In our increasingly digital and interconnected world, the role of a fraud analyst has never been more critical. These professionals are the digital detectives on the front lines, protecting companies and consumers from financial loss. If you have an analytical mind, an eye for detail, and a passion for justice, this career path can be both intellectually stimulating and financially rewarding.

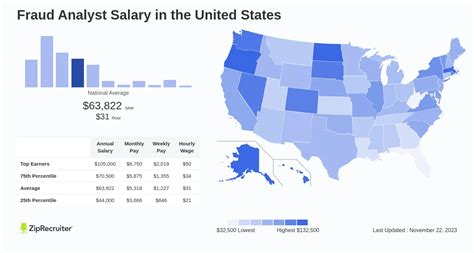

So, what can you expect to earn? While salaries vary, a fraud analyst in the United States can expect a median salary in the range of $65,000 to $75,000 per year. Entry-level positions typically start around $55,000, while senior analysts, team leads, and specialists in high-demand areas can command salaries well over $100,000.

This article will break down everything you need to know about a fraud analyst's salary, the factors that drive earnings, and the promising future of this essential profession.

What Does a Fraud Analyst Do?

Before diving into the numbers, it's important to understand the role. A fraud analyst is an expert investigator who uses data to identify, analyze, and prevent fraudulent activity. They work in a variety of industries, including banking, finance, e-commerce, insurance, and government.

Their core responsibilities often include:

- Monitoring Transactions: Using sophisticated software to monitor real-time transactions for suspicious patterns or red flags.

- Investigating Alerts: Conducting deep-dive investigations into flagged accounts or activities to determine if they are fraudulent.

- Analyzing Data: Identifying trends, patterns, and emerging fraud tactics by analyzing large datasets.

- Reporting Findings: Compiling detailed reports on fraud cases and presenting findings to management or law enforcement.

- Improving Systems: Recommending and implementing new rules, tools, and strategies to improve fraud detection and prevention systems.

Average Fraud Analyst Salary

The salary for a fraud analyst is competitive and reflects the high-demand nature of the skill set. While there is a range, we can establish a clear picture by looking at data from several authoritative sources.

According to reputable salary aggregators, the national median salary for a fraud analyst typically falls within this range:

- Salary.com reports the median salary for a Fraud Analyst I is $66,971, with a typical range falling between $56,765 and $79,890 as of late 2023.

- Payscale lists the average salary at around $62,500 per year.

- Glassdoor states a median base salary of approximately $68,000 per year, with total pay (including potential bonuses) rising to over $72,000.

It's also useful to consider data from the U.S. Bureau of Labor Statistics (BLS). While the BLS does not have a specific category for "Fraud Analyst," the role closely aligns with Financial Examiners. The BLS reports a median annual wage for Financial Examiners of $87,850 as of May 2023. This higher figure often includes more senior, specialized, and government-based roles, reflecting the strong earning potential as you advance in your career.

Key Factors That Influence Salary

Your specific salary as a fraud analyst will depend on a combination of factors. Understanding these variables can help you maximize your earning potential throughout your career.

###

Level of Education

A bachelor's degree is typically the minimum requirement for an entry-level fraud analyst position. Degrees in Finance, Accounting, Criminal Justice, Statistics, or Computer Science are highly valued. While a bachelor's degree will get you in the door, a master's degree (such as an MBA or a Master's in Data Analytics or Cybersecurity) can lead to a higher starting salary and open doors to management and strategy roles more quickly.

###

Years of Experience

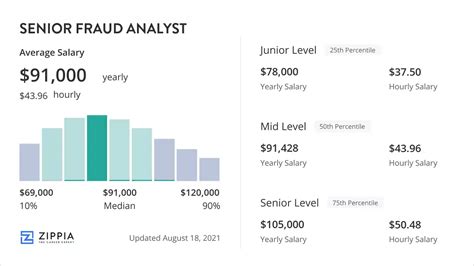

Experience is one of the most significant drivers of salary growth in this field. As you gain more expertise in identifying complex fraud schemes and working with advanced analytical tools, your value to an organization increases substantially.

- Entry-Level (0-2 years): Analysts new to the field can expect to earn between $55,000 and $65,000. The focus at this stage is on learning company-specific tools and handling initial fraud alerts.

- Mid-Level (3-5 years): With a few years of experience, analysts can see their salaries increase to the $65,000 to $85,000 range. They take on more complex investigations and may begin to mentor junior analysts.

- Senior/Lead (6+ years): Senior fraud analysts with extensive experience, strong leadership skills, and a proven track record can earn $85,000 to $110,000+. These roles often involve managing a team, developing fraud prevention strategy, and working with cross-functional departments.

###

Geographic Location

Where you work matters. Major metropolitan areas, especially financial and tech hubs, tend to offer higher salaries to compensate for a higher cost of living and greater demand for talent.

Cities like New York, NY; San Francisco, CA; Washington, D.C.; and Boston, MA consistently offer salaries that are 15-25% above the national average. Conversely, salaries in smaller cities and rural areas may be closer to the lower end of the national range.

###

Company Type

The industry and size of your employer play a major role in your compensation package.

- Large Financial Institutions (e.g., JPMorgan Chase, Bank of America): These companies handle massive transaction volumes and face significant risk, so they invest heavily in top-tier fraud teams and often offer the highest salaries.

- Major Credit Card Companies (e.g., Visa, American Express): As the primary targets of payment fraud, these organizations are leaders in fraud prevention and offer highly competitive pay.

- E-commerce and Tech Companies (e.g., Amazon, PayPal): Fast-paced and data-driven, these companies offer strong salaries and often include attractive benefits like stock options.

- Insurance Companies: These firms have dedicated fraud units (Special Investigation Units) to investigate fraudulent claims, offering stable and competitive careers.

- Government Agencies (e.g., FBI, IRS, Treasury): While starting salaries may be slightly lower than in the private sector, government roles offer exceptional job security, excellent benefits, and a clear path for advancement.

###

Area of Specialization

Fraud is not a one-size-fits-all problem. Specializing in a high-demand area can significantly boost your earnings. Areas of specialization include e-commerce fraud, payment fraud, insurance claims fraud, identity theft, or anti-money laundering (AML).

Furthermore, professional certifications demonstrate a commitment to the field and a verified level of expertise. The single most important certification for a fraud analyst is the Certified Fraud Examiner (CFE) from the Association of Certified Fraud Examiners (ACFE). According to the ACFE's *2022 Compensation Guide for Anti-Fraud Professionals*, CFEs earn a 17% salary premium on average compared to their non-certified peers.

Job Outlook

The future for fraud analysts is exceptionally bright. As commerce and finance become increasingly digital, so do the methods used by criminals. This creates a constant and growing need for skilled professionals who can protect assets and stay one step ahead of emerging threats.

The BLS projects that employment for Financial Examiners will grow 2% from 2022 to 2032, which is about as fast as the average for all occupations. However, this number likely understates the true demand in the private sector, especially in areas like e-commerce and fintech, which are expanding rapidly. Job security in this field is considered very high, as fraud prevention is a core, non-negotiable function for almost any company handling financial transactions.

Conclusion

A career as a fraud analyst offers a compelling blend of meaningful work, intellectual challenge, and strong financial rewards. With a median salary that provides a comfortable living and significant room for growth, it's an excellent path for analytical thinkers.

To maximize your potential in this field, focus on these key takeaways:

- Build a Strong Foundation: A relevant bachelor's degree is your entry ticket.

- Gain Experience: Your value and salary will grow significantly with each year of experience.

- Consider Location & Industry: Target high-paying geographic hubs and industries like finance and tech to boost your earnings.

- Get Certified: Earning your CFE certification is one of the most direct ways to increase your salary and career opportunities.

For those ready to build a career on the front lines of digital defense, the role of a fraud analyst is not just a job—it's a stable, rewarding, and future-proof profession.