For ambitious professionals in the financial services industry, achieving the title of Vice President at a prestigious bulge bracket firm like J.P. Morgan Chase represents a significant career milestone. This role is not only a marker of expertise and responsibility but is also associated with substantial earning potential. A Vice President at J.P. Morgan can expect a total compensation package often ranging from $350,000 to over $550,000 annually, making it one of the most sought-after positions in finance.

This article provides a data-driven breakdown of a J.P. Morgan VP's salary, the factors that influence it, and what you need to know if you're aspiring to this rewarding career path.

What Does a Vice President at J.P. Morgan Chase Do?

First, it's crucial to understand that in the world of investment banking, the title "Vice President" (VP) does not signify an executive leadership role just below the C-suite. Instead, it is a mid-to-senior level rank in the corporate hierarchy, typically sitting above an Associate and below a Director or Executive Director.

A VP at J.P. Morgan acts as the primary project manager on deals and client engagements. Their responsibilities are a critical bridge between junior execution and senior relationship management. Key duties often include:

- Managing Deal Execution: Overseeing the entire lifecycle of a transaction, from initial pitch to final closing.

- Leading Junior Teams: Directly managing and mentoring Analysts and Associates, reviewing their financial models, valuations, and presentations.

- Client Interaction: Serving as a key point of contact for clients, building relationships, and presenting analytical findings.

- Developing Strategy: Contributing to strategic discussions, creating pitch books, and identifying new business opportunities.

- Due Diligence: Leading the due diligence process for mergers, acquisitions, and capital raises.

Average Vice President Salary at J.P. Morgan Chase

The compensation for a VP at J.P. Morgan is multifaceted, composed primarily of a base salary and a significant performance-based bonus.

- Base Salary: The fixed portion of the compensation is highly competitive. According to data from salary aggregators, the average base salary for a Vice President at J.P. Morgan Chase typically falls between $250,000 and $275,000 per year (Source: Glassdoor, Salary.com, 2024).

- Bonus / Variable Compensation: This is where the earning potential truly skyrockets. The annual bonus is highly variable and depends on individual performance, the division's success, and the firm's overall profitability. It can range from 50% to over 100% of the base salary.

- Total Compensation: When combined, the total compensation package is formidable. Most VPs at J.P. Morgan can expect to earn within a range of $350,000 to $550,000, with top performers in high-revenue divisions potentially exceeding this figure.

Key Factors That Influence Salary

While the average figures provide a strong benchmark, actual earnings can vary significantly based on several key factors.

### Level of Education

A strong educational background is foundational. Most professionals promoted to VP have either a bachelor's degree from a top-tier university and have risen through the ranks (Analyst to Associate to VP) or they hold a Master of Business Administration (MBA), typically from an elite program. An MBA from a target school like Wharton, Harvard, or Columbia can often lead to a higher starting base salary and a faster track to the VP level.

### Years of Experience

The VP title is earned, not given. It is not an entry-level position. A professional typically reaches the VP level after accumulating significant experience:

- Analyst Program: 2-3 years post-undergraduate.

- Associate Role: 3-4 years post-MBA or post-Analyst promotion.

Therefore, a newly promoted VP usually has at least 5 to 7 years of direct industry experience. More senior VPs with a decade or more of experience will command salaries and bonuses at the higher end of the spectrum.

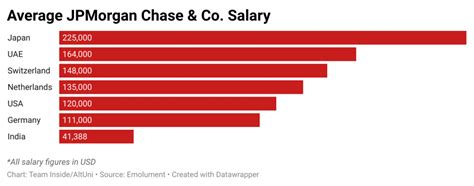

### Geographic Location

Where you work matters. Major financial centers offer the highest compensation due to a higher cost of living and a greater concentration of deal flow.

- New York City: As J.P. Morgan's headquarters and the world's financial capital, NYC sets the benchmark for top-tier salaries in the U.S.

- Other Major Hubs: Locations like San Francisco (tech banking), London, and Hong Kong offer compensation packages that are highly competitive with New York.

- Regional Offices: Offices in cities like Chicago, Houston, or Charlotte will still offer very strong salaries, but they may be slightly lower than those in the primary financial hubs.

### The Bulge Bracket Advantage: J.P. Morgan Chase vs. Other Firms

J.P. Morgan Chase is a "bulge bracket" investment bank, a term for the largest and most profitable multinational investment banks. These firms generally pay at the top of the market to attract and retain the best talent. Compensation at a firm like J.P. Morgan is often higher and more stable than at:

- Boutique Banks: While elite boutique firms can sometimes offer higher bonuses in good years, their compensation can be more volatile.

- Corporate Finance: A VP of Finance role at a Fortune 500 company will typically have a lower salary and bonus structure compared to a VP in investment banking, though it may offer a better work-life balance.

### Area of Specialization

Within a massive organization like J.P. Morgan, which division you work for is perhaps the most significant factor impacting your earnings.

- Investment Banking Division (IBD): This is traditionally the highest-paying area. VPs in groups like Mergers & Acquisitions (M&A) or Leveraged Finance often receive the largest bonuses due to the high-revenue nature of their deals.

- Sales & Trading (S&T): Compensation can be extremely high but is also highly volatile and directly tied to the performance of an individual's trading book or sales record.

- Asset & Wealth Management: VPs in this division manage money for high-net-worth individuals and institutions. While compensation is excellent, it is generally structured differently and may be slightly lower than in IBD.

- Corporate Banking & Commercial Banking: These roles are still highly compensated but typically have a lower bonus potential than front-office IBD roles.

- Technology & Operations: VPs in these essential support functions have strong, stable salaries, but their variable compensation is not as high as their counterparts in revenue-generating divisions.

Job Outlook

The career outlook for skilled financial professionals remains very strong. While the investment banking industry is cyclical and sensitive to economic conditions, the demand for experts who can manage complex financial transactions is constant.

The U.S. Bureau of Labor Statistics (BLS) projects that employment for Financial Managers—a category that includes high-level banking professionals—is expected to grow by 16% from 2022 to 2032, which is much faster than the average for all occupations. This robust growth indicates that the skills and experience of a VP will remain in high demand.

Conclusion

A Vice President role at J.P. Morgan Chase is a demanding but immensely rewarding position. The journey requires years of dedication, a top-tier education, and an unwavering commitment to excellence.

For those considering this path, here are the key takeaways:

- Expect High Total Compensation: The combination of a strong base salary and a significant bonus places this role in the upper echelon of earners.

- Compensation is More Than One Number: Your final earnings are heavily influenced by your division, performance, location, and experience.

- It’s a Marathon, Not a Sprint: The VP title is a mid-career milestone earned after years of proven success as an Analyst and Associate.

- The Outlook is Bright: The financial industry continues to grow, ensuring that opportunities for talented and driven professionals will persist.

Ultimately, for those with the ambition and resilience to thrive in the high-stakes world of finance, a Vice President position at J.P. Morgan Chase offers a career that is both intellectually stimulating and financially lucrative.