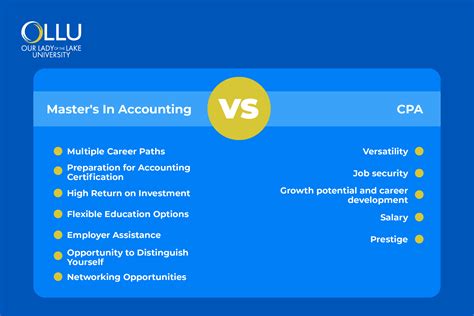

The master's degree itself gives you an edge, but its primary value lies in its role as a stepping stone to the Certified Public Accountant (CPA) license. Most states require 150 semester hours of education to become a licensed CPA, and a master’s program is the most common way to meet this requirement after a four-year bachelor's degree.

Holding a CPA license is one of the single most impactful drivers of salary. According to the American Institute of Certified Public Accountants (AICPA), CPAs often earn a salary premium of 5-15% over their non-certified peers. This premium grows throughout a professional's career, making the CPA designation a non-negotiable for serious earning potential.

### Years of Experience

Experience is paramount in accounting. As you progress from a staff-level employee to a manager and eventually a director or controller, your responsibilities and compensation grow exponentially.

- Entry-Level (0-2 Years): As a Staff Accountant or Junior Auditor, you will focus on foundational tasks. Your salary will be competitive but at the lower end of the spectrum.

- Mid-Career (3-8 Years): After gaining experience and often a CPA license, you can move into Senior Accountant or Manager roles. This is where salaries see a significant jump as you begin supervising teams and managing complex projects.

- Senior/Executive Level (8+ Years): With extensive experience, you can pursue executive-track roles like Controller, Director of Finance, or Partner in a public accounting firm. At this level, salaries are often six figures, supplemented by significant bonuses and equity.

### Geographic Location

Where you work matters. Salaries for accountants are closely tied to the cost of living and the demand for financial professionals in a specific metropolitan area. Major financial hubs and tech centers typically offer the highest salaries.

Top-Paying Metropolitan Areas:

- New York, NY

- San Francisco, CA

- San Jose, CA

- Boston, MA

- Washington, D.C.

An accountant in New York City may earn 20-30% more than an accountant in a smaller midwestern city. However, it's crucial to weigh this against the higher cost of living in major urban centers.

### Company Type

The type of organization you work for has a profound impact on your salary and career trajectory.

- Public Accounting (e.g., The "Big Four"): Firms like Deloitte, PwC, EY, and KPMG are known for offering high starting salaries, excellent training, and rapid career progression. While the hours can be demanding, a few years in public accounting is a powerful resume-builder that often leads to high-paying industry jobs.

- Corporate/Industry Accounting: Working directly for a company in sectors like tech, healthcare, or manufacturing can offer a better work-life balance and deep industry expertise. Salaries are competitive, especially in high-growth industries.

- Government: Roles with federal agencies (like the IRS, FBI, or GAO) or state and local governments offer unmatched job security and excellent benefits. While the base salary may be slightly lower than in the private sector, the total compensation package is often very attractive.

- Non-Profit: Working for a non-profit organization is often driven by a passion for the mission. Salaries are typically lower than in for-profit sectors, but the work can be incredibly rewarding.

### Area of Specialization

General accounting is always in demand, but specializing in a high-growth niche can make you a more valuable—and higher-paid—asset. A master's program is the perfect place to build this specialized knowledge.

High-Paying Specializations:

- Information Technology (IT) Audit: Blends accounting with technology to assess and secure financial systems. As businesses become more digital, these skills are critically important and command high salaries.

- Forensic Accounting: Involves investigating fraud and financial crime. This niche skill set is highly sought after by law firms, corporations, and government agencies.

- International Taxation: For multinational corporations, navigating the complex web of global tax law requires expert knowledge. Professionals in this area are highly compensated for their expertise.

- Managerial Accounting/Corporate Finance: Professionals who can translate financial data into strategic business decisions are on the path to high-level roles like Controller and CFO, which come with executive-level compensation.

Job Outlook

The future for accounting professionals is bright. The BLS projects a 4% growth rate for accountants and auditors from 2022 to 2032, which translates to about 126,500 openings each year, on average.

This steady demand is driven by globalization, a constantly evolving regulatory environment, and the need for financial accountability in all sectors of the economy. Furthermore, the increasing use of data analytics and artificial intelligence in finance is creating new opportunities for tech-savvy accountants who can interpret complex data sets—a skill often honed in modern master's programs.

Conclusion: Is a Master's in Accounting Worth It?

The data is clear: a master's degree in accounting is a powerful catalyst for a successful and lucrative career. It not only accelerates your path to obtaining the all-important CPA license but also opens doors to specialized, high-demand roles that command premium salaries.

While your starting salary will be influenced by factors like location and company type, your long-term earning potential is determined by your commitment to continuous learning, professional certification, and strategic specialization. For those ready to invest in their future, a Master's in Accounting offers a clear and reliable return, paving the way for a career that is both financially and professionally rewarding.