Introduction

For millions of people, a single number announced at the end of each year dictates the financial trajectory of the next twelve months. In Colombia, this number is the *Salario Mínimo Mensual Legal Vigente (SMMLV)*, or the legal monthly minimum wage. It's more than just a figure on a payslip; it's the bedrock of the national economy, a tool for social policy, and a subject of intense annual negotiation between government, business leaders, and labor unions. Whether you are a Colombian worker navigating the job market, an expatriate considering a move, or a business owner planning your budget, understanding the nuances of Colombia’s minimum salary is absolutely critical.

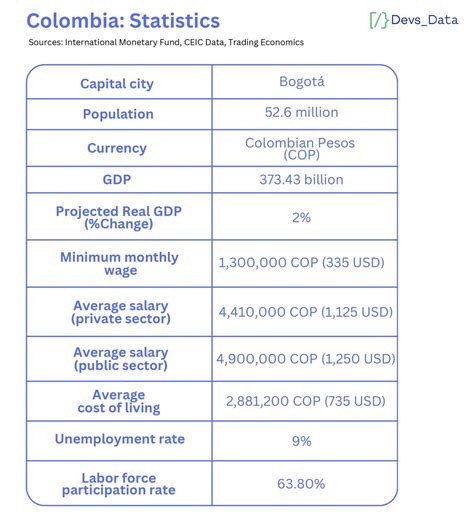

This guide is designed to be the definitive resource on the topic. We will move beyond the headline figure to explore every facet of the Colombian minimum wage. We will break down its components, analyze the economic forces that shape it, and examine its real-world purchasing power across different regions of this vibrant and diverse country. The current minimum salary for 2024 is COP $1,300,000 per month, supplemented by a mandatory transportation allowance of COP $162,000, for a total monthly compensation package of COP $1,462,000. While this provides a baseline, actual take-home pay and living standards vary enormously.

I've spent years analyzing labor markets and economic policies, and I once had a conversation with a small coffee farmer in the hills outside of Medellín. He explained that the annual minimum wage debate wasn't just news to him; it directly determined whether he could afford to hire an extra hand during the harvest season, a decision that could make or break his year. This interaction crystallized for me that the minimum salary is a profoundly human number, a fulcrum upon which countless livelihoods, dreams, and business plans pivot.

This article will serve as your expert guide, providing the data, context, and analysis you need to fully understand the minimum salary in Colombia.

### Table of Contents

- [What is the Minimum Salary in Colombia? A Comprehensive Overview](#what-is-the-minimum-salary-in-colombia-a-comprehensive-overview)

- [Colombia's Minimum Salary in 2024: A Deep Dive into the Numbers](#colombias-minimum-salary-in-2024-a-deep-dive-into-the-numbers)

- [Key Factors That Influence the Minimum Salary and Real Earnings in Colombia](#key-factors-that-influence-the-minimum-salary-and-real-earnings-in-colombia)

- [Economic Outlook and the Future of Wages in Colombia](#economic-outlook-and-the-future-of-wages-in-colombia)

- [Navigating the Colombian Job Market: A Guide for Workers and Expats](#navigating-the-colombian-job-market-a-guide-for-workers-and-expats)

- [Conclusion](#conclusion)

What is the Minimum Salary in Colombia? A Comprehensive Overview

The *Salario Mínimo Mensual Legal Vigente (SMMLV)* is the lowest legal remuneration that an employer in the formal sector in Colombia can pay to a full-time worker for a standard work month. This standard is defined by the Colombian Labour Code as a maximum of 47 hours per week as of 2024, a figure that is gradually being reduced from 48 hours to 42 hours by 2026. The SMMLV is a cornerstone of Colombian labor law, established under Article 145 of the Substantive Labor Code (*Código Sustantivo del Trabajo*).

Its primary purpose is to protect workers from unduly low pay and provide a basic floor to ensure a minimum standard of living. However, its influence extends far beyond a simple wage floor. The SMMLV is used as a reference unit, known as a UVT (*Unidad de Valor Tributario*) in some tax contexts but more directly as a multiple of SMMLV for many other fees, fines, social housing eligibility criteria, court costs, and even some visa requirements for foreigners.

The Annual Negotiation Process

The value of the SMMLV is not static; it is adjusted annually in a process that is often a major national news event. The negotiation takes place in December and is conducted by the "Permanent Commission for the Consultation of Labor and Wage Policies" (*Comisión Permanente de Concertación de Políticas Salariales y Laborales*). This commission is a tripartite body, composed of:

1. Government Representatives: Led by the Minister of Labor, along with representatives from the Ministry of Finance and the National Planning Department.

2. Business Associations: Major guilds representing employers, such as the National Business Association of Colombia (ANDI) and the National Federation of Merchants (FENALCO).

3. Labor Unions: The largest confederations representing workers, such as the Unitary Workers' Central (CUT) and the General Confederation of Labor (CGT).

These groups negotiate based on several key economic indicators, primarily past inflation (to recover lost purchasing power) and projected future inflation, as well as labor productivity and the country's overall economic growth (GDP). If the parties reach a consensus by a mid-December deadline, the agreed-upon figure is signed into law by the President. If they fail to agree—which happens frequently—the national government sets the new minimum wage by decree before the end of the year.

A "Real-World Impact" Example: The Life of a Minimum Wage Earner

To understand what the SMMLV means in practice, consider a hypothetical "Day in the Life" of 'Ana,' a single mother working as a cleaner for a formal company in a major city like Bogotá.

- 5:00 AM: Ana wakes up. Her monthly rent for a small apartment in a working-class neighborhood like Bosa or Usme consumes a significant portion of her COP $1,300,000 salary, often 40-50% or more.

- 6:00 AM: She prepares a simple breakfast and gets her child ready for the public school. Her food budget is tight, relying heavily on staples like rice, potatoes, arepas, and legumes.

- 6:30 AM: She leaves for work. Her commute involves taking two buses on the TransMilenio system. The COP $162,000 transportation subsidy is essential; without it, daily transport costs would eat up over 10% of her base salary. This subsidy is specifically for workers earning up to two times the minimum wage.

- 8:00 AM - 5:00 PM: Ana works a full day. Because she is in the formal sector, her employer is legally required to make social security contributions on her behalf. This includes payments for health insurance (EPS - *Entidades Promotoras de Salud*), a pension fund (AFP - *Administradoras de Fondos de Pensiones*), and occupational risk insurance (ARL - *Administradoras de Riesgos Laborales*). These deductions reduce her take-home pay but provide a critical safety net.

- 7:00 PM: After another long commute, she arrives home to cook dinner, help with homework, and manage household chores. Her budget leaves little to no room for entertainment, savings, or unexpected expenses like a medical emergency not fully covered by her basic health plan.

This example illustrates the reality for the millions of Colombians for whom the SMMLV is not an abstract economic figure but the tightrope they walk every single day.

Colombia's Minimum Salary in 2024: A Deep Dive into the Numbers

For the year 2024, the Colombian government decreed a significant adjustment to the minimum wage, driven by high inflation in the preceding year. Let's break down the exact figures and what they mean.

Official 2024 Figures

As established by Decree 2292 of 2023, the key components are:

- Base Monthly Salary (SMMLV): COP $1,300,000

- Transportation Subsidy (*Auxilio de Transporte*): COP $162,000

- Total Minimum Monthly Compensation: COP $1,462,000

This represents a 12.07% increase in the base salary and a 15.22% increase in the transport subsidy compared to 2023. The total package saw an approximate 12.5% increase.

Conversion to Other Currencies (for context)

Currency exchange rates fluctuate daily. The following conversions are approximate and based on rates in mid-2024 (roughly USD 1 = COP 3,900). It is crucial to check the current exchange rate for accurate figures.

- Total Monthly Compensation (USD): ~$375

- Total Monthly Compensation (EUR): ~€345

- Total Monthly Compensation (GBP): ~£295

Breakdown of Earnings and Deductions

It's important to understand that the headline figure is not the take-home pay. For formal workers, mandatory deductions for social security are applied.

| Description | Calculation | Monthly Amount (COP) |

| :--- | :--- | :--- |

| Gross Base Salary | Official SMMLV | $1,300,000 |

| Health Insurance (EPS) | 4% of base salary (employee's share) | -$52,000 |

| Pension Fund (AFP) | 4% of base salary (employee's share) | -$52,000 |

| Net Salary After Deductions | Base Salary - Deductions | $1,196,000 |

| Transportation Subsidy | Flat rate (not subject to deductions) | +$162,000 |

| Estimated Monthly Take-Home Pay| Net Salary + Transport Subsidy | ~$1,358,000 |

*Note: The employer pays a larger share of the social security contributions (8.5% for health, 12% for pension), which significantly increases the total cost of hiring a minimum wage employee for the business.*

Salary by Different Time Frames

To put the salary into further perspective, let's break it down by hour, day, and year. The standard work week in 2024 is 47 hours.

- Hourly Rate (Base Salary): COP $1,300,000 / (47 hours * 4.33 weeks/month) ≈ COP $6,395 per hour (~$1.64/hour)

- Daily Rate (Base Salary for an 8-hour day): ~COP $51,160 per day (~$13.12/day)

- Annual Gross Compensation (including subsidy): COP $1,462,000 * 12 = COP $17,544,000 per year (~$4,500/year)

The "Thirteenth Salary" and Other Benefits (*Prima de Servicios*)

A crucial part of Colombian compensation is the *Prima de Servicios*, a legally mandated bonus equivalent to one month's salary per year. It is paid in two installments:

1. First Half: Paid by June 30th.

2. Second Half: Paid by December 20th.

For a minimum wage worker, this means they receive two extra payments of approximately COP $731,000 each (half of the total monthly package of $1,462,000), calculated proportionally to the time worked in each semester. This effectively acts as a "thirteenth salary," providing vital cash infusions mid-year and for the holiday season. Employers are also required to pay into a severance fund (*Cesantías*) and cover interest on that fund, adding to the worker's overall benefits package.

This detailed breakdown shows that while the headline monthly figure seems straightforward, the actual financial reality for a minimum wage worker is shaped by mandatory deductions, essential subsidies, and legally required bonuses.

Key Factors That Influence the Minimum Salary and Real Earnings in Colombia

While the SMMLV is a national standard, a worker's actual economic standing and potential to earn *above* this floor are influenced by a multitude of factors. This section explores the most critical variables that determine real income and purchasing power in Colombia.

###

Geographic Location and Cost of Living

This is arguably the most significant factor affecting the real value of the minimum wage. Colombia is a country of stark regional contrasts, and a salary of COP $1,462,000 provides a vastly different quality of life in Bogotá versus a smaller, rural town.

High-Cost Cities:

- Bogotá: The capital and largest city. According to data from cost-of-living aggregator Numbeo, Bogotá is consistently one of the most expensive cities in Colombia. Rent for a one-bedroom apartment outside the city center can easily consume 50-70% of a single minimum wage salary. Groceries, transportation, and utilities are also higher.

- Cartagena: As a major tourist hub, Cartagena has a high cost of living, particularly for housing and food in desirable areas. While job opportunities in tourism and hospitality are plentiful, many are at or near the minimum wage, creating a challenging financial situation for residents.

- Medellín: Known for its innovation and pleasant climate, Medellín attracts both Colombians and expats, which has driven up living costs, especially rent in popular neighborhoods like El Poblado or Laureles. A minimum wage earner would likely live in more peripheral neighborhoods like Bello or Itagüí, facing long commutes.

Mid-to-Low-Cost Cities:

- Cali, Barranquilla, Bucaramanga: These large cities generally offer a lower cost of living than Bogotá or Medellín. Housing and food are more affordable, allowing the minimum wage to stretch further.

- Smaller Cities and Rural Areas (e.g., Manizales, Pereira, Ibagué, Pasto): In these locations, the minimum wage can provide a more comfortable, albeit still modest, standard of living. Rent is significantly lower, and a larger portion of income can be allocated to food, savings, or other goods.

Purchasing Power Disparity: An Example

| Item | Estimated Cost in Bogotá (COP) | Estimated Cost in a Smaller City (e.g., Pasto) (COP) |

| :--- | :--- | :--- |

| Rent (1-BR Apt, outside center) | 900,000 - 1,500,000+ | 500,000 - 800,000 |

| Basic Lunch Menu (*Corrientazo*) | 12,000 - 18,000 | 8,000 - 12,000 |

| Monthly Utilities (Basic) | 250,000 - 400,000 | 180,000 - 300,000 |

| % of Minimum Salary for Rent | ~65-100% | ~35-55% |

*Source: Analysis based on data from Numbeo and Expatistan, mid-2024.*

This table clearly demonstrates that a worker on a fixed national minimum wage has significantly less disposable income in the capital compared to a provincial city.

###

The Formal vs. Informal Economy

A critical factor shaping earnings in Colombia is the massive informal labor market. According to DANE (Colombia's National Administrative Department of Statistics), for the quarter of February-April 2024, the informality rate was 55.8% nationally. This means over half of the country's workforce operates outside the legal framework of labor contracts.

- Formal Sector: Workers are employed by a registered company, receive at least the SMMLV, have a formal contract, and are covered by social security (health, pension, etc.). Their rights are protected by the Ministry of Labor. This is the only sector where the minimum wage is legally enforced.

- Informal Sector: This includes self-employed street vendors, domestic workers without contracts, small-scale farmers, and employees of unregistered micro-businesses. These workers often earn *less* than the minimum wage, work longer hours, and have no access to social security, paid leave, or bonuses like the *prima*. Their income is often unstable and depends on daily earnings. While they avoid payroll deductions, they also lack a crucial safety net.

Therefore, for a large portion of the Colombian population, the official minimum wage is an aspirational target rather than a guaranteed floor.

###

Level of Education

Education is a primary driver for earning above the minimum wage. While an entry-level job requiring no specific qualifications may pay the SMMLV, higher educational attainment opens doors to significantly better-paying roles.

- No High School Diploma/High School Diploma: Workers in this category are most likely to hold minimum wage jobs, especially in sectors like retail, cleaning services, agriculture, and general labor.

- *Técnico* or *Tecnólogo* (Technical/Technological Degrees): These are 2-3 year post-secondary vocational programs. Graduates in fields like industrial maintenance, software development, accounting assistance, or graphic design can start at salaries 1.5 to 2.5 times the minimum wage (e.g., COP $2,000,000 - $3,500,000).

- University Degree (*Profesional*): A bachelor's degree is a significant stepping stone. An entry-level professional in a field like engineering, finance, or marketing might start at 2 to 4 times the SMMLV (e.g., COP $2,600,000 - $5,200,000). According to a 2023 report from Fedesarrollo, a leading Colombian economic think tank, workers with a university degree earn, on average, more than double what a worker with only a high school diploma earns.

- Post-Graduate Degree (*Especialización*, *Maestría*, *Doctorado*): Master's degrees and doctorates unlock the highest salary brackets, especially in specialized technical or managerial roles. Professionals with advanced degrees can earn anywhere from 5 to 15 times the SMMLV or more.

###

Industry Sector and Area of Specialization

The industry you work in is a powerful determinant of salary, even for entry-level positions.

- High-Paying Sectors:

- Information Technology (IT) and Tech: This is one of Colombia's highest-paying sectors. A junior software developer or data analyst can start at a salary far exceeding the minimum wage. Mid-level and senior roles, especially for those proficient in English and working for multinational companies, can command salaries comparable to those in developed countries.

- Oil, Gas, and Mining: Historically a source of high-paying jobs, though often located in remote areas and subject to commodity price cycles.

- Finance and Banking: Roles in financial analysis, investment banking, and corporate finance are among the best compensated in the country.

- Pharmaceuticals and Healthcare (Specialized): While general healthcare workers may not earn high salaries, specialized doctors, medical researchers, and managers in pharmaceutical companies are high earners.

- Sectors Prone to Minimum Wage Pay:

- Agriculture: A huge portion of the rural workforce earns at or below the minimum wage, often in informal conditions.

- Hospitality and Tourism: Roles like hotel cleaning staff, waiters, and kitchen porters are frequently paid the minimum wage (though tips can supplement income for some).

- Retail: Cashiers, stockers, and sales associates in many stores often start at the SMMLV.

- General Services: Security guards, cleaning staff, and general laborers are classic examples of minimum wage professions.

###

Years of Experience

Experience is a universal factor in salary growth. In Colombia, the progression is clear:

- Entry-Level (0-2 years): Professionals in this stage are most likely to be at the bottom of the pay scale for their role. For unskilled labor, this means the minimum wage. For university graduates, it means the starting salary for their profession.

- Mid-Career (3-8 years): With proven skills and a track record, professionals can expect significant salary increases. This is the stage where workers can double or triple their entry-level salary. Salary aggregator Payscale shows a distinct upward curve as experience grows across nearly all professions in Colombia.

- Senior/Experienced (8+ years): Senior professionals, managers, and directors reach the highest earning potential. Their salaries are less about a "market rate" and more about the value they bring to a specific organization. Their compensation is often 5-20+ times the SMMLV.

###

In-Demand Skills

Beyond formal education, specific skills can dramatically increase earning potential and lift a worker far above the minimum wage.

- English Proficiency: For professional roles, fluency in English is arguably the single most valuable skill. It opens the door to working for multinational corporations, which typically pay significantly higher salaries than local companies. An accountant who speaks English can earn 50-100% more than a monolingual counterpart.

- Technical Skills: Proficiency in software development (Python, Java, JavaScript), data science (SQL, R, Power BI), cloud computing (AWS, Azure), cybersecurity, and digital marketing (SEO, SEM) are in extremely high demand and command premium salaries.

- Project Management and Leadership: Skills demonstrated by certifications like PMP (Project Management Professional) or proven experience in leading teams and delivering complex projects are highly valued and compensated accordingly.

In summary, while the SMMLV provides a legal floor, it is this combination of geography, formality, education, industry, experience, and specific skills that truly dictates an individual's economic reality and upward mobility in Colombia.

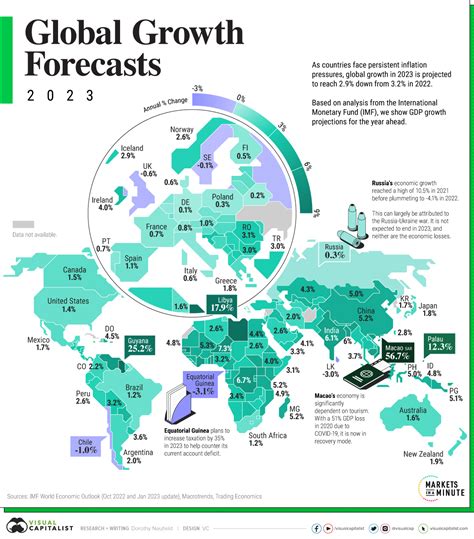

Economic Outlook and the Future of Wages in Colombia

The annual adjustment of the minimum wage doesn't happen in a vacuum. It's deeply intertwined with the health of the Colombian economy, government policy, and long-term structural challenges. Understanding these dynamics is key to anticipating the future of wages in the country.

Key Economic Indicators and Their Influence

Several key metrics form the backdrop for the minimum wage negotiations and overall salary trends:

1. Inflation: This is the most direct influence. The primary goal of the annual wage increase is to ensure workers' purchasing power does not erode due to rising prices. For example, the 12% increase for 2024 was a direct response to the 2023 annual inflation rate, which finished at 9.28% according to DANE. High inflation forces larger nominal wage increases, but doesn't necessarily translate to a better standard of living if prices rise just as fast. The Banco de la República's inflation targets and monetary policy are thus central to the wage debate.

2. Unemployment Rate: This is the other side of the coin. Business associations frequently argue that excessively large minimum wage hikes can increase labor costs, forcing companies—especially small and medium-sized enterprises (SMEs)—to slow hiring or even lay off workers, thus increasing unemployment. As of April 2024, DANE reported a national unemployment rate of 10.6%. The government must balance the goal of higher wages with the need for job creation.

3. GDP Growth: The overall economic performance of the country provides the resources for wage increases. A booming economy with high productivity growth can more easily absorb higher labor costs. A sluggish economy, like the one Colombia experienced post-pandemic with GDP growth of just 0.6% in 2023 (according to the World Bank), makes large, real wage increases more difficult to sustain without negative side effects.

4. Labor Productivity: This is a crucial, though often contentious, metric. Ideally, real wage increases should be aligned with increases in labor productivity (the amount of output per hour worked). If wages grow much faster than productivity, it can fuel inflation or reduce business competitiveness.

Emerging Trends and Future Challenges

- The Shift to a 42-Hour Work Week: Law 2101 of 2021 mandates a gradual reduction of the standard work week from 48 to 42 hours by 2026, without any reduction in salary. As of July 2024, the standard is 47 hours. This effectively increases the hourly wage rate for minimum wage workers each time it is reduced. The challenge will be for businesses to absorb this increase in the hourly cost of labor, likely by finding productivity gains.

- The "Dollarization" of Tech Salaries: The rise of remote work has allowed a growing number of Colombian professionals, particularly in the tech sector, to work for U.S. or European companies and earn in USD or EUR. This creates a significant wage gap between those with global skills and the rest of the domestic labor market. While excellent for the individuals involved, it can also drive up costs in major cities and highlights the importance of English and tech skills for economic mobility.

- The Debate on Regional Minimum Wages: There is a recurring academic and political debate about whether Colombia should move from a single national minimum wage to a system of regional minimum wages that reflect the vast differences in cost of living and economic productivity across the country. Proponents argue this would make the wage more realistic and less damaging to employment in poorer regions. Opponents worry it would formalize inequality and be politically difficult to implement. This debate is likely to intensify in the coming years.

- Pension and Labor Reform: The current government has made pension and labor reform a central part of its agenda. Proposed changes aim to strengthen unions, provide greater job stability, and expand pension coverage. The final form of these reforms will have a profound long-term impact on the entire labor market, including compensation structures, hiring practices, and the formal-informal divide.

How to Stay Relevant and Advance

For individuals looking to grow their earnings in the Colombian context, the path forward involves a clear strategy:

1. Formalize: The first step to a stable career path is moving from the informal to the formal sector to gain legal protections and benefits.

2. Upskill and Reskill: Continuously invest in education and training, focusing on the skills in highest demand—English, digital literacy, and technical expertise relevant to growth sectors.

3. Gain Experience in Growth Industries: Target sectors like technology, renewable energy, nearshoring/BPO (Business Process Outsourcing), and high-value-added services.

4. Build a Professional Network: Use platforms like LinkedIn and attend industry events to connect with employers and stay abreast of market trends.

The future of wages in Colombia will be shaped by the push and pull of these economic forces and policy debates. While the SMMLV provides a crucial safety net, long-term prosperity for individuals will depend on their ability to adapt and acquire the skills that the modern Colombian economy values most.

Navigating the Colombian Job Market: A Guide for Workers and Expats

Whether you are a local graduate entering the workforce or a foreigner planning to work in Colombia, understanding how to navigate the job market in the context of the minimum wage is essential for success.

A Step-by-Step Guide for Aspiring Professionals (Colombian and Foreign)

Step 1: Foundational Education and Skill Assessment

- Define Your Path: Your journey begins with education. As established, a university or technical degree is the most reliable way to position yourself to earn well above the minimum wage. Choose a field with strong demand in the Colombian market, such as engineering, IT, finance, or international business.

- Assess Your "Golden Skill": For all professional roles, assess your English level honestly. If it is not at a B2 (Upper Intermediate) level or higher, make improving it your top priority. Enroll in courses, use language apps, and seek conversation practice. This single skill can be the biggest differentiator in your salary potential.

- Acquire In-Demand Technical Skills: Supplement your formal education with certifications in high-