A career as a Financial Analyst offers a potent combination of intellectual challenge and significant earning potential. For those with a keen eye for numbers and a passion for strategy, this path can be exceptionally rewarding. But what can you realistically expect to earn? This guide breaks down the salary landscape for Financial Analysts, from entry-level positions to senior roles in top-tier firms. On average, a Financial Analyst in the United States can expect to earn a median salary of approximately $99,750 per year, with salaries commonly ranging from $75,000 to over $150,000.

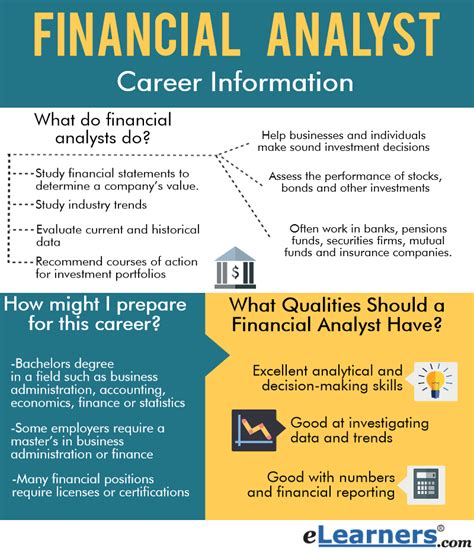

What Does a Financial Analyst Do?

At their core, Financial Analysts are financial detectives and strategists. They dive deep into data to guide businesses and individuals in making sound investment decisions. Their primary responsibilities include:

- Analyzing Financial Data: Scrutinizing balance sheets, income statements, and cash flow statements to assess a company's financial health.

- Financial Modeling: Building complex spreadsheets and models to forecast future revenues, expenses, and profits. This helps in budgeting, forecasting, and long-term strategic planning.

- Recommending Actions: Based on their analysis, they recommend actions like buying or selling a company's stock ("equity research"), investing in projects, or restructuring debt.

- Industry and Market Research: Staying on top of market trends, economic news, and competitor performance to provide context for their financial recommendations.

They are the backbone of data-driven decision-making in corporations, investment banks, insurance companies, and private equity firms.

Average Financial Analyst Salary

Salary expectations for Financial Analysts vary widely, but we can establish a strong baseline using data from authoritative sources.

According to the U.S. Bureau of Labor Statistics (BLS), the median annual wage for financial and investment analysts was $96,220 in May 2022.

Reputable salary aggregators provide a more granular, real-time view:

- Salary.com reports that the median salary for a Financial Analyst in the U.S. is $99,750 as of early 2024, with the typical range falling between $89,848 and $111,217.

- Glassdoor lists the average total pay for a Financial Analyst at $96,654 per year, combining an average base salary of $83,097 with additional pay like cash bonuses and profit sharing.

- Payscale shows a typical salary range from $62,000 for entry-level positions to $102,000 for experienced analysts, with an average base salary of around $76,000.

This data illustrates a clear progression: while an entry-level analyst might start in the $60k-$75k range, a senior analyst with specialized skills can easily command a six-figure salary.

Key Factors That Influence Salary

Your specific salary as a Financial Analyst is determined by a combination of critical factors. Understanding these levers is key to maximizing your earning potential.

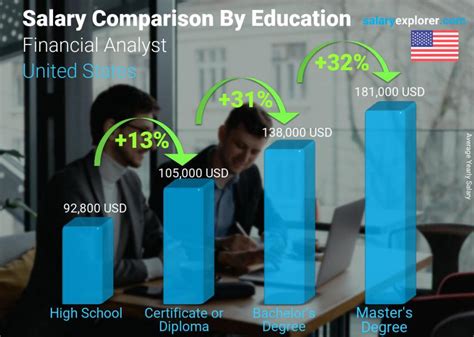

### Level of Education

A bachelor's degree in finance, economics, accounting, or a related field is the standard entry requirement. However, advanced degrees and certifications significantly boost earning power. Analysts with a Master of Business Administration (MBA) from a top-tier business school or those who earn the prestigious Chartered Financial Analyst (CFA) designation often see a substantial salary premium and have access to more senior roles. For instance, holding a CFA charter can increase an analyst's salary by 15-20% or more.

### Years of Experience

Experience is one of the most significant drivers of salary growth in this field.

- Entry-Level (0-2 years): Analysts are typically focused on data gathering, spreadsheet maintenance, and supporting senior staff. Salaries often range from $60,000 to $80,000.

- Mid-Level (3-5 years): With growing expertise, these analysts take on more complex modeling and present findings to stakeholders. Salaries can move into the $80,000 to $110,000 range.

- Senior/Lead (5+ years): Senior analysts manage teams, direct financial strategy, and interact with executive leadership. Their base salaries frequently exceed $120,000, with bonuses pushing total compensation much higher.

### Geographic Location

Where you work matters immensely. Financial hubs with a high concentration of major corporations and investment firms offer the highest salaries, though this is often balanced by a higher cost of living.

- Top-Tier Cities: New York City, San Francisco, and Boston lead the nation in compensation for financial analysts, with salaries often 20-30% above the national average.

- Major Metro Areas: Cities like Chicago, Los Angeles, and Dallas also offer competitive salaries that are well above the national median.

- Remote Work: While remote work has expanded opportunities, salaries are often still benchmarked to a specific region or a national average, which may be lower than those in top financial centers.

### Company Type

The type of company you work for is a major determinant of your paycheck.

- Investment Banking & Private Equity: These "buy-side" and "sell-side" roles are the most lucrative, with total compensation (salary + bonus) for first-year analysts often reaching $150,000 to $200,000 or more.

- Corporate Finance (FP&A): Analysts working within a large corporation in Financial Planning & Analysis (FP&A) roles earn strong, stable salaries, often in the $80,000 to $130,000 range depending on the size of the company.

- Insurance and Commercial Banking: These sectors offer competitive and stable salaries, though typically less than what is found in investment banking.

- Government: Government roles offer the highest job security and excellent benefits but generally have lower base salaries compared to the private sector.

### Area of Specialization

Within the broad field of financial analysis, specializations can lead to different salary outcomes. An Equity Research Analyst who covers a high-growth sector like technology may have higher bonus potential than a corporate budget analyst. A Quantitative Analyst ("Quant") with advanced skills in programming and statistical modeling commands a significant premium due to the technical nature of their work.

Job Outlook

The future for Financial Analysts is bright. The U.S. Bureau of Labor Statistics (BLS) projects employment for financial analysts to grow 8 percent from 2022 to 2032, which is much faster than the average for all occupations.

This growth is fueled by the increasing complexity of financial markets and the growing need for in-depth analysis to guide investment. As big data and advanced analytics become more integrated into finance, analysts who can blend traditional financial acumen with data science skills will be in particularly high demand.

Conclusion

A career as a Financial Analyst is a demanding but highly rewarding path for analytical thinkers. While the national median salary hovers around the high five-figure to low six-figure mark, your individual earnings are directly in your control. By pursuing advanced education like an MBA or a CFA, gaining experience in high-impact roles, targeting major financial hubs, and choosing a lucrative industry, you can build a career that is both intellectually stimulating and financially prosperous. For anyone considering this profession, the strong job outlook and significant earning potential make it a compelling choice for the years ahead.