A major change is reshaping the employment landscape for millions of American workers. A new federal rule from the Department of Labor (DOL) is set to significantly increase the salary threshold for overtime eligibility, meaning many salaried professionals previously not entitled to overtime pay may soon be. This shift presents both opportunities and critical questions for employees and employers alike. If you are a salaried worker earning under $58,000, this article is essential reading.

What is the New Federal Overtime Rule?

At its core, the new regulation is an update to the Fair Labor Standards Act (FLSA). The FLSA establishes rules around minimum wage, recordkeeping, and overtime pay. Employees are generally classified as either "non-exempt" or "exempt" from overtime.

- Non-Exempt Employees: Must be paid overtime (at least 1.5 times their regular rate of pay) for any hours worked over 40 in a workweek.

- Exempt Employees: Are not entitled to overtime pay. To be considered exempt, employees must meet three tests:

1. Be paid on a salary basis.

2. Be paid at least the minimum salary threshold set by the DOL.

3. Primarily perform executive, administrative, or professional (EAP) duties, as defined by the law (the "duties test").

The "new federal law" that most people are referring to is the DOL's 2024 final rule, "Defining and Delimiting the Exemptions for Executive, Administrative, Professional, Outside Sales, and Computer Employees." This rule significantly raises the minimum salary threshold (the second test), making it harder for employers to classify lower-paid salaried workers as exempt.

The New Salary Thresholds: What You Need to Know

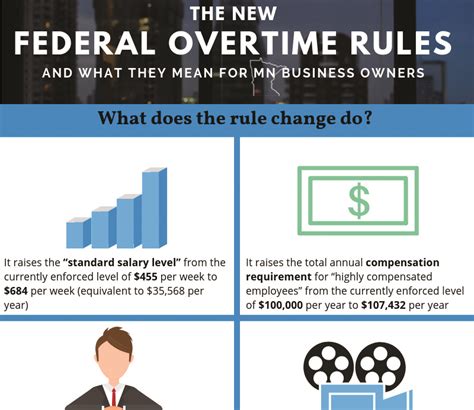

The most critical part of the new rule is the dramatic increase in the minimum salary an employee must earn to be classified as exempt from overtime. The current threshold of $35,568 per year (or $684 per week) is being raised in a two-step process.

According to the U.S. Department of Labor, the new standard salary levels are:

- Effective July 1, 2024: The threshold will increase to $43,888 per year ($844 per week).

- Effective January 1, 2025: The threshold will increase again to $58,656 per year ($1,128 per week).

Furthermore, the rule increases the salary threshold for Highly Compensated Employees (HCEs), who are subject to a more lenient duties test, from the current $107,432 to $151,164 per year by January 1, 2025. The rule also includes a mechanism for these thresholds to be automatically updated every three years to reflect current wage data.

Key Factors That Influence How This Law Affects You

This rule will not impact every salaried professional equally. Its effect on your job and paycheck depends heavily on your current salary and circumstances.

### Years of Experience

Experience is a primary driver of salary. An entry-level professional is far more likely to be impacted than a senior-level one.

- Early-Career Professionals (0-5 years): This group will see the most significant impact. Many roles like junior accountants, marketing coordinators, non-profit program managers, and assistant store managers have salaries that fall between the old $35,568 threshold and the new $58,656 threshold. These employees will likely either see a salary increase to remain exempt or be reclassified as non-exempt and become eligible for overtime.

- Mid- to Senior-Career Professionals (5+ years): Most experienced professionals in fields like finance, tech, and healthcare already earn salaries above the $58,656 threshold. For them, this rule will have little to no direct financial impact, as they will remain exempt based on their salary.

### Geographic Location

Where you live and work plays a massive role in determining both salaries and the impact of this rule.

- High Cost-of-Living (HCOL) Areas: In major metropolitan centers like New York City, San Francisco, or Boston, market-rate salaries for many professional roles are already well above the new $58,656 threshold. For example, according to Salary.com, the median salary for a Human Resources Generalist in San Francisco is over $90,000. Therefore, the rule's impact will be less widespread in these cities.

- Low to Medium Cost-of-Living (LCOL/MCOL) Areas: The rule will have a profound effect in the Midwest, the South, and rural areas. A salaried manager in a retail store in Ohio or an office administrator in Arkansas might earn $45,000 - $55,000. These are precisely the workers the law targets. Their employers must now make a critical decision: increase their base pay above the new threshold or start paying them overtime.

### Industry and Company Type

The industry you work in and the size of your company will dictate how your employer responds.

- Industries like Retail, Hospitality, and Non-Profits: These sectors traditionally have tighter margins and employ many frontline managers, supervisors, and coordinators with salaries in the $40,000-$55,000 range. They will be heavily impacted and may be more likely to reclassify employees as non-exempt to control costs.

- Industries like Tech, Finance, and Law: These fields typically have higher salary structures, even for junior roles. A first-year software engineer or financial analyst often starts well above the $58,656 threshold, making the rule's direct impact minimal for most professional staff.

- Small Businesses vs. Large Corporations: Large corporations may have more resources to absorb the cost of raising salaries. Small businesses may face a tougher choice between increasing payroll costs and the administrative burden of tracking hours for newly non-exempt employees.

### Job Role and Duties

Remember, salary is only one part of the exemption test. Your primary job responsibilities are also crucial. If your salary is above the new threshold, your employer must still prove that your role meets the "duties test" for executive, administrative, or professional work. This new rule change provides a perfect opportunity for all salaried employees to review their job descriptions. If you are a manager who spends 70% of your time on the cash register or an "analyst" who primarily does data entry, you may not have met the duties test in the first place, regardless of your salary.

Impact on the Job Market and Career Progression

According to the U.S. Bureau of Labor Statistics (BLS), occupations in management, business, and financial operations often require work beyond the standard 40-hour week. The new rule will force a re-evaluation of this dynamic. We can expect several potential outcomes:

1. Salary Compression: Some employers may raise the salaries of those just below the threshold to $58,656, while the salaries of those already earning slightly more (e.g., $60,000) may not change. This can tighten the pay gap between junior and mid-level employees.

2. Shift to Hourly Pay: Many companies may choose to convert salaried-exempt employees to non-exempt hourly workers to manage payroll precisely and avoid unexpected overtime costs. This could provide better work-life balance for some but may be perceived as a status reduction by others.

3. Increased Focus on Efficiency: With overtime now a direct cost for millions more employees, companies will be heavily incentivized to improve processes, manage workloads, and ensure that work can be completed within a 40-hour week.

The overall job outlook for professional roles remains strong. The BLS projects employment in management occupations to grow 6 percent from 2022 to 2032, faster than the average for all occupations. This rule doesn't change the demand for skilled professionals, but it does change the financial equation for how they are compensated.

Conclusion: What to Do Next

The new federal overtime rule is one of the most significant compensation changes for salaried workers in decades. For millions of professionals, it promises either a pay raise or the opportunity to be paid for every hour they work.

Key Takeaways:

- Know the Numbers: The salary threshold to be exempt from overtime will be $43,888 on July 1, 2024, and $58,656 on January 1, 2025.

- Assess Your Situation: Your eligibility is determined by your salary, your location, your industry, and your specific job duties.

- Prepare for a Conversation: If your salary is below the new threshold, expect a communication from your employer about how they plan to comply. This could mean a salary increase or a change in your pay structure.

This change empowers you with new knowledge about your rights and value. Use this opportunity to review your compensation, understand your role, and advocate for fair pay that truly reflects your contribution and your time.