Decoding the Paycheck: A Deep Dive into a JPMorgan Chase Vice President's Salary

For ambitious finance professionals, achieving the title of "Vice President" at a global powerhouse like JPMorgan Chase & Co. (JPMC) is a monumental career milestone. It signifies expertise, leadership, and a significant jump in responsibility and, of course, compensation. But what does that salary actually look like? This role commands a substantial six-figure income, with total compensation packages often soaring well above $250,000, reflecting the high stakes and deep expertise required.

This article provides a data-driven analysis of a Vice President's salary at JPMorgan Chase, exploring the average compensation and the key factors that can dramatically influence your earning potential.

What Does a Vice President at JPMorgan Chase Do?

Before diving into the numbers, it's crucial to understand the role. Unlike a VP in many other industries, a Vice President in investment banking is a mid-to-senior level position, not typically part of the executive C-suite. It sits above the Analyst and Associate levels and below the Director and Managing Director ranks.

A VP at JPMC acts as the primary project manager on deals. Responsibilities often include:

- Deal Execution: Managing the day-to-day execution of transactions, whether in Mergers & Acquisitions (M&A), Capital Markets, or other advisory services.

- Client Relationship Management: Serving as a key point of contact for clients, building trust, and providing strategic financial advice.

- Team Leadership: Mentoring and managing junior bankers (Analysts and Associates), reviewing their financial models, and ensuring the quality of all analytical work.

- Financial Analysis: Overseeing complex financial modeling, valuation analysis, and the creation of client-facing presentations and pitchbooks.

In essence, a VP is the engine of the deal team, blending technical prowess with developing client-facing skills.

Average Vice President Salary at JPMorgan Chase

Compensation for a JPMC Vice President is a combination of a base salary and a significant performance-based bonus, which together form the "total compensation." It's this total figure that provides a true picture of their earnings.

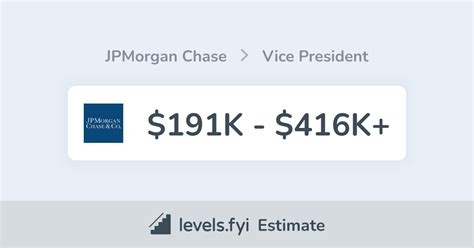

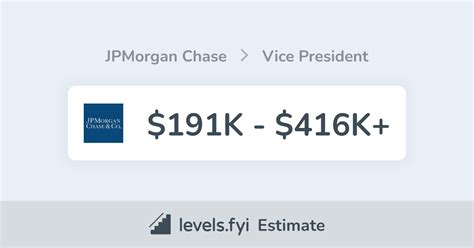

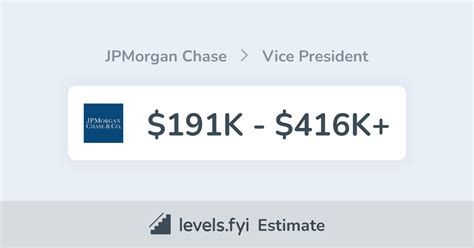

Based on aggregated data from leading salary reporting platforms, the average compensation for a Vice President at JPMorgan Chase breaks down as follows:

- Average Base Salary: Approximately $180,000 to $210,000 per year.

- Average Bonus: Can range widely from $60,000 to $150,000+, heavily dependent on individual, group, and firm performance.

- Average Total Compensation: Typically falls in the range of $250,000 to $350,000+.

*Sources: Salary data is synthesized from recent self-reported figures on Glassdoor, Payscale, and Salary.com (as of late 2023/early 2024). It's important to note that these figures are estimates and can vary.*

The wide range in total compensation underscores the importance of several influencing factors.

Key Factors That Influence Salary

Your exact salary as a VP at JPMC isn’t set in stone. It is influenced by a combination of your background, location, and specific role within the firm.

### Level of Education

While a bachelor's degree in finance, economics, or a related field is the minimum requirement, an advanced degree can significantly impact career trajectory and earning potential. Many VPs are promoted directly after serving as an Associate for several years. However, a large contingent is hired externally after completing a Master of Business Administration (MBA), particularly from a top-tier business school (e.g., Wharton, Harvard Business School, Chicago Booth). An MBA from a prestigious program can lead to a higher starting base salary and position a candidate for faster advancement.

### Years of Experience

Experience is arguably the most critical factor. The VP title is typically awarded to professionals with 6 to 9 years of relevant experience in the finance industry. Within the VP title itself, there are levels of seniority. A first-year VP will earn less than a third-year VP who is on the cusp of a promotion to Director. Each year of successful experience adds to a VP's ability to lead larger deals and manage more complex client relationships, which is directly reflected in their year-end bonus.

### Geographic Location

Where you work matters immensely. JPMC has a global footprint, but its major financial hubs offer the highest compensation, largely to offset the higher cost of living.

- Top-Tier Cities (New York, London): VPs in these global financial centers command the highest salaries and bonuses. New York, as the firm's headquarters and the center of U.S. finance, typically sets the benchmark for compensation.

- Other Major U.S. Cities (Chicago, Houston, San Francisco): Salaries in these locations remain highly competitive but may be slightly lower than in New York.

- Strategic Hubs (Plano, TX; Columbus, OH; Wilmington, DE): In these large operational centers, a VP in a corporate or non-investment banking role might see a lower base salary, though this is often balanced by a significantly lower cost of living.

### Firm Type and Prestige

While this article focuses on JPMC, it's helpful to understand where the firm sits in the financial landscape. JPMC is a "bulge bracket" bank—a global, full-service investment bank involved in all aspects of finance. Bulge bracket firms are known for high compensation and working on the largest, most complex deals. Their pay is generally competitive with other bulge brackets (like Goldman Sachs or Morgan Stanley) and "elite boutique" firms (like Evercore or Lazard), which sometimes offer even higher bonuses due to their specialized focus.

### Area of Specialization

Not all VP roles are created equal. The division you work in has a direct impact on your bonus potential, as some groups are considered more direct revenue generators.

- Investment Banking Division (IBD): VPs within core IBD groups like Mergers & Acquisitions (M&A), Leveraged Finance, or industry-specific groups like Technology, Media & Telecom (TMT) or Healthcare, often earn the highest bonuses. Their compensation is directly tied to the lucrative fees generated from closed deals.

- Markets (Sales & Trading): A VP in sales or trading will have compensation heavily tied to their individual performance (P&L) and market conditions.

- Corporate & Commercial Banking: VPs in these roles have very competitive salaries, but their variable compensation may be lower and more stable compared to IBD.

- Support & Risk Functions: Roles in Risk Management, Compliance, or Technology, while crucial to the firm, typically have a lower variable pay component than front-office, client-facing roles.

Job Outlook

While the U.S. Bureau of Labor Statistics (BLS) does not track data for "Investment Banking Vice President" specifically, the outlook for the broader category of "Financial Managers" is an excellent proxy.

According to the BLS, employment for financial managers is projected to grow 16 percent from 2022 to 2032, which is much faster than the average for all occupations. The BLS attributes this growth to the increasing complexity of the global financial landscape and the continued need for expert financial analysis and management. This strong demand ensures that skilled and experienced finance professionals, like VPs at JPMC, will remain highly sought after.

Conclusion

The role of a Vice President at JPMorgan Chase represents a pinnacle of success in the financial industry. It is a demanding, high-pressure position that requires years of dedication, but the rewards are commensurate with the challenges.

Key Takeaways:

- High Earning Potential: Expect a total compensation package in the $250,000 to $350,000+ range, driven largely by performance bonuses.

- Experience is Paramount: The role is earned after 6-9 years of proven performance and expertise.

- Location and Specialization Matter: Working in a major financial hub like New York and in a high-revenue group like M&A will maximize your earnings.

- Strong Career Outlook: The demand for high-caliber financial leadership remains robust, promising long-term career security and growth.

For those aspiring to reach this level, the path requires resilience and a commitment to excellence. But for those who achieve it, the role of VP at JPMorgan Chase is not just a prestigious title—it's a gateway to becoming a true leader in the world of finance.