Navigating the professional world means understanding the language of compensation. At the heart of most job offers and career discussions lies a key figure: the annual salary. But what does that number truly represent? For many, it's the foundation of their financial stability and a key measure of professional value. In the United States, median annual salaries can range from around $35,000 for entry-level service roles to well over $200,000 for specialized professionals in fields like medicine and technology.

This guide will break down the concept of annual salary, explore the national averages, and detail the critical factors that determine your earning power. Whether you're a student planning your future, a professional negotiating a raise, or simply curious about how compensation works, this article will equip you with the knowledge to understand your worth.

What is an Annual Salary? The Core Definition

An annual salary is the fixed, pre-tax amount of money an employer pays an employee for their work over a 12-month period. This amount is typically stated in an employment contract or offer letter and is paid out in regular increments, such as weekly, bi-weekly, or monthly, depending on the company's payroll schedule.

Unlike an hourly wage, where you are paid for each hour you work, a salary is consistent regardless of the specific hours worked in a given week. Salaried employees are often considered "exempt," meaning they are generally not eligible for overtime pay.

It's crucial to remember that your stated annual salary is your gross pay—the total amount before any deductions are made. Your actual take-home pay, or net pay, will be lower after taxes, insurance premiums, and retirement contributions are subtracted.

Average Salaries in the U.S.: A National Snapshot

To understand what an annual salary figure means, it helps to have a baseline. Salary data provides a picture of the overall economic landscape.

According to the U.S. Bureau of Labor Statistics (BLS), the median annual wage for all full-time wage and salary workers in the United States was $61,900 as of the fourth quarter of 2023.

"Median" means that half of all workers earned more than this amount, and half earned less. However, this is just a single data point. Salary ranges are vast. Data from salary aggregators like Payscale and Salary.com show that compensation can be broken down into percentiles:

- 10th Percentile (Entry-Level): Represents the starting point, often for those with minimal experience.

- 50th Percentile (Median): The mid-point salary for a given role or demographic.

- 90th Percentile (Senior/Expert): Represents the top earners, typically those with extensive experience, specialized skills, and leadership responsibilities.

For example, while the overall median is around $62,000, an entry-level position might start in the $35,000-$45,000 range, while a senior executive could earn upwards of $250,000.

Key Factors That Influence Your Annual Salary

Your personal salary is not determined by a single number but by a combination of factors. Understanding these variables is the key to maximizing your earning potential.

###

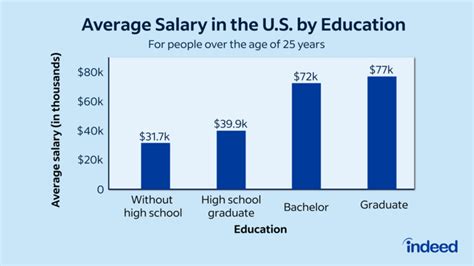

Level of Education

Your educational attainment is one of the strongest predictors of income. Higher levels of education often lead to more specialized skills and access to higher-paying professions. The BLS consistently reports a clear correlation between education and earnings.

According to 2023 BLS data on median usual weekly earnings for full-time workers:

- High School Diploma: ~$876/week (approx. $45,552 annually)

- Bachelor's Degree: ~$1,498/week (approx. $77,896 annually)

- Master's Degree: ~$1,739/week (approx. $90,428 annually)

- Doctoral or Professional Degree: ~$2,197/week (approx. $114,244 annually)

These figures demonstrate that investing in higher education can yield a significant return in lifetime earnings.

###

Years of Experience

Experience is a direct measure of your expertise and proven ability to deliver value. Companies pay a premium for professionals who can solve problems efficiently and mentor junior staff. Compensation is often tiered based on experience level:

- Entry-Level (0-2 years): Salaries are typically at the lower end of the range for a given role as employees are still learning and require supervision.

- Mid-Career (3-8 years): After gaining solid experience and independence, professionals can expect significant salary growth and may take on more complex projects.

- Senior/Late-Career (8+ years): With deep expertise and often leadership responsibilities, senior professionals command the highest salaries within their field. Payscale data shows that late-career employees can earn 30-60% more than their entry-level counterparts in the same role.

###

Geographic Location

Where you work matters—a lot. Salaries for the same job can vary dramatically between cities and states due to differences in cost of living, local demand for skills, and state tax laws. A $100,000 salary in San Francisco, California, will have significantly less purchasing power than the same salary in Des Moines, Iowa.

Companies often adjust salary bands based on location. For example, according to Glassdoor, a Software Engineer role that pays $120,000 in a mid-sized city might pay upwards of $160,000 in a major tech hub like the Bay Area or Seattle to account for the higher cost of living.

###

Industry and Company Type

The industry you work in and the type of company you work for are massive drivers of salary.

- Industry: Some industries are historically higher-paying than others. For example, fields like Finance, Technology, and Legal services typically offer higher average salaries than Hospitality, Retail, or Non-Profit sectors.

- Company Type: A large, established public corporation will often have more structured and higher salary bands than a small, early-stage startup. However, a startup might offer equity (stock options) as part of a compensation package, which could have a significant future value. Government jobs often offer moderate salaries but come with excellent benefits and job security.

###

Your Specific Job Role and Area of Specialization

Ultimately, the most significant factor is your specific job function. Different roles require different levels of skill, carry different responsibilities, and have different market values. Specializing in a high-demand niche within your field can dramatically increase your earning potential.

Consider these median annual salaries from the BLS's Occupational Outlook Handbook (May 2023 data):

- Registered Nurses: $86,070

- Software Developers: $132,270

- Marketing Managers: $152,090

- Financial Managers: $156,100

- Physicians and Surgeons: $239,200+

This illustrates that even within professional fields, specialization is key to higher earnings.

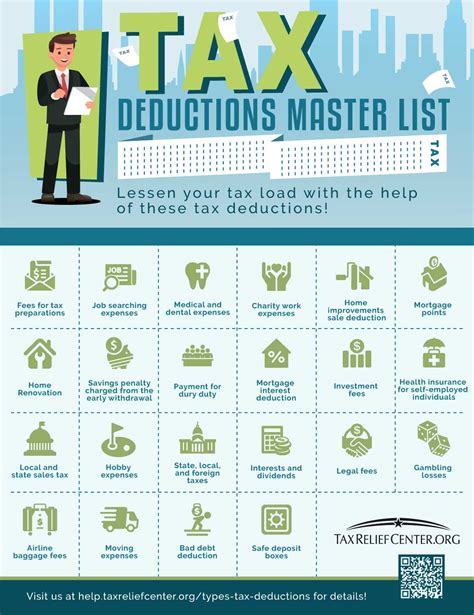

From Gross to Net: Don't Forget Deductions!

One of the most important lessons for anyone earning a salary is understanding the difference between gross pay and net pay. The annual salary you are quoted in a job offer is the gross figure. Before that money hits your bank account, several deductions are made:

- Federal and State Income Taxes

- FICA Taxes (Social Security and Medicare)

- Health, Dental, and Vision Insurance Premiums

- Retirement Contributions (e.g., 401(k) or 403(b))

- Other Pre-Tax or Post-Tax Deductions (e.g., Life Insurance, HSA/FSA)

These deductions can easily reduce your gross pay by 20-35%, so it's essential to budget based on your anticipated net (take-home) pay.

Conclusion: Putting It All Together

An annual salary is more than just a number; it is a comprehensive reflection of your skills, experience, education, and the market's demand for your role. While national and industry averages provide a useful benchmark, your personal earning potential is shaped by a unique combination of factors.

Here are the key takeaways:

1. Salary is a Starting Point: Your annual salary is your gross, pre-tax pay. Always calculate your estimated net pay to understand your true monthly income.

2. You Have Influence: Factors like education, gaining experience, and developing specialized skills are within your control and can significantly boost your lifetime earnings.

3. Context is Everything: A salary figure is only meaningful in the context of its location, industry, and the specific responsibilities of the role.

4. Look Beyond the Salary: Remember that benefits like health insurance, retirement matching, paid time off, and professional development opportunities are all part of your total compensation package and add significant value.

By understanding these dynamics, you can better navigate job offers, negotiate your worth, and make strategic decisions that will advance your career and secure your financial future.