The dream of homeownership is a cornerstone of personal and financial stability for millions. It represents security, legacy, and the creation of a personal sanctuary. Standing at the very center of this monumental life event is a crucial, yet often unseen, professional: the Mortgage Loan Originator (MLO). If you've ever felt a calling to guide people through one of the most significant financial decisions of their lives, blending analytical skill with empathetic counsel, this career path might be your perfect fit. But beyond the fulfillment, there's a practical question every aspiring professional must ask: What is the real earning potential? The salary for a mortgage loan originator is one of the most dynamic and performance-driven compensation structures in the financial world, offering a pathway to substantial income for those with the right skills and tenacity.

This guide will demystify the complex world of MLO compensation. We won't just give you a single number; we will dissect every factor that influences your paycheck, from your experience and location to the type of company you work for and the specialized skills you cultivate. I still remember the MLO who handled my first home loan. The market was volatile, and my financial situation was far from straightforward. Her calm expertise and relentless problem-solving not only secured the loan but transformed a stressful process into an empowering one. It was a masterclass in the tangible impact a great MLO can have, and it underscored that this job is about far more than just numbers—it's about turning aspirations into reality.

Whether you're a recent graduate exploring your options, a professional considering a career change, or an existing MLO looking to maximize your earnings, this comprehensive article will serve as your definitive roadmap. We will explore the day-to-day realities of the job, dive deep into salary data from authoritative sources, analyze the future job outlook, and provide a concrete, step-by-step plan to launch and accelerate your career.

### Table of Contents

- [What Does a Mortgage Loan Originator Do?](#what-does-a-mortgage-loan-originator-do)

- [Average Mortgage Loan Originator Salary: A Deep Dive](#average-mortgage-loan-originator-salary-a-deep-dive)

- [Key Factors That Influence an MLO's Salary](#key-factors-that-influence-an-mlos-salary)

- [Job Outlook and Career Growth for MLOs](#job-outlook-and-career-growth-for-mlos)

- [How to Become a Mortgage Loan Originator](#how-to-become-a-mortgage-loan-originator)

- [Conclusion: Is a Career as an MLO Right for You?](#conclusion-is-a-career-as-an-mlo-right-for-you)

What Does a Mortgage Loan Originator Do?

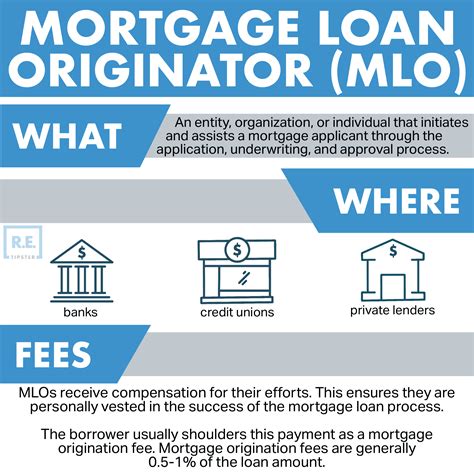

At its core, a Mortgage Loan Originator (also known as a Loan Officer or Mortgage Consultant) is a licensed financial professional who acts as the intermediary between a borrower seeking a home loan and a lender (such as a bank, credit union, or mortgage company) that provides the funds. Their primary objective is to help individuals and families secure the right financing to purchase or refinance a property. This involves much more than simply processing paperwork; it's a multifaceted role that requires a unique blend of sales, finance, customer service, and regulatory compliance skills.

The MLO is the client's main point of contact and trusted advisor throughout the entire loan process, from the initial inquiry to the final closing. They are responsible for a wide range of critical tasks:

- Business Development and Lead Generation: Proactively finding new clients. This involves networking with real estate agents, financial planners, builders, and past clients, as well as marketing their services through social media, local events, and other channels. The most successful MLOs are masters of building and nurturing professional relationships.

- Client Consultation and Pre-Qualification: The initial step involves understanding a potential borrower's financial situation, goals, and needs. The MLO analyzes the client's income, assets, debts, and credit history to determine their borrowing power and pre-qualify them for a specific loan amount. This gives the homebuyer the confidence to start shopping for a house within their budget.

- Loan Product Education: There isn't a one-size-fits-all mortgage. MLOs must have an encyclopedic knowledge of various loan products, including Conventional, FHA, VA, USDA, Jumbo, and non-traditional loans. They explain the pros and cons of each, including differences in interest rates, down payment requirements, and mortgage insurance, helping the client choose the optimal program for their circumstances.

- Application and Documentation: Once a property is under contract, the MLO guides the borrower through the formal loan application. This is an intensive process of collecting and verifying a mountain of documentation, such as pay stubs, W-2s, tax returns, bank statements, and investment records. Attention to detail is paramount to avoid delays.

- Loan Structuring and Submission: The MLO structures the loan file to meet the specific guidelines of the lender and the chosen loan program. They then submit this complete package to the lender's underwriting department for review and approval.

- Problem-Solving and Communication: An MLO acts as a project manager. They constantly communicate with the borrower, the real estate agents, the underwriter, the appraiser, and the title company to ensure the loan moves forward smoothly. When issues arise—and they often do, such as a low appraisal or a question about a borrower's income—the MLO must be a creative and persistent problem-solver to find a solution and keep the deal on track for closing.

#### A Day in the Life of a Mortgage Loan Originator

To make this more tangible, let's walk through a typical day for a successful MLO:

- 8:00 AM - 9:30 AM: Pipeline and Market Review. The day starts with a review of the current loan pipeline—checking the status of all active files. They'll follow up on any outstanding conditions from underwriting and check in on scheduled appraisals. They also review the day's financial market news, as changes in bond markets can directly impact mortgage interest rates.

- 9:30 AM - 11:00 AM: Proactive Outreach. This is prime time for business development. They might call real estate agents they partner with to ask about new listings or clients, follow up on leads from their website, and send thank-you notes to clients who recently closed.

- 11:00 AM - 1:00 PM: Client Meetings. An MLO might have a meeting (in-person or virtual) with new clients to conduct a pre-qualification, explaining the process and gathering initial information. This could be followed by a call with a current client to walk them through the complex closing disclosure document.

- 1:00 PM - 2:00 PM: Lunch and Networking. Lunch is often a working event, perhaps with a top-producing real estate agent to strengthen their partnership and discuss co-marketing strategies.

- 2:00 PM - 4:30 PM: File Work and Problem-Solving. The afternoon is dedicated to the detailed work. This involves reviewing new loan applications for completeness, submitting a file to processing, and tackling problems. They might spend an hour on the phone with an underwriter to clarify a complex income scenario for a self-employed borrower or drafting a letter of explanation for a client.

- 4:30 PM - 6:00 PM (and beyond): Catch-up and Planning. As the standard workday ends, an MLO is often still working. They respond to the flood of emails that came in while they were in meetings, update clients on their loan status, and plan their priorities for the next day. Since clients and realtors often work evenings and weekends, being available after hours is a common requirement for success.

This "day in the life" illustrates that the role is not a standard 9-to-5 job. It's a dynamic, demanding, and highly rewarding career for self-starters who thrive on building relationships and closing deals.

Average Mortgage Loan Originator Salary: A Deep Dive

The compensation structure for a Mortgage Loan Originator is one of the most significant draws—and one of the most misunderstood aspects—of the profession. Unlike many salaried roles, an MLO's income is heavily tied to performance, meaning there is theoretically no ceiling on what a top producer can earn. However, this also introduces a level of variability that can be daunting for newcomers.

It's crucial to differentiate between base salary and total compensation. Many MLO positions, especially at non-bank lenders and mortgage brokers, are commission-heavy. The base salary might be modest (or in some cases, non-existent, structured as a recoverable "draw"), with the vast majority of earnings coming from commissions paid on closed loans.

#### National Averages and Typical Ranges

To establish a baseline, let's look at data from several authoritative sources. It's important to view these as a composite picture, as each source uses a different methodology.

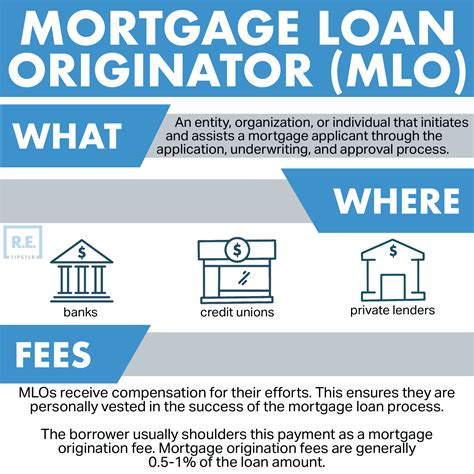

- U.S. Bureau of Labor Statistics (BLS): The BLS groups Mortgage Loan Originators under the broader category of "Loan Officers." As of May 2023, the BLS reports the median annual wage for loan officers was $72,570. The lowest 10 percent earned less than $39,010, and the highest 10 percent earned more than $158,520. This data provides a reliable median but often underrepresents the earning potential of high-performing, commission-based MLOs.

- Salary.com: This platform provides more granular data. As of early 2024, Salary.com reports the average Mortgage Loan Originator I (entry-level) salary in the United States is $48,775, but the typical range falls between $42,657 and $56,086. For a senior MLO (level III), the average jumps to $114,923, with a range typically between $95,038 and $134,222. Crucially, this site notes that these figures often represent *base salary only* and do not include the substantial commission potential.

- Payscale: Payscale provides a more comprehensive look at total compensation. Their data, updated in 2024, shows the average MLO salary is around $79,800 per year. However, the total pay range is exceptionally wide, spanning from $44,000 to $204,000, including bonuses and commissions. This highlights the performance-driven nature of the role.

- Glassdoor: According to Glassdoor data from early 2024, the estimated total pay for a Mortgage Loan Originator in the United States is $126,626 per year, with an average salary of $69,451 and an estimated additional pay (commission, bonuses) of $57,175. This again illustrates that for many, commissions can make up nearly half—or more—of their total income.

Key Takeaway: While a starting MLO might see a base salary in the $40,000 to $50,000 range, a realistic total compensation for a competent, first-year MLO is closer to $60,000 - $80,000. An established, mid-career MLO can comfortably earn $100,000 - $180,000, and elite top producers consistently break the $250,000, $500,000, or even $1 million mark in a strong housing market.

#### Salary by Experience Level

An MLO's income grows directly with their experience, network, and reputation. Here is a more detailed breakdown of what you can expect at different stages of your career.

| Experience Level | Typical Base Salary Range | Typical Total Compensation Range (with Commission) | Profile and Responsibilities |

| :--- | :--- | :--- | :--- |

| Entry-Level (0-2 Years) | $35,000 - $55,000 | $55,000 - $90,000 | Often starts as a Loan Officer Assistant or Junior MLO. Focus is on learning the process, supporting senior MLOs, handling documentation, and building initial contacts. May work on a lower commission split or a salary + bonus structure. |

| Mid-Career (3-8 Years) | $45,000 - $70,000 | $90,000 - $180,000 | Has an established network of referral partners (realtors, etc.). Manages their own pipeline of loans from start to finish. Possesses deep product knowledge and can handle more complex loan scenarios. Commission split is higher. |

| Senior/Top Producer (9+ Years) | $50,000 - $80,000+ | $180,000 - $500,000+ | A recognized expert with a powerful, self-sustaining referral network. May lead a team of junior MLOs and processors. Specializes in a lucrative niche (e.g., jumbo loans, construction loans). The base salary is less relevant as commission income is massive. |

#### Understanding the Compensation Components

To fully grasp MLO salary, you must understand how it's built.

1. Base Salary: A fixed annual amount paid regardless of production. This is more common at large banks and credit unions, providing a stable income floor. At independent mortgage brokers, the base may be very low or non-existent.

2. Draw Against Commission: A common structure where the company provides a modest, regular paycheck (a "draw"), which is essentially an advance on future commissions. If your earned commissions are less than your draw, you may owe the difference back to the company. If you earn more, you get the overage. It's a safety net, but with a catch.

3. Commission: This is the heart of MLO compensation. It's calculated as a percentage of the total loan amount, known as Basis Points (Bps). One basis point is 1/100th of a percentage point (0.01%). A typical commission for an MLO might range from 50 Bps (0.50%) to 150 Bps (1.50%) of the loan amount.

- Example: On a $400,000 loan, a commission of 100 Bps (1.0%) would be $4,000. If an MLO closes just two such loans per month, that's $96,000 in annual commission, on top of any base salary.

4. Bonuses: These can be tied to several metrics:

- Volume Bonuses: Tiered bonuses for exceeding certain monthly, quarterly, or annual funding volume targets (e.g., a $5,000 bonus for closing over $3 million in a quarter).

- Profit Sharing: Some companies offer a share of the branch or company's overall profits.

- Sign-on Bonuses: Experienced, high-producing MLOs are highly sought after and may be offered significant sign-on bonuses to switch companies.

5. Benefits: Don't overlook the value of a strong benefits package. Larger institutions typically offer superior health insurance, dental/vision plans, and 401(k) matching programs. For a 100% commission MLO at a small brokerage, these may be costs they have to cover themselves, impacting their net take-home pay.

Key Factors That Influence an MLO's Salary

An MLO's income is not a fixed number; it's a dynamic equation with multiple variables. Two MLOs working in the same city could have drastically different earnings based on their experience, employer, and skill set. Understanding these factors is critical for anyone looking to maximize their earning potential in this field.

###

1. Level of Education and Certifications

While a four-year college degree is not a strict requirement to become an MLO, it can significantly influence your career trajectory and starting opportunities. The mandatory entry ticket for every MLO in the United States is passing the SAFE Act NMLS exam and obtaining state licensure. However, what you do beyond that minimum requirement is what sets you apart.

- Educational Background: A bachelor's degree in Finance, Economics, or Business Administration is highly favored by employers, especially larger banks and financial institutions. It provides a strong foundational knowledge of financial principles, market analysis, and business ethics. Candidates with these degrees are often seen as lower-risk hires and may be placed on a faster track to higher-producing roles. While an MLO with only a high school diploma can be incredibly successful through sheer sales talent and hard work, a relevant degree can open doors more quickly, particularly in the corporate banking world.

- Mandatory Licensing (The Floor): The Secure and Fair Enforcement for Mortgage Licensing (SAFE) Act requires all MLOs to be licensed through the Nationwide Multistate Licensing System & Registry (NMLS). This involves completing 20 hours of pre-licensing education, passing a national exam, and undergoing a criminal background and credit check. This is the non-negotiable minimum standard for entry.

- Voluntary Advanced Certifications (The Ceiling): To truly stand out and justify higher compensation, experienced MLOs can pursue advanced certifications. These signal a deep commitment to the profession and a higher level of expertise.

- Certified Residential Mortgage Specialist (CRMS): Offered by the National Association of Mortgage Brokers (NAMB), this is a prestigious designation that requires a minimum of five years of experience and demonstrates a comprehensive knowledge of residential mortgage lending.

- Certified Mortgage Banker (CMB): Offered by the Mortgage Bankers Association (MBA), this is one of the highest professional designations for real estate finance professionals, signifying expertise in both residential and commercial lending as well as management skills.

- Holding these certifications can make an MLO more attractive to high-net-worth clients and employers, potentially leading to leadership roles or access to more complex, higher-commission loan products.

###

2. Years of Experience

Experience is arguably the single most powerful factor determining an MLO's income. This is not simply about time served; it's about the compounding effect of building a reputation and a referral network.

- 0-2 Years (The Learning Curve): The first two years are about survival and learning. Income is often modest as the MLO builds their knowledge base and, most importantly, their network of referral partners (primarily real estate agents). Many start as assistants (LOAs), earning a salary and a small bonus per file. Total compensation might range from $55,000 to $90,000, with a heavy reliance on the employer for leads.

- 3-8 Years (The Growth Phase): This is where MLOs hit their stride. They have a reliable, growing network that sends them consistent business. They are no longer dependent on company-provided leads. They have mastered the loan process, can navigate complex files with ease, and have built a strong reputation for closing loans on time. Income jumps significantly into the $90,000 to $180,000 range, with top performers in this bracket pushing past $200,000 in strong markets.

- 9+ Years (The Expert Phase): Senior MLOs are titans of the industry. Their business is almost entirely referral-based from a deeply loyal network of realtors, financial planners, past clients, and builders. They are highly efficient, often supported by a team of assistants and processors that they manage. Their experience allows them to confidently handle any loan scenario. Earnings for this group regularly exceed $180,000, with top producers in high-cost-of-living areas earning $300,000, $500,000, or more annually. Their value is not just in the volume they produce but in the leadership and expertise they bring to their organization.

###

3. Geographic Location

Where you work as an MLO has a direct and dramatic impact on your paycheck. This is driven by two primary forces: the median home value in the area and the cost of living. Higher property values mean larger loan amounts, which directly translate to larger commission checks.

- High-Paying States and Metropolitan Areas: States with high property values and bustling real estate markets are magnets for MLOs.

- California: Cities like San Francisco, San Jose, Los Angeles, and San Diego boast some of the highest median home prices in the country. An MLO closing a $1 million loan here earns twice the commission as an MLO closing a $500,000 loan elsewhere, all else being equal.

- New York: The New York City metro area, including parts of New Jersey and Connecticut, is another hotspot due to high property values.

- Washington, Massachusetts, Colorado, and Hawaii: These states also feature high median home prices and competitive real estate markets, leading to higher-than-average MLO compensation. According to BLS data, the annual mean wage for loan officers in states like New York and Massachusetts can be 20-30% higher than the national average.

- Lower-Paying States and Rural Areas: Conversely, MLOs in states with a lower cost of living and more modest property values will naturally have lower average earnings, even if they are highly skilled. States like Mississippi, Arkansas, West Virginia, and Oklahoma have median home prices that are a fraction of those in coastal states. While an MLO can still make a very comfortable living here, achieving the massive incomes seen in places like California is statistically more challenging due to smaller average loan sizes.

It's a numbers game: A top MLO in a lower-cost area might need to close 3-4 loans to equal the commission from a single loan closed by an average MLO in a high-cost area.

###

4. Company Type and Size

The type of institution an MLO works for fundamentally shapes their compensation structure, work culture, and lead generation opportunities.

- Depository Institutions (Large Banks and Credit Unions):

- *Examples:* Wells Fargo, JPMorgan Chase, Bank of America, local credit unions.

- *Compensation:* Typically a higher base salary and lower commission split. For instance, the commission might be 30-60 Bps. They offer strong benefits packages (health insurance, 401(k) match) and a greater sense of income stability.

- *Pros:* They have a massive existing customer base and significant brand recognition, providing a steady stream of "in-house" leads. This is an excellent environment for new MLOs to learn the ropes.

- *Cons:* Less flexibility in loan programs ("credit overlays" can be stricter than standard guidelines), more corporate bureaucracy, and a lower ceiling on potential earnings due to the lower commission structure.

- Independent Mortgage Brokers and Lenders:

- *Examples:* Guild Mortgage, CrossCountry Mortgage, and thousands of smaller local and regional brokerages.

- *Compensation:* Typically a lower (or no) base salary and a much higher commission split (e.g., 80-150 Bps). The MLO is expected to be an entrepreneur who generates their own business.

- *Pros:* A wider array of loan products from various wholesale lenders, giving them more flexibility to find solutions for clients. Greater autonomy and a much higher earning potential for self-starters.

- *Cons:* Higher risk. Income can be volatile, especially in the beginning. MLOs are often responsible for their own marketing expenses and may have to pay for their own benefits. This is a "high-risk, high-reward" environment best suited for experienced, disciplined professionals.

- Online/Direct Lenders:

- *Examples:* Rocket Mortgage, Better.com.

- *Compensation:* Can be a hybrid model. Some roles are salaried with bonuses tied to volume and customer satisfaction rather than a traditional commission structure.

- *Pros:* Access to cutting-edge technology and a massive national marketing budget that generates a high volume of inbound leads. MLOs here can focus more on processing and advising rather than cold-calling and prospecting.

- *Cons:* May feel more like a call-center environment. Less personal connection with clients and referral partners. Compensation may have a lower ceiling than for a top-producing traditional MLO.

###

5. Area of Specialization

Just as doctors specialize, MLOs can significantly increase their value and income by developing expertise in specific loan niches. Generalists are common, but specialists are often in higher demand and can command more business.

- Government Loans (FHA/VA/USDA): Specializing in these loans requires deep knowledge of specific government guidelines, which can be complex. MLOs who become the go-to expert for VA loans in a military town or USDA loans in a rural area can build a powerful and loyal client base.

- Jumbo Loans: These are loans that exceed the conforming loan limits set by Fannie Mae and Freddie Mac (