For decades, a career at Goldman Sachs has been a hallmark of ambition and success in the financial world. Reaching the level of Vice President (VP) at this prestigious institution is a significant mid-career milestone, signifying deep expertise and leadership. But what does this achievement translate to financially? While the role is demanding, the compensation can be exceptionally rewarding, with total packages often ranging from $300,000 to well over $550,000 annually.

This article will break down the salary of a Goldman Sachs Vice President, exploring the components of their compensation, the key factors that influence their earnings, and the career outlook for professionals in this field.

What Does a Goldman Sachs Vice President Do?

First, it's crucial to understand that the title "Vice President" in investment banking is not an executive or C-suite position as it is in many other industries. It is a mid-level management role, typically for professionals with 5-10 years of experience. A VP sits above Analysts and Associates and reports to a Director or Managing Director.

The primary responsibilities of a VP at Goldman Sachs include:

- Project and Deal Execution: VPs are the primary engines on transactions. They manage the day-to-day execution of deals, whether it's an IPO, a merger or acquisition (M&A), or a financing round.

- Team Management: They oversee the work of junior bankers (Analysts and Associates), ensuring the accuracy of financial models, pitchbooks, and due diligence materials.

- Client Relationship Management: VPs begin to take on more client-facing responsibilities, often serving as a key point of contact and building relationships with client counterparts.

- Strategic Input: They contribute to strategic discussions, help generate ideas for clients, and play a pivotal role in shaping the final presentations and recommendations.

Essentially, a VP is an experienced professional who combines deep technical skill with growing management and client-facing responsibilities.

Average Goldman Sachs Vice President Salary

Compensation for a Goldman Sachs VP is not a single number but a package composed of a base salary and a significant performance-based bonus. This structure is designed to reward both individual and firm-wide success.

Base Salary

The base salary for a Vice President at Goldman Sachs provides a stable and substantial income. According to recent data from authoritative sources, this figure is highly competitive.

- Typical Range: Data from Glassdoor indicates that the base salary for a Vice President at Goldman Sachs typically falls between $175,000 and $275,000 per year.

- Median Salary: Salary.com reports a median base salary closer to $235,500, with the full range extending based on the specific role and location.

Performance Bonus & Total Compensation

The variable bonus is what truly defines the earning potential of a VP. This bonus is tied to individual performance, the performance of their division, and the overall profitability of the firm for that year.

- Bonus Potential: The annual bonus can range from 50% to over 150% of the base salary. For a VP with a $250,000 base, this could mean a bonus between $125,000 and $375,000+.

- Total Compensation: Combining the base and bonus, the total compensation for a Goldman Sachs VP is powerful. Glassdoor reports an average total pay of around $380,000, while senior VPs in high-performing divisions can easily surpass $500,000 or $600,000 in a strong year.

Key Factors That Influence Salary

Compensation is not one-size-fits-all. Several factors play a critical role in determining a VP's final earnings.

### Level of Education

While a bachelor's degree from a top-tier university is the standard entry point into investment banking, advanced degrees can impact career trajectory and earning potential. Many VPs are promoted internally after joining as an Analyst post-undergrad. However, a Master of Business Administration (MBA) from an elite business school is a common entry point for those transitioning into banking at the Associate level, which is the direct feeder to the VP role. An MBA can command a higher starting base salary and signals a strong commitment to a long-term finance career.

### Years of Experience

Experience is a primary driver of salary within the VP title itself. The role is not static; there is a clear progression. A "VP1" (a first-year Vice President) will earn significantly less than a "VP3" (a third-year, more senior VP). As a VP gains experience, executes more deals, and builds stronger client relationships, both their base salary and, more importantly, their annual bonus will see substantial increases.

### Geographic Location

Where you work matters immensely. Goldman Sachs has offices in major financial hubs worldwide, but compensation varies to reflect the cost of living and market competition.

- Top-Tier Hubs: New York City, London, and San Francisco are the highest-paying locations due to the concentration of deals and talent. Salaries in these cities often set the industry benchmark.

- Other Major Offices: Locations like Chicago, Houston, or Los Angeles offer very competitive salaries, though they may be slightly lower than in New York.

- Strategic Locations: Goldman Sachs has built up significant operations in locations like Salt Lake City and Dallas. While the base salaries and bonuses in these offices are generally lower, the reduced cost of living can result in a comparable or even higher quality of life.

### Company Type

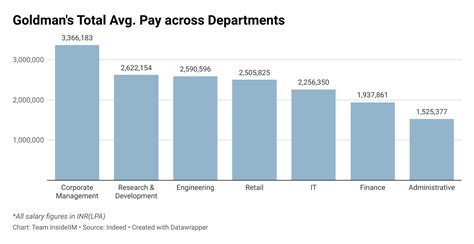

While this article is specific to Goldman Sachs, a crucial factor *within* the firm is the division in which a VP works. This is perhaps the single most significant determinant of pay.

- Front Office (Revenue-Generating): VPs in the Investment Banking Division (IBD), Sales & Trading, and Asset Management work directly on generating revenue for the firm. These are the highest-compensated roles.

- Back Office / Middle Office (Support): VPs in divisions like Operations, Technology, Global Compliance, or Human Resources are vital to the firm's success but are not directly generating revenue. As a result, their compensation, particularly the bonus component, is considerably lower than their front-office counterparts. A VP in a support function might have a total compensation package closer to the $200,000-$300,000 range.

### Area of Specialization

Even within a front-office division like Investment Banking, specialization can impact earnings. A VP working in a "hot" sector with high deal flow—such as Technology, Media, & Telecom (TMT) or Healthcare—may see larger bonuses due to the sheer volume and size of the transactions they help execute. In contrast, a VP in a more cyclical or slower-moving industry group may have a lower bonus potential in a given year.

Job Outlook

The demand for skilled financial professionals remains robust. While Goldman Sachs does not have specific hiring quotas published, the broader industry outlook is positive.

According to the U.S. Bureau of Labor Statistics (BLS), employment for Financial Managers is projected to grow 17 percent from 2021 to 2031, which is much faster than the average for all occupations. The BLS notes that this demand is driven by the need for strategic financial planning and analysis as the global economy grows more complex. This strong industry-wide demand ensures that top-tier institutions like Goldman Sachs will continue to compete fiercely for talented, experienced professionals to fill critical VP roles.

Conclusion

Becoming a Vice President at Goldman Sachs is a testament to years of hard work, financial acumen, and resilience. The role offers a challenging and dynamic career path with substantial financial rewards.

Key takeaways for any aspiring financial professional:

- Total Compensation is Key: Look beyond the base salary; the performance bonus is where VPs build significant wealth.

- Your Division Dictates Your Pay: The most lucrative roles are in front-office, revenue-generating divisions like Investment Banking.

- Performance is Paramount: Your individual success, your team's results, and the firm's profitability are all directly tied to your annual bonus.

- It's a Marathon, Not a Sprint: The VP role is a mid-career position that requires years of dedication to achieve, offering continued growth in both responsibility and compensation.

For those with the drive and talent to navigate the demanding world of high finance, the role of a Goldman Sachs Vice President remains one of the most sought-after and financially rewarding positions in the industry.